Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Negotiator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

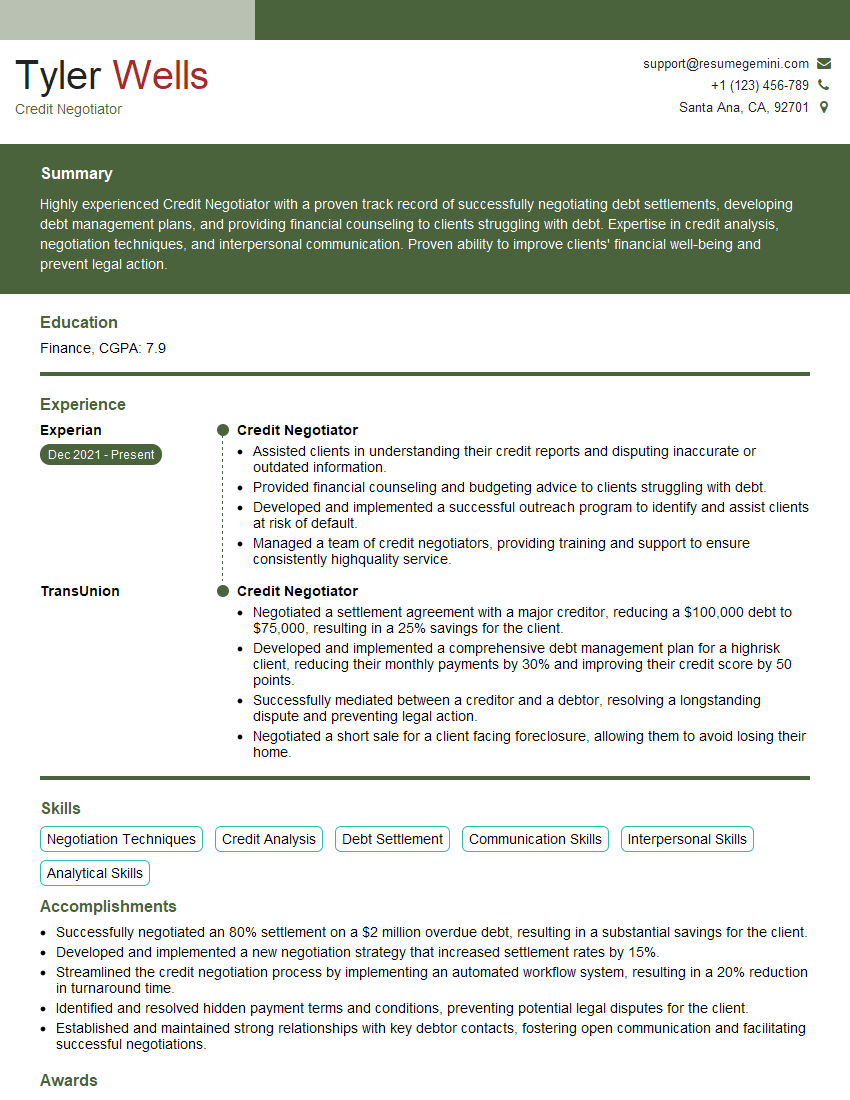

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Negotiator

1. What is your understanding of the role of a Credit Negotiator?

As a Credit Negotiator, my key responsibility is to assist borrowers in resolving delinquent debts with creditors. My role involves negotiating payment plans, modifying loan terms, and advocating for the borrower’s interests to obtain favorable outcomes.

2. How do you prioritize and manage a high volume of cases?

Managing Caseload

- Employ a systematic approach to organize and track multiple cases.

- Prioritize cases based on urgency, account status, and potential impact.

- Utilize case management software or spreadsheets for efficient tracking.

Time Management

- Implement time management techniques to allocate time effectively.

- Block out time for specific tasks and adhere to schedules.

- Delegate tasks when appropriate to optimize productivity.

3. Describe the key skills and qualities required to be an effective Credit Negotiator.

- Excellent communication and negotiation skills.

- Strong understanding of credit laws and regulations.

- Analytical and problem-solving abilities.

- Empathy and understanding of borrower’s financial situations.

- Persistence and resilience in dealing with challenging cases.

4. How do you prepare for and conduct a successful negotiation with a creditor?

Preparation

- Thoroughly review account history, credit report, and supporting documentation.

- Assess the borrower’s financial situation and develop a realistic negotiation strategy.

- Research applicable laws, regulations, and industry guidelines.

Negotiation

- Establish rapport with the creditor and present the borrower’s case effectively.

- Utilize negotiation techniques to advocate for the borrower’s interests.

- Explore various options and be prepared to compromise while maintaining the borrower’s goals.

5. How do you handle situations where you are unable to reach an agreement with a creditor?

- Maintain professionalism and continue to advocate for the borrower’s interests.

- Explore alternative solutions, such as mediation or legal action, if necessary.

- Document all communications and actions taken to protect the borrower’s rights.

6. How do you stay up-to-date with the latest industry regulations and best practices?

- Attend industry conferences, workshops, and seminars.

- Review publications, articles, and online resources.

- Network with other Credit Negotiators and professionals in the field.

7. What is your ethical approach to negotiating on behalf of borrowers?

- Prioritize the borrower’s interests while ensuring fair and ethical outcomes.

- Maintain confidentiality and protect the borrower’s sensitive information.

- Avoid making false or misleading statements during negotiations.

8. How do you measure your success as a Credit Negotiator?

- Positive outcomes for borrowers, including debt reduction, lower interest rates, and improved credit scores.

- Successful resolution of cases within a reasonable time frame.

- Building strong relationships with creditors and maintaining a reputation for integrity.

9. Describe a challenging negotiation experience you had and how you overcame it.

I recently negotiated with a creditor on behalf of a borrower who had a significant amount of debt. The creditor was initially unwilling to compromise. However, by thoroughly preparing, presenting a strong case, and exploring alternative solutions, I was able to negotiate a payment plan that was affordable for the borrower and acceptable to the creditor.

10. How do you think technology is impacting the role of a Credit Negotiator?

- Automating certain tasks, such as document preparation and communication.

- Providing access to real-time data and analytics for informed decision-making.

- Enhancing collaboration with creditors through online platforms.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Negotiator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Negotiator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Negotiators play a pivotal role in assisting borrowers who are experiencing financial difficulties or have defaulted on their credit obligations. Their primary responsibilities encompass:

1. Debtor Communication

Establishing and maintaining productive communication with debtors to understand their financial situation, assess their ability to repay, and discuss potential debt resolution options.

2. Debt Analysis

Thoroughly reviewing and analyzing debtors’ financial profiles, including assets, income, expenses, and credit history, to determine their capacity to repay debts.

3. Negotiation and Settlement

Skilfully negotiating with creditors to modify loan terms, reduce interest rates, extend payment schedules, or pursue other debt relief alternatives that benefit both the debtor and the creditor.

4. Documentation and Reporting

Accurately documenting all communications, agreements, and transactions, and providing regular updates to creditors and debtors on the progress of debt resolution efforts.

5. Legal Compliance

Ensuring adherence to all applicable laws and regulations governing debt collection and credit negotiations, protecting the rights of debtors and maintaining ethical practices.

Interview Tips

To ace a Credit Negotiator interview, candidates should meticulously prepare and demonstrate their skills and qualifications. Here are some invaluable tips:

1. Research the Company and Industry

Thoroughly research the prospective employer and the broader debt collection industry to gain insights into their practices, culture, and key players. This knowledge will enable you to articulate your alignment with their values and goals.

2. Highlight Communication and Negotiation Abilities

Emphasize your exceptional communication skills, both verbal and written, as well as your proven ability to effectively negotiate with debtors and creditors. Provide specific examples of successful negotiations that showcase your diplomacy and conflict resolution capabilities.

3. Demonstrate Analytical and Problem-Solving Skills

Highlight your proficiency in analyzing financial data, understanding debtor situations, and developing tailored debt resolution solutions. Quantify your accomplishments with specific metrics, such as the number of accounts successfully negotiated or the percentage reduction in debt achieved.

4. Showcase Ethical and Legal Knowledge

Convey your in-depth knowledge of debt collection laws and regulations. Emphasize your commitment to ethical practices and protecting the rights of debtors while effectively representing the interests of creditors.

5. Prepare for Industry-Specific Questions

Familiarize yourself with industry-specific terminology, trends, and best practices. Research common negotiation strategies and be prepared to discuss how you would approach specific debt resolution scenarios.

Next Step:

Now that you’re armed with the knowledge of Credit Negotiator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Negotiator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini