Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

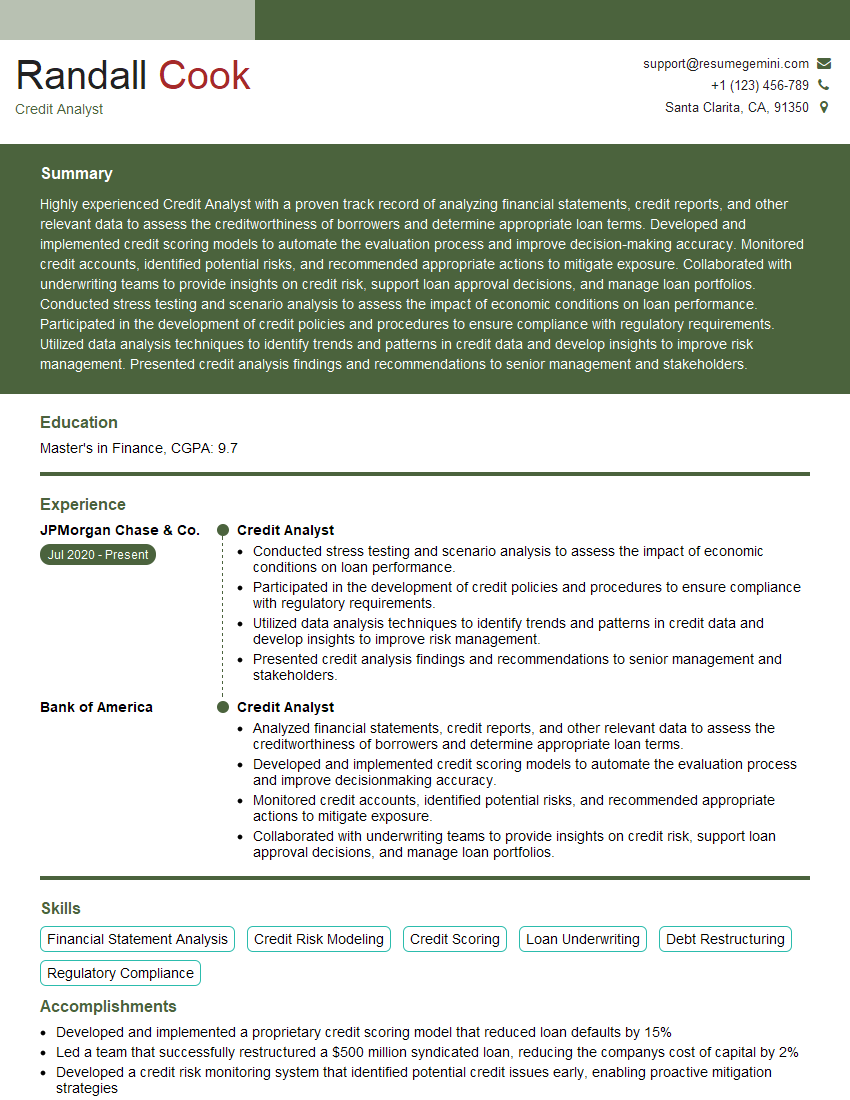

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Analyst

1. What is the significance of cash flow analysis and profitability analysis in credit analysis?

Answer:

- Cash flow analysis:

- Assesses a company’s ability to generate cash and meet its financial obligations.

- Provides insights into the company’s liquidity and solvency.

- Profitability analysis:

- Evaluates a company’s financial performance and its ability to generate profits.

- Helps identify the company’s strengths and weaknesses in terms of revenue generation and cost control.

2. Describe the key financial ratios used to assess a company’s creditworthiness.

- Liquidity ratios: Measure the company’s ability to meet short-term obligations, such as current ratio, acid-test ratio, and cash ratio.

- Solvency ratios: Evaluate the company’s long-term financial health and its ability to repay debts, such as debt-to-equity ratio, debt-to-assets ratio, and interest coverage ratio.

- Profitability ratios: Assess the company’s ability to generate profits, such as gross profit margin, net profit margin, and return on assets.

- Leverage ratios: Measure the company’s use of debt and its ability to manage its debt obligations, such as debt-to-equity ratio, debt-to-capital ratio, and times interest earned ratio.

3. How do you assess the credit risk of a new client?

Answer:

- Gather and review financial information, including financial statements, income statements, and balance sheets.

- Calculate key financial ratios to assess liquidity, solvency, profitability, and leverage.

- Conduct industry and peer analysis to compare the company’s performance to industry benchmarks.

- Evaluate the company’s management team and their experience in the industry.

- Consider macroeconomic factors that may impact the company’s performance.

4. What are the different types of credit facilities available to businesses?

Answer:

- Line of credit: Provides flexible access to funds up to a predefined limit.

- Term loan: A fixed amount of money borrowed for a specific period, repaid in regular installments.

- Revolving credit facility: Similar to a line of credit, but often used for longer-term borrowing.

- Invoice financing: Provides financing based on outstanding invoices.

- Equipment financing: Specifically designed for financing the purchase of equipment.

5. How do you manage a high-risk credit relationship?

Answer:

- Establish a clear and effective monitoring plan, including regular financial reporting and site visits.

- Maintain close communication with the client to understand their situation and address any issues promptly.

- Collaborate with the client to develop a plan to improve their financial performance and reduce risk.

- Consider restructuring the debt or taking other measures to mitigate risk if necessary.

6. What is the role of external credit ratings in credit analysis?

Answer:

- Provide independent assessment of a company’s creditworthiness, which can influence investor and lender decisions.

- Offer a standardized and transparent framework for comparing different companies’ credit profiles.

- Can be used as a benchmark for internal credit analysis and risk management.

7. How do you stay up-to-date on industry trends and developments that could impact credit analysis?

Answer:

- Attend industry conferences and webinars.

- Read industry publications and research reports.

- Network with other credit professionals.

- Participate in professional development courses.

8. What are the ethical considerations in credit analysis?

Answer:

- Maintain confidentiality of client information.

- Avoid conflicts of interest.

- Act with integrity and objectivity.

- Follow industry best practices and regulations.

9. How do you handle disagreements with underwriters or other stakeholders?

Answer:

- Maintain a professional and respectful demeanor.

- Present clear and well-reasoned arguments.

- Be open to compromise and consensus.

- Document the disagreement and any agreed-upon resolutions.

10. Describe a time when you had to make a difficult credit decision.

How did you approach the situation?

Answer:

- Thoroughly analyzed the financial information.

- Met with the client to discuss their situation.

- Considered the potential risks and rewards.

- Made a decision based on the best available information.

What was the outcome?

- The client was able to improve their financial performance and repay the loan.

- The loan was not repaid and the company filed for bankruptcy.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Analysts are responsible for assessing the creditworthiness of individuals and businesses, making recommendations on loan applications, and monitoring existing loans.

1. Analyze Financial Data

Credit Analysts gather and analyze financial data from a variety of sources, including financial statements, tax returns, and credit reports.

- Evaluate financial ratios and trends to assess a borrower’s financial strength and risk.

- Conduct industry and peer group analysis to compare the borrower’s performance to similar companies.

2. Assess Credit Risk

Credit Analysts assess the likelihood that a borrower will repay a loan, based on their financial analysis and other factors.

- Identify potential risks, such as changes in the borrower’s industry or economy, or weaknesses in the borrower’s financial position.

- Assign credit ratings to borrowers based on their risk assessment.

3. Make Loan Recommendations

Credit Analysts make recommendations to loan officers on whether to approve or deny loan applications.

- Provide detailed analysis and supporting documentation to justify their recommendations.

- Collaborate with loan officers to negotiate loan terms and conditions.

4. Monitor Loan Performance

Credit Analysts monitor the performance of existing loans and identify any potential problems.

- Track financial ratios and trends to monitor the borrower’s financial health.

- Conduct site visits and meet with borrowers to assess their operations and discuss any concerns.

Interview Tips

To prepare for a Credit Analyst interview, candidates should:

1. Research the Job and Company

- Review the job description and identify the key responsibilities of the role.

- Learn about the company’s products or services, industry, and financial performance.

2. Practice Financial Analysis

- Review common financial ratios and their uses in credit analysis.

- Practice analyzing financial statements and identifying potential risks.

3. Prepare Case Studies

- Prepare case studies of actual credit analyses you have conducted.

- Be ready to discuss your methodology, findings, and recommendations.

4. Network and Learn

- Attend industry events and connect with professionals in the field.

- Read articles and books on credit analysis and financial markets.

5. Highlight Your Skills

- Emphasize your analytical skills, attention to detail, and ability to communicate complex financial information clearly.

- Quantify your accomplishments and provide specific examples of your work.

6. Prepare for Common Interview Questions

- Why are you interested in credit analysis?

- What are your strengths and weaknesses as a credit analyst?

- How do you approach the task of assessing credit risk?

- Can you describe a challenging credit analysis project you have handled?

- What are your career goals and how does this position fit into your plans?

7. Ask Thoughtful Questions

- Prepare questions to ask the interviewer, which demonstrate your interest in the role and the company.

- This shows that you are engaged and eager to learn more.

8. Dress Professionally and Be On Time

- First impressions matter, so dress professionally and arrive on time for your interview.

- This demonstrates respect for the interviewer and the company.

Next Step:

Now that you’re armed with the knowledge of Credit Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini