Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Cover Inspector interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Cover Inspector so you can tailor your answers to impress potential employers.

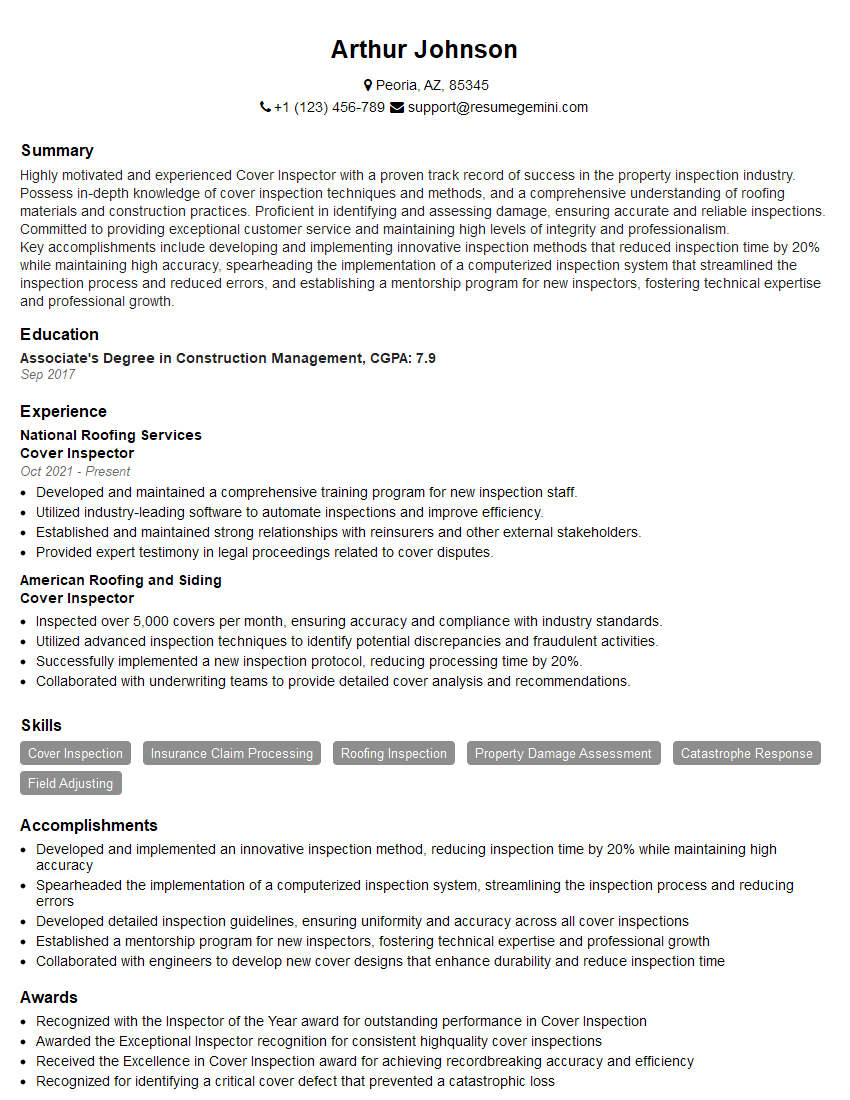

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cover Inspector

1. What is the difference between a load cover and a hull cover?

A load cover is an insurance policy that covers the goods being transported in the event of loss or damage. A hull cover is an insurance policy that covers the physical structure of the vessel carrying the goods.

2. What are the different types of loss or damage that can occur to cargo?

There are many different types of loss or damage that can occur to cargo, including:

- Physical damage, such as breakage, denting, or scratching

- Spoilage, due to temperature changes, moisture, or contamination

- Theft or pilferage

- Delay, which can result in loss of value or market opportunity

3. What factors should be considered when assessing the risk of loss or damage to cargo?

When assessing the risk of loss or damage to cargo, a number of factors should be considered, including:

- The type of cargo being transported

- The mode of transport

- The route of transport

- The time of year

- The political and economic stability of the countries involved

4. What are some of the key provisions of a cargo insurance policy?

Some of the key provisions of a cargo insurance policy include:

- The scope of coverage, which defines the types of risks that are covered

- The limits of liability, which specify the maximum amount that the insurer will pay for a covered loss

- The deductible, which is the amount that the policyholder must pay before the insurer will start to cover a loss

- The exclusions, which list the types of losses that are not covered

- The conditions, which specify the terms and conditions that must be met in order for coverage to apply

5. What are the different types of cargo insurance policies?

There are many different types of cargo insurance policies, each designed to meet the specific needs of the policyholder. Some of the most common types of cargo insurance policies include:

- Open cargo policies, which cover all shipments made by the policyholder during a specified period of time

- Specific cargo policies, which cover a single shipment or a series of shipments

- Warehouse-to-warehouse policies, which cover cargo from the time it leaves the warehouse of the shipper until it arrives at the warehouse of the consignee

- Door-to-door policies, which cover cargo from the time it leaves the premises of the shipper until it arrives at the premises of the consignee

6. What are some of the benefits of having cargo insurance?

There are many benefits to having cargo insurance, including:

- Peace of mind, knowing that your cargo is protected in the event of loss or damage

- Financial protection, in the event that you need to file a claim

- Improved relationships with customers and suppliers, who know that their cargo is protected

7. What are some of the challenges in cargo insurance?

There are a number of challenges in cargo insurance, including:

- The complex and ever-changing nature of the global supply chain

- The increasing frequency and severity of natural disasters

- The rising cost of cargo insurance

8. What are the latest trends in cargo insurance?

Some of the latest trends in cargo insurance include:

- The growing use of technology to improve the efficiency and accuracy of underwriting and claims processing

- The increasing use of data analytics to identify and mitigate risks

- The development of new products and services to meet the changing needs of the global supply chain

9. What are the key challenges facing cargo insurers in the coming years?

Some of the key challenges facing cargo insurers in the coming years include:

- The increasing complexity and interconnectedness of the global supply chain

- The rising frequency and severity of natural disasters

- The increasing cost of cargo insurance

- The need for more innovative and tailored products and services

10. What are the opportunities for cargo insurers in the coming years?

Some of the opportunities for cargo insurers in the coming years include:

- The growing use of technology to improve the efficiency and accuracy of underwriting and claims processing

- The increasing use of data analytics to identify and mitigate risks

- The development of new products and services to meet the changing needs of the global supply chain

- The expansion of cargo insurance into new markets

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cover Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cover Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cover Inspectors play a critical role in the insurance industry, ensuring the quality and accuracy of insurance policies. Their primary responsibilities include:

1. Policy Review and Analysis

Thoroughly review and analyze insurance policies to identify any errors, omissions, or inaccuracies.

- Verify coverage details, including limits, deductibles, and exclusions.

- Check for compliance with underwriting guidelines and regulatory requirements.

2. Risk Assessment and Underwriting

Evaluate proposals and determine the risk associated with potential policies.

- Review applicant information, financial statements, and property inspections.

- Recommend appropriate coverage and underwriting actions.

3. Policy Issuance and Maintenance

Prepare and issue insurance policies once they have been approved through underwriting.

- Coordinate with policyholders and agents to collect necessary information.

- Maintain and update policy records throughout the policy’s life.

4. Claims Processing and Resolution

Assist in the claims process by reviewing and evaluating claims submissions.

- Determine coverage eligibility and investigate claims.

- Recommend settlement amounts and communicate with policyholders and claimants.

Interview Tips

To ace an interview for the role of Cover Inspector, candidates should prepare thoroughly and demonstrate the following skills and qualities:

1. Technical Expertise

Highlight your in-depth knowledge of insurance concepts, policy provisions, and underwriting practices.

- Emphasize your ability to read, understand, and interpret complex insurance documents.

- Provide examples of successful risk assessments and underwriting decisions you have made.

2. Analytical Skills

Showcase your ability to analyze data, identify patterns, and make sound judgments.

- Describe how you have used analytical tools and techniques to improve underwriting processes.

- Share examples of how you have identified and mitigated risks in your previous roles.

3. Communication and Interpersonal Skills

Demonstrate your ability to communicate effectively with policyholders, agents, and other stakeholders.

- Highlight your experience in explaining complex insurance concepts in a clear and concise manner.

- Provide examples of how you have built and maintained positive relationships with clients.

4. Attention to Detail

Emphasize your meticulous nature and ability to work accurately and efficiently.

- Share examples of how you have ensured accuracy in your previous roles.

- Discuss your methods for organizing and managing large volumes of information.

5. Professional Development

Highlight your commitment to continuous learning and professional growth.

- Mention any certifications or industry designations you hold.

- Discuss your plans for future professional development and how it aligns with the company’s goals.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Cover Inspector interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.