Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Currency Examiner interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Currency Examiner so you can tailor your answers to impress potential employers.

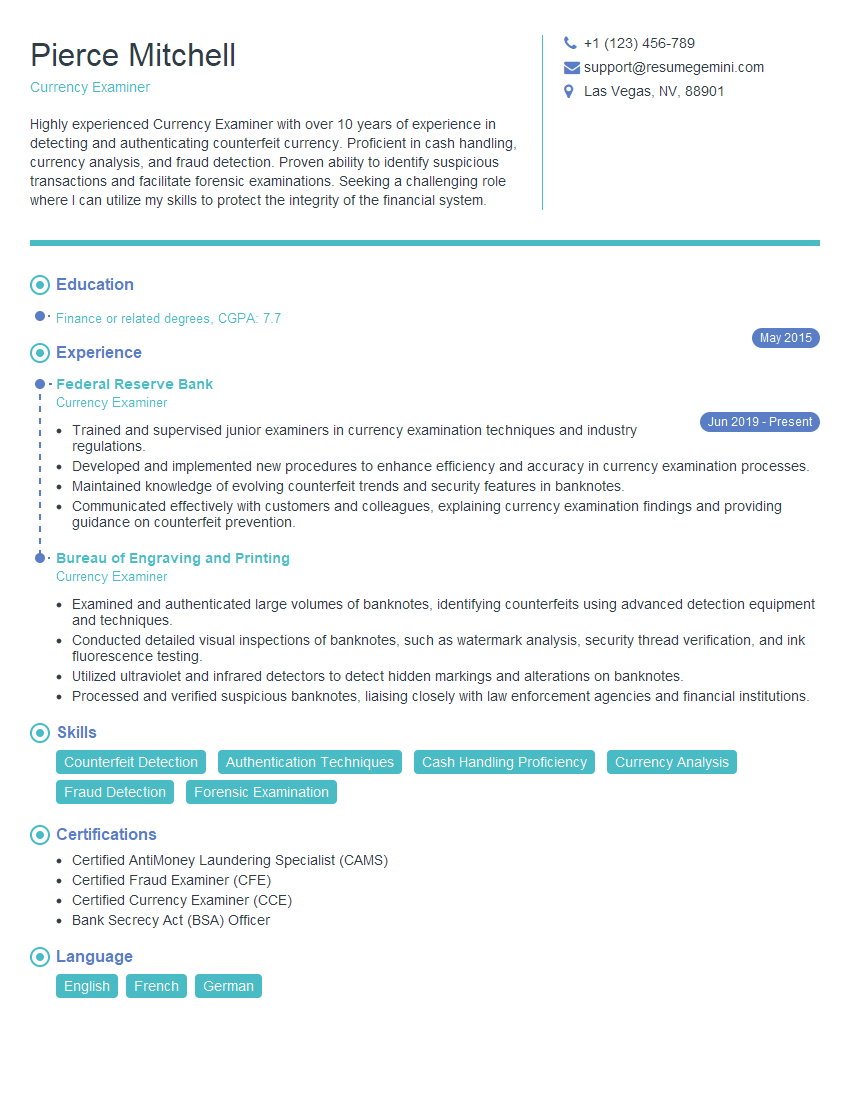

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Currency Examiner

1. Explain the process of identifying counterfeit currency

To identify counterfeit currency, I employ a comprehensive approach that involves relying on sophisticated equipment and detailed visual examinations. I utilize ultraviolet (UV) light to detect hidden security features and watermarks that are visible under specific wavelengths. Additionally, I inspect the paper quality, paying close attention to its texture, color, and thickness, as genuine currency exhibits distinct characteristics in these aspects.

- Conduct ultraviolet (UV) light examination to reveal hidden security features and watermarks.

- Inspect paper quality, focusing on texture, color, and thickness, as genuine currency possesses specific characteristics.

- Scrutinize printing quality, checking for sharpness, clarity, and alignment of details.

- Examine security threads embedded within the paper, which are unique to genuine banknotes.

- Utilize magnifying equipment to study microprinting and intricate design elements.

- Consult databases and reference materials to stay updated on the latest counterfeiting techniques and security features.

2. Describe the types of counterfeit detection devices and their functions

UV Light Detector

- Reveal hidden security features and watermarks when exposed to ultraviolet light.

- Detect alterations or bleaching attempts on banknotes.

Magnifying Glass

- Examine microprinting and intricate design elements.

- Identify minute details that may be difficult to see with the naked eye.

Currency Validation Machine

- Automated device that performs multi-faceted examinations.

- Checks for magnetic properties, size, thickness, and other security features.

3. Explain how you would handle a situation where you suspect a customer is trying to pass counterfeit currency

In such a situation, I would approach the customer professionally and discreetly. I would request their cooperation and explain that I suspect the currency they presented might be counterfeit. I would refer to the specific detection methods used to arrive at my suspicion, such as noticing irregularities in security features or paper quality. I would then proceed with the necessary procedures, such as contacting law enforcement or confiscating the suspected counterfeit currency.

- Maintain a professional and calm demeanor.

- Explain your suspicion politely and clearly.

- Provide evidence to support your suspicion, such as detected security feature irregularities.

- Request the customer’s cooperation and understanding.

- Contact law enforcement or follow established protocols for handling potential counterfeit currency.

4. What are some common counterfeiting techniques and how do you detect them?

Common counterfeiting techniques include:

- Color copying or printing on genuine paper

- Bleaching and reprinting genuine banknotes

- Creating entirely fake banknotes

To detect these techniques, I rely on careful visual examination, UV light detection, and advanced equipment. I scrutinize the quality of printing, paper texture, and security features to identify any discrepancies from genuine currency.

- Inspect printing quality for sharpness, alignment, and consistency.

- Check paper texture and thickness to ensure it matches genuine banknotes.

- Utilize UV light to reveal hidden security features and watermarks.

- Examine security threads and embedded holograms for authenticity.

5. How do you stay up-to-date on the latest counterfeiting trends and security features?

To remain knowledgeable about emerging counterfeiting trends and security features, I engage in continuous professional development. I attend industry conferences, seminars, and workshops to learn about the latest techniques and best practices.

- Attend industry conferences and seminars.

- Participate in training programs and workshops.

- Review publications and resources from central banks and law enforcement agencies.

- Network with other currency examiners and experts.

6. How do you handle the stress of working with large amounts of money and detecting counterfeit currency?

I manage stress by maintaining a structured and organized approach to my work. I prioritize tasks, delegate responsibilities when necessary, and take regular breaks to maintain focus and accuracy. Additionally, I engage in stress-reducing techniques such as deep breathing exercises and mindfulness practices.

- Maintain a structured and organized work environment.

- Prioritize tasks and delegate responsibilities.

- Take regular breaks to maintain focus and accuracy.

- Practice stress-reducing techniques such as deep breathing and mindfulness.

7. How do you ensure confidentiality and integrity when handling sensitive financial information?

Maintaining confidentiality and integrity is paramount in my role as a Currency Examiner. I adhere strictly to established security protocols and ethical guidelines. I limit access to sensitive information to authorized personnel only, and I handle all documents and data with the utmost care and discretion.

- Adhere to established security protocols and ethical guidelines.

- Limit access to sensitive information to authorized personnel.

- Handle all documents and data with care and discretion.

- Report any suspicious activities or breaches of confidentiality.

8. How do you maintain a high level of accuracy and attention to detail in your work?

Accuracy and attention to detail are crucial in my role. I employ a systematic approach to my work, double-checking and verifying all findings. I take pride in my ability to focus intently and identify even the slightest discrepancies. Regular training and continuous professional development further enhance my skills and knowledge.

- Employ a systematic approach to work, double-checking and verifying findings.

- Maintain a high level of focus and attention to detail.

- Engage in regular training and professional development.

- Utilize advanced equipment and technology to aid in accuracy.

9. How do you prioritize tasks and manage your time effectively?

Effective time management and prioritization are essential in my role. I use a combination of planning, organization, and delegation to ensure that all tasks are completed efficiently and on time. I assess the importance and urgency of each task and allocate my time accordingly, utilizing tools such as to-do lists and calendars.

- Utilize planning, organization, and delegation for effective time management.

- Assess the importance and urgency of tasks and allocate time accordingly.

- Use tools such as to-do lists and calendars to stay organized.

- Delegate tasks to team members when appropriate.

10. How do you handle working under pressure and meeting deadlines?

Working under pressure and meeting deadlines is an integral part of my role. I thrive in fast-paced environments and possess the ability to remain calm and focused even when faced with demanding situations. I prioritize tasks, delegate responsibilities, and communicate effectively to ensure that deadlines are met without compromising quality.

- Thrive in fast-paced environments and remain calm under pressure.

- Prioritize tasks and delegate responsibilities effectively.

- Communicate clearly and concisely with colleagues and supervisors.

- Utilize time management techniques to meet deadlines without compromising quality.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Currency Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Currency Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Currency Examiners play a vital role in safeguarding the integrity of the financial system by identifying and removing counterfeit currency from circulation. Their responsibilities encompass various aspects of currency examination, ensuring that the public has access to genuine and secure currency.

1. Currency Examination

Examiners meticulously inspect large quantities of currency notes and coins, utilizing specialized equipment and their trained eye to detect counterfeit or suspicious items. They verify the authenticity of security features, such as watermarks, security threads, and holograms.

- Detect counterfeit currency using high-tech equipment and advanced techniques

- Identify manipulated or altered currency, rendering it unusable

2. Counterfeit Detection and Analysis

Examiners possess a deep understanding of the characteristics of counterfeit currency and are skilled in identifying subtle differences from genuine notes. They analyze suspected counterfeits to determine their origin, production methods, and potential risks to the financial system.

- Stay abreast of the latest counterfeiting techniques and trends

- Collaborate with law enforcement agencies to investigate and prosecute counterfeiting operations

3. Fraud Prevention and Education

Currency Examiners actively participate in educating the public about counterfeit currency and its implications. They conduct training sessions, distribute educational materials, and engage with financial institutions to raise awareness and prevent fraud.

- Develop and implement training programs on counterfeit detection

- Circulate alerts and advisories to financial institutions and the public

4. Record Keeping and Reporting

Examiners maintain detailed records of currency examined, including the number of counterfeits detected and the methods used. They generate reports summarizing their findings and share them with relevant authorities, such as the Federal Reserve and law enforcement agencies.

- Document all suspected counterfeits and their characteristics

- Provide expert testimony in legal proceedings related to counterfeiting

Interview Tips

Preparing thoroughly for a Currency Examiner interview is crucial to showcasing your skills and making a positive impression. Here are some invaluable tips to help you ace the interview:

1. Research the Organization and Position

Familiarize yourself with the organization’s mission, values, and recent developments. Understand the specific responsibilities of the Currency Examiner position and how your qualifications align with the requirements.

- Visit the organization’s website and social media pages

- Read industry publications and news articles

2. Practice Your Currency Examination Skills

Refresh your knowledge of currency examination techniques and equipment. Practice identifying counterfeit currency using both standard and advanced methods. The more confident you are in your abilities, the better you will perform during the interview.

- Obtain sample counterfeit currency for practice

- Use online resources or training materials to enhance your skills

3. Highlight Your Attention to Detail

Currency Examiners must possess a meticulous eye for detail. Emphasize your ability to focus on small details and identify subtle differences. Provide examples from your previous work experience or academic background that demonstrate your attention to detail.

- Describe how you have successfully detected errors or discrepancies in complex datasets

- Mention your experience with quality control or auditing

4. Demonstrate Your Analytical Skills

Currency Examiners need to be able to analyze counterfeits and determine their origin and production methods. Highlight your analytical skills and provide examples of how you have used them to solve problems or make informed decisions.

- Describe a time when you successfully analyzed a complex issue and developed a solution

- Mention your experience with data analysis or pattern recognition

5. Prepare for Common Interview Questions

Research common interview questions for Currency Examiners and prepare thoughtful answers. Practice answering them clearly and concisely, providing specific examples to support your claims.

- Why are you interested in becoming a Currency Examiner?

- Describe a time when you detected a counterfeit currency note.

- How do you stay updated on the latest counterfeiting trends?

6. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. Your attire and punctuality reflect your respect for the organization and the position you are seeking.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Currency Examiner, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Currency Examiner positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.