Feeling lost in a sea of interview questions? Landed that dream interview for Credit Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

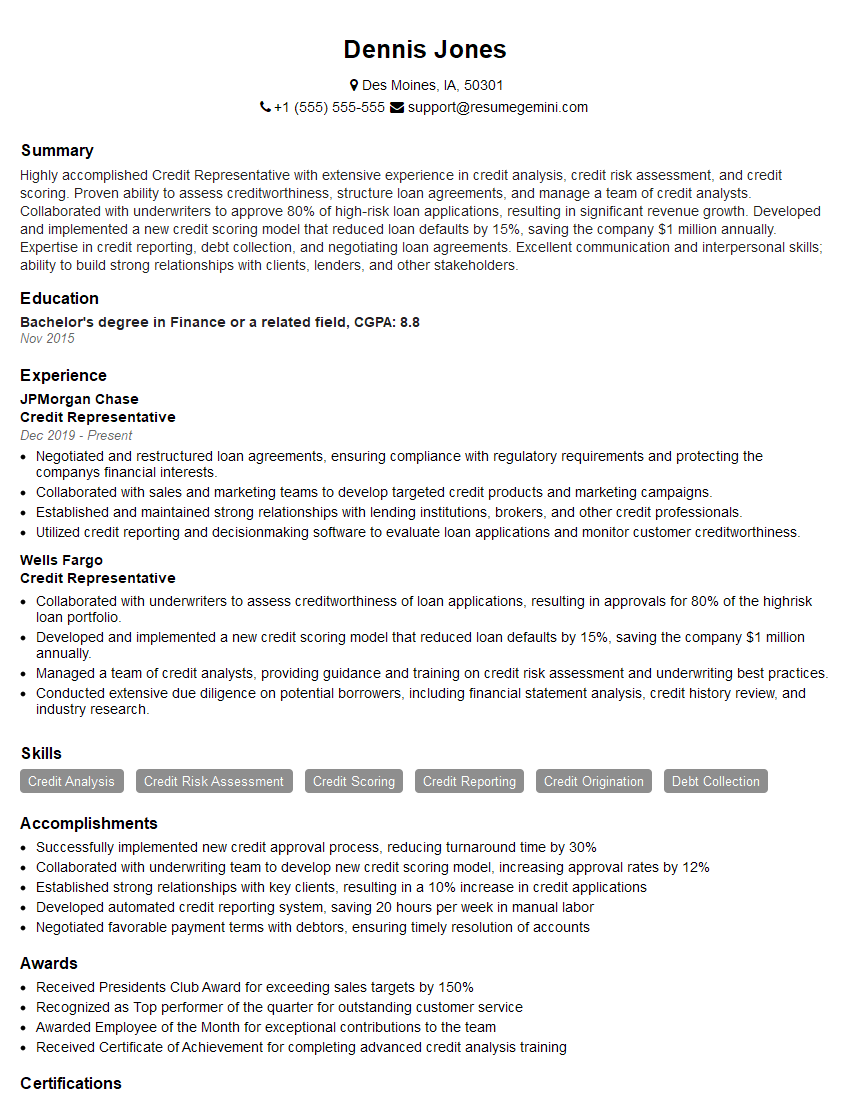

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Representative

1. Describe your understanding of the primary responsibilities of a Credit Representative?

- Evaluating financial status of potential borrowers to assess creditworthiness

- Explaining loan terms and options to clients

- Negotiating loan agreements and closing deals

- Maintaining client relationships and providing ongoing support

- Ensuring compliance with industry regulations and ethical guidelines

2. Explain the key principles and regulations governing the credit industry?

National Consumer Credit Protection Act

- Prohibits unfair lending practices

- Requires disclosure of loan terms and conditions

- Protects borrowers from predatory lending

Banking Code of Conduct

- Sets ethical standards for financial institutions

- Requires responsible lending practices

- Protects the interests of consumers

3. How do you assess the creditworthiness of potential borrowers?

I employ a comprehensive approach that includes the following steps:

- Reviewing credit reports and scores

- Analyzing financial statements and tax returns

- Verifying income and employment information

- Assessing debt-to-income ratio and payment history

- Conducting face-to-face interviews to gather additional information

4. What strategies do you use to negotiate favorable loan terms for your clients?

I leverage a combination of techniques:

- Thorough preparation and research on market trends and lender offerings

- Building strong relationships with lenders and understanding their underwriting criteria

- Negotiating on multiple aspects such as interest rates, loan amounts, and repayment terms

- Advocating for the best possible terms based on the client’s financial situation and goals

5. How do you maintain compliance with industry regulations?

I make it a priority to:

- Stay abreast of the latest regulatory changes and updates

- Attend industry workshops and seminars

- Implement robust compliance procedures within my business

- Seek legal counsel when necessary

- Regularly audit my practices to ensure ongoing compliance

6. Explain how you handle ethical dilemmas or conflicts of interest in your role?

I adhere to a strict code of ethics:

- Always prioritizing the best interests of my clients

- Avoiding conflicts of interest or disclosing them promptly

- Maintaining confidentiality of client information

- Treating all clients fairly and without bias

- Seeking guidance from senior management or legal counsel when faced with ethical challenges

7. How do you stay up-to-date with industry best practices and market trends?

I actively pursue ongoing professional development:

- Attending industry conferences and webinars

- Reading industry publications and research reports

- Participating in professional associations and networking with peers

- Seeking feedback from clients and industry experts

- Continuously analyzing market data and trends to identify opportunities and risks

8. Describe your approach to building and maintaining client relationships?

I believe in cultivating long-term relationships based on:

- Exceptional customer service

- Clear communication and regular follow-ups

- Understanding the client’s financial needs and goals

- Tailoring solutions to meet their specific requirements

- Building trust and rapport through personalized interactions

9. How do you handle objections or negative feedback from clients?

I proactively address concerns with:

- Active listening and empathy

- Thorough explanation of loan terms and processes

- Providing alternative options or solutions if needed

- Maintaining a positive and professional attitude

- Seeking support from senior management when necessary

10. Why are you interested in this particular role with our company?

Your company has an excellent reputation within the industry for its ethical practices and commitment to customer satisfaction. As a highly qualified and experienced Credit Representative, I am eager to contribute my expertise to your team. I am confident that my skills and knowledge will enable me to make a significant impact on your business and provide exceptional service to your clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Representatives serve as the frontline between financial institutions and customers, playing a crucial role in the credit approval process. Their primary responsibilities include:

1. Credit Analysis and Assessment

Examining financial documents, including credit reports, income statements, and tax returns, to assess the creditworthiness of loan applicants.

- Analyzing financial ratios, cash flow statements, and other relevant data to determine the applicant’s ability to repay the loan.

- Evaluating collateral and security to mitigate potential risks.

2. Loan Origination and Approval

Assisting loan applicants with completing and submitting loan applications, including gathering necessary documentation.

- Recommending loan terms, interest rates, and loan amounts based on the applicant’s financial profile and credit history.

- Working closely with underwriters to ensure that loans meet the institution’s lending guidelines.

3. Customer Service and Relationship Management

Providing exceptional customer service by answering questions, addressing concerns, and building strong relationships with loan applicants and borrowers.

- Explaining loan terms and conditions clearly and providing guidance throughout the loan process.

- Resolving customer inquiries and complaints promptly and efficiently.

4. Compliance and Regulatory Adherence

Ensuring that all loan activities comply with applicable laws, regulations, and industry standards.

- Staying updated on changes in credit regulations and industry best practices.

- Documenting loan processes and maintaining accurate records to meet regulatory requirements.

Interview Tips

To ace your Credit Representative interview, consider the following preparation tips:

1. Research the Financial Institution

Thoroughly research the financial institution you’re applying to, including its products, services, and industry reputation. This will demonstrate your interest and enthusiasm for the company.

- Visit their website to gather information about their lending practices, loan programs, and company culture.

- Read industry articles and news to stay informed about the institution’s performance and position in the market.

2. Emphasize Your Credit Analysis Skills

Highlight your strong understanding of financial analysis and lending principles. Explain how you approach credit assessments, analyze financial data, and make informed credit decisions.

- Provide examples of complex financial situations you’ve handled and the strategies you used to evaluate and mitigate risk.

- Discuss your knowledge of credit scoring models, loan covenants, and industry regulations.

3. Demonstrate Customer Service Orientation

Emphasize your ability to build strong customer relationships and resolve issues promptly. Share examples of how you’ve exceeded customer expectations in previous roles.

- Describe how you handle customer inquiries and complaints while maintaining a professional and positive demeanor.

- Explain your strategies for building rapport and establishing trust with loan applicants and borrowers.

4. Highlight Your Compliance and Regulatory Knowledge

Show that you’re aware of the importance of compliance in the financial industry. Discuss your understanding of relevant laws and regulations, and provide examples of how you’ve ensured compliance in your previous roles.

- Explain how you stay up-to-date with regulatory changes and industry best practices.

- Describe your experience with documenting loan processes and maintaining accurate records.

5. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers beforehand. This will help you stay confident and articulate during the interview.

- “Tell me about your experience in credit analysis and lending.”

- “Describe your approach to assessing a loan applicant’s creditworthiness.”

- “How do you handle challenging customer interactions?”

- “What are your strategies for ensuring compliance in the credit process?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.