Are you gearing up for an interview for a Credit Department Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Department Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

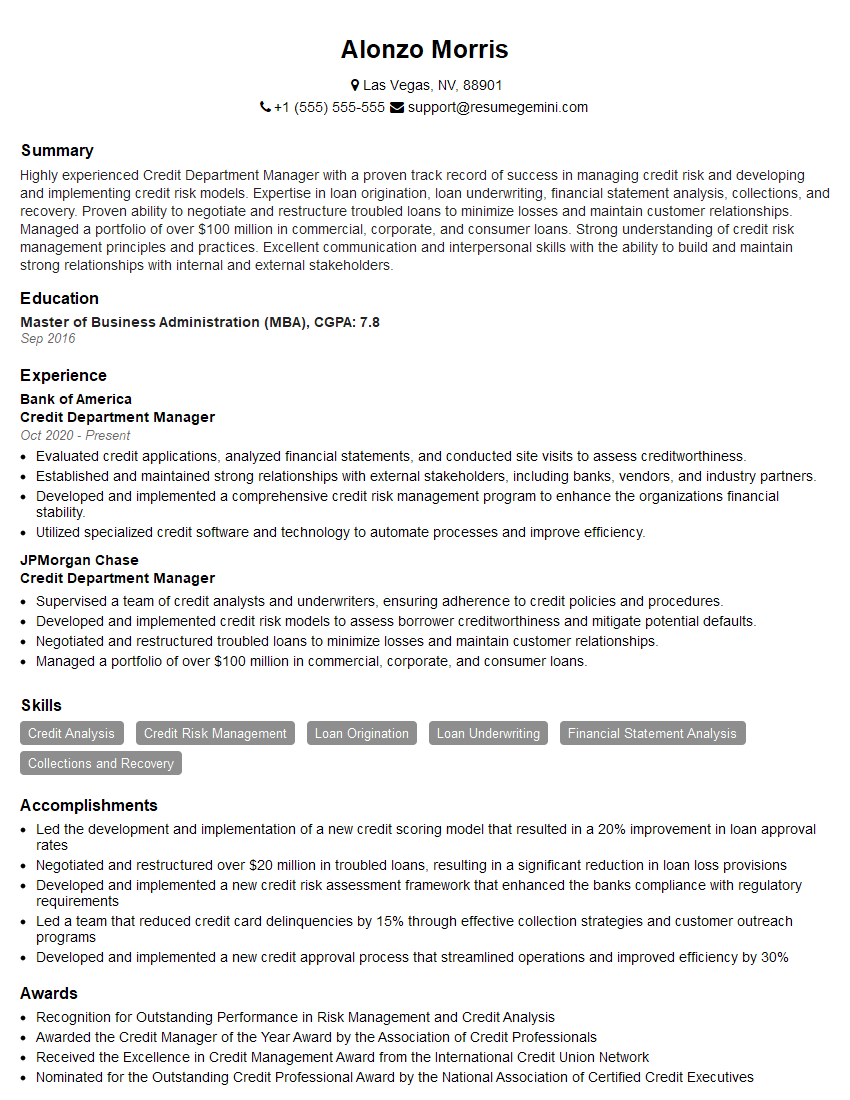

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Department Manager

1. What are the key responsibilities of a Credit Department Manager?

As a Credit Department Manager, my key responsibilities include:

- Developing and implementing credit policies and procedures

- Analyzing and approving credit applications

- Monitoring and managing credit risk

- Collecting and recovering overdue accounts

- Reporting on credit performance to senior management

- Managing a team of credit analysts and collectors

2. What are the different types of credit analysis techniques?

Quantitative Analysis

- Ratio analysis

- Cash flow analysis

- Balance sheet analysis

Qualitative Analysis

- Industry analysis

- Management analysis

- Company analysis

3. What are the factors that you consider when approving a credit application?

When approving a credit application, I consider the following factors:

- The borrower’s credit history

- The borrower’s financial statements

- The borrower’s business plan

- The borrower’s industry

- The borrower’s management team

- The amount of credit being requested

- The terms of the credit agreement

4. What are the different types of credit risk?

The different types of credit risk include:

- Default risk

- Concentration risk

- Country risk

- Industry risk

- Political risk

5. How do you manage credit risk?

I manage credit risk by:

- Developing and implementing credit policies and procedures

- Analyzing and approving credit applications

- Monitoring and managing credit risk

- Collecting and recovering overdue accounts

- Reporting on credit performance to senior management

- Managing a team of credit analysts and collectors

6. What are the different types of credit scoring models?

The different types of credit scoring models include:

- Discriminant analysis

- Logistic regression

- Neural networks

- Decision trees

7. What are the advantages and disadvantages of using credit scoring models?

Advantages

- Objectivity

- Consistency

- Speed

- Cost-effectiveness

Disadvantages

- Can be biased

- May not be accurate for all types of borrowers

- Can be difficult to develop and maintain

8. What are the different types of credit insurance?

The different types of credit insurance include:

- Trade credit insurance

- Political risk insurance

- Surety bonds

9. What are the advantages and disadvantages of using credit insurance?

Advantages

- Protects against credit losses

- Can improve access to credit

- Can reduce the cost of credit

Disadvantages

- Can be expensive

- May not cover all types of credit losses

- Can be difficult to obtain

10. What are the trends in credit risk management?

The trends in credit risk management include:

- The use of big data and analytics

- The development of new credit scoring models

- The use of machine learning and artificial intelligence

- The increasing use of credit insurance

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Department Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Department Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Credit Department Manager is responsible for leading and managing all aspects of the credit department, including credit risk management, credit analysis, and collections. The ideal candidate will have a deep understanding of credit risk management principles and practices, as well as a strong track record of success in managing a credit department.

1. Credit Risk Management

The Credit Department Manager is responsible for developing and implementing credit risk management policies and procedures. This includes setting credit limits, evaluating credit applications, and monitoring credit risk exposure. The Manager must also stay up-to-date on changes in the regulatory environment and ensure that the department is in compliance with all applicable laws and regulations.

- Develop and implement credit risk management policies and procedures.

- Set credit limits and evaluate credit applications.

- Monitor credit risk exposure and take appropriate action to mitigate risks.

- Stay up-to-date on changes in the regulatory environment and ensure compliance with all applicable laws and regulations.

2. Credit Analysis

The Credit Department Manager is responsible for overseeing the credit analysis process. This includes analyzing financial statements, conducting credit checks, and assessing the creditworthiness of potential borrowers. The Manager must have a strong understanding of financial analysis techniques and be able to make sound credit decisions.

- Oversee the credit analysis process.

- Analyze financial statements and conduct credit checks.

- Assess the creditworthiness of potential borrowers.

- Make sound credit decisions.

3. Collections

The Credit Department Manager is responsible for overseeing the collections process. This includes managing delinquent accounts, negotiating payment arrangements, and taking legal action when necessary. The Manager must have a strong understanding of collections laws and regulations and be able to effectively manage a team of collectors.

- Oversee the collections process.

- Manage delinquent accounts.

- Negotiate payment arrangements.

- Take legal action when necessary.

4. Reporting and Analysis

The Credit Department Manager is responsible for providing regular reports to senior management on the performance of the credit department. This includes reporting on credit risk exposure, delinquencies, and collections. The Manager must be able to analyze data and identify trends and patterns.

- Provide regular reports to senior management on the performance of the credit department.

- Report on credit risk exposure, delinquencies, and collections.

- Analyze data and identify trends and patterns.

Interview Tips

The interview process for a Credit Department Manager position can be competitive. To increase your chances of success, it is important to prepare thoroughly. Here are a few tips to help you ace the interview:

1. Research the Company and the Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and goals. You should also learn as much as you can about the job responsibilities and the qualifications required for the position.

- Visit the company’s website.

- Read the job description carefully.

- Talk to people in your network who work at the company.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Write down your answers to common interview questions.

- Practice delivering your answers out loud.

- Get feedback from a friend or family member.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience and qualifications. Be prepared to talk about your work history, your skills, and your accomplishments. You should also be able to explain how your experience makes you a good fit for the position.

- Highlight your experience in credit risk management, credit analysis, and collections.

- Quantify your accomplishments whenever possible.

- Be prepared to discuss your strengths and weaknesses.

4. Ask Questions

At the end of the interview, the interviewer will likely give you an opportunity to ask questions. This is your chance to learn more about the position and the company. Be sure to ask thoughtful questions that show your interest in the position and the company.

- Ask about the company’s culture and values.

- Ask about the specific responsibilities of the position.

- Ask about the company’s plans for the future.

Next Step:

Now that you’re armed with the knowledge of Credit Department Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Department Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini