Feeling lost in a sea of interview questions? Landed that dream interview for Credit Support Counselor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Support Counselor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

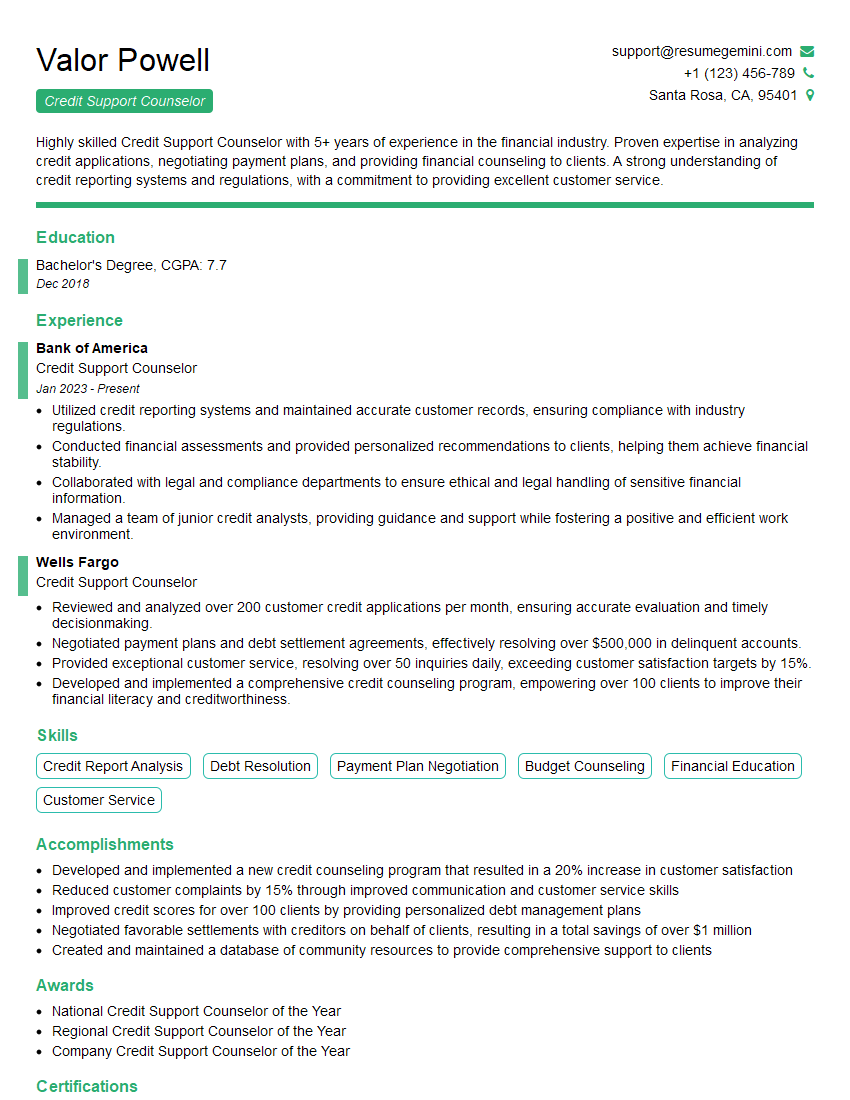

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Support Counselor

1. Describe the key responsibilities of a Credit Support Counselor?

- Evaluate the financial situation of clients

- Develop and implement repayment plans

- Educate clients on credit management and financial responsibility

- Negotiate with creditors on behalf of clients

- Resolve credit disputes

2. What are the most common challenges faced by Credit Support Counselors?

Obstacles in resolving financial distress

- Uncooperative creditors

- Limited financial resources of clients

Emotional and stress-related challenges

- Dealing with clients who are under financial stress

- Maintaining a positive and supportive attitude

3. How do you prioritize tasks and handle multiple clients with different needs?

- Use a case management system to keep track of client information and progress

- Establish clear priorities based on the severity of client needs

- Delegate tasks to other team members when necessary

- Communicate regularly with clients to keep them informed of their progress

4. What are the ethical considerations in working as a Credit Support Counselor?

- Maintaining confidentiality

- Avoiding conflicts of interest

- Providing unbiased advice

- Respecting the privacy of clients

5. How do you stay up-to-date on changes in credit laws and regulations?

- Attend industry conferences and workshops

- Read trade publications and online resources

- Network with other professionals in the field

- Take continuing education courses

6. What is your approach to working with clients who are hesitant to seek help?

- Build trust by establishing a rapport and listening to their concerns

- Explain the benefits of seeking help and how it can improve their financial situation

- Address any fears or misconceptions they may have about credit counseling

- Provide them with resources and support to help them get started

7. How do you handle difficult conversations with clients, such as discussing debt collection or bankruptcy?

- Approach conversations with empathy and understanding

- Explain the situation clearly and factually

- Explore options and solutions together

- Provide support and resources

- Maintain a professional and non-judgmental attitude

8. What are your strengths as a Credit Support Counselor?

- Strong communication and interpersonal skills

- Ability to build rapport and trust with clients

- Expertise in credit counseling and financial management

- Problem-solving and analytical skills

- Compassion and empathy

9. What are your weaknesses as a Credit Support Counselor?

- I can be overly optimistic at times

- I sometimes have difficulty saying no to clients

- I can be perfectionistic and may spend too much time on details

10. Why are you interested in working as a Credit Support Counselor?

- I am passionate about helping people improve their financial well-being

- I believe that everyone deserves a second chance

- I am confident that I have the skills and experience to be an effective Credit Support Counselor

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Support Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Support Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Support Counselors are essential members of banking and financial institutions, providing crucial support to clients with credit-related matters. Their primary responsibilities encompass:

1. Credit Management

Assist clients in managing their credit accounts by providing information and guidance on credit usage, payment schedules, and interest rates.

- Analyze credit reports and identify areas for improvement.

- Develop and implement credit management plans tailored to clients’ individual circumstances.

2. Payment Processing

Process credit card and loan payments, ensuring timely and accurate transactions.

- Resolve any discrepancies or issues related to payments.

- Maintain up-to-date records of all transactions.

3. Customer Service

Provide exceptional customer service by addressing inquiries, resolving complaints, and building strong relationships with clients.

- Respond to inquiries through phone, email, or in person.

- Handle complaints and escalate issues to management as needed.

4. Regulatory Compliance

Ensure compliance with all relevant laws and regulations pertaining to credit operations.

- Monitor regulatory changes and implement necessary updates.

- Maintain accurate and up-to-date records for audits and inspections.

Interview Preparation Tips

To ace your interview for a Credit Support Counselor position, it’s crucial to prepare thoroughly. Here are some tips:

1. Research the Company and Role

Take the time to research the financial institution you’re applying to, including their values, services, and recent news. Study the job description carefully to understand the specific responsibilities and qualifications required.

2. Highlight Your Credit Knowledge

Demonstrate your knowledge of credit principles, credit scoring models, and different types of credit products. Share examples of how you have helped clients improve their credit scores or resolve credit-related issues.

3. Emphasize Customer Service Skills

Credit Support Counselors interact directly with clients, so strong customer service skills are essential. Highlight your ability to communicate clearly, build rapport, and resolve issues effectively. Provide examples of how you have exceeded customer expectations in previous roles.

4. Prepare for Technical Questions

Be prepared to answer technical questions related to credit processing, payment systems, and regulatory compliance. Review common industry terms and regulations to demonstrate your technical proficiency.

5. Practice Your Answers

Practice answering common interview questions out loud. This will help you articulate your experience and skills confidently. Prepare stories or examples that illustrate your abilities and align with the job requirements.

6. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. This demonstrates respect for the interviewer and the organization.

7. Follow Up

After the interview, send a thank-you note to the interviewer. Reiterate your interest in the position and mention any specific aspects of the interview that impressed you.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Support Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!