Are you gearing up for an interview for a Customs Broker position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Customs Broker and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

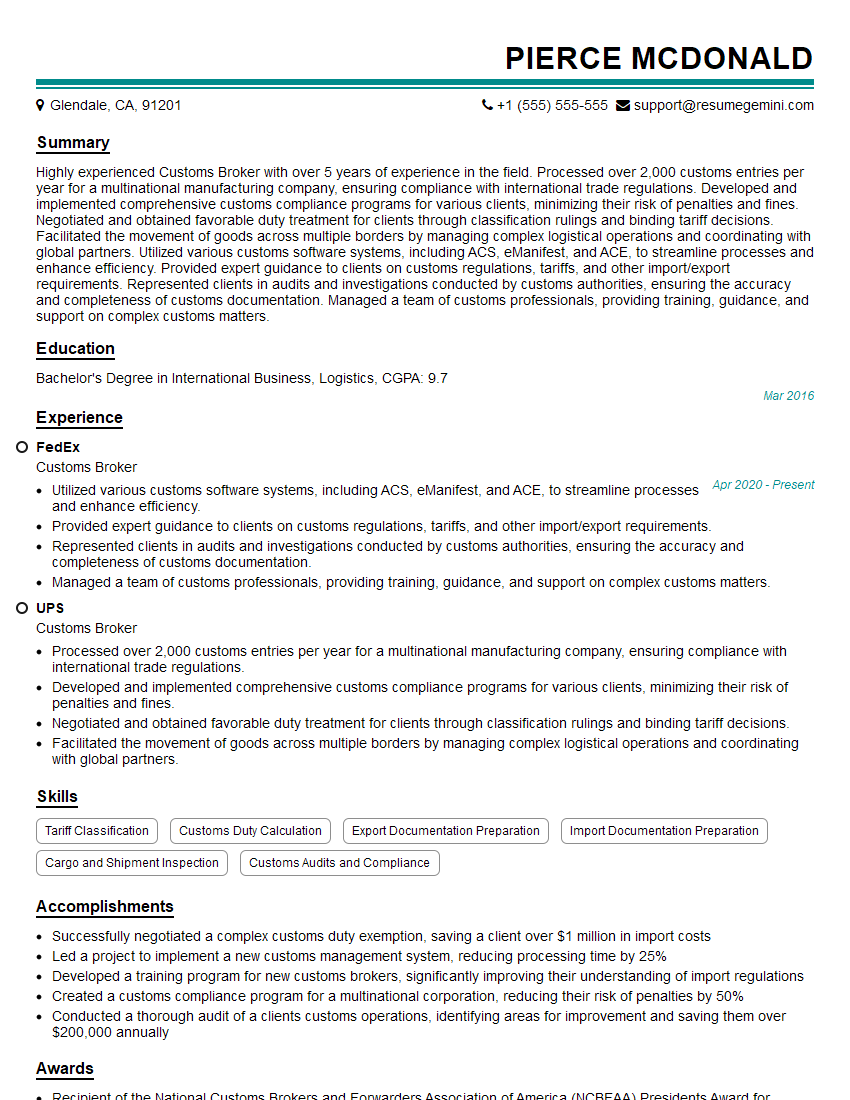

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Broker

1. Define the term “Entry Summary” and explain its significance in the customs clearance process.

- An Entry Summary is a document that provides detailed information about imported goods, including their value, quantity, and classification.

- It is required by U.S. Customs and Border Protection (CBP) for the formal entry of goods into the United States.

- The Entry Summary is used to determine the amount of duty and taxes owed on the goods.

2. Explain the role of a Customs Broker in facilitating international trade.

- Customs Brokers act as intermediaries between importers and exporters and the government agencies responsible for regulating international trade.

- They prepare and submit customs documentation, calculate duties and taxes, and represent clients in customs audits and investigations.

3. Describe the different methods of classifying goods for import purposes.

- There are two main methods of classifying goods for import purposes: the Harmonized System (HS) and the Schedule B.

- The HS is an international system used to classify goods for customs purposes.

- The Schedule B is a U.S.-specific system used to classify goods for export purposes.

4. Discuss the importance of accurate tariff classification for customs clearance.

- Accurate tariff classification is essential for ensuring that the correct duties and taxes are paid on imported goods.

- Misclassifying goods can result in penalties or delays in the clearance process.

5. Explain the process of duty drawback.

- Duty drawback is a refund of duties paid on imported goods that are subsequently exported.

- To claim duty drawback, the exporter must file a drawback claim with CBP.

6. Describe the requirements for obtaining a Customs Broker’s license.

- To obtain a Customs Broker’s license, individuals must pass a licensing exam and meet certain experience requirements.

- Licensees must also maintain a bond with CBP.

7. Explain the role of the Automated Commercial Environment (ACE) in customs clearance.

- ACE is a centralized electronic system that allows importers, exporters, and Customs Brokers to file customs documents and track the status of their shipments.

- ACE has streamlined the customs clearance process and reduced the need for paper-based documentation.

8. Discuss the legal liabilities of a Customs Broker.

- Customs Brokers are liable for the accuracy of the information they provide to CBP.

- They are also liable for any duties and taxes that are owed on the goods they clear.

9. Describe the ethical considerations that a Customs Broker must observe.

- Customs Brokers must maintain the highest ethical standards in their dealings with clients, CBP, and other parties.

- They must avoid conflicts of interest and must not engage in any conduct that could compromise the integrity of the customs clearance process.

10. Explain how you would handle a situation where you suspect that your client is attempting to evade customs duties.

- If I suspected that my client was attempting to evade customs duties, I would first try to resolve the issue with them directly.

- If I was unable to resolve the issue with my client, I would report the matter to CBP.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs Brokers are intermediaries between importers and exporters and government agencies, facilitating the movement of goods across borders. Their key job responsibilities include:

1. Compliance and Regulations

Customs Brokers are responsible for ensuring compliance with customs regulations and procedures, both domestic and international. This includes:

- Classifying goods according to the Harmonized System (HS) codes

- Determining applicable duties, taxes, and fees

- Preparing and submitting customs entries

2. Documentation Management

Customs Brokers manage documentation related to the import and export of goods, including:

- Bills of lading

- Commercial invoices

- Certificates of origin

- Packing lists

3. Customs Clearance

Customs Brokers facilitate the clearance of goods through customs, which involves:

- Presenting documentation to customs officials

- Answering questions and providing additional information as required

- Arranging for the release of goods

4. Duty Drawback and Other Programs

Customs Brokers advise clients on duty drawback programs and other initiatives that can reduce import costs, including:

- Foreign Trade Zones

- Bonded Warehouses

- In-house Customs

5. Client Communication and Consulting

Customs Brokers communicate with clients, providing guidance on customs matters and advising on best practices. They also:

- Identify risks and vulnerabilities in clients’ customs processes

- Recommend changes to improve efficiency and compliance

Interview Tips

Preparing thoroughly can significantly enhance your chances of excelling in a Customs Broker interview:

1. Research the Company and Industry

Familiarize yourself with the company’s history, services, and industry trends. This demonstrates your interest and commitment to the profession.

2. Practice Answering Common Questions

Anticipate questions about your experience, knowledge of customs regulations, and problem-solving abilities. Prepare thoughtful answers that showcase your skills and expertise.

3. Showcase Your Compliance Knowledge

Highlight your understanding of customs laws and regulations, ensuring you can effectively navigate complex import and export processes.

4. Emphasize Your Communication and Client Management Skills

Stress your ability to build strong relationships with clients, effectively communicating complex information and resolving any issues that may arise.

5. Consider Obtaining a Customs Broker License

A Customs Broker license demonstrates your commitment to the profession and is highly valued by employers. Consider pursuing this qualification if you don’t already have one.

Next Step:

Now that you’re armed with the knowledge of Customs Broker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Customs Broker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini