Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Credit and Loan Collections Supervisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Credit and Loan Collections Supervisor so you can tailor your answers to impress potential employers.

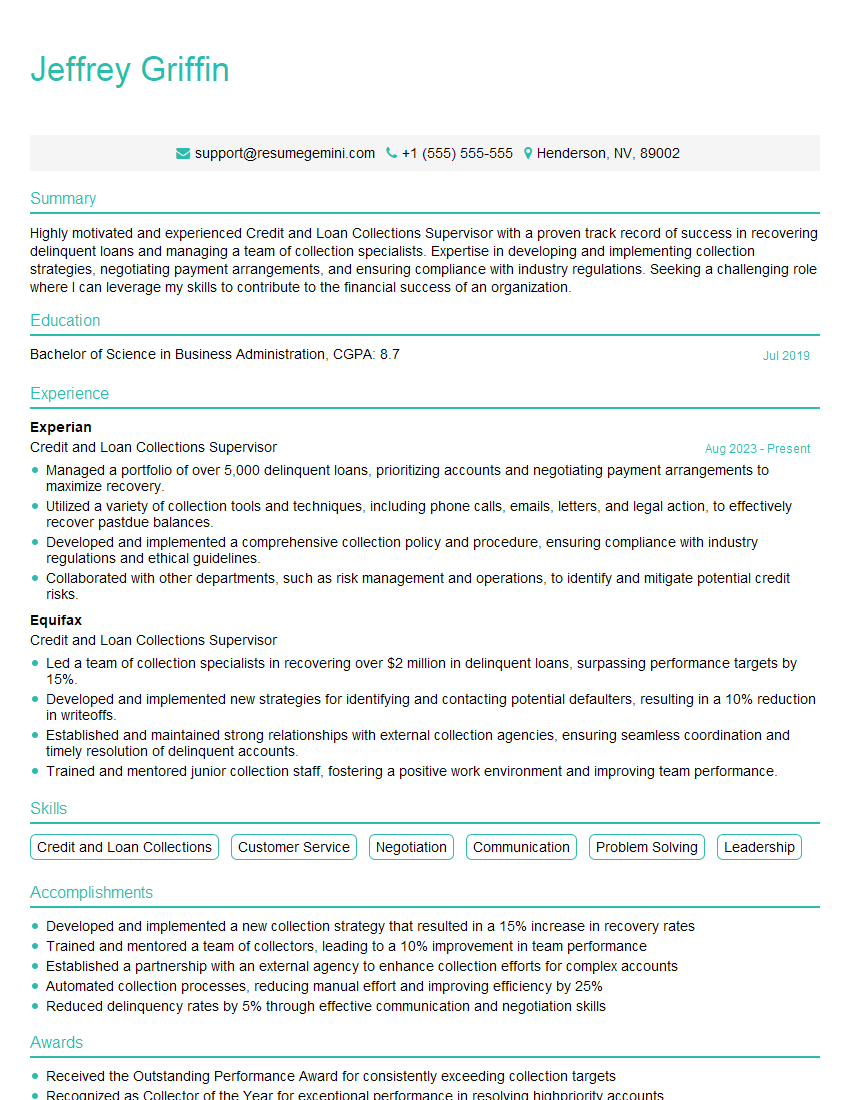

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit and Loan Collections Supervisor

1. How do you prioritize loan applications for approval when you have multiple applications to review?

- Review the applicant’s credit history and score to assess their creditworthiness.

- Examine the applicant’s income and debt-to-income ratio to determine their ability to repay the loan.

- Consider the applicant’s employment history and stability.

- Evaluate the applicant’s collateral, if any, to determine the level of risk associated with the loan.

- Assign a risk rating to each application based on the factors above and prioritize them accordingly.

2. What strategies do you use to collect overdue loans while maintaining positive customer relationships?

Strategies for Collecting Overdue Loans:

- Early intervention: Contact borrowers promptly after their first missed payment to discuss payment options.

- Personalized communication: Tailor collection strategies to the individual borrower’s situation and communication preferences.

- Negotiation and compromise: Be willing to work with borrowers to find mutually acceptable payment arrangements.

- Legal action: Consider legal action as a last resort when other collection efforts have been unsuccessful.

Maintaining Positive Customer Relationships:

- Empathy and understanding: Treat borrowers with respect and acknowledge their challenges.

- Clear communication: Keep borrowers informed about their loan status and any payment arrangements.

- Avoid harassment: Follow ethical collection practices and avoid aggressive or threatening behavior.

- Offer financial counseling: Provide referrals to financial counseling services if needed.

3. How do you manage a team of collectors and ensure they are meeting performance targets?

- Set clear performance goals and expectations.

- Provide ongoing training and support to collectors.

- Monitor collector performance metrics and provide feedback.

- Recognize and reward successful collectors.

- Address underperformance promptly and provide support to improve.

4. What is your approach to risk management in loan collections?

- Identify potential risks associated with loan collections.

- Develop risk mitigation strategies to minimize potential losses.

- Monitor and evaluate risk levels on an ongoing basis.

- Implement internal controls to ensure compliance and minimize fraud.

- Stay informed about changes in industry regulations and best practices.

5. How do you stay up-to-date on industry best practices and regulatory changes in loan collections?

- Attend industry conferences and webinars.

- Read industry publications and white papers.

- Consult with legal and regulatory experts.

- Network with other loan collection professionals.

- Stay informed through online resources and databases.

6. How do you handle challenging customers or situations in loan collections?

- Maintain a calm and professional demeanor.

- Listen to the customer’s concerns and acknowledge their feelings.

- Explain the situation clearly and provide options for resolution.

- Be willing to negotiate and compromise within reason.

- Document all interactions and follow up promptly.

7. What are the key metrics you track to measure loan collection performance?

- Collection rate:Percentage of past due balances collected.

- Average days past due:Average number of days a loan is past due.

- Recovery rate:Percentage of charged-off loans that are recovered.

- Cost of collection:Expenses incurred in the collection process.

- Compliance rate:Percentage of collections activities that are conducted in compliance with regulations.

8. How do you use technology to enhance loan collection processes?

- Automated collection systems:Streamline collection processes and improve efficiency.

- Data analytics:Identify trends and optimize collection strategies.

- Customer relationship management (CRM) software:Manage customer interactions and track progress.

- Mobile apps:Enable collectors to work remotely and access real-time data.

- Predictive modeling:Identify customers at risk of delinquency.

9. What is your experience with developing and implementing loan collection policies and procedures?

- Collaborate with legal and compliance departments to ensure compliance with regulations.

- Develop clear and concise policies that outline collection strategies and procedures.

- Train staff on new policies and procedures.

- Monitor and evaluate the effectiveness of policies and make adjustments as needed.

- Stay informed about industry best practices and regulatory changes.

10. What are the ethical considerations you take into account when managing loan collections?

- Treat customers with fairness and respect.

- Avoid harassing or threatening behavior.

- Protect customer privacy and confidentiality.

- Comply with all applicable laws and regulations.

- Promote a culture of ethical conduct within the collection team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit and Loan Collections Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit and Loan Collections Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit and Loan Collections Supervisor plays a pivotal role in ensuring the efficient recovery of overdue payments and maintaining positive customer relationships. Key responsibilities include:

1. Strategic Planning and Management

Develop and implement collection strategies to optimize recovery rates and minimize write-offs.

2. Team Management and Development

Supervise and train a team of collectors, providing guidance, support, and performance evaluations.

3. Financial Performance Monitoring

Track and analyze collection metrics, such as recovery rates, average handling time, and customer satisfaction.

4. Customer Relationship Management

Communicate with delinquent customers to understand their situations, resolve disputes, and negotiate repayment plans.

5. Compliance and Legal adherence

Ensure all collection activities comply with regulatory requirements and industry best practices.

Interview Tips

To ace an interview for a Credit and Loan Collections Supervisor, candidates should:

1. Research the Company and Role

Gather information about the company’s collection policies, target market, and your potential responsibilities.

2. Highlight Relevant Experience and Skills

Showcase your expertise in collections management, team leadership, and customer service.

3. Prepare for Behavioral Questions

Using the STAR method, prepare examples of how you have handled challenging collection situations, resolved customer disputes, and motivated your team.

4. Practice Case Studies

Be prepared to discuss hypothetical collection scenarios and demonstrate your analytical and problem-solving abilities.

5. Emphasize Customer Focus

Highlight your commitment to building positive customer relationships even in challenging situations.

6. Dress Professionally and Be Punctual

First impressions matter, so dress appropriately and arrive on time for your interview.

7. Ask Thoughtful Questions

At the end of the interview, ask questions that demonstrate your interest in the role and the company.

Next Step:

Now that you’re armed with the knowledge of Credit and Loan Collections Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit and Loan Collections Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini