Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

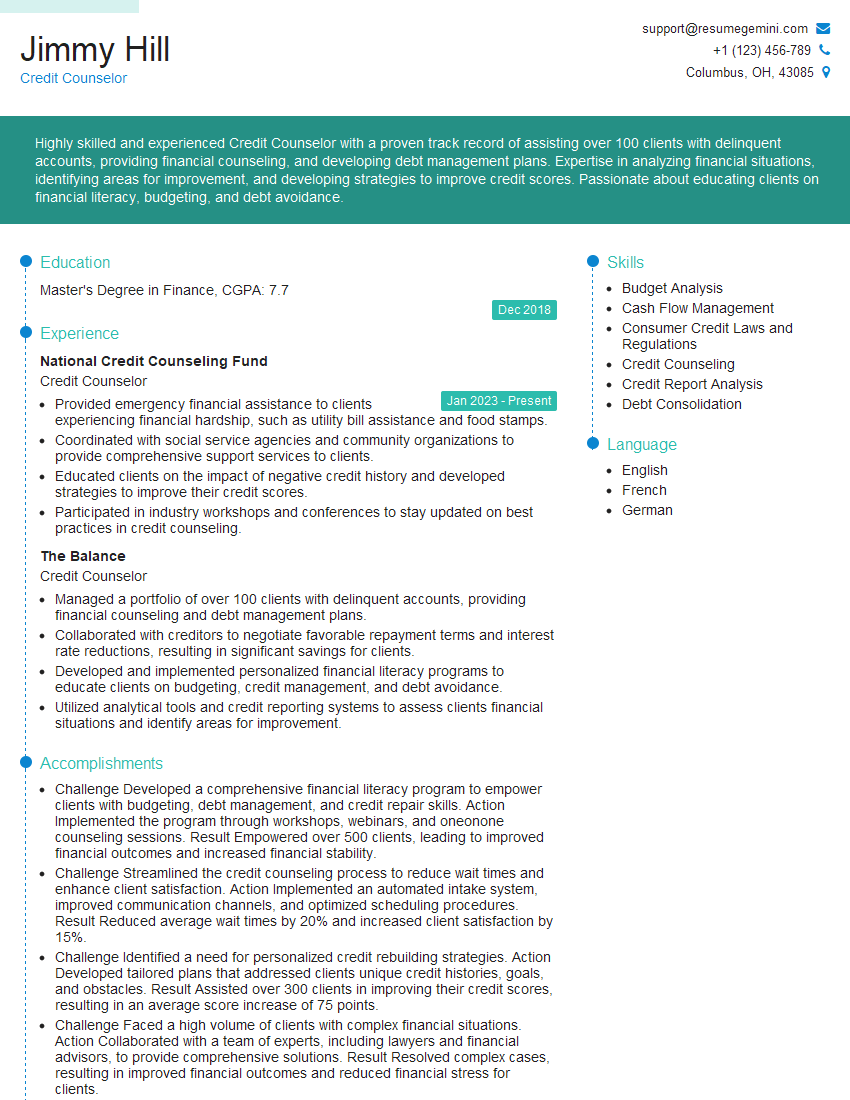

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Counselor

1. Describe the role of a Credit Counselor and explain its significance in improving clients’ financial situations.

A Credit Counselor is a professional who assists individuals and families in managing their credit and debt effectively. We play a significant role in improving clients’ financial situations by:

- Educating them about credit and debt management.

- Developing personalized debt repayment plans.

- Negotiating with creditors to reduce interest rates and fees.

- Monitoring clients’ progress and providing ongoing support.

2. What are the key principles of Fair Debt Collection Practices Act (FDCPA)?

Prohibited Actions

- Calling before 8 AM or after 9 PM.

- Contacting third parties (except the debtor, attorney, or co-signer).

- Harassing or threatening the debtor.

- Using profane or obscene language.

- Falsely representing the amount of debt owed.

Required Actions

- Identifying themselves and their purpose.

- Verifying the debt and providing written notice within 5 days.

- Honoring the debtor’s written request for validation of the debt.

- Cease communication if the debtor disputes the debt and requests it in writing.

3. Explain the difference between secured and unsecured debt. Provide examples of each.

Secured debt is backed by collateral, such as a house or car. If the borrower defaults on the loan, the lender can seize and sell the collateral to recover the debt. Examples include mortgages, auto loans, and home equity loans.

Unsecured debt is not backed by collateral. If the borrower defaults, the lender has no recourse except to sue for repayment. Examples include credit card debt, personal loans, and medical bills.

4. How do you determine a client’s creditworthiness? What factors do you consider?

To determine a client’s creditworthiness, I consider several factors, including:

- Credit history and score

- Debt-to-income ratio

- Employment history and income

- Assets and liabilities

- Any recent credit inquiries or defaults

5. Describe the different types of debt consolidation options available to clients. What are the advantages and disadvantages of each?

Debt consolidation loan: Combines multiple debts into a single loan with a lower interest rate. Advantages: Simplifies repayment, potential interest savings. Disadvantages: May require collateral, application and origination fees.

Balance transfer credit card: Transfers balances from high-interest cards to a card with a lower interest rate. Advantages: Interest-free period, lower interest rate. Disadvantages: Balance transfer fees, still making multiple payments.

Debt management plan (DMP): Works with a credit counseling agency to make monthly payments to creditors. Advantages: Reduced interest rates, fees, and penalties. Disadvantages: May affect credit score, can take several years to pay off debt.

6. How do you handle clients who are struggling with emotional or psychological issues related to debt?

I approach such clients with empathy and understanding. I:

- Acknowledge their emotions and let them express their concerns.

- Educate them about the psychological effects of debt.

- Discuss coping mechanisms and provide resources for emotional support.

- Refer them to mental health professionals if necessary.

7. Describe a challenging situation you faced as a Credit Counselor and how you resolved it.

I worked with a client who was a single mother struggling with overwhelming credit card debt. She had lost her job and was facing foreclosure on her home. I:

- Negotiated with creditors to reduce her interest rates and monthly payments.

- Developed a personalized debt management plan that included budgeting and financial literacy training.

- Connected her with social services and community resources for additional support.

Through her hard work and my guidance, she was able to get her finances back on track, save her home, and improve her overall well-being.

8. How do you stay updated on changes in credit laws and regulations?

I regularly attend industry conferences, webinars, and workshops to stay abreast of the latest changes in credit laws and regulations. I also subscribe to industry publications and newsletters, and consult with legal experts when necessary.

9. What are some of the ethical considerations that Credit Counselors must be aware of?

Credit Counselors have a duty to act in the best interests of their clients. This includes:

- Maintaining confidentiality

- Avoiding conflicts of interest

- Providing accurate and unbiased information

- Treating clients with respect and compassion

- Adhering to all applicable laws and regulations

10. How do you measure the success of your work as a Credit Counselor?

I measure the success of my work by the positive impact I have on my clients’ financial lives. This includes:

- Reduced debt and improved credit scores

- Increased financial literacy and confidence

- Improved overall well-being and reduced financial stress

- Referrals from satisfied clients

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Credit Counselor, you will play a crucial role in assisting individuals and families in managing their finances and improving their credit. Here are the key job responsibilities you can expect:

1. Financial Counseling

Provide financial guidance and counseling to clients facing credit challenges, budgeting issues, and debt repayment.

- Analyze clients’ financial situations and identify areas for improvement.

- Develop personalized debt management plans and credit rebuilding strategies.

2. Credit Education

Educate clients on credit management, responsible borrowing, and the impact of credit scores on financial health.

- Conduct workshops and presentations on credit-related topics.

- Develop educational materials and resources for clients.

3. Debt Negotiation

Negotiate with creditors on behalf of clients to reduce interest rates, lower monthly payments, or consolidate debts.

- Review clients’ credit reports and identify potential areas for debt settlement.

- Communicate and negotiate with creditors to reach favorable agreements.

4. Budgeting and Financial Planning

Assist clients in creating and managing budgets, reducing expenses, and improving their overall financial health.

- Develop customized spending plans and provide guidance on budgeting.

- Identify opportunities for clients to increase their income or reduce their expenses.

Interview Tips

To ace your Credit Counselor interview, consider the following tips and preparation strategies:

1. Research the Organization and Role

Thoroughly research the organization you are applying to, including their mission, values, and approach to financial counseling. This knowledge will demonstrate your interest and understanding of the role.

- Review the organization’s website, annual reports, and social media presence.

- Read articles and news about the organization’s work in the community.

2. Highlight Your Skills and Experience

In your resume and interview, emphasize your relevant skills and experience in credit counseling, financial management, and interpersonal communication. Use specific examples to demonstrate your abilities.

- Quantify your accomplishments, such as the number of clients you have assisted or the amount of debt you have helped clients negotiate.

- Provide examples of how you have successfully applied your financial counseling knowledge to help clients improve their financial situation.

3. Show Empathy and Understanding

Credit counselors play a vital role in helping individuals overcome financial challenges. During the interview, convey your empathy and understanding of the sensitive nature of the work. Highlight your passion for helping others.

- Share your experiences in working with individuals facing financial difficulties.

- Explain how you create a supportive and non-judgmental environment for clients.

4. Prepare for Common Interview Questions

Practice answering common interview questions related to credit counseling, financial management, and your career goals. Anticipating these questions will help you respond confidently and effectively.

- Why did you choose a career in credit counseling?

- How do you approach working with clients from diverse backgrounds and financial situations?

- What strategies have you found effective in helping clients manage their debt and improve their credit scores?

5. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for your interview on time to demonstrate your respect for the opportunity and the organization.

- Choose attire that is appropriate for a business setting, such as a suit or business casual.

- Allow ample time for travel and unforeseen circumstances to ensure you arrive at the interview location on time.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Counselor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.