Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Credit Assessment Analyst interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Credit Assessment Analyst so you can tailor your answers to impress potential employers.

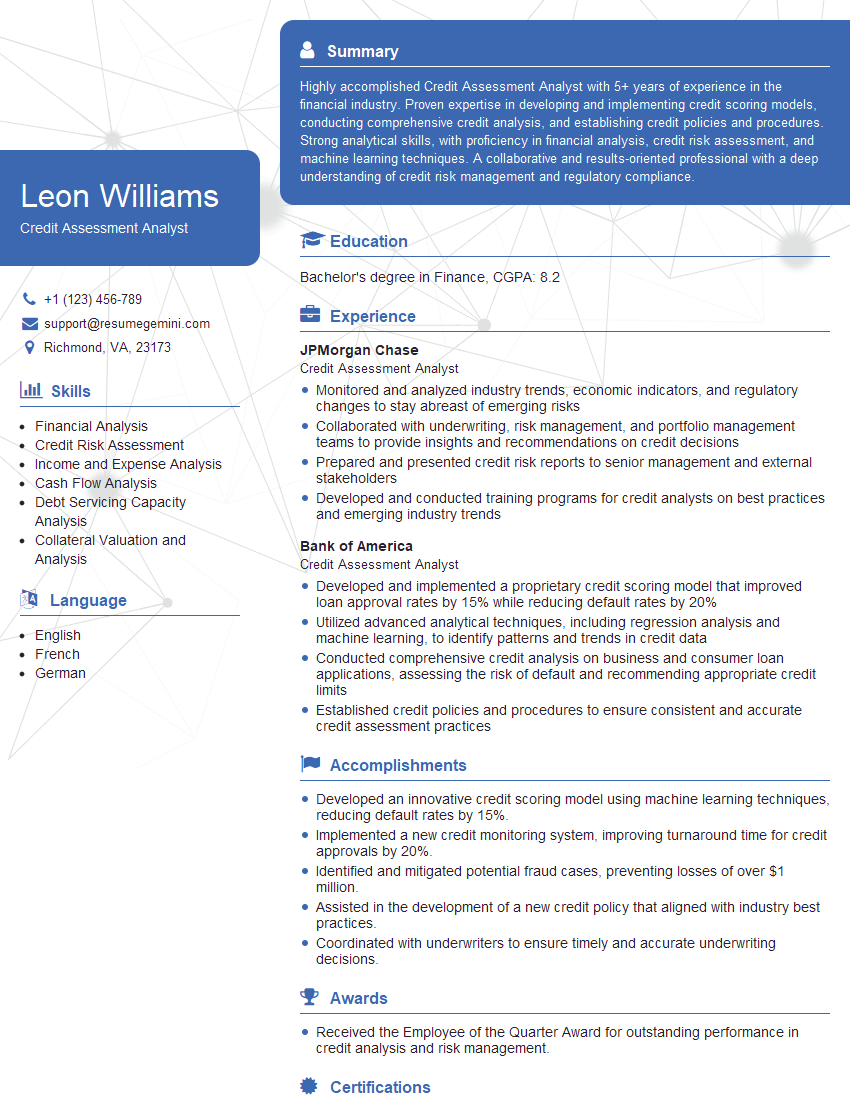

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Assessment Analyst

1. How do you evaluate a company’s financial health?

- Analyze Financial Statements: Review income statements, balance sheets, and cash flow statements to assess profitability, liquidity, and solvency.

- Examine Industry and Market Conditions: Consider the company’s industry dynamics, competitive landscape, and economic factors that impact its financial performance.

- Conduct Ratio Analysis: Calculate financial ratios such as debt-to-equity, current ratio, and profit margin to identify strengths, weaknesses, and trends.

- Assess Management Quality: Evaluate the experience, qualifications, and track record of the management team to gauge their ability to navigate challenges and drive growth.

- Consider Credit History and Payment Performance: Review the company’s credit history, payment patterns, and any outstanding debt obligations to assess their financial responsibility.

2. Explain the process of developing a credit risk model.

Data Collection and Analysis

- Gather historical data on credit performance, financial ratios, and other relevant variables.

- Clean and preprocess the data to ensure its accuracy and consistency.

- Perform exploratory data analysis to identify patterns and trends in the data.

Model Development and Validation

- Select appropriate statistical techniques, such as logistic regression or neural networks, to build the model.

- Calibrate the model’s parameters using cross-validation and other techniques to optimize its predictive accuracy.

- Validate the model’s performance on a holdout dataset to assess its generalization ability.

Implementation and Monitoring

- Deploy the model to score new credit applications and assess their risk levels.

- Monitor the model’s performance over time and make adjustments as needed to maintain its accuracy.

3. Describe the different types of credit analysis used in commercial lending.

- Qualitative Analysis: Involves subjective assessments of the borrower’s business model, management team, and industry outlook.

- Quantitative Analysis: Focuses on the borrower’s financial performance, debt structure, and cash flow analysis.

- Scorecard Analysis: Utilizes statistical models to assign numerical scores to credit applications based on various financial and non-financial factors.

- Cash Flow Analysis: Assesses the borrower’s ability to generate sufficient cash flow to meet its debt obligations.

- Sensitivity Analysis: Evaluates the impact of changes in key financial assumptions on the borrower’s creditworthiness.

4. What are the key factors that influence a borrower’s creditworthiness?

- Financial Performance: Including profitability, liquidity, and solvency.

- Debt Structure: Level of debt, interest coverage ratio, and debt maturity schedule.

- Cash Flow Generation: Ability to generate sufficient cash flow to meet debt obligations.

- Management Experience and Quality: Expertise and track record of the management team.

- Industry and Market Conditions: Dynamics of the borrower’s industry and the overall economic environment.

- Collateral: Value and quality of any collateral pledged to secure the loan.

5. How do you assess the credit risk of a new business?

- Review Business Plan and Projections: Evaluate the company’s business model, growth strategy, and financial projections.

- Analyze Financial Statements: Assess the company’s financial performance, cash flow, and debt structure.

- Conduct Industry Research: Understand the industry dynamics, competitive landscape, and potential risks specific to the business.

- Interview Management Team: Meet with the company’s key executives to gauge their experience, qualifications, and commitment to the business.

- Perform Sensitivity Analysis: Analyze the impact of different financial assumptions on the company’s creditworthiness.

6. Explain the concept of loan covenants and their importance in credit analysis.

- Purpose: Loan covenants are contractual agreements that restrict the borrower’s actions and provide protection to the lender in case of financial distress.

- Types: Covenants can include financial ratios (e.g., debt-to-equity ratio), restrictions on asset sales, and limitations on dividend payments.

- Importance: Covenants ensure that the borrower maintains a certain level of financial health and discourages actions that could weaken its creditworthiness.

7. How do you stay up to date on the latest credit analysis techniques and industry best practices?

- Professional Development: Attend industry conferences, webinars, and workshops to enhance knowledge and skills.

- Continuing Education: Pursue certifications or advanced degrees in credit analysis or related fields.

- Industry Publications: Read industry journals, magazines, and research papers to stay abreast of emerging trends and best practices.

- Networking: Connect with other credit professionals and participate in industry groups to exchange knowledge and insights.

8. Describe a time when you had to make a difficult credit decision and explain your rationale.

- Situation: Describe the context and specific credit decision in question.

- Analysis: Explain the key factors and data you considered in your analysis.

- Decision: Outline the decision you made and the reasons behind it.

- Outcome: Summarize the impact or consequences of your decision.

9. Explain how you use data visualization tools to communicate credit analysis findings.

- Types of Tools: Discuss specific data visualization tools you use, such as Tableau, Power BI, or Google Data Studio.

- Benefits: Highlight the effectiveness of data visualization in conveying complex credit analysis results in a clear and concise manner.

- Examples: Provide examples of how you have used data visualization to present insights on financial performance, credit risk assessment, or industry trends.

10. Describe your experience in using credit scoring models and how you ensure their accuracy and fairness.

- Model Types: Discuss the different types of credit scoring models you have used, such as logistic regression, decision trees, or neural networks.

- Model Development: Explain the steps involved in developing and validating a credit scoring model, including data collection, feature selection, and performance evaluation.

- Accuracy and Fairness: Emphasize the measures you take to ensure the accuracy and fairness of your credit scoring models, such as cross-validation, bias analysis, and external audits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Assessment Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Assessment Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Assessment Analyst is responsible for assessing the creditworthiness of individuals and businesses. They analyze financial data such as credit reports, income statements, and balance sheets to determine the risk of lending money. Based on their analysis, they make recommendations on whether or not to approve loans, set credit limits, and adjust interest rates.

1. Credit Analysis

Assess the creditworthiness of individuals and businesses. Review financial statements to verify income, assets, and debt. Calculate credit scores and other risk assessment metrics.

2. Loan Approvals

Recommend loan approvals or denials based on credit analysis. Determine loan amounts, interest rates, and repayment terms. Monitor loan performance and make adjustments as needed.

3. Risk Management

Identify and mitigate credit risks. Develop and implement credit policies and procedures. Monitor changes in economic conditions and industry trends.

4. Customer Service

Provide excellent customer service to loan applicants and borrowers. Explain credit decisions and answer questions. Assist with loan applications and documentation.

Interview Tips

Preparing for an interview can help you feel more confident and perform at your best. Here are some tips to help you ace your interview for a Credit Assessment Analyst position:

1. Research the Company and Position

Before the interview, take some time to learn about the company and the specific role you’re applying for. This will help you understand the company’s culture and the responsibilities of the position.

2. Practice Answering Common Interview Questions

There are several common interview questions that you’re likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” Practice answering these questions in advance so that you can deliver your responses confidently.

3. Highlight Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the job. For example, if you have experience in financial analysis or credit risk management, be sure to mention it.

4. Ask Thoughtful Questions

At the end of the interview, you will likely be given an opportunity to ask questions. This is a great chance to show your interest in the position and the company. Ask thoughtful questions about the company’s culture, the team you would be working with, and the company’s plans for the future.

Example Outline

When answering interview questions, it can be helpful to use an outline to structure your response. Here is an example outline that you can use:

- Introduce yourself and state your interest in the position.

- Briefly describe your skills and experience that are relevant to the job.

- Provide a specific example of a time when you successfully completed a similar task.

- Conclude by reiterating your interest in the position and how you can contribute to the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Assessment Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!