Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

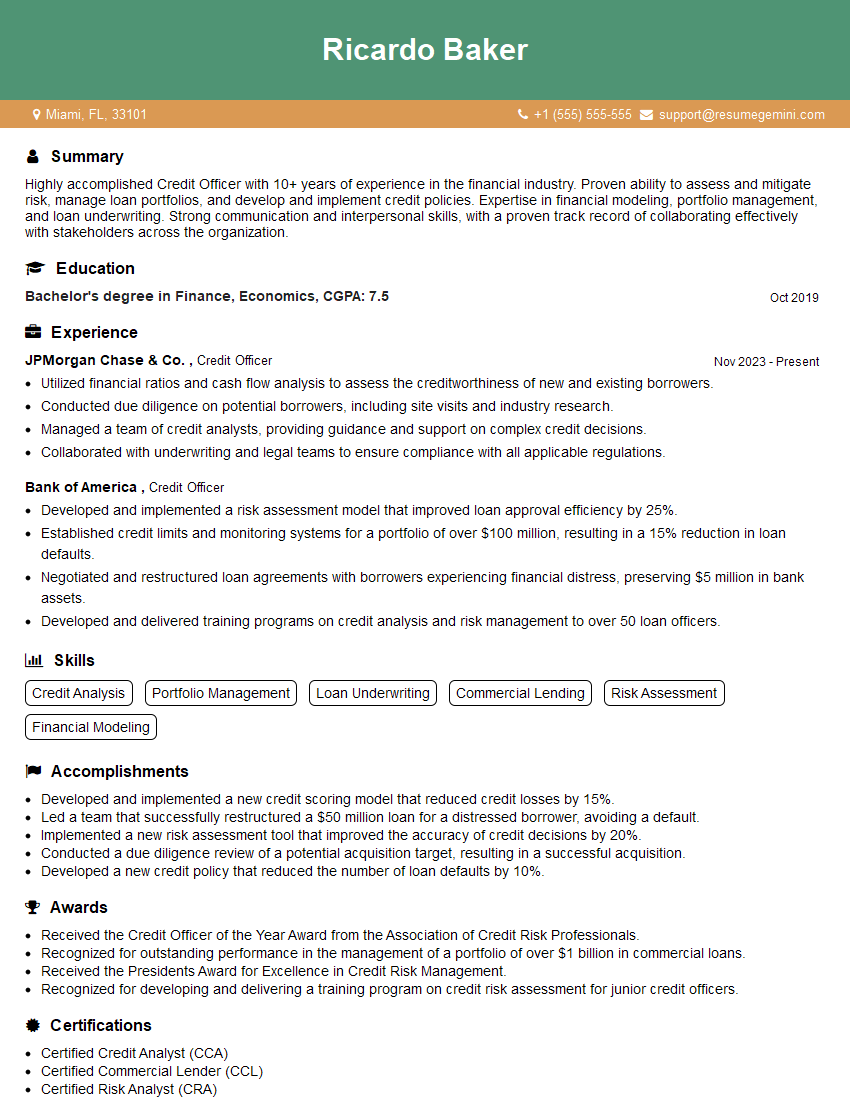

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Officer

1. Describe the key steps involved in the credit assessment process?

- Collect and review the applicant’s financial information, including income, assets, and liabilities.

- Analyze the applicant’s credit history, including credit score, number of open accounts, and payment history.

- Evaluate the applicant’s repayment capacity, including debt-to-income ratio, cash flow, and stability of income.

- Make a determination on the applicant’s creditworthiness, including the amount of credit that can be extended and the terms of repayment.

- Monitor the applicant’s credit performance and make adjustments to the credit agreement as necessary.

2. What are the different types of credit analysis techniques?

Financial Ratio Analysis

- Liquidity ratios

- Solvency ratios

- Profitability ratios

- Activity ratios

Cash Flow Analysis

- Operating cash flow

- Investing cash flow

- Financing cash flow

Industry Analysis

- Industry risk

- Industry growth

- Industry competition

3. What are the key factors that you consider when evaluating a business loan application?

- The financial strength of the business

- The purpose of the loan

- The terms of the loan

- The collateral that is offered

- The personal credit history of the business owners

4. What are the most common reasons for declining a loan application?

- Insufficient financial strength

- Poor credit history

- Insufficient collateral

- Loan purpose is not sound

- Loan terms are not acceptable

5. How do you stay up-to-date on the latest credit trends and regulations?

- Read industry publications

- Attend industry conferences

- Take continuing education courses

- Stay in touch with colleagues and peers

- Follow relevant regulatory agencies

6. What are the ethical considerations that you must be aware of when performing your job?

- Confidentiality

- Objectivity

- Avoidance of conflicts of interest

- Compliance with all applicable laws and regulations

7. How do you manage your workload and prioritize your tasks?

- Create a to-do list and prioritize the tasks based on importance and urgency.

- Use a time management tool to track your progress and stay organized.

- Delegate tasks to others when possible.

- Take breaks throughout the day to avoid burnout.

8. What are your strengths and weaknesses as a credit officer?

- Excellent analytical skills

- Strong understanding of credit principles and regulations

- Proven ability to make sound credit decisions

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- I can be overly cautious at times

- I am still learning about the industry

Strengths:

Weaknesses:

9. Why are you interested in working for our company?

- Your company is a leader in the financial services industry.

- I am impressed by your company’s commitment to customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am excited about the opportunity to learn and grow within your company.

10. What are your career goals?

- I would like to continue to develop my skills and experience as a credit officer.

- I am interested in eventually moving into a management role.

- I would like to make a significant contribution to the financial services industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Officers are responsible for assessing and managing the creditworthiness of individuals and businesses. They play a critical role in the lending process, ensuring that institutions make sound lending decisions and minimize financial risk.

1. Credit Analysis

Conduct thorough financial analysis of potential borrowers, including reviewing financial statements, credit reports, and other relevant documentation.

- Assess the borrower’s income, assets, and liabilities to determine their ability to repay the loan.

- Evaluate the borrower’s credit history and track record to assess their creditworthiness.

2. Risk Assessment

Identify and evaluate potential risks associated with lending to a particular borrower.

- Assess industry trends, economic conditions, and other factors that may impact the borrower’s ability to repay.

- Identify potential fraud or irregularities in the borrower’s financial records.

3. Credit Decision-Making

Make recommendations to management regarding the approval or denial of credit applications.

- Determine the appropriate amount and terms of the loan based on the borrower’s creditworthiness and risk assessment.

- Set loan covenants and restrictions to mitigate risk and protect the lender’s interests.

4. Loan Monitoring and Management

Monitor the performance of outstanding loans and take appropriate actions to manage credit risk.

- Review periodic financial statements and other relevant information to assess the borrower’s financial health.

- Work with borrowers who are experiencing financial difficulties to develop repayment plans and mitigate losses.

- Identify and report potential credit quality issues to management.

Interview Tips

To ace the interview for a Credit Officer position, candidates should keep the following tips in mind:

1. Research the Company and Industry

Demonstrate your knowledge of the financial institution and the industry in which they operate. Research their loan products, target market, and recent financial performance. This shows that you are genuinely interested in the position and have taken the time to prepare.

- Read the company’s website, annual reports, and press releases.

- Follow industry news and trends.

- Network with professionals in the field.

2. Highlight Your Analytical Skills

Emphasize your strong analytical abilities, both quantitative and qualitative. Provide examples of how you have used financial analysis to make sound decisions in your previous roles. This is essential for a Credit Officer, as they need to be able to assess financial statements, credit reports, and other data to determine the creditworthiness of potential borrowers.

- Quantify your accomplishments whenever possible, using specific metrics and data.

- Be prepared to discuss your understanding of credit scoring models and risk assessment techniques.

3. Showcase Your Industry Knowledge

Demonstrate your familiarity with the lending industry, including regulations, best practices, and ethical considerations. This shows that you are up-to-date on the latest developments and are committed to maintaining high ethical standards. Having industry knowledge is a must-have for Credit Officers, as they must be aware of the risks and regulations that surround the lending process.

- Discuss your understanding of relevant laws and regulations, such as the Equal Credit Opportunity Act.

- Explain your approach to ethical decision-making in a lending context.

4. Prepare for Behavioral Questions

Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result). This technique helps you provide structured and concise responses that highlight your skills and experiences. Some common behavioral questions for Credit Officer interviews include:

- “Tell me about a time when you had to make a difficult decision regarding a loan application.” Emphasize your analytical process, risk assessment, and communication skills.

- “Describe a situation where you identified and mitigated a potential credit risk.” Highlight your attention to detail, problem-solving abilities, and sense of urgency.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!