Are you gearing up for an interview for a Customs Compliance Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Customs Compliance Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

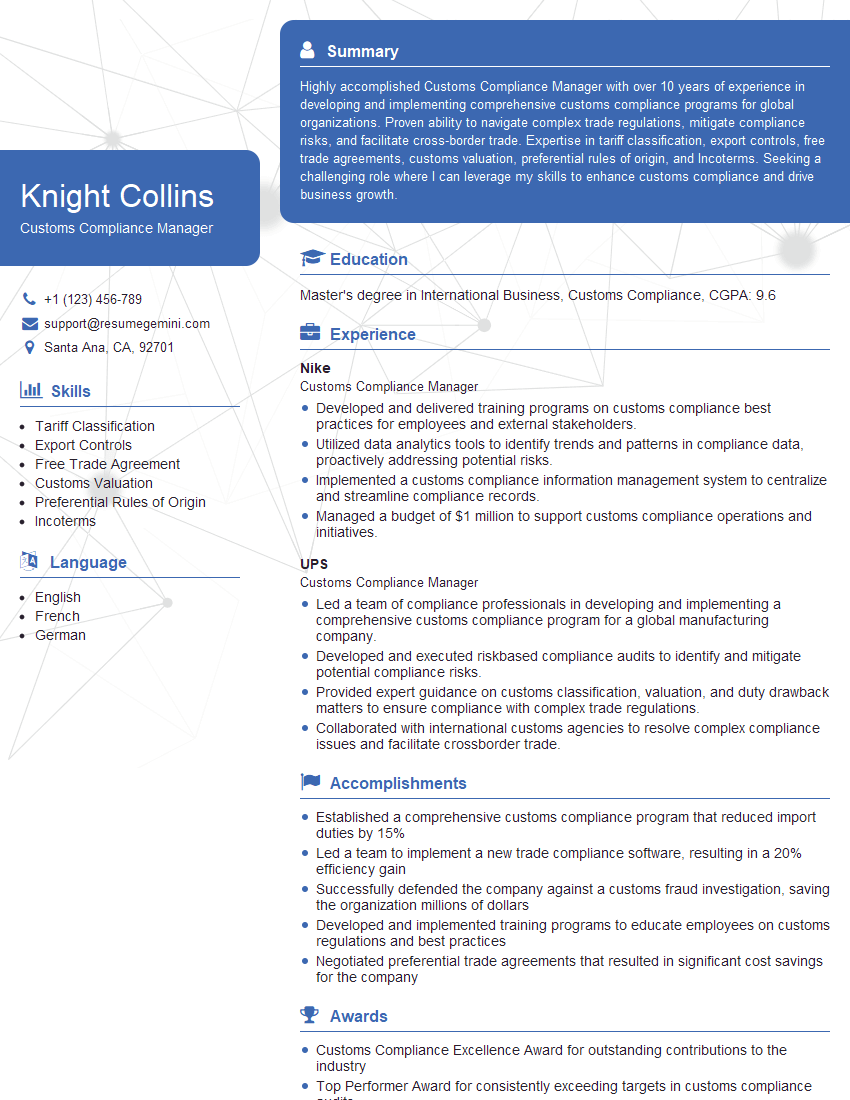

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Compliance Manager

1. What are the key responsibilities of a Customs Compliance Manager?

The key responsibilities of a Customs Compliance Manager include:

- Developing and implementing customs compliance programs

- Ensuring compliance with all applicable customs laws and regulations

- Conducting risk assessments and developing mitigation strategies

- Managing relationships with customs authorities

- Providing training and guidance to employees on customs compliance

- Staying up-to-date on changes to customs laws and regulations

- Monitoring customs compliance trends and identifying potential risks

2. What are the different types of customs audits that can be conducted?

Internal audits

- Conducted by the company’s own internal audit team

- Can be used to assess the company’s compliance with customs laws and regulations

- Can also be used to identify areas where the company can improve its customs compliance

External audits

- Conducted by customs authorities

- Can be used to assess the company’s compliance with customs laws and regulations

- Can also be used to identify areas where the company can improve its customs compliance

3. What are the different types of customs violations that can be found during an audit?

The different types of customs violations that can be found during an audit include:

- Misclassification of goods

- Undervaluation of goods

- False or misleading information on customs documents

- Failure to declare all goods

- Failure to pay the correct duties and taxes

- Smuggling

4. What are the consequences of a customs violation?

The consequences of a customs violation can include:

- Fines

- Seizure of goods

- Criminal prosecution

- Loss of import privileges

- Damage to the company’s reputation

5. What are the best practices for customs compliance?

The best practices for customs compliance include:

- Having a clear understanding of customs laws and regulations

- Developing and implementing a customs compliance program

- Conducting regular risk assessments

- Providing training and guidance to employees on customs compliance

- Staying up-to-date on changes to customs laws and regulations

- Monitoring customs compliance trends and identifying potential risks

- Working with a customs broker to ensure compliance

6. What are the challenges of customs compliance?

The challenges of customs compliance include:

- The complexity of customs laws and regulations

- The ever-changing nature of customs laws and regulations

- The need to comply with multiple jurisdictions

- The potential for penalties and other consequences for non-compliance

7. What are the opportunities for customs compliance?

The opportunities for customs compliance include:

- Reducing the risk of fines, seizures, and other penalties

- Improving the company’s reputation

- Gaining a competitive advantage

- Positioning the company for growth

8. What are the key trends in customs compliance?

The key trends in customs compliance include:

- The increasing use of technology

- The growing importance of data analytics

- The need for greater collaboration between customs authorities

- The focus on risk-based compliance

9. What are the qualities of a successful Customs Compliance Manager?

The qualities of a successful Customs Compliance Manager include:

- Strong knowledge of customs laws and regulations

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Strong analytical and problem-solving skills

- Attention to detail

- Ability to stay up-to-date on changes to customs laws and regulations

- Commitment to compliance

10. What are your career goals?

My career goals are to become a Customs Compliance Manager and to eventually lead a team of compliance professionals. I am passionate about customs compliance and I believe that I have the skills and experience necessary to be successful in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Compliance Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Compliance Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Customs Compliance Manager is a critical role within any organization that engages in international trade. They are responsible for leading and managing the organization’s customs compliance program, ensuring that it meets all applicable customs regulations and requirements.

1. Develop and implement customs compliance programs

The Customs Compliance Manager plays a key role in developing and implementing the organization’s customs compliance program. This program should be tailored to the specific needs of the organization and should address all applicable customs regulations and requirements. The Customs Compliance Manager should also ensure that the program is effectively communicated to all employees involved in international trade.

- Conduct risk assessments to identify potential areas of non-compliance.

- Develop and implement policies and procedures to address identified risks.

- Provide training to employees on customs compliance requirements.

2. Monitor and audit customs compliance

The Customs Compliance Manager is responsible for monitoring and auditing the organization’s customs compliance program to ensure that it is effective and compliant with all applicable regulations. This involves conducting regular audits of the organization’s customs operations and reviewing import and export documentation for compliance with customs requirements.

- Conduct regular audits of the organization’s customs operations.

- Review import and export documentation for compliance with customs requirements.

- Investigate any potential non-compliance issues.

3. Represent the organization in customs matters

The Customs Compliance Manager may be required to represent the organization in customs matters, such as responding to customs inquiries or participating in customs audits. The Customs Compliance Manager should have a strong understanding of customs regulations and procedures and should be able to effectively communicate with customs officials.

- Respond to customs inquiries.

- Participate in customs audits.

- Represent the organization in customs proceedings.

4. Stay informed of changes in customs regulations

Customs regulations are constantly changing, so it is important for the Customs Compliance Manager to stay informed of these changes. This can be done by attending industry conferences and seminars, reading trade publications, and networking with other customs professionals.

- Attend industry conferences and seminars.

- Read trade publications.

- Network with other customs professionals.

Interview Tips

Preparing for an interview for a Customs Compliance Manager position can be daunting, but by following these tips, you can increase your chances of success.

1. Research the company and the position

Before your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and the specific requirements of the role. You can find this information on the company’s website, in industry publications, or by networking with people who work at the company.

- Visit the company’s website.

- Read industry publications.

- Network with people who work at the company.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and clearly.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What experience do you have in customs compliance?

3. Be prepared to discuss your experience in customs compliance

The interviewer will likely want to know about your experience in customs compliance. Be prepared to discuss your experience in detail, including your knowledge of customs regulations, your experience in developing and implementing customs compliance programs, and your experience in monitoring and auditing customs compliance.

- Discuss your knowledge of customs regulations.

- Discuss your experience in developing and implementing customs compliance programs.

- Discuss your experience in monitoring and auditing customs compliance.

4. Be prepared to answer questions about your qualifications

The interviewer will likely want to know about your qualifications for the position. Be prepared to discuss your education, your experience, and your skills. You should also be prepared to discuss your motivation for pursuing a career in customs compliance.

- Discuss your education.

- Discuss your experience.

- Discuss your skills.

- Discuss your motivation for pursuing a career in customs compliance.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Customs Compliance Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Customs Compliance Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.