Are you gearing up for a career in Customs House Broker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Customs House Broker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

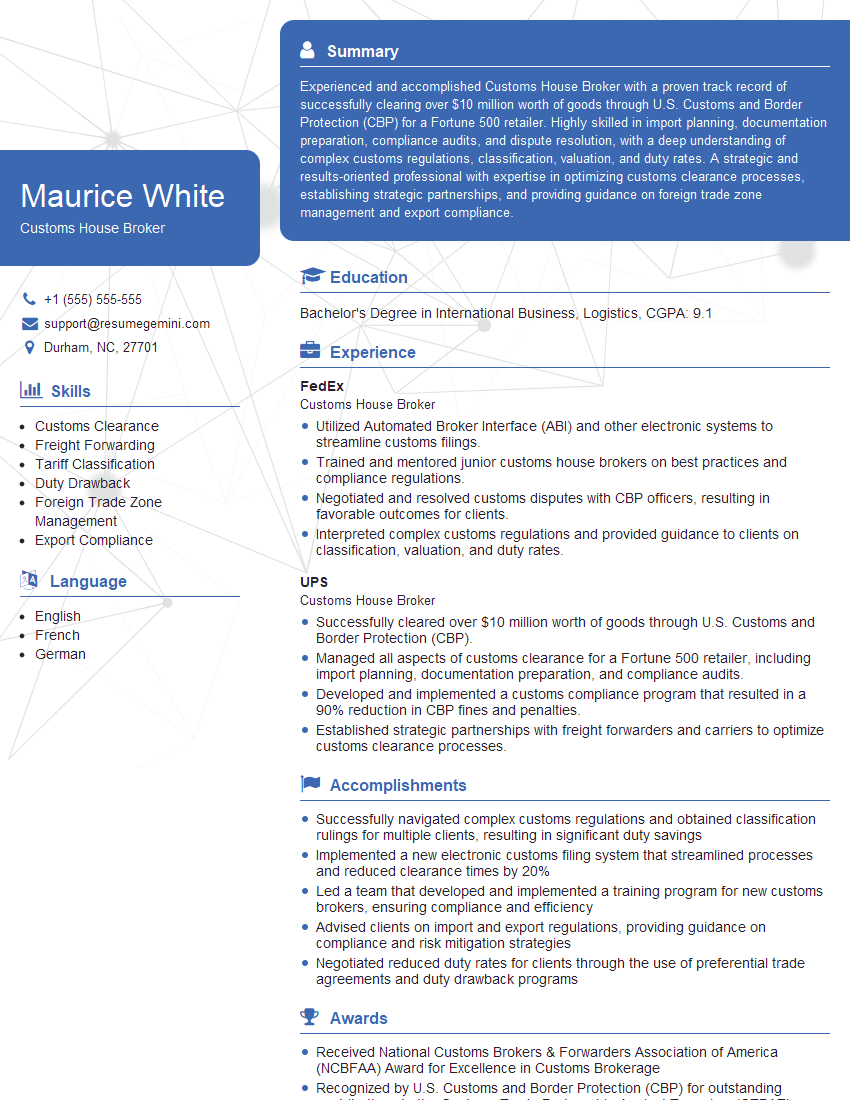

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs House Broker

1. What are the key responsibilities of a Customs House Broker?

As a Customs House Broker, I will be responsible for:

- Classifying imported and exported goods according to the Harmonized Tariff Schedule (HTS) and determining the applicable duty rates.

- Preparing and filing customs entries and other required documents.

2. How do you stay up-to-date with changes in customs regulations?

- Regularly attending industry conferences and webinars.

- Subscribing to trade publications and newsletters.

- Consulting with experts in the field.

3. What are the different types of customs bonds?

- Single-entry bonds: Used for a single importation or exportation.

- Continuous bonds: Used for multiple importations or exportations over a period of time.

- Term bonds: Used to cover multiple transactions for a specified period of time.

4. How do you handle discrepancies between the shipper’s invoice and the customs entry?

- Contact the shipper to verify the information.

- If the discrepancy cannot be resolved, file a protest with Customs.

5. What are the consequences of making a false statement on a customs entry?

- Forfeiture of the goods.

- Civil penalties.

- Criminal prosecution.

6. What are the benefits of using a Customs House Broker?

- Expertise in customs regulations.

- Avoid costly mistakes.

- Save time and resources.

7. How do you calculate the value of goods for customs purposes?

- Transaction value: The price actually paid or payable for the goods.

- Deductive value: The price of identical or similar goods sold in the United States.

- Computed value: The sum of the cost of production and a reasonable profit.

8. What are the different types of customs entry procedures?

- Formal entry: Used for high-value or dutiable goods.

- Informal entry: Used for low-value or non-dutiable goods.

- Immediate delivery: Used for goods that are needed urgently.

9. How do you determine the country of origin of goods?

- The country where the goods were wholly obtained.

- The country where the goods were substantially transformed.

10. What are the prohibited and restricted items that cannot be imported or exported?

- Counterfeit goods.

- Dangerous goods.

- Perishable goods.

- Live animals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs House Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs House Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs House Brokers are responsible for ensuring that goods are imported and exported in compliance with all applicable laws and regulations, by performing various key functions such as:

1. Classifying Goods

Customs House Brokers are responsible for classifying goods under the Harmonized System (HS) code, which is an internationally recognized system for classifying goods. This is important for determining the correct duty and tax rates that apply to the goods.

- Ensuring that the goods are properly described in the import or export documentation.

- Researching and analyzing the relevant laws and regulations to determine the correct classification.

2. Determining Duty and Taxes

Customs House Brokers are responsible for calculating the correct duty and tax rates that apply to the goods. This involves considering the value of the goods, the country of origin, and any applicable trade agreements.

- Preparing and submitting the necessary import or export documentation to the customs authorities.

- Paying the required duties and taxes on behalf of their clients.

3. Liaising with Customs Authorities

Customs House Brokers must liaise with customs authorities to ensure that goods are cleared through customs in a timely and efficient manner. This involves providing the customs authorities with the necessary documentation and answering any questions they may have.

- Responding to any queries or requests from the customs authorities.

- Attending meetings with customs officials to discuss issues related to the importation or exportation of goods.

4. Maintaining Records

Customs House Brokers are required to maintain accurate records of all their transactions. This includes records of the goods that they have imported or exported, the duties and taxes that have been paid, and the correspondence that they have had with the customs authorities.

- Keeping up-to-date on changes in customs laws and regulations.

- Providing training to clients on how to comply with customs regulations.

Interview Tips

To ace an interview for a Customs House Broker position, it is important to prepare thoroughly and to be able to demonstrate your knowledge of customs laws and regulations. Here are some tips to help you prepare for your interview:

1. Research the Company

Before your interview, take some time to research the company that you are applying to. This will help you to understand the company’s business model, its target market, and its competitive landscape. This will also show the interviewer that you are interested in the company and that you have taken the time to learn more about it.

- Visit the company’s website.

- Read the company’s annual report.

- Search for news articles and press releases about the company.

2. Prepare for Behavioral Questions

In addition to questions about your knowledge of customs laws and regulations, you can also expect to be asked behavioral questions during your interview. These questions are designed to assess your soft skills, such as your teamwork, communication, and problem-solving skills.

- Use the STAR method to answer behavioral questions (Situation, Task, Action, Result).

- Be specific and provide concrete examples to support your answers.

- Practice answering behavioral questions with a friend or family member.

3. Be Professional

First impressions matter, so it is important to be professional throughout the interview process. This means dressing appropriately, arriving on time, and being polite and respectful to everyone you meet.

- Dress in business attire.

- Arrive on time for your interview.

- Be polite and respectful to everyone you meet, including the receptionist, the interviewer, and other employees.

4. Ask Questions

At the end of the interview, be sure to ask the interviewer any questions that you have about the position or the company. This shows that you are interested in the job and that you are taking the interview seriously.

- Prepare a list of questions to ask the interviewer.

- Ask questions about the company, the position, and the interviewer’s experience.

- Be specific and avoid asking general questions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Customs House Broker interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.