Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Credit Coordinator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Credit Coordinator so you can tailor your answers to impress potential employers.

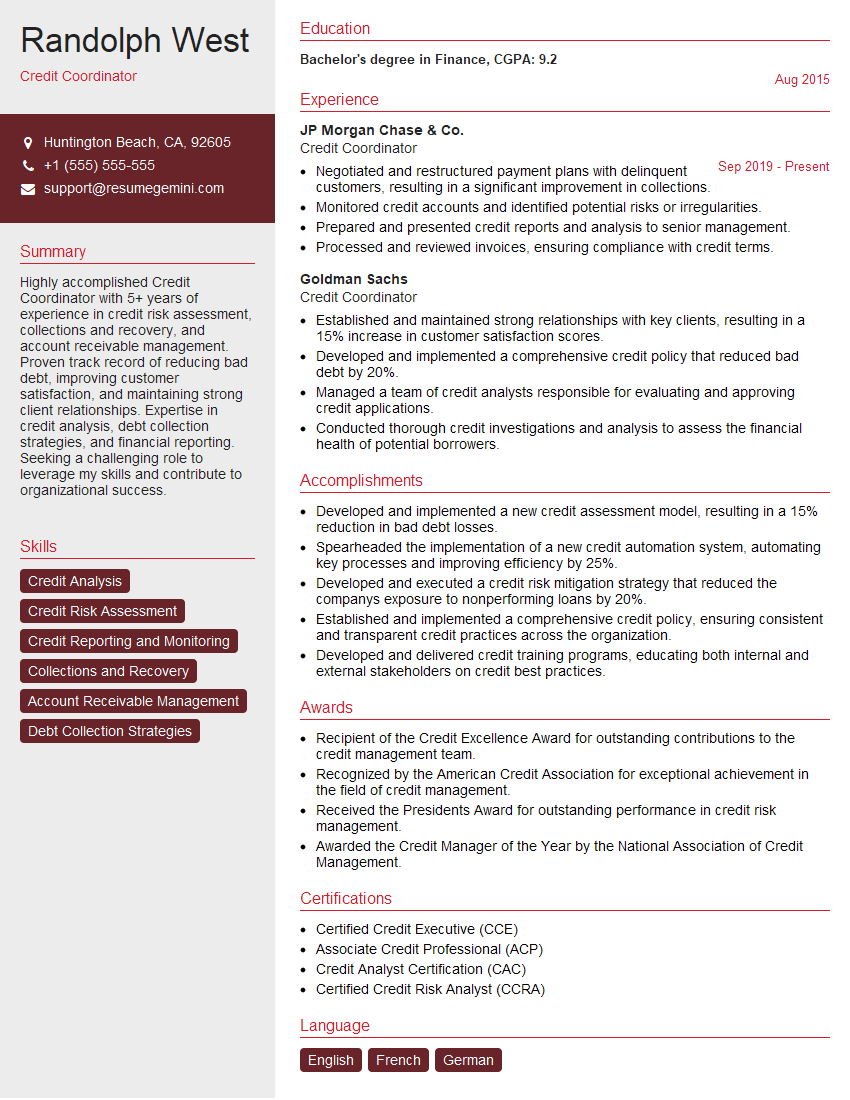

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Coordinator

1. Describe the key responsibilities of a Credit Coordinator.

• Managing the customer credit applications and assessing their financial stability.

• Communicating with customers regarding credit limits, payment terms, and other credit-related issues.

• Monitoring customer accounts and ensuring timely payments.

• Investigating and resolving customer credit issues.

• Maintaining accurate and up-to-date credit files.

• Developing and implementing credit policies and procedures.

2. What are the key metrics used to evaluate the performance of a Credit Coordinator?

Key Metrics:

- Number of credit applications processed

- Time taken to process credit applications

- Credit approval rate

- Customer satisfaction

- Bad debt ratio

3. What are the different types of credit analysis techniques and when would you use each technique?

Types of Credit Analysis Techniques:

- Financial ratio analysis: Used to assess the financial health of a company by comparing its financial ratios to industry benchmarks.

- Cash flow analysis: Used to assess a company’s ability to generate and use cash.

- Credit scoring: Used to predict the likelihood that a customer will default on a loan.

- Industry analysis: Used to assess the overall health of a particular industry.

- Peer group analysis: Used to compare a company to similar companies in the same industry.

4. What are the common red flags that you look for when reviewing a credit application?

- Inconsistent or incomplete financial information

- Poor credit history

- High levels of debt

- Unstable employment history

- Negative references

5. How do you handle a customer who is disputing a credit decision?

- Listen to the customer’s concerns and try to understand their perspective.

- Review the credit file and any other relevant information to ensure that the decision was made correctly.

- Explain the decision to the customer in a clear and concise manner.

- Be willing to negotiate with the customer, if appropriate.

- Document the conversation and any agreements that are made.

6. What are the key challenges that you face in your role as a Credit Coordinator?

- Keeping up with the latest changes in credit regulations.

- Managing a high volume of credit applications.

- Making credit decisions in a timely manner.

- Balancing the need to approve credit with the need to minimize risk.

- Dealing with difficult customers.

7. What are your strengths and weaknesses as a Credit Coordinator?

Strengths:

- Strong analytical skills

- Excellent communication and interpersonal skills

- Proven ability to manage a high volume of work

- Up-to-date knowledge of credit regulations

- Experience in developing and implementing credit policies and procedures

Weaknesses:

- Limited experience in managing a team

- Can be a bit too detail-oriented at times

8. What are your career goals for the next 5 years?

- To become a Credit Manager

- To develop a deep understanding of credit risk management

- To help my company develop and implement innovative credit policies and procedures

- To build a strong team of credit professionals

9. What are your salary expectations?

My salary expectations are in line with the market average for Credit Coordinators with my experience and skill set. I am confident that I can make a significant contribution to your company and I am willing to negotiate a salary that is fair and equitable.

10. Do you have any questions for me?

- What are the biggest challenges that the company is facing in terms of credit risk?

- What are the company’s plans for growth in the next few years?

- How does the company view the role of the Credit Coordinator in the overall success of the business?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Coordinators play a vital role in safeguarding a company’s financial interests. Here are their key responsibilities:

1. Credit Risk Management

Assessing the creditworthiness of potential customers, evaluating their financial standing, and determining credit limits is a primary job responsibility.

2. Order Processing and Invoicing

Coordinators track orders, maintain accurate customer records, and generate invoices to initiate payments.

3. Accounts Receivable Management

They manage unpaid invoices, facilitate payment processing, and handle customer inquiries regarding balances.

4. Payment Processing and Collection

Credit Coordinators oversee the timely collection of payments, apply received funds, and follow up on overdue accounts.

Interview Tips

To ace the interview, follow these tips:

1. Research the Company

Demonstrate your interest in the company by thoroughly researching their industry, products/services, and culture. This shows you’re well-informed and engaged.

2. Highlight Relevant Skills

During the interview, emphasize your credit analysis expertise, attention to detail, and communication skills. These abilities are essential for success in this role.

3. Prepare Questions

Asking thoughtful questions not only shows your interest but also gives you insights into the company’s operations and expectations. Inquire about the company’s credit policies, average credit terms, and team structure.

4. Quantify Your Accomplishments

Support your responses with specific examples and quantify your achievements whenever possible. For instance, “I successfully reduced overdue accounts by 15% within the first six months of my previous role.”

5. Be Enthusiastic

Convey your passion for credit coordination and demonstrate your eagerness to contribute to the company’s financial stability. Your enthusiasm can make a lasting impression.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Coordinator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.