Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Office Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

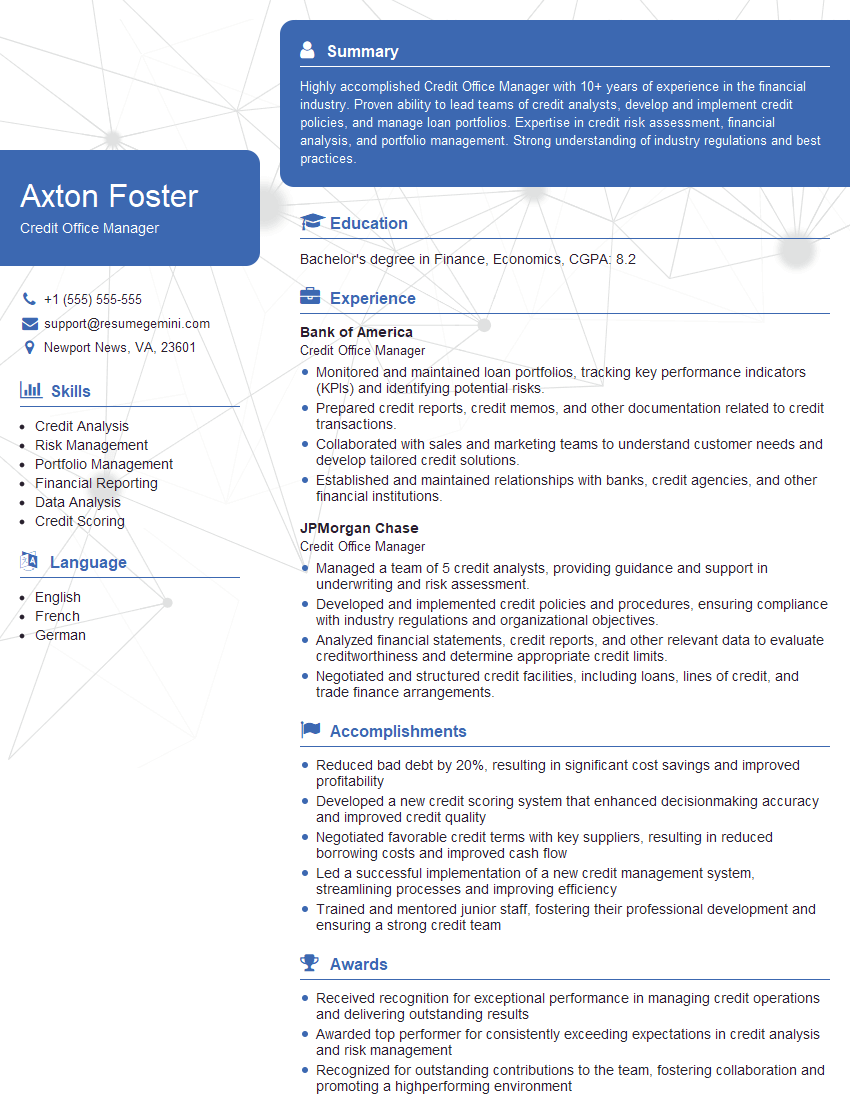

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Office Manager

1. Explain the key responsibilities of a Credit Office Manager?

- Managing the overall operations of the credit office

- Developing and implementing credit policies and procedures

- Analyzing financial statements and making credit decisions

- Monitoring and managing credit risk

- Collaborating with other departments, such as sales and finance

2. How do you stay up-to-date on changes in credit laws and regulations?

- Subheading Content

- Subheading Content

- Subheading Content

- Subheading Content

: Reading industry publications

Subheading: Attending industry events

3. What are your strengths and weaknesses as a Credit Office Manager?

- Strengths:

- Strong analytical skills

- Excellent communication and interpersonal skills

- Proven ability to manage risk

- Weaknesses:

- Could improve my knowledge of international credit markets

- Not fluent in any foreign languages

4. How do you motivate and manage your team?

- Setting clear goals and expectations

- Providing regular feedback

- Recognizing and rewarding success

- Creating a positive and supportive work environment

5. What are the most important qualities of a successful Credit Office Manager?

- Strong analytical skills

- Excellent communication and interpersonal skills

- Proven ability to manage risk

- Up-to-date knowledge of credit laws and regulations

- Ability to motivate and manage a team

6. What is your experience with credit scoring models?

- Explain your understanding of credit scoring models

- Describe your experience using credit scoring models in your previous role

- Discuss the advantages and disadvantages of using credit scoring models

7. How do you handle difficult customers?

- Listen to the customer’s concerns

- Empathize with the customer

- Work to find a mutually acceptable solution

- Follow up with the customer to ensure satisfaction

8. What are your thoughts on the future of credit management?

- Discuss the increasing use of technology in credit management

- Explain how artificial intelligence and machine learning are impacting credit decisions

- Share your thoughts on the future of credit scoring

9. What is your salary expectation?

- Research industry benchmarks for credit office manager salaries

- Consider your experience, skills, and qualifications

- Be prepared to negotiate your salary

10. Do you have any questions for me?

- This is an opportunity for you to ask questions about the company, the position, or the interviewer

- Asking thoughtful questions shows that you are interested in the position and the company

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Office Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Office Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Credit Office Manager is responsible for overseeing all aspects of the credit department within an organization. This includes managing credit operations, developing and implementing policies and procedures, and managing risk. The following are some of the key job responsibilities:

1. Manage Credit Operations

The Credit Office Manager is responsible for the day-to-day operations of the credit department. This includes:

- Approving or denying credit applications

- Collecting and analyzing customer credit data

- Maintaining customer credit files

- Monitoring customer payment history

2. Develop and Implement Policies and Procedures

The Credit Office Manager is responsible for developing and implementing policies and procedures for the credit department. This includes:

- Establishing credit limits

- Setting payment terms

- Developing collection strategies

- Implementing risk management policies

3. Manage Risk

The Credit Office Manager is responsible for managing risk in the credit department. This includes:

- Identifying and assessing credit risks

- Developing and implementing strategies to mitigate credit risks

- Monitoring credit risk exposure

- Reporting on credit risk to senior management

4. Other responsibilities

In addition to the key responsibilities listed above, the Credit Office Manager may also be responsible for other tasks, such as:

- Providing customer service

- Training and supervising staff

- Preparing reports

- Working with other departments

Interview Tips

If you are interviewing for a Credit Office Manager position, it is important to be prepared to answer questions about your experience and qualifications. Here are some tips to help you ace the interview:

1. Research the company

Before you go to your interview, take some time to research the company. This will help you understand their business, their culture, and their credit policies. This will also help you tailor your answers to the specific requirements of the position.

2. Practice answering common interview questions

There are a number of common interview questions that you can expect to be asked. These questions may include:

- Tell me about your experience in credit management.

- What are your strengths and weaknesses as a credit manager?

- How do you assess credit risk?

- What are your strategies for mitigating credit risk?

- How do you manage a team of credit analysts?

Take some time to practice answering these questions before you go to your interview. This will help you feel more confident and prepared.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in credit management. Be prepared to talk about your successes and accomplishments. You should also be able to articulate how your experience has prepared you for the Credit Office Manager position.

4. Be professional and enthusiastic

First impressions matter, so it is important to be professional and enthusiastic during your interview. Dress appropriately, arrive on time, and be polite and respectful to everyone you meet. Remember, the interviewer is looking for someone who is not only qualified, but also someone who is a good fit for the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Office Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!