Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Customs Compliance Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

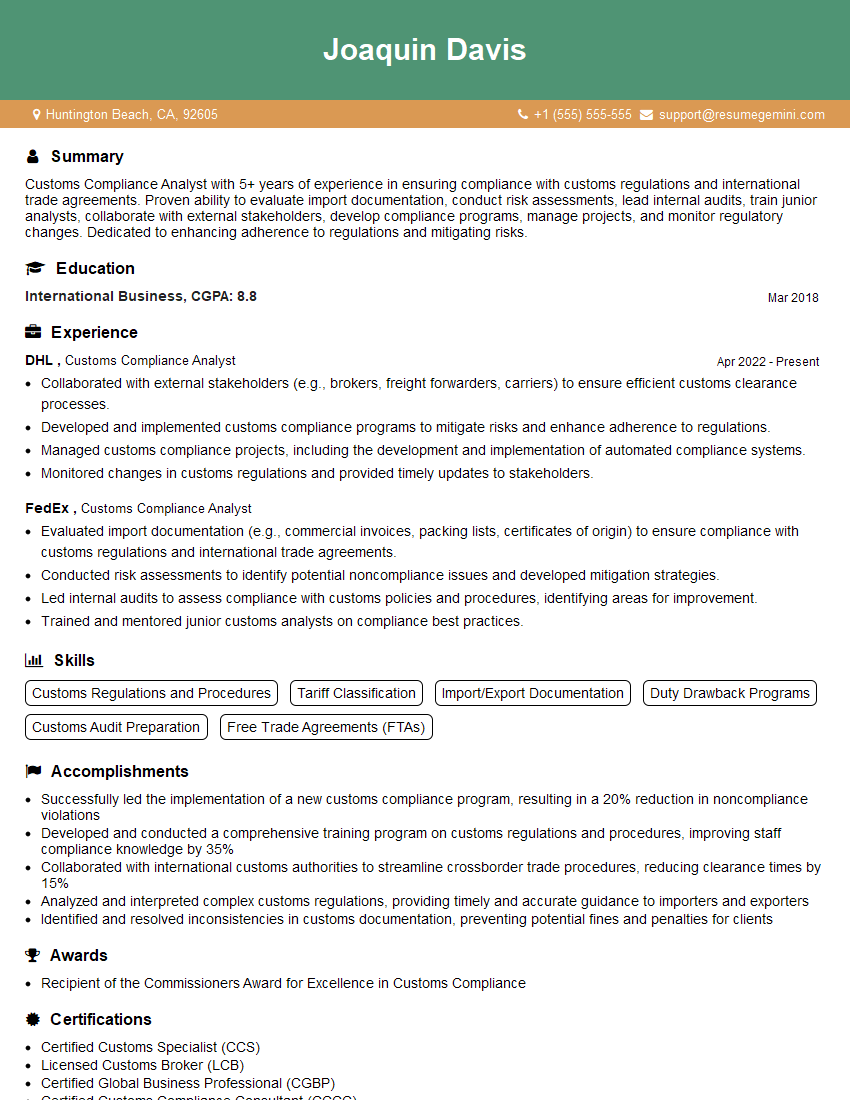

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Compliance Analyst

1. Can you explain the difference between Customs Value and Transaction Value?

Here are the key differences between Customs Value and Transaction Value:

- Customs Value: The value of imported goods for the purpose of assessing customs duties and taxes. It is determined by the World Trade Organization (WTO) valuation methods.

- Transaction Value: The price actually paid or payable for the imported goods, excluding certain adjustments such as packaging, transportation, and insurance costs.

2. What are the different types of customs bonds and when are they required?

Types of Customs Bonds

- Single Entry Bond: Used for a single import transaction.

- Continuous Bond: Used for multiple import transactions over a specified period.

- Term Bond: Used to cover a series of import transactions for a specific period, typically up to three years.

When Required

- When goods are entered into a customs warehouse or foreign trade zone.

- When goods are being imported under a duty drawback or duty preference program.

- When a surety is required to guarantee payment of duties and taxes.

3. What is the Harmonized System (HS) Code and how is it used in customs compliance?

The Harmonized System (HS) Code is a universally recognized system of classifying goods for customs and statistical purposes. It is maintained by the World Customs Organization (WCO).

- Used to determine the applicable customs duties and taxes for imported goods.

- Facilitates international trade by providing a common language for describing and classifying goods.

- Helps in identifying and controlling the movement of restricted or prohibited items.

4. Explain the concept of preferential duty rates and how they are determined.

- Preferential Duty Rates: Reduced or eliminated customs duties for goods imported from certain countries or under specific trade agreements.

- Determination: Based on bilateral or multilateral trade agreements, such as free trade agreements (FTAs) or the Generalized System of Preferences (GSP).

- Factors Considered: Economic development, political stability, human rights, and trade volume.

5. What are the key elements of a Certificate of Origin and how is it used in customs clearance?

- Key Elements:

- Exporter’s name and address

- Consignee’s name and address

- Description of goods

- Preferential origin claimed

- Signature of authorized official

- Use: Used to support a claim for preferential duty rates under trade agreements.

- Importance: Helps avoid unnecessary duties and ensures compliance with trade regulations.

6. Describe the process of duty drawback and the eligibility criteria for claiming it.

- Duty Drawback: A refund of customs duties paid on imported goods that are subsequently exported or used in the production of exported goods.

- Eligibility Criteria:

- Goods must be exported within three years of importation.

- Goods must be in the same condition as when imported.

- Importer must have paid the duties in full.

- Process:

- File a drawback application with supporting documentation.

- Customs verifies the eligibility and approves the claim.

- Importer receives a refund of the duties paid.

7. Explain the role of a Customs Broker in the import and export process.

- Licensed professionals who act as intermediaries between importers/exporters and customs authorities.

- Handle tasks such as:

- Preparing and filing customs documentation

- Classifying goods and determining duties

- Arranging for the transportation and clearance of goods

- Providing advice on customs regulations and compliance

- Ensure that imports and exports comply with legal and regulatory requirements.

8. Describe the different types of customs audits and how they are conducted.

Types of Audits

- Importer Audit: Focuses on the importer’s compliance with customs regulations.

- Exporter Audit: Examines the exporter’s compliance with export control regulations.

- Special Audit: Conducted to investigate specific allegations of fraud or non-compliance.

Conduct of Audit

- Review of documentation (e.g., entries, invoices, certificates of origin)

- Interviews with company personnel

- Physical inspection of goods

- Analysis of data and issuance of an audit report

9. What are the consequences of non-compliance with customs regulations?

- Monetary penalties (fines)

- Suspension or revocation of import/export privileges

- Seizure or forfeiture of goods

- Criminal prosecution (in severe cases)

- Damage to business reputation

10. How do you stay up-to-date with changes in customs laws and regulations?

- Regularly review customs websites and publications

- Attend industry conferences and webinars

- Subscribe to trade newsletters and updates

- Consult with customs brokers or other compliance professionals

- Engage in ongoing professional development and training

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Compliance Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Compliance Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs Compliance Analysts are responsible for ensuring that their organizations adhere to the complex regulations and laws governing international trade. Their primary duties include:

1. Monitor and Interpret Customs Regulations

Staying abreast of the latest customs regulations and policies, both domestically and internationally.

- Conducting research and analysis to interpret regulations and provide guidance to importers and exporters.

- Monitoring changes in customs laws and regulations to ensure compliance.

2. Classification and Valuation of Goods

Classifying and valuing imported and exported goods according to the Harmonized System (HS) codes and other relevant regulations.

- Determining the correct duty rates and other charges applicable to goods.

- Ensuring that goods are valued correctly for customs purposes.

3. Preparation and Submission of Customs Declarations

Preparing and submitting accurate and timely customs declarations on behalf of their clients.

- Verifying the accuracy and completeness of documentation related to customs declarations.

- Communicating with customs authorities to resolve any issues or discrepancies.

4. Audits and Inspections

Conducting internal audits and inspections to ensure compliance with customs regulations and internal policies.

- Reviewing documentation, records, and procedures to identify any potential risks or areas of non-compliance.

- Working with external auditors and customs authorities to resolve any audit findings or issues.

Interview Tips

To prepare for an interview for a Customs Compliance Analyst position, it is crucial to demonstrate your knowledge and experience in the field. Consider the following tips:

1. Research the Company and Industry

Research the company’s size, industry, and target market. Understanding their business model and the specific customs regulations they must adhere to will show the interviewer that you are genuinely interested in the position.

- Identify any recent news or developments related to customs compliance in their industry.

- Familiarize yourself with the company’s website and social media to gain insights into their culture and values.

2. Highlight Your Expertise

Emphasize your expertise in customs regulations, classification, valuation, and customs declaration procedures. Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Provide specific examples of how you have successfully resolved complex customs issues or implemented compliance programs that improved efficiency.

- Mention any certifications or training programs you have completed to enhance your knowledge and skills.

3. Demonstrate Communication and Problem-Solving Skills

Customs Compliance Analysts must have excellent communication and problem-solving skills. Showcase your ability to interact effectively with both internal and external stakeholders.

- Describe situations where you successfully communicated complex technical information to non-experts in a clear and understandable manner.

- Provide examples of how you have identified and resolved problems related to customs compliance, such as discrepancies in documentation or classification errors.

4. Show Your Continuous Learning Mindset

The field of customs compliance is constantly evolving. Express your commitment to continuous learning and staying up-to-date on the latest regulations and best practices.

- Discuss your involvement in industry events, webinars, or training programs that demonstrate your desire to stay current.

- Mention any research projects or initiatives you have undertaken to expand your knowledge base or improve compliance practices.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Customs Compliance Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.