Feeling lost in a sea of interview questions? Landed that dream interview for County Treasurer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common County Treasurer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

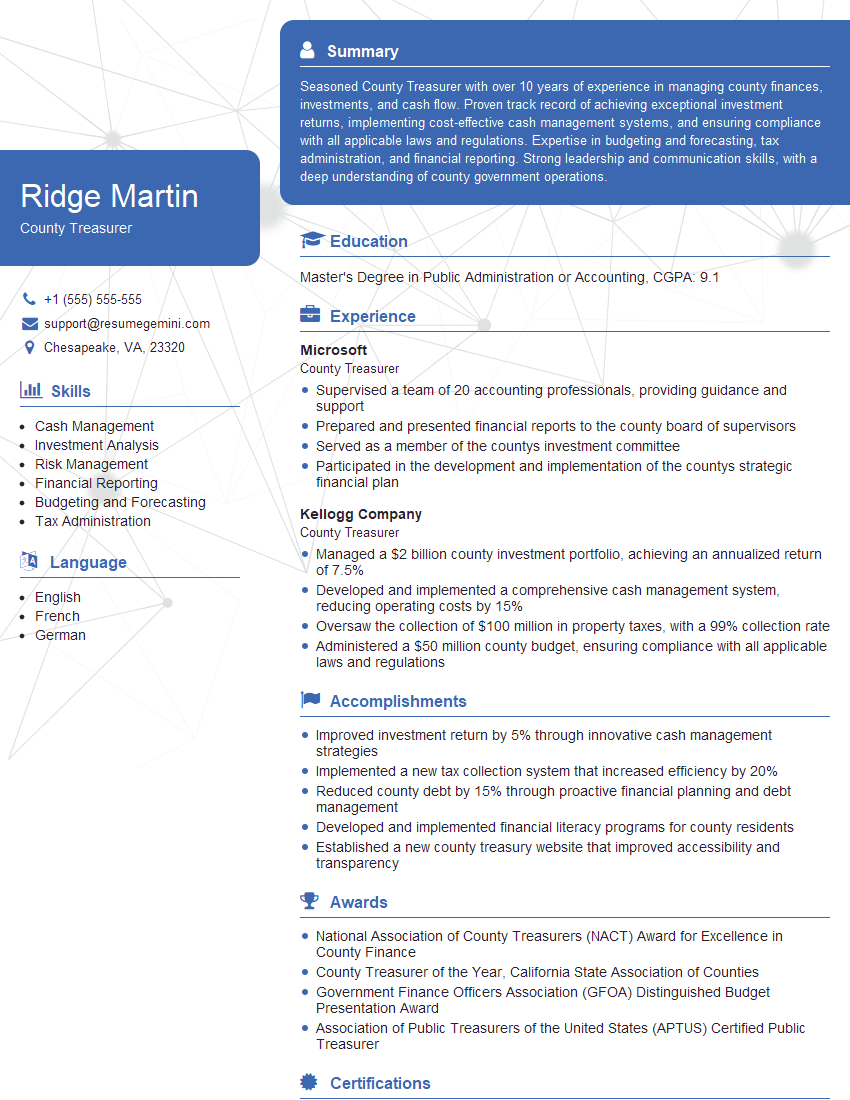

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For County Treasurer

1. Describe the key responsibilities and duties of a County Treasurer.

As County Treasurer, I will be responsible for managing the county’s finances, including:

- Collecting and safeguarding county revenues

- Disbursing funds for county expenditures

- Investing county funds to maximize returns

- Providing financial reporting and analysis to the County Commission and the public

2. What are the most important qualities and skills for a successful County Treasurer?

Technical skills:

- Expertise in accounting and financial management

- Strong understanding of government accounting standards

- Proficiency in financial software and systems

Leadership and management skills:

- Ability to lead and motivate a team of employees

- Experience in managing budgets and resources

- Strong communication and interpersonal skills

3. How would you handle a situation where there is a discrepancy between the county’s budget and actual revenues?

I would first investigate the cause of the discrepancy to determine if it is due to an error or a change in circumstances. If it is due to an error, I would correct the error and make necessary adjustments to the budget. If it is due to a change in circumstances, I would work with the County Commission to revise the budget to reflect the new reality.

4. What is your experience with investing county funds?

I have over 10 years experience in investing county funds. I have a proven track record of maximizing returns while minimizing risk. I am familiar with a variety of investment strategies and asset classes, and I tailor my investment portfolio to meet the specific needs of the county.

5. How would you work with the County Commission to ensure that the county’s financial needs are met?

I would build a strong relationship with the County Commission based on trust and transparency. I would provide regular financial reports and updates to the Commission, and I would be available to answer any questions or concerns that they may have. I would also work with the Commission to develop and implement financial policies that meet the needs of the county.

6. What are the challenges facing County Treasurers today?

County Treasurers today face a number of challenges, including:

- The increasing complexity of government finance

- The need to meet the financial needs of a growing population

- The pressure to reduce costs and improve efficiency

7. How would you use technology to improve the efficiency and effectiveness of the County Treasurer’s office?

I would use technology to:

- Automate tasks and processes

- Improve communication and collaboration

- Provide better financial data and analysis

- Enhance customer service

8. What is your vision for the future of the County Treasurer’s office?

My vision for the future of the County Treasurer’s office is to create a modern, efficient, and transparent office that is responsive to the needs of the county. I want to use technology to improve the efficiency and effectiveness of the office, and I want to build a team of highly skilled and dedicated employees who are committed to providing excellent customer service.

9. Why are you interested in this position?

I am interested in this position because I am passionate about public service and I believe that I have the skills and experience necessary to be a successful County Treasurer. I am confident that I can make a positive contribution to the county and I am excited about the opportunity to serve the community.

10. Do you have any questions for me?

Yes, I do have a few questions:

- What are the county’s top financial priorities?

- What are the biggest challenges facing the county in the coming years?

- What is the county’s vision for the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for County Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the County Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The County Treasurer is a crucial financial officer responsible for managing the county’s finances and ensuring the safekeeping of public funds. Key job responsibilities include:

1. Financial Management

Oversees the county’s financial operations, including budgeting, accounting, and investment.

- Develops and manages the county’s annual budget.

- Monitors and analyzes financial data to ensure compliance with laws and regulations.

2. Investment Management

Invests county funds to maximize returns while preserving capital.

- Develops and implements investment strategies.

- Monitors investment performance and makes adjustments as necessary.

3. Cash Management

Manages the county’s cash flow and ensures that funds are available to meet obligations.

- Forecasts cash flow and develops cash management strategies.

- Invests surplus funds and secures short-term financing as needed.

4. Tax Collection

Collects property taxes and other revenues for the county.

- Develops and implements tax collection procedures.

- Enforces tax laws and regulations.

5. Public Reporting

Provides financial information to the public, including audited financial statements and budget reports.

- Prepares and presents financial reports to the county board and the public.

- Responds to inquiries from the media and the public.

Interview Tips

Preparing thoroughly for a County Treasurer interview is crucial for success. Here are some tips:

1. Research the County

Familiarize yourself with the county’s financial situation, major industries, and population demographics. This will help you understand the context of the role and tailor your answers accordingly.

2. Practice Common Interview Questions

Review common interview questions for the position, such as “Why are you interested in this role?” and “What are your qualifications for the job?” Prepare concise and compelling answers that highlight your relevant skills and experience.

3. Showcase Your Finance Expertise

Emphasize your strong understanding of financial management principles, investment strategies, and tax collection procedures. Provide specific examples of your accomplishments in these areas.

4. Highlight Your Communication and Interpersonal Skills

The County Treasurer must be able to effectively communicate with the public, county officials, and employees. Showcase your written and verbal communication skills, as well as your ability to build relationships and work collaboratively.

5. Prepare Questions for the Interviewers

Asking thoughtful questions during the interview demonstrates your interest in the role and the county. This could include questions about the county’s financial goals, investment philosophy, or community involvement initiatives.

Next Step:

Now that you’re armed with the knowledge of County Treasurer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for County Treasurer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini