Are you gearing up for a career in Credit Cashier? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Credit Cashier and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

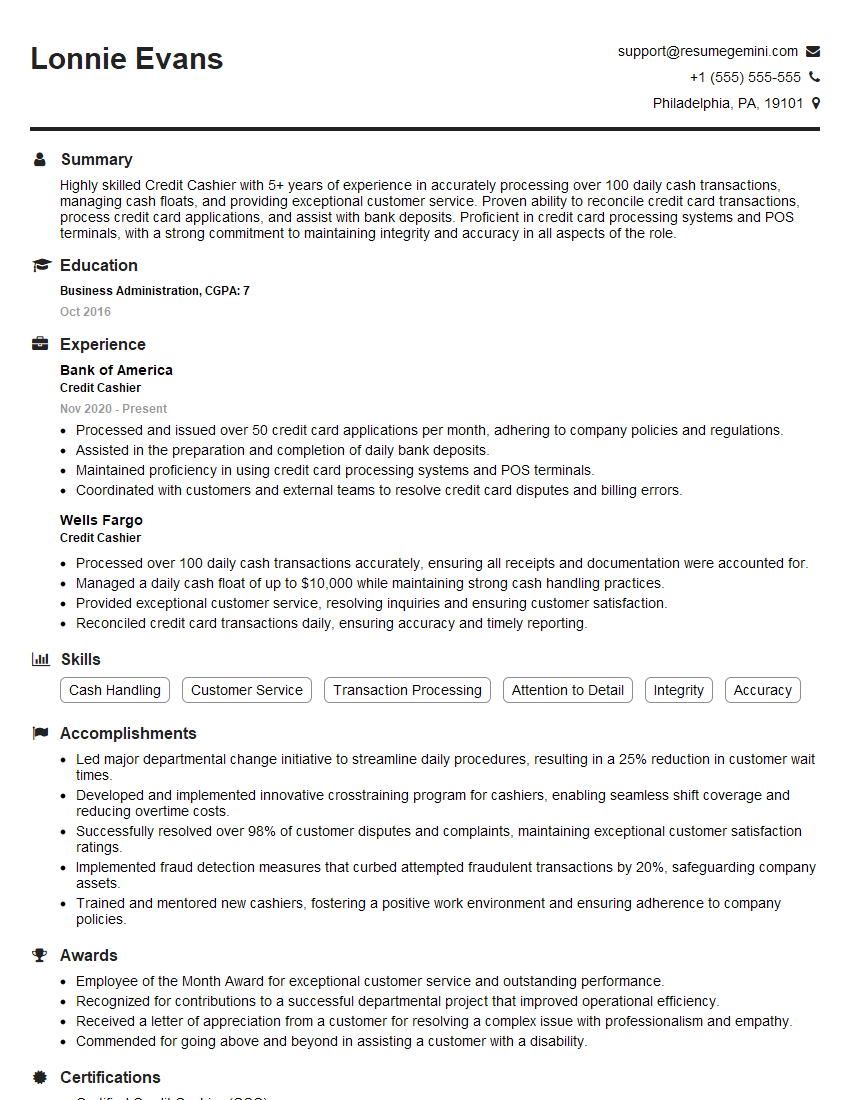

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Cashier

1. How do you ensure that the customer’s sensitive financial information is kept confidential?

The confidentiality of our customers’ financial information is of utmost importance to me. I follow strict protocols and security measures to safeguard this sensitive data. Some key practices include:

- Adhering to company policies and PCI DSS compliance standards

- Maintaining physical security measures, such as access control and surveillance systems

- Using encryption and secure communication channels for transmitting sensitive data

- Regularly updating software and security patches to protect against vulnerabilities

- Educating myself and staying informed about the latest security best practices

2. Describe the process you would follow when receiving and processing a customer’s credit card payment.

Verifying the Customer’s Identity

- Requesting a valid photo ID

- Verifying the signature on the card against the customer’s ID

Processing the Transaction

- Entering the card information into the payment terminal

- Confirming the transaction amount with the customer

- Obtaining the customer’s authorization (e.g., PIN or signature)

Completing the Transaction

- Printing a receipt for the customer

- Documenting the transaction in the system

- Ensuring that the transaction is processed accurately and securely

3. What do you do if you notice a discrepancy between the customer’s credit card information and their identification?

If I notice a discrepancy between the customer’s credit card information and their identification, I would:

- Discreetly notify my supervisor or manager

- Request additional identification from the customer (e.g., another form of ID or a recent utility bill)

- Compare the additional identification to the credit card information

- Document the discrepancy and the steps taken

- Follow the company’s policies and procedures for handling potential fraudulent transactions

4. How do you handle customers who are experiencing financial difficulties?

When dealing with customers experiencing financial difficulties, I strive to be empathetic and understanding. I would:

- Listen attentively to the customer’s situation and express empathy

- Explain the company’s policies and procedures for late payments or payment arrangements

- Provide information on available financial assistance programs

- Refer the customer to a financial counselor if necessary

- Maintain confidentiality and treat the customer with respect

5. Describe how you would resolve a dispute from a customer who claims that their credit card was stolen.

To resolve a dispute from a customer who claims that their credit card was stolen, I would:

- Calmly and empathetically acknowledge the customer’s concern

- Request the customer’s account information and a copy of the disputed transaction

- Review the account history and transaction details to identify any suspicious activity

- Contact the card issuer to report the dispute and freeze the account

- Document the customer’s claim and the steps taken to resolve it

- Follow the company’s policies and procedures for handling fraud disputes

6. What is your understanding of the Payment Card Industry Data Security Standard (PCI DSS)?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that businesses must follow to protect customer credit card data. I am familiar with the key requirements of PCI DSS, including:

- Storing cardholder data securely

- Transmitting cardholder data securely

- Protecting cardholder data from unauthorized access

- Regularly testing security systems and processes

7. How do you handle large cash transactions?

When handling large cash transactions, I follow strict procedures to ensure accuracy and security:

- Counting the cash carefully and verifying the amount

- Documenting the transaction details, including the amount, currency, and date

- Storing the cash securely in a designated safe or vault

- Reconciling the cash at the end of the day

8. What do you do if you make a mistake in processing a transaction?

If I make a mistake in processing a transaction, I would:

- Immediately acknowledge the error to the customer and my supervisor

- Correct the mistake as quickly and accurately as possible

- Document the error and the steps taken to correct it

- Review my processes and procedures to identify any areas for improvement

9. Describe your experience in handling customer complaints.

Throughout my experience as a Credit Cashier, I have effectively handled various customer complaints. I approach each situation with empathy and professionalism:

- Actively listening to the customer’s concerns

- Investigating the issue thoroughly

- Providing clear and concise explanations

- Resolving the complaint fairly and efficiently

- Following up with the customer to ensure satisfaction

10. What motivates you to excel as a Credit Cashier?

I am deeply motivated to excel as a Credit Cashier due to my passion for customer service and my commitment to financial accuracy. I find immense satisfaction in:

- Ensuring that every customer interaction is positive and efficient

- Protecting sensitive financial information and maintaining compliance

- Contributing to the smooth operation of the business

- Growing my knowledge and skills to enhance my performance

- Making a meaningful difference in the financial well-being of our customers

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Cashier.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Cashier‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Process Credit Card Transactions

Promptly and accurately process credit card transactions for customers making purchases

- Verify customer information, check for fraud, and obtain authorization

- Use a variety of payment processing systems and electronic terminals

2. Maintain Cash Drawer and Reconcile Transactions

Establish and maintain a balanced cash drawer throughout each shift

- Count cash and coins, prepare deposits, and make change

- Reconcile transactions to ensure accuracy and prevent discrepancies

3. Provide Excellent Customer Service

Interact with customers in a professional and courteous manner

- Answer questions, resolve issues, and provide assistance

- Maintain a positive attitude and represent the company well

4. Follow Company Policies and Procedures

Adhere to established policies and procedures for handling cash, transactions, and customer interactions

- Follow security protocols to prevent fraud and ensure safety

- Attend training and maintain knowledge of best practices

Interview Tips

A well-prepared interview can significantly increase your chances of success. Here are some tips to help you prepare effectively:

1. Research the Company and Position

Familiarize yourself with the company’s history, values, and products/services

- Visit their website, read company reviews, and follow them on social media

- Understand the specific responsibilities and qualifications outlined in the job description

2. Practice Answering Common Interview Questions

Prepare thoughtful responses to frequently asked interview questions

- Develop answers that highlight your skills, experience, and enthusiasm for the role

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

3. Dress Professionally and Arrive on Time

Make a good impression by dressing appropriately and arriving punctually

- Choose attire that is neat, clean, and fits the company culture

- Be mindful of personal grooming and hygiene

4. Be Enthusiastic and Show Your Interest

Demonstrate your interest in the position and express why you are passionate about the company

- Share specific examples that illustrate your enthusiasm and commitment

- Ask thoughtful questions about the company, team, and role

5. Follow Up After the Interview

Send a thank-you note within 24 hours of the interview

- Express your appreciation for the opportunity to interview

- Reiterate your interest in the position and key strengths you bring

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Credit Cashier, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Credit Cashier positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.