Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Customs Consultant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

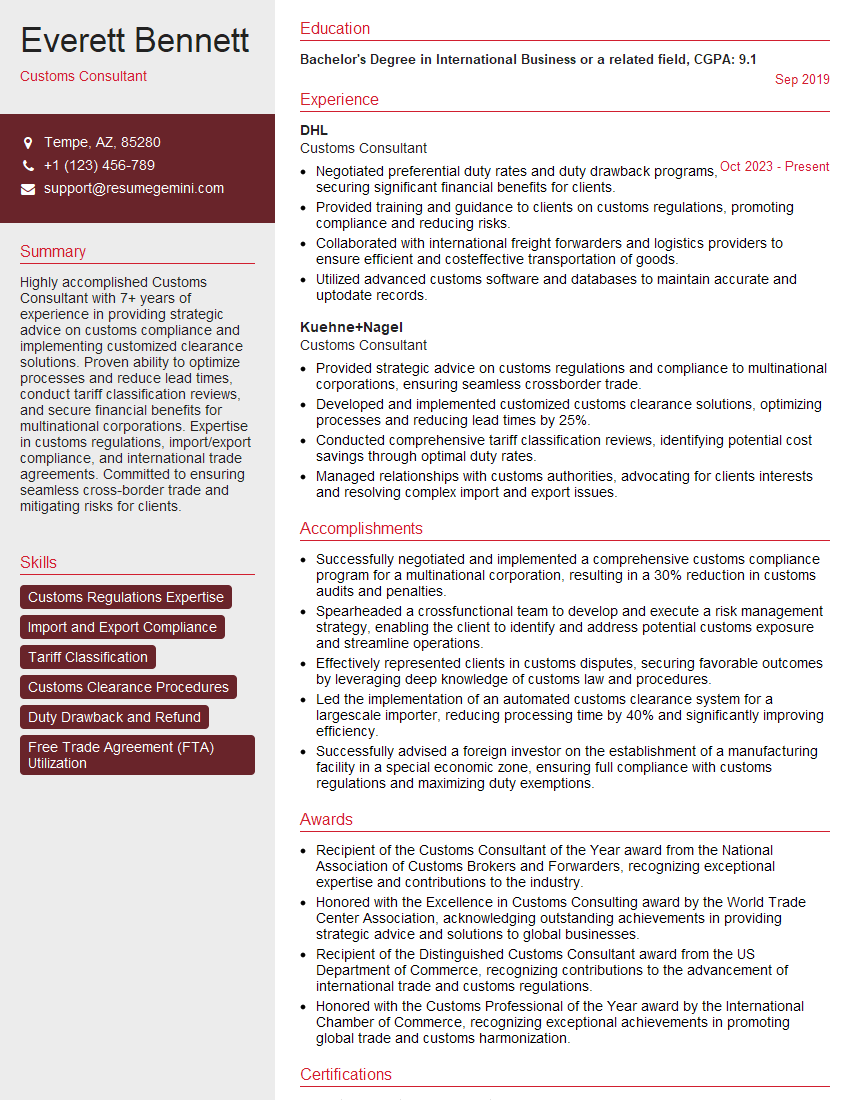

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Consultant

1. Explain the role of a Customs Consultant in detail.

Customs Consultant’s Role:

- Advising clients on import and export regulations, tariffs, and customs procedures.

- Preparing and submitting customs declarations and documentation.

- Representing clients before customs authorities and resolving disputes.

- Keeping abreast of changes in customs laws and regulations.

- Identifying opportunities for clients to optimize customs processes and save money.

2. What are the key challenges and risks associated with customs clearance?

Types of Challenges

- Complexity of customs regulations and documentation.

- Different interpretations of regulations by customs authorities.

- Unexpected delays or inspections.

- Potential for penalties or seizures due to non-compliance.

Mitigation of Risks

- Engaging a knowledgeable customs consultant.

- Proper planning, preparation, and documentation.

- Building strong relationships with customs officials.

3. How do you stay updated on the latest customs regulations and changes?

- Subscribing to customs newsletters and publications.

- Attending industry events and conferences.

- Networking with other customs professionals.

- Consulting with customs brokers and attorneys.

4. Describe the different types of customs duty and how they are calculated.

- Ad Valorem Duty: Calculated as a percentage of the value of the goods.

- Specific Duty: Calculated as a fixed amount per unit of quantity (e.g., per kilogram, per gallon).

- Compound Duty: Combination of ad valorem and specific duty.

- Preferential Duty: Reduced rate applied to goods from countries with which the importing country has a trade agreement.

- Anti-dumping Duty: Additional duty imposed to counter unfair pricing practices.

5. What is Harmonized System (HS) Code and how does it impact customs clearance?

- International classification system for goods used by customs authorities worldwide.

- Used to determine the applicable duty rate and other customs regulations.

- Accurate classification is crucial for efficient and compliant customs clearance.

6. How do you handle disputes or audits by customs authorities?

- Preparation: Gather documentation and evidence to support your position.

- Negotiation: Attempt to reach an amicable resolution with customs authorities.

- Appeal: Formal process to challenge customs decisions.

- Seek Legal Counsel: If necessary, consult with an attorney specializing in customs law.

7. Describe the importance of duty drawback and how it can benefit importers.

- Refund or credit on import duties paid on goods subsequently exported.

- Can significantly reduce the overall cost of importing and exporting goods.

- Requires careful planning and documentation to qualify for drawback.

8. How do you ensure the accuracy and completeness of customs documentation?

- Thorough review of all supporting documentation (e.g., invoices, packing lists, certificates).

- Verification of HS Codes and calculation of duties and taxes.

- Attention to detail and adherence to customs regulations.

9. What are some common mistakes or challenges that importers and exporters face in dealing with customs?

- Inaccurate or incomplete documentation.

- Misclassification of goods.

- Lack of understanding of customs regulations.

- Delays or penalties due to non-compliance.

10. What sets you apart as a highly qualified Customs Consultant?

- Strong understanding of customs laws and regulations.

- Proven track record of successful customs clearances.

- Excellent communication and negotiation skills.

- Commitment to providing exceptional client service.

- Proficiency in customs software and tools.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs consultants provide comprehensive guidance on customs regulations, duties, and international trade procedures to businesses and individuals engaged in import and export activities. Their responsibilities encompass a wide range of tasks that are crucial for ensuring compliance with customs laws and maximizing efficiency in cross-border transactions.

1. Compliance and Risk Assessment

Customs consultants assess the compliance status of businesses, identify potential risks, and develop strategies to mitigate them. They conduct due diligence reviews, analyze customs regulations, and advise clients on best practices to ensure adherence to legal requirements.

- Review and interpret complex customs regulations and tariffs

- Identify potential risks associated with customs procedures

- Develop and implement risk mitigation strategies

2. Classification and Valuation

Customs consultants determine the appropriate classification of goods under customs tariffs and calculate their customs value. They analyze product descriptions, review technical specifications, and consider industry practices to ensure accurate classification and valuation.

- Classify goods according to the Harmonized System (HS) codes

- Calculate customs value based on transaction value, cost of goods sold, or other relevant methods

- Provide guidance on preferential programs and duty reduction opportunities

3. Duty Optimization and Drawback Management

Customs consultants optimize duty payments by identifying applicable tariff concessions, exemptions, and incentives. They also assist clients in managing drawback programs, which allow for the recovery of duties and taxes paid on imported goods that are subsequently exported.

- Identify tariff concessions and preferences based on trade agreements or specific industry sectors

- Develop duty optimization strategies to minimize customs charges

- Manage drawback programs and ensure compliance with related regulations

4. Customs Clearance and Post-Clearance Audit Support

Customs consultants facilitate the clearance of goods through customs by preparing and submitting necessary documentation. They also provide support during post-clearance audits, representing clients and ensuring compliance with customs requirements.

- Prepare and submit customs declarations, invoices, and other required documents

- Monitor the clearance process and provide updates to clients

- Represent clients in post-clearance audits and appeals

Interview Tips

Preparing thoroughly for a customs consultant interview is essential to showcase your expertise and maximize your chances of success. Here are some key tips to help you ace the interview:

1. Research the Company and Industry

Before the interview, take the time to research the company you are applying to and the customs industry in general. Familiarize yourself with their services, clientele, and industry trends. This knowledge will demonstrate your interest and enthusiasm for the role.

- Visit the company website and LinkedIn page

- Read recent articles and news related to customs regulations and trade

- Learn about the company’s competitors and the overall market landscape

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to customs regulations, classification, valuation, and clearance procedures. Practice answering these questions clearly and concisely, highlighting your knowledge and experience.

- Review the key job responsibilities outlined in the job description

- Prepare examples of your experience in each area

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

3. Emphasize Your Key Skills and Experience

Highlight your relevant skills and experience that are directly applicable to the customs consultant role. Quantify your accomplishments and demonstrate your ability to contribute to the company’s success.

- Focus on your expertise in customs regulations and procedures

- Quantify your experience in duty optimization and drawback management

- Discuss your ability to work independently and as part of a team

4. Prepare Thoughtful Questions

Asking thoughtful questions at the end of the interview demonstrates your engagement and interest in the role. Prepare questions that are specific to the company, the industry, or the specific challenges of the position.

- Inquire about the company’s growth plans and how you can contribute

- Ask about the company’s approach to compliance and risk management

- Request insights into the challenges and opportunities in the customs industry

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Customs Consultant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!