Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Interviewer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

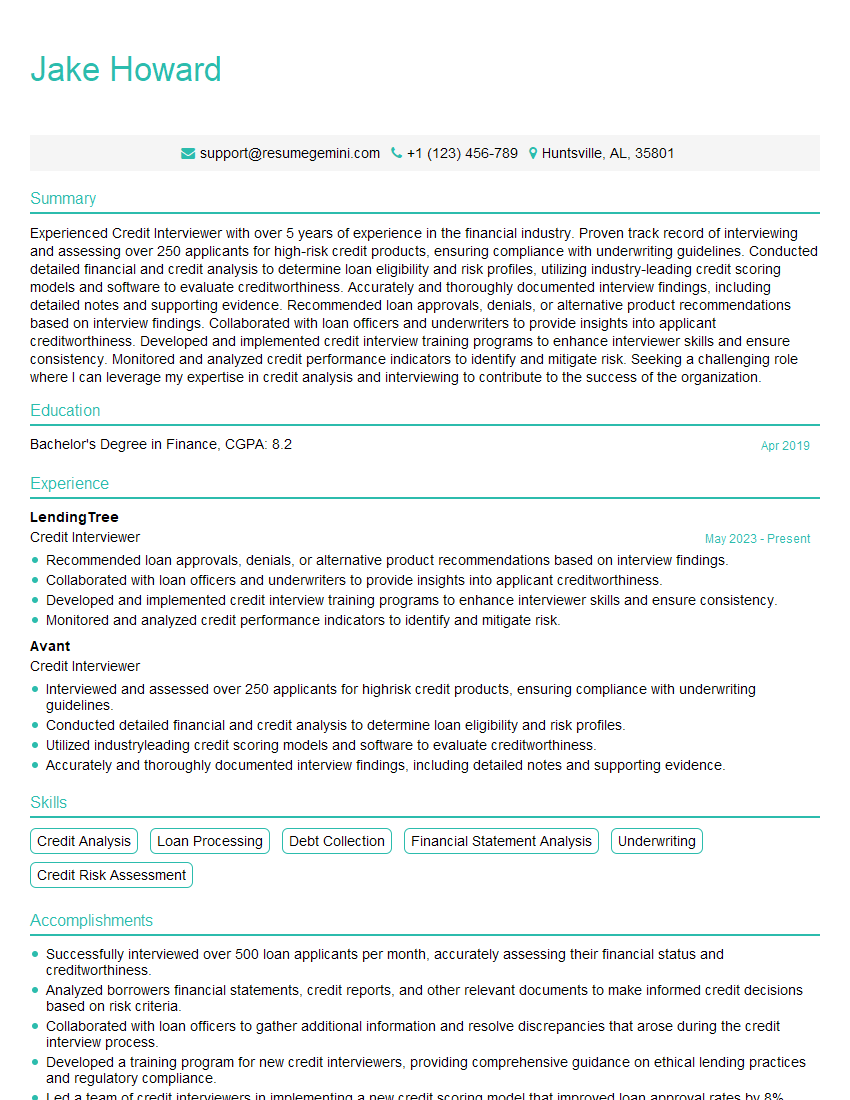

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Interviewer

1. How do you typically conduct financial ratio analysis for credit assessment?

– Assessing liquidity, efficiency, leverage, and profitability ratios – Comparing ratios to industry benchmarks and historical performance – Identifying trends and anomalies to gain insights into financial health

2. Describe the steps you take to prepare and present a credit analysis report.

Data Gathering

- Collect financial statements, industry data, and other relevant information

- Verify and clean data for accuracy and consistency

Analysis

- Perform ratio analysis and other financial assessments

- Identify key findings and develop insights

Report Writing

- Summarize findings and present key metrics

- Provide recommendations and credit rating

3. What methodologies do you use to assess credit risk?

– Traditional approaches (e.g., ratio analysis, cash flow analysis) – Statistical models (e.g., credit scoring, regression analysis) – Machine learning techniques (e.g., decision trees, neural networks)

4. How do you handle sensitive client data and maintain confidentiality?

– Adhering to data protection regulations and company policies – Using secure data storage and encryption protocols – Limiting access to sensitive information on a need-to-know basis

5. Describe your experience in evaluating credit applications for both individuals and businesses.

– Assessing individual applicants’ income, assets, and liabilities – Analyzing business financials, industry trends, and management team – Verifying documentation, conducting interviews, and reference checks

6. How do you stay up-to-date with industry best practices and regulatory changes in credit assessment?

– Attending conferences and webinars – Reading industry publications and research reports – Participating in professional development programs – Monitoring regulatory updates and maintaining compliance

7. What are the most common challenges you face in credit assessment and how do you overcome them?

– Incomplete or inaccurate data: Verify information through multiple sources – Subjective judgments: Use objective methodologies and seek input from colleagues – Pressure to approve or decline applications: Maintain professional integrity

8. Can you describe a specific instance where your credit assessment skills helped make a significant impact on a business decision?

– Identifying a high-risk investment and preventing a potential loss – Approving a business loan that led to significant growth for the company

9. What are your thoughts on the use of AI and automation in credit assessment?

– Benefits: Improved efficiency, consistency, and objectivity – Challenges: Potential bias, need for human oversight, regulatory compliance

10. How do you handle situations where you disagree with the recommendations of your colleagues or superiors?

– Respectfully present your analysis and supporting data – Seek alternative perspectives and consider their reasoning – Escalate concerns to management if necessary, maintaining professionalism

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Interviewer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Interviewer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A credit interviewer is a crucial part of the financial industry, tasked with evaluating and assessing the creditworthiness of individuals or businesses. They play a pivotal role in making informed decisions about lending and credit approvals, contributing to the stability and soundness of the financial system. Key job responsibilities include:

1. Credit Analysis:

Thoroughly reviewing and analyzing financial documents, such as credit reports, bank statements, and tax returns, to assess the applicant’s financial history and current financial position.

- Evaluating income, assets, debts, and credit history to determine creditworthiness and repayment capacity.

- Calculating key financial ratios and analyzing trends to assess the applicant’s financial stability and risk profile.

- Identifying any red flags or inconsistencies that may indicate credit risks or fraudulent activities.

2. Applicant Interviewing:

Conducting in-person or telephone interviews with applicants to gather additional information and verify the accuracy of the financial documents provided.

- Asking probing questions to understand the applicant’s financial situation, reasons for seeking credit, and repayment plans.

- Assessing the applicant’s communication skills, demeanor, and overall credibility.

- Documenting the interview findings and summarizing key takeaways.

3. Credit Recommendation:

Providing a comprehensive credit recommendation to the lending or underwriting team, outlining the applicant’s creditworthiness, risk assessment, and recommended credit terms.

- Justifying the recommendation based on the analysis and interview findings.

- Explaining the rationale, risks, and potential implications of the credit decision.

- Ensuring that the recommendation aligns with the organization’s lending policies and risk appetite.

4. Follow-up and Monitoring:

Following up with approved applicants to finalize the credit agreement and ensure proper documentation. Monitoring the performance of the approved loans and identifying any potential issues or early warning signs.

- Addressing any customer inquiries or concerns related to the credit decision or loan performance.

- Escalating any significant changes or concerns to the relevant departments or individuals.

- Providing regular updates and reports on the overall portfolio performance and identifying trends or potential risks.

Interview Tips

1. Research the Organization and Role:

Thoroughly research the financial institution and the specific credit interviewer role you are applying for. Understand the organization’s lending criteria, risk appetite, and industry standing. Familiarize yourself with the key responsibilities and expectations of the role.

- Visit the organization’s website to gather information about their mission, values, and recent financial performance.

- Read industry publications and articles to stay updated on current trends and best practices in credit analysis.

- Look for news or reviews about the organization to understand their reputation and market position.

2. Highlight Your Skills and Experience:

Emphasize your analytical, financial modeling, and communication skills. Quantify your experience in credit analysis or related fields, providing specific examples of successful credit decisions you made.

- Showcase your ability to interpret financial data, identify risks and opportunities, and make sound recommendations.

- Discuss your experience in conducting effective interviews, building rapport with clients, and extracting relevant information.

- Explain how your understanding of lending regulations and industry best practices has contributed to your success in credit analysis.

3. Prepare for Behavioral Interview Questions:

Be prepared to answer behavioral interview questions that focus on your past experiences and how they relate to the role of a credit interviewer. Use the STAR method (Situation, Task, Action, Result) to provide structured and impactful answers.

- Describe a challenging credit analysis you handled and how you resolved it successfully.

- Explain how you identified a potential risk or fraud during an applicant interview and the steps you took to mitigate it.

- Share an example of how you communicated a complex credit decision to a client or stakeholder, addressing their concerns effectively.

4. Practice and Rehearse:

Practice answering common interview questions out loud. Seek feedback from a mentor, friend, or family member to refine your responses and improve your confidence.

- Prepare for technical questions related to credit analysis, such as financial ratio analysis, credit scoring models, or regulatory compliance.

- Consider mock interviews with industry professionals or recruiters to get valuable insights and feedback on your performance.

- Time yourself to ensure you can provide concise and impactful answers within the allotted time.

Next Step:

Now that you’re armed with the knowledge of Credit Interviewer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Interviewer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini