Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Risk Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

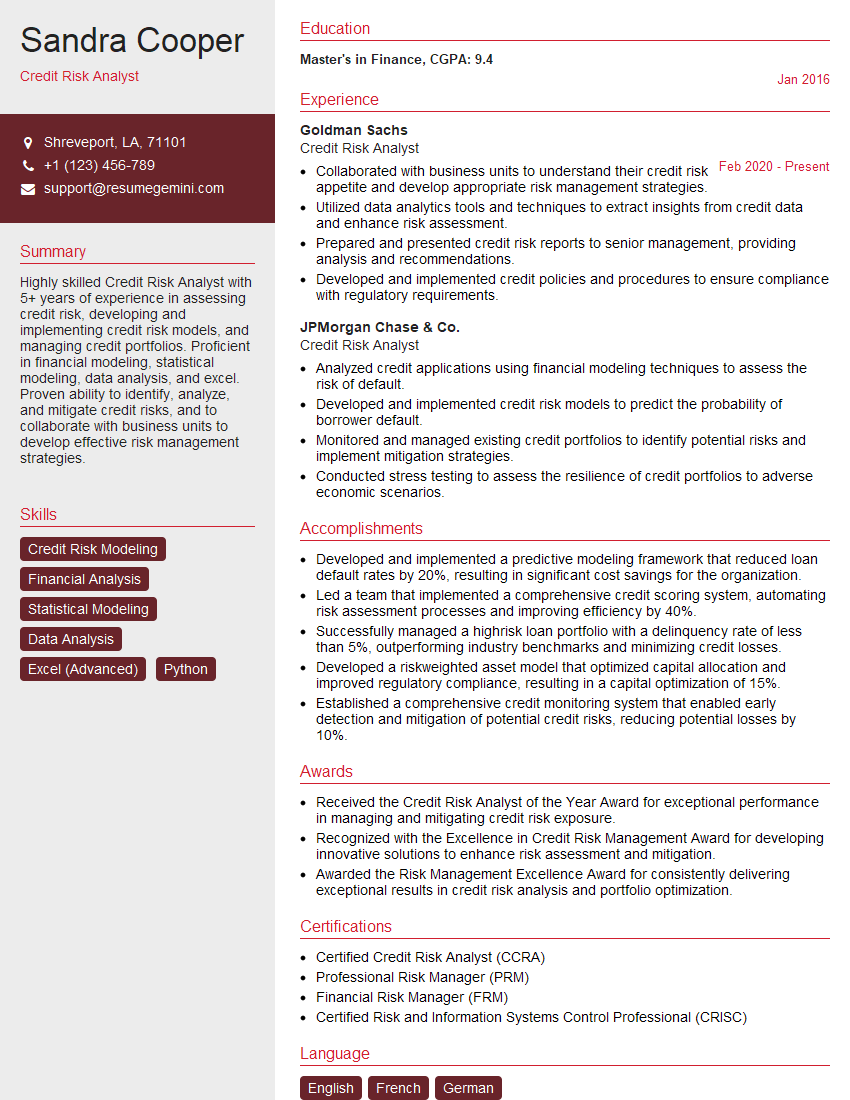

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Risk Analyst

1. Explain the Basel Accords and how they impact your work as a Credit Risk Analyst?

The Basel Accords are a set of regulations that aim to enhance the safety and soundness of the global banking system. They are issued by the Basel Committee on Banking Supervision, which is a group of central bank governors and supervisors from around the world. The Accords set out minimum capital requirements for banks, as well as guidelines for risk management and corporate governance.

As a Credit Risk Analyst, I am responsible for assessing the creditworthiness of borrowers and making recommendations on lending decisions. The Basel Accords provide me with a framework for evaluating the risks associated with different types of borrowers and for determining the appropriate amount of capital that a bank should hold to cover those risks.

2. What are the different types of credit risk that a bank faces?

Credit Risk

- Default Risk: The risk that a borrower will fail to make its scheduled payments.

- Spread Risk: The risk that the spread between the interest rate paid by a borrower and the risk-free rate will increase.

- Concentration Risk: The risk that a bank has too much exposure to a particular borrower, industry, or geographic region.

Non-Credit Risk

- Liquidity Risk: The risk that a bank will not be able to meet its obligations as they come due.

- Operational Risk: The risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.

3. What are the key factors that you consider when assessing the creditworthiness of a borrower?

- Financial statements

- Business plan

- Management team

- Industry analysis

- Economic outlook

4. What are the different types of credit analysis techniques that you use?

- Ratio analysis

- Cash flow analysis

- Credit scoring

- Scenario analysis

5. How do you use data and analytics to inform your credit risk assessments?

- I use data to identify trends and patterns in credit risk.

- I use analytics to develop models that predict the likelihood of default.

- I use data and analytics to stress test portfolios and assess the impact of different scenarios.

6. How do you communicate your findings and recommendations to stakeholders?

- I write credit reports that summarize my findings and recommendations.

- I present my findings and recommendations to senior management.

- I work with other teams to develop and implement credit risk mitigation strategies.

7. What are the ethical considerations that you need to be aware of as a Credit Risk Analyst?

- I need to maintain confidentiality of client information.

- I need to avoid conflicts of interest.

- I need to be objective in my assessments.

- I need to act in the best interests of the bank and its stakeholders.

8. What are the challenges and opportunities that you see in the field of credit risk analysis?

Challenges

- Increasing complexity of financial markets.

- Growing volume of data.

- Regulatory changes.

Opportunities

- Use of new technologies, such as artificial intelligence and machine learning.

- Growing demand for credit risk analysts.

- Opportunities to develop new and innovative credit risk management strategies.

9. What are your career goals?

- I would like to continue to develop my skills and knowledge in the field of credit risk analysis.

- I would like to take on more leadership roles within the bank.

- I would like to eventually become a Chief Risk Officer.

10. Why are you interested in this position?

- I am attracted to the challenges and opportunities that the position offers.

- I believe that my skills and experience would be a valuable asset to your team.

- I am eager to learn more about your bank and its credit risk management practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Risk Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Risk Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Risk Analyst is responsible for assessing and managing the risks associated with lending. They analyze financial data to determine the creditworthiness of potential borrowers, and make recommendations on whether to approve or deny loans. Some other key responsibilities of a Credit Risk Analyst include:

1. Develop and implement credit policies and procedures

Credit Risk Analysts help develop and implement credit policies and procedures to ensure that the institution lends money safely and responsibly. They also work with other departments to ensure that the institution is in compliance with all applicable laws and regulations.

2. Analyze financial data

Credit Risk Analysts analyze financial data to assess the creditworthiness of potential borrowers. They consider factors such as the borrower’s income, debt, and credit history to determine the likelihood that the borrower will be able to repay the loan.

3. Make recommendations on loan applications

Credit Risk Analysts make recommendations on whether to approve or deny loan applications. They consider the results of their financial analysis as well as other factors, such as the borrower’s character and the purpose of the loan.

4. Monitor loan performance

Credit Risk Analysts monitor the performance of loans to identify any potential problems. They work with borrowers to resolve any issues and prevent defaults.

5. Communicate with other departments

Credit Risk Analysts communicate with other departments, such as sales and marketing, to ensure that the institution is lending money to creditworthy borrowers. They also work with senior management to provide input on the institution’s overall risk appetite.

Interview Tips

Preparing for a Credit Risk Analyst interview can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips:

1. Research the company and the position

Take some time to learn about the company you’re applying to and the specific position you’re interested in. This will help you understand the company’s culture and values, as well as the specific skills and experience they’re looking for.

2. Practice your answers to common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. Prepare your answers to these questions in advance so that you can deliver them confidently and concisely.

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your relevant experience and how it qualifies you for the position. Be sure to highlight any specific skills or experience that are directly relevant to the job description.

4. Dress professionally and arrive on time

First impressions matter, so dress professionally and arrive on time for your interview. This will show the interviewer that you’re serious about the position and that you respect their time.

5. Be prepared to ask questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the position and the company, so be prepared to ask thoughtful questions. This will show the interviewer that you’re engaged and interested in the position.

Next Step:

Now that you’re armed with the knowledge of Credit Risk Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit Risk Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini