Are you gearing up for an interview for a Customs Entry Writer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Customs Entry Writer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

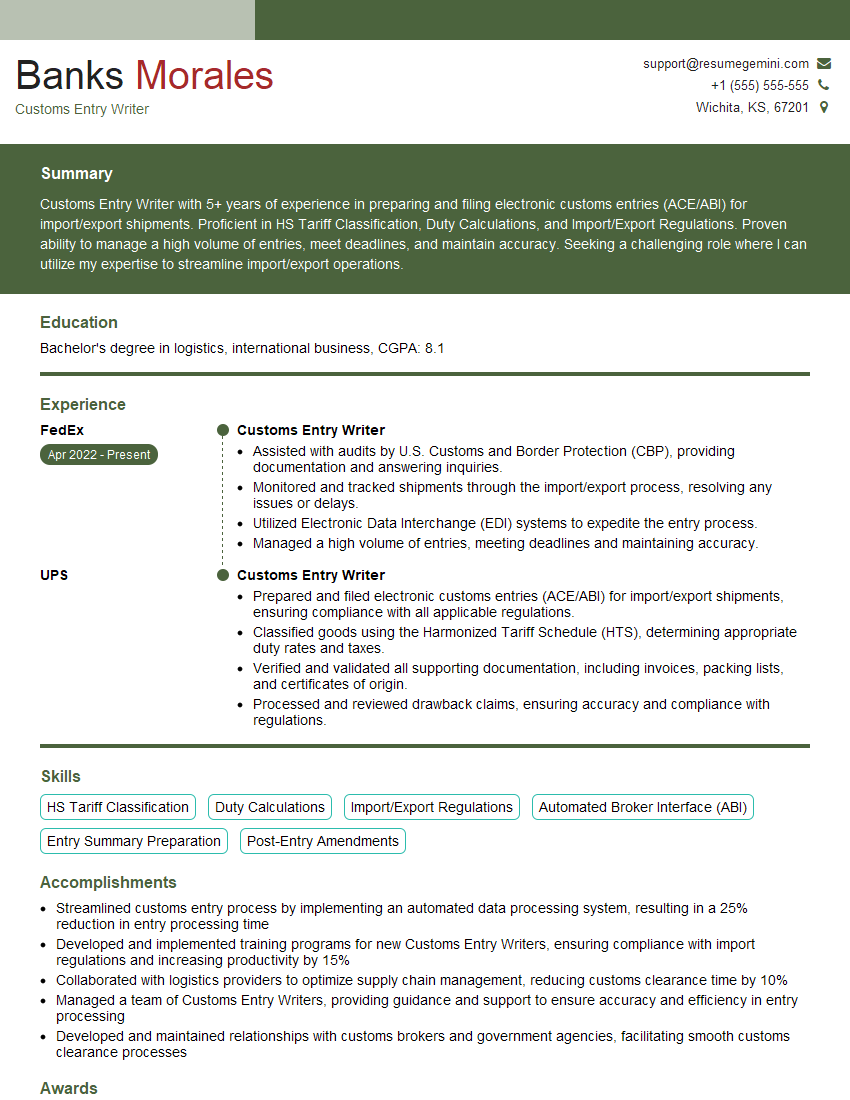

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Entry Writer

1. What are the key responsibilities of a Customs Entry Writer?

- Classifying and encoding imported and exported goods according to the Harmonized System (HS) codes

- Determining the value of goods for customs purposes

- Preparing and filing customs entry documents, including bills of lading, commercial invoices, and packing lists

- Calculating and paying customs duties and taxes

- Ensuring that all goods are imported or exported in compliance with customs regulations

2. What are the most important qualities of a successful Customs Entry Writer?

Attention to detail

- Accuracy is crucial in this role, as errors in customs entries can result in penalties or delays.

- Customs Entry Writers must be able to carefully review documents and identify any inconsistencies or errors.

Knowledge of customs regulations

- Customs Entry Writers must be familiar with the complex and ever-changing world of customs regulations.

- They must be able to interpret and apply these regulations to ensure that goods are imported or exported in compliance.

3. What are the challenges of working as a Customs Entry Writer?

- The workload can be high, especially during peak import or export seasons.

- Customs regulations are constantly changing, so it is important to stay up-to-date on the latest requirements.

- The job can be stressful, as Customs Entry Writers are often responsible for ensuring that goods are imported or exported on time and without any problems.

4. What are the rewards of working as a Customs Entry Writer?

- The job offers a good salary and benefits package.

- Customs Entry Writers play an important role in the global trade system.

- The job can be challenging and rewarding, as it requires a high level of knowledge and expertise.

5. What is your experience with using the Automated Commercial Environment (ACE)?

- ACE is a web-based system used by Customs and Border Protection (CBP) to process customs entries.

- Customs Entry Writers must be proficient in using ACE in order to prepare and file customs entries.

6. What is your experience with the Harmonized System (HS) codes?

- HS codes are used to classify imported and exported goods.

- Customs Entry Writers must be able to correctly classify goods in order to determine the applicable customs duties and taxes.

7. What is your experience with calculating customs duties and taxes?

- Customs duties and taxes are levied on imported goods.

- Customs Entry Writers must be able to calculate the correct amount of duties and taxes to be paid.

8. What is your experience with preparing and filing customs entry documents?

- Customs entry documents include bills of lading, commercial invoices, and packing lists.

- Customs Entry Writers must be able to prepare and file these documents accurately and completely.

9. What is your experience with working with freight forwarders?

- Freight forwarders are companies that handle the transportation of goods.

- Customs Entry Writers often work with freight forwarders to arrange for the transportation of goods across borders.

10. What is your experience with working with customs brokers?

- Customs brokers are licensed professionals who assist importers and exporters with customs clearance processes.

- Customs Entry Writers often work with customs brokers to ensure that goods are imported or exported in compliance with customs regulations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Entry Writer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Entry Writer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Customs Entry Writer is responsible for preparing and submitting customs entries on behalf of importers and exporters, ensuring compliance with government regulations. Key job responsibilities include:

1. Processing Customs Entries

Prepare and submit customs entries for goods being imported or exported, accurately classifying goods according to the Harmonized Tariff Schedule (HTS).

- Determine the correct duty rates, taxes, and fees applicable to imported goods.

- Calculate and pay customs duties and taxes in a timely manner.

2. Maintaining Accurate Records

Maintain accurate and up-to-date records of all customs entries, including supporting documentation.

- Respond to requests for information from customs officials and other government agencies.

- Prepare and maintain reports on customs activities for internal and external stakeholders.

3. Staying Informed on Customs Regulations

Stay informed on the latest customs regulations and procedures, including changes in tariffs, duties, and import/export restrictions.

- Advise clients on how to comply with customs regulations and avoid penalties.

- Identify and resolve potential customs issues before they escalate.

4. Assisting with Compliance Audits

Assist with customs compliance audits, providing documentation and information to customs officials.

- Work with clients to develop and implement strategies to minimize customs risks.

- Identify and correct any errors or discrepancies in customs entries.

Interview Tips

To ace an interview for a Customs Entry Writer position, consider the following preparation tips:

1. Research the Company and Industry

Familiarize yourself with the company’s business, including its products, services, and target market. Research the customs regulations and procedures relevant to the industry.

- This shows your interest in the role and demonstrates your knowledge of the field.

- Example: “I understand that your company specializes in importing textiles from Asia. I have experience with HTS classification of textile products and am aware of the specific regulations that apply.”

2. Highlight Your Customs Knowledge

Emphasize your understanding of customs regulations, documentation requirements, and entry processing procedures.

- Quantify your experience and provide specific examples of your accomplishments.

- Example: “In my previous role, I processed over 500 customs entries per month, ensuring accurate classification and timely payment of duties.”

3. Demonstrate Attention to Detail

Customs entry writing requires meticulous attention to detail. Highlight your ability to carefully review documents, identify errors, and ensure compliance with regulations.

- Provide examples of your ability to work independently and follow instructions precisely.

- Example: “I have a proven track record of accuracy in my customs work. I meticulously check all supporting documentation and ensure that all entries are filled out correctly.”

4. Show Commitment to Compliance

Emphasize your commitment to compliance with customs regulations and your ability to adapt to changes in procedures.

- Explain how you have proactively stayed informed about new regulations and implemented them effectively.

- Example: “I regularly attend industry conferences and webinars to stay updated on the latest customs regulations. I have implemented these updates successfully in my previous roles.”

Next Step:

Now that you’re armed with the knowledge of Customs Entry Writer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Customs Entry Writer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini