Feeling lost in a sea of interview questions? Landed that dream interview for Credit Products Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Products Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

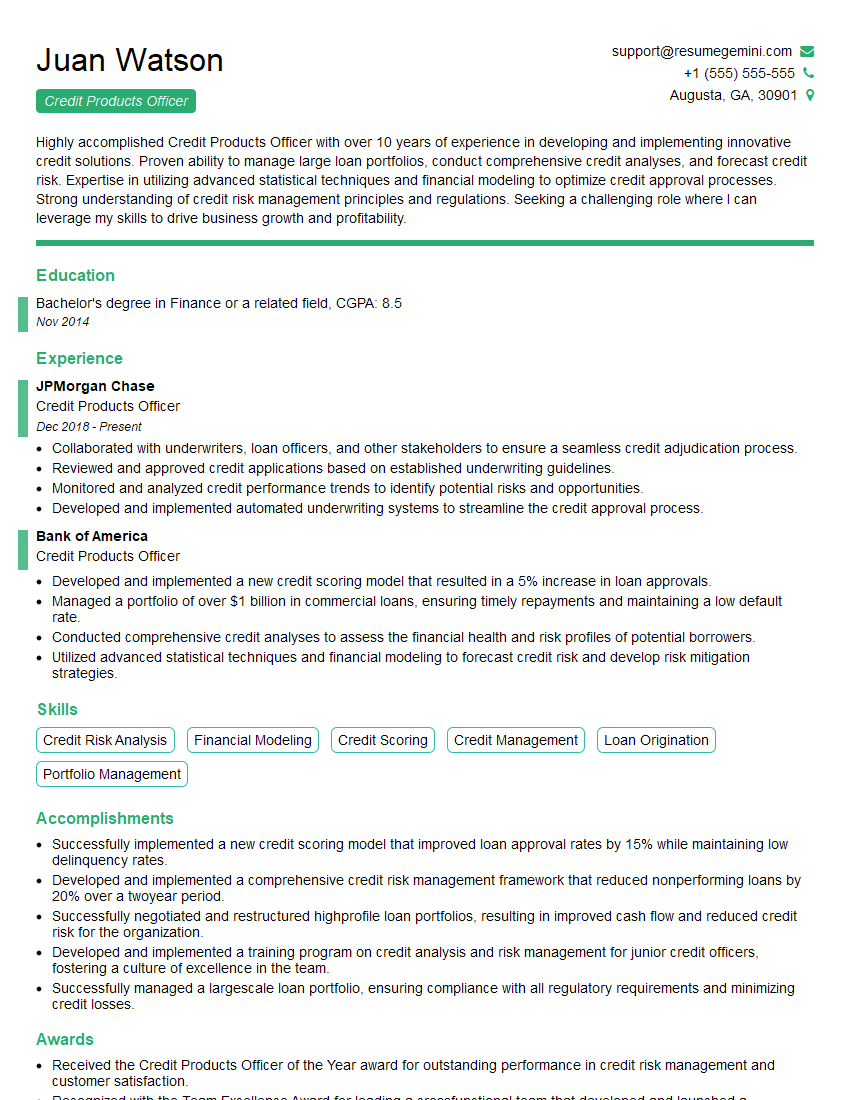

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Products Officer

1. Explain the concept of credit scoring and how it is used to assess the creditworthiness of loan applicants?

- Credit scoring is a statistical method used to predict the likelihood of a borrower repaying a loan.

- It is based on a number of factors, including the borrower’s credit history, income, and debt-to-income ratio.

- A higher credit score indicates that the borrower is a lower risk and is more likely to repay the loan.

2. What are the different types of credit products available and how are they structured?

Types of Credit Products

- Unsecured loans: These loans are not backed by collateral and are typically used for short-term borrowing.

- Secured loans: These loans are backed by collateral, such as a house or a car, and are typically used for long-term borrowing.

- Revolving credit: This type of credit allows the borrower to borrow up to a certain limit and repay the balance over time.

Structure of Credit Products

- Interest rate: The interest rate is the cost of borrowing money and is expressed as a percentage of the loan amount.

- Loan term: The loan term is the length of time the borrower has to repay the loan.

- Repayment schedule: The repayment schedule outlines the amount of each payment and the due date.

3. How do you evaluate the creditworthiness of a loan applicant?

- Review the applicant’s credit history, including their credit score and any past defaults or bankruptcies.

- Assess the applicant’s income and debt-to-income ratio to determine their ability to repay the loan.

- Consider the applicant’s employment history and stability.

- Obtain references from the applicant’s previous lenders or other creditors.

4. What are the different types of collateral that can be used to secure a loan?

- Real estate: This is the most common type of collateral and includes homes, land, and commercial properties.

- Vehicles: Cars, trucks, and motorcycles can be used as collateral for loans.

- Equipment: Businesses can use equipment, such as machinery or inventory, as collateral for loans.

- Securities: Stocks, bonds, and other financial instruments can be used as collateral for loans.

5. How do you determine the amount of credit to extend to a loan applicant?

- Consider the applicant’s creditworthiness, including their credit score and debt-to-income ratio.

- Evaluate the purpose of the loan and the amount of money needed.

- Assess the value of any collateral that is being offered to secure the loan.

- Consider the bank’s lending policies and risk tolerance.

6. What are the different types of loan covenants and what are their purposes?

- Financial covenants: These covenants restrict the borrower’s ability to take on additional debt or make certain financial decisions.

- Operating covenants: These covenants restrict the borrower’s ability to engage in certain activities, such as selling assets or changing its business.

- Negative covenants: These covenants prohibit the borrower from engaging in certain activities, such as defaulting on other loans or violating any laws.

- Affirmative covenants: These covenants require the borrower to take certain actions, such as maintaining a certain level of insurance or providing financial statements.

7. How do you monitor the performance of a loan portfolio?

- Review loan performance reports regularly.

- Monitor the creditworthiness of borrowers and identify any potential problems.

- Attend meetings with borrowers to discuss their financial performance and any concerns.

- Take appropriate action to address any problems that arise, such as modifying loan terms or working with borrowers to improve their financial performance.

8. What are the different types of credit risk and how do you manage them?

Types of Credit Risk

- Default risk: The risk that the borrower will fail to repay the loan.

- Interest rate risk: The risk that changes in interest rates will affect the value of the loan portfolio.

- Liquidity risk: The risk that the bank will not be able to meet its obligations to depositors or other creditors.

- Operational risk: The risk of losses due to errors, fraud, or other operational failures.

Managing Credit Risk

- Diversify the loan portfolio across different borrowers and industries.

- Establish and maintain sound lending policies and procedures.

- Monitor the performance of the loan portfolio regularly.

- Take appropriate action to address any problems that arise.

9. What are the ethical considerations that must be taken into account when making lending decisions?

- Ensure that loans are made to creditworthy borrowers who are able to repay the loan.

- Avoid predatory lending practices that target vulnerable borrowers.

- Be transparent with borrowers about the terms and conditions of the loan.

- Respect the privacy of borrowers and their financial information.

10. What are the current trends in the credit industry and how are they likely to impact your work as a Credit Products Officer?

- The increasing use of technology in lending, such as online lending and mobile banking.

- The growing popularity of alternative lending products, such as peer-to-peer lending and marketplace lending.

- The changing regulatory landscape for the credit industry.

- The impact of economic conditions on the credit market.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Products Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Products Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Products Officer is responsible for managing the development, implementation, and maintenance of credit products offered by a financial institution. Key job responsibilities include:

1. Product Development

Conduct market research to identify customer needs and develop new credit products that meet those needs.

- Analyze market trends and competitive offerings.

- Work with product management to define product specifications and features.

2. Product Implementation

Work with various departments, including underwriting, risk management, and technology, to implement new credit products.

- Develop and implement product policies and procedures.

- Train staff on new product offerings.

3. Product Maintenance

Monitor the performance of credit products and make adjustments as needed to ensure that they continue to meet customer needs and comply with regulatory requirements.

- Review product performance data and identify areas for improvement.

- Work with product management to make necessary changes to product offerings.

4. Risk Management

Identify and assess risks associated with credit products and develop strategies to mitigate those risks.

- Conduct credit risk analysis and develop risk models.

- Work with risk management to implement risk management controls.

Interview Tips

Preparing for an interview for a Credit Products Officer position requires a thorough understanding of the job responsibilities and the financial industry. Here are some tips to help you ace the interview:

1. Research the Company and the Position

Before the interview, take the time to research the financial institution and the specific Credit Products Officer position you are applying for. This will give you a better understanding of the company’s culture, business model, and the specific responsibilities of the role.

- Visit the company’s website to learn about their products, services, and recent news.

- Read industry publications and news articles to stay up-to-date on the latest trends in credit products and risk management.

2. Quantify Your Accomplishments

When describing your experience and accomplishments in the interview, use specific numbers and metrics to quantify your results. This will help the interviewer understand the impact of your work and how you contributed to the success of your previous organization.

- For example, instead of saying “I developed new credit products,” you could say “I developed three new credit products that generated $10 million in revenue within the first year.”

3. Be Prepared to Discuss Your Risk Management Approach

Credit Products Officers are responsible for identifying and managing risks associated with credit products. In the interview, be prepared to discuss your approach to risk management and how you would mitigate risks in a variety of situations.

- Explain your experience in conducting credit risk analysis and developing risk models.

- Describe how you would collaborate with risk management to implement risk management controls.

4. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked in an interview for a Credit Products Officer position. Take the time to practice your answers to these questions in advance so that you can deliver clear, concise, and confident responses.

- Examples of common interview questions for Credit Products Officers include:

- Tell me about your experience in developing and implementing credit products.

- How do you assess and manage risks associated with credit products?

- What are your thoughts on the current trends in the credit products industry?

- Why are you interested in this position?

- What are your salary expectations?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Products Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!