Feeling lost in a sea of interview questions? Landed that dream interview for Credit Risk Management Director but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Risk Management Director interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

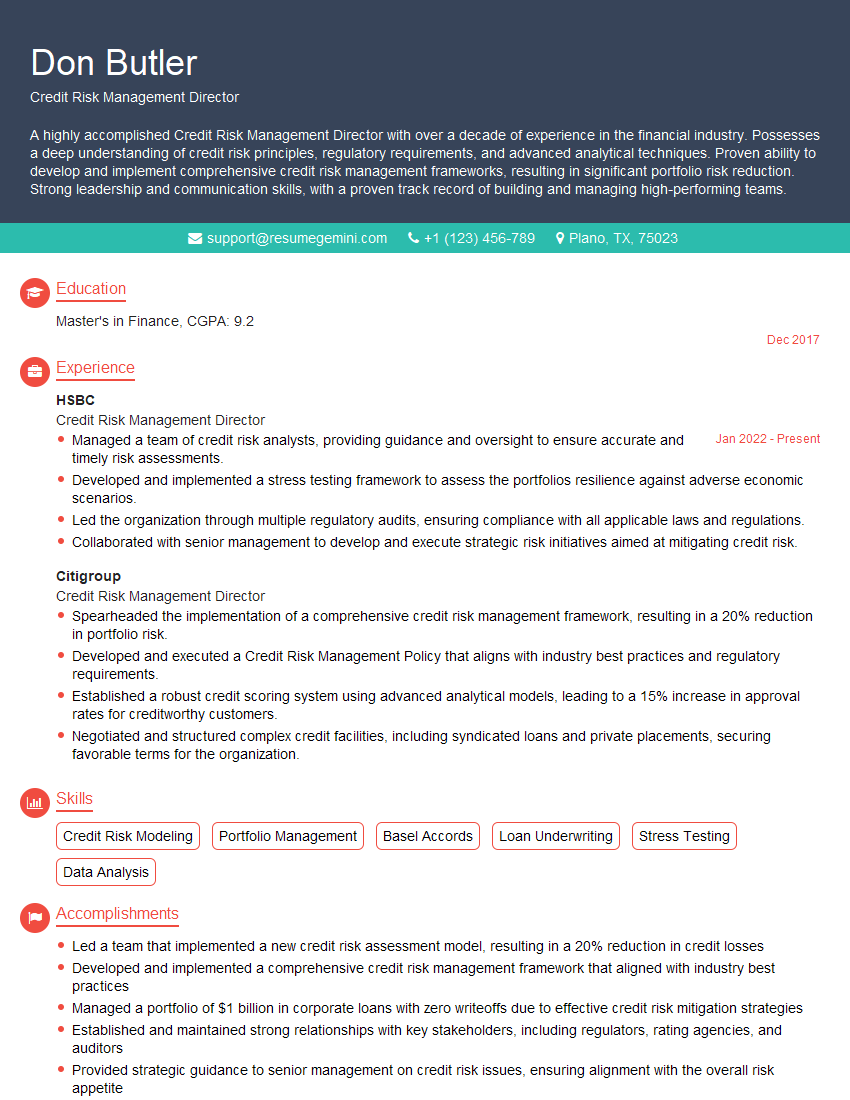

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Risk Management Director

1. What are the key responsibilities of a Credit Risk Management Director?

- Develop and implement credit risk management policies and procedures.

- Analyze and assess credit risk exposure of the organization.

- Monitor and manage credit risk limits and exposures.

- Develop and implement strategies to mitigate credit risk.

- Provide guidance and support to other departments on credit risk management issues.

2. What are the different types of credit risk models?

Credit Scoring Models

- Statistical models used to assess the creditworthiness of borrowers.

- Examples: FICO score, VantageScore

Behavioral Scoring Models

- Models that evaluate borrower behavior, such as payment history, to predict future credit performance.

- Examples: Experian’s NextGen Score

Cash Flow Models

- Models that analyze a borrower’s cash flow to assess its ability to repay debt.

- Examples: CreditMetrics, KMV

3. What are the different techniques for mitigating credit risk?

- Diversification

- Hedging

- Loan covenants

- Credit insurance

- Collateral

4. What are the key elements of a credit risk management framework?

- Credit risk identification and assessment

- Credit risk monitoring and measurement

- Credit risk mitigation and control

- Credit risk reporting and analysis

- Credit risk governance

5. What are the challenges facing credit risk managers in the current economic environment?

- Rising interest rates

- Inflation

- Geopolitical uncertainty

- Technological disruption

- Changing consumer behavior

6. What are the emerging trends in credit risk management?

- Use of artificial intelligence and machine learning

- Focus on environmental, social, and governance (ESG) factors

- Increased regulation

- Collaboration between credit risk managers and other departments

- Greater use of data analytics

7. What are the Basel Accords?

- International banking regulations that set minimum capital requirements for banks.

- Basel I: Issued in 1988, focused on credit risk.

- Basel II: Issued in 2004, introduced more sophisticated risk management techniques.

- Basel III: Issued in 2010, strengthened capital requirements and liquidity standards.

8. What is the difference between expected loss and unexpected loss?

- Expected loss: The average loss that is expected to occur over a given period of time.

- Unexpected loss: The loss that exceeds the expected loss.

9. What is the role of stress testing in credit risk management?

- Stress testing is a technique used to assess the resilience of a financial institution to adverse economic conditions.

- Stress tests involve simulating different economic scenarios and measuring the impact on the institution’s financial performance.

10. What is the difference between a credit rating and a credit score?

- Credit rating: An assessment of the creditworthiness of a borrower issued by a credit rating agency.

- Credit score: A numerical value that represents the likelihood of a borrower defaulting on a loan.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Risk Management Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Risk Management Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Credit Risk Management Director is responsible for developing and implementing the organization’s credit risk management strategy. This involves identifying, assessing, and mitigating credit risks to ensure the financial stability of the organization.

1. Develop and implement credit risk management strategy

The Credit Risk Management Director is responsible for developing and implementing the organization’s credit risk management strategy. This strategy should be aligned with the organization’s overall business strategy and risk appetite. The director should also ensure that the strategy is compliant with all applicable laws and regulations.

- Develop and implement credit risk management policies and procedures

- Conduct due diligence on potential borrowers

- Monitor and manage кредитный риск

2. Identify and assess credit risks

The Credit Risk Management Director is responsible for identifying and assessing credit risks. This involves understanding the organization’s business activities and the factors that could affect its financial stability. The director should also identify and assess the risks associated with specific borrowers and transactions.

- Identify and assess external factors that could affect the organization’s financial stability

- Identify and assess internal factors that could affect the organization’s financial stability

- Assess the creditworthiness of potential borrowers

3. Mitigate credit risks

The Credit Risk Management Director is responsible for mitigating credit risks. This involves taking steps to reduce the likelihood and impact of credit losses. The director should also develop and implement strategies to manage кредитный риск.

- Develop and implement risk mitigation strategies

- Monitor and manage кредитный риск

- Manage the organization’s credit portfolio

4. Report on credit risks

The Credit Risk Management Director is responsible for reporting on credit risks to senior management and the board of directors. This reporting should be timely, accurate, and transparent. The director should also provide recommendations for mitigating credit risks.

- Report on credit risks to senior management

- Report on credit risks to the board of directors

- Make recommendations for mitigating credit risks

Interview Tips

To ace your interview for a Credit Risk Management Director position, it is important to prepare thoroughly and to demonstrate your knowledge of credit risk management. Here are some tips to help you succeed:

1. Research the company and the position

Before your interview, take some time to research the company and the position. This will help you understand the company’s business activities and the specific responsibilities of the Credit Risk Management Director. You can find information on the company’s website, in financial news articles, and in industry publications.

- Visit the company’s website

- Read financial news articles about the company

- Read industry publications

2. Practice answering interview questions

Once you have researched the company and the position, it is important to practice answering interview questions. This will help you to feel more confident and prepared during your interview. You can practice answering questions with a friend or family member, or you can use online resources such as mock interview websites.

- Practice answering common interview questions about credit risk management

- Practice answering questions about your experience and qualifications

- Practice answering behavioral interview questions

3. Be prepared to talk about your experience and qualifications

During your interview, the interviewer will likely ask you about your experience and qualifications. Be prepared to discuss your experience in credit risk management, and highlight your skills and knowledge. You should also be prepared to discuss your educational background and any certifications or licenses you have.

- Highlight your experience in credit risk management

- Discuss your skills and knowledge

- Mention your educational background and any certifications or licenses you have

4. Be confident and enthusiastic

It is important to be confident and enthusiastic during your interview. This will show the interviewer that you are genuinely interested in the position and that you have the skills and experience to succeed. Be yourself, and let your personality shine through.

- Be yourself

- Be confident

- Be enthusiastic

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Risk Management Director role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.