Are you gearing up for an interview for a Credit Reporting Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Reporting Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

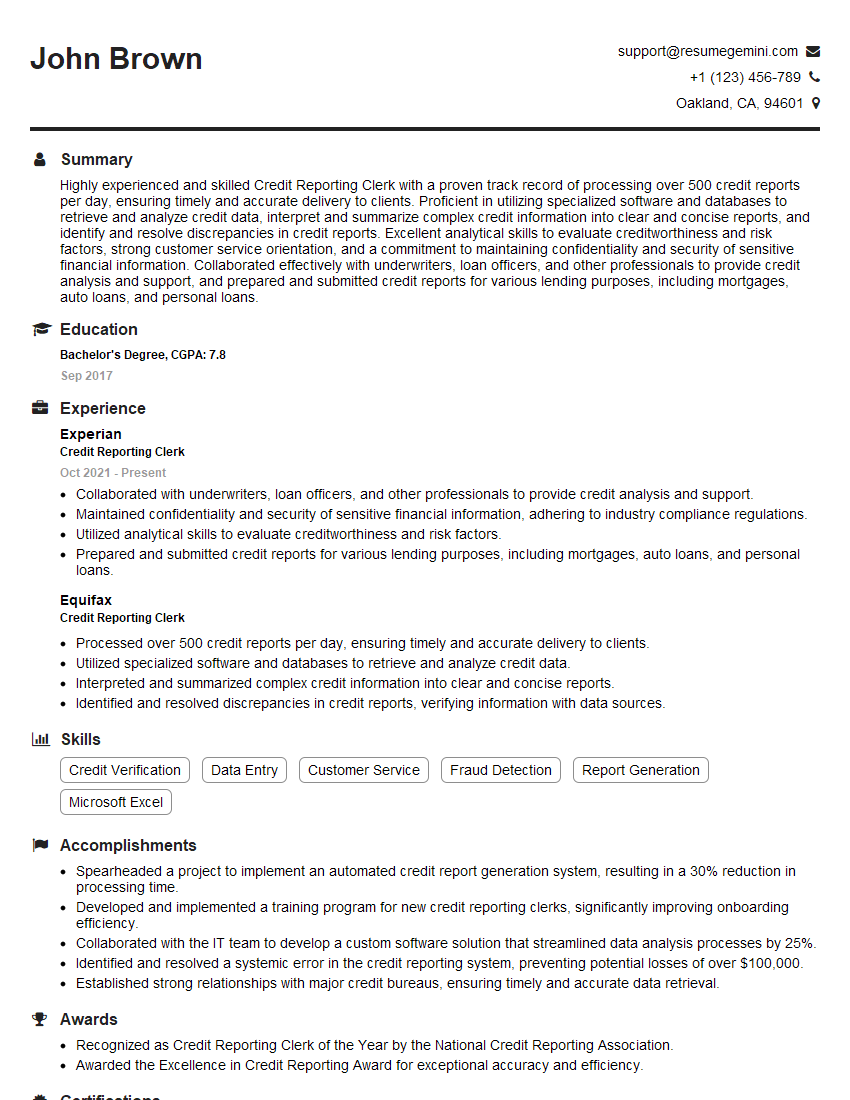

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Reporting Clerk

1. Explain the process of generating a credit report?

The process of generating a credit report typically involves the following steps:

- Data collection: Credit reporting agencies collect data from various sources, such as banks, credit unions, and other lenders, about an individual’s credit history.

- Data analysis: The collected data is analyzed to create a credit score and a credit report that summarizes the individual’s credit history.

- Report generation: The credit report is generated and sent to the individual or to a third party, such as a lender or employer, who has requested the report.

2. What are the different types of credit reports?

There are three main types of credit reports:

Annual Credit Report

- Free to obtain once a year from each of the three major credit bureaus (Equifax, Experian, and TransUnion)

- Provides a detailed overview of your credit history, including accounts, balances, and payment history

Credit Monitoring Report

- Paid subscription service that provides ongoing monitoring of your credit report

- Alerts you to any changes in your credit, such as new accounts, inquiries, or changes in your credit score

Specialized Credit Report

- Obtained for specific purposes, such as employment or insurance applications

- May contain additional information not found on a standard credit report, such as your employment history or income

3. What are the most common errors found on credit reports?

Some of the most common errors found on credit reports include:

- Incorrect personal information: such as name, address, or Social Security number

- Inaccurate account information: such as incorrect balances, payment histories, or account statuses

- Unauthorized inquiries: such as hard inquiries from lenders or creditors that you did not authorize

- Identity theft: such as fraudulent accounts or inquiries that appear on your credit report without your knowledge

4. What are the steps to dispute an error on a credit report?

To dispute an error on a credit report, you can follow these steps:

- Obtain a copy of your credit report: You can get a free copy of your credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

- Identify the error: Review your credit report carefully and identify any errors or inaccurate information.

- File a dispute: Contact the credit bureau that issued the report and submit a dispute letter. You can also file a dispute online or by phone.

- Provide supporting documentation: Include copies of any supporting documentation that proves the error, such as bank statements, payment receipts, or letters from creditors.

5. What are the consequences of having a bad credit report?

Having a bad credit report can have several negative consequences, including:

- Higher interest rates: Lenders may charge you higher interest rates on loans and credit cards if you have a poor credit score.

- Denied credit: You may be denied credit for certain loans or credit cards if your credit score is too low.

- Limited housing options: Landlords may be less likely to rent to you if you have a bad credit report.

- Higher insurance rates: Some insurance companies use credit scores to set insurance rates, so a bad credit report could lead to higher insurance premiums.

6. What are some strategies for improving your credit score?

There are several strategies you can use to improve your credit score, including:

- Pay your bills on time: Payment history is the most important factor in determining your credit score, so it’s crucial to make all of your payments on time, every time.

- Keep your credit utilization low: Credit utilization is the amount of credit you’re using compared to the amount of credit you have available. Keeping your credit utilization low shows lenders that you’re not overextending yourself.

- Avoid opening too many new accounts: Opening too many new credit accounts in a short period of time can hurt your credit score.

- Dispute any errors on your credit report: If you find any errors on your credit report, be sure to dispute them with the credit bureau.

7. What are the different types of credit inquiries?

There are two main types of credit inquiries:

Hard Inquiries

- Initiated by lenders or creditors when you apply for new credit

- Can temporarily lower your credit score

- Stay on your credit report for two years

Soft Inquiries

- Initiated by you or by companies that you have an existing relationship with

- Do not affect your credit score

- Stay on your credit report for one year

8. What is a credit freeze?

A credit freeze is a security measure that you can place on your credit report to prevent anyone from accessing it without your permission.

- Protects you from identity theft and fraud

- Makes it more difficult for lenders to approve new credit applications

- Is free to place and lift

9. What is the Fair Credit Reporting Act (FCRA)?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, use, and disclosure of consumer credit information.

- Gives consumers the right to access their credit reports

- Prohibits credit reporting agencies from providing inaccurate or incomplete information

- Requires creditors to investigate disputes and correct any errors

10. What are some of the ethical considerations in credit reporting?

Some of the ethical considerations in credit reporting include:

- Accuracy and fairness: Credit reporting agencies have a responsibility to ensure that the information they provide is accurate and fair.

- Privacy: Consumers have a right to privacy when it comes to their credit information.

- Non-discrimination: Credit reporting agencies cannot discriminate against consumers based on their race, religion, sex, or other protected characteristics.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Reporting Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Reporting Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Reporting Clerks play a pivotal role in maintaining accurate and up-to-date credit information for individuals and businesses.

1. Collecting and Verifying Credit Data

- Gathering credit information from various sources, including credit bureaus, lenders, and creditors

- Verifying the accuracy and completeness of collected data

2. Generating and Maintaining Credit Reports

- Compiling and formatting credit reports based on collected data

- Updating and maintaining credit reports as new information becomes available

3. Responding to Credit Inquiries

- Handling credit inquiries from individuals, businesses, and lending institutions

- Providing accurate and timely information about credit history and creditworthiness

4. Monitoring and Investigating Credit Disputes

- Investigating credit disputes and inaccuracies flagged by individuals or businesses

- Working with credit bureaus and creditors to resolve disputes and maintain accurate credit information

Interview Tips

To ace your interview for a Credit Reporting Clerk position, consider the following tips:

1. Research the Company and Position

- Study the company’s website, industry news, and social media profiles to gain insights into their operations and values.

- Thoroughly review the job description and identify key responsibilities and required skills.

2. Highlight Relevant Skills and Experience

- Quantify your accomplishments whenever possible, using specific metrics and examples.

- Emphasize your proficiency in data entry, analysis, and report generation.

3. Practice Common Interview Questions

- Prepare for questions related to your experience with credit reporting, data management, and customer service.

- Use the STAR method to structure your answers and provide detailed examples.

4. Be Professional and Enthusiastic

- Arrive on time, dress professionally, and make eye contact.

- Demonstrate your enthusiasm for the role and the company’s mission.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Reporting Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.