Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Daily Sales Audit Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

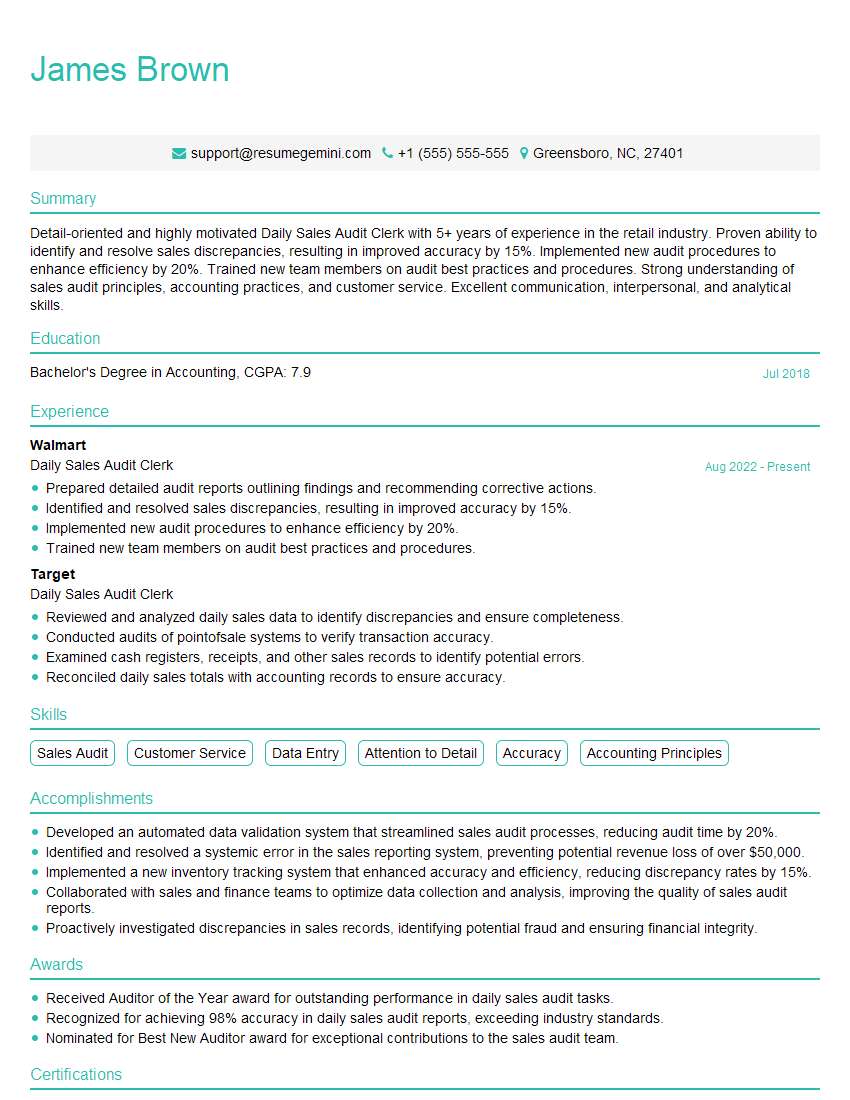

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Daily Sales Audit Clerk

1. What are the key responsibilities of a Daily Sales Audit Clerk?

As a Daily Sales Audit Clerk, my primary responsibilities would include:

- Reconciling daily sales reports with point-of-sale (POS) data and other relevant documents.

- Identifying and resolving discrepancies in sales records and accounting data.

2. How would you approach verifying and reconciling daily sales transactions?

Validating POS Data

- Cross-checking POS data with source documents, such as receipts and invoices.

- Verifying product codes, quantities, and unit prices against inventory records.

Reconciling with Accounting Data

- Matching sales totals with the general ledger and sub-ledgers.

- Investigating any variances and making necessary adjustments.

3. What steps would you take if you discover a discrepancy in the sales records?

Upon identifying a discrepancy, I would follow these steps:

- Document the discrepancy and its potential impact.

- Investigate the root cause by reviewing related transactions and supporting documentation.

- Consult with the relevant stakeholders, such as sales associates or supervisors, to obtain additional information.

- Propose and implement a solution to resolve the discrepancy promptly and accurately.

4. How do you ensure the confidentiality and security of sensitive sales data?

Maintaining data confidentiality and security is paramount. I would follow established policies and procedures, including:

- Restricting access to sensitive data to authorized personnel on a need-to-know basis.

- Utilizing secure storage and encryption methods for sensitive documents.

- Reporting any suspected breaches or unauthorized access promptly.

5. What are common methods of sales fraud, and how would you identify them?

Common methods of sales fraud include:

- Collusion between employees to override controls.

- Fictitious transactions or sales to fictitious customers.

- Unadjusted voids or discounts without proper authorization.

I would identify potential fraud through:

- Trend analysis and variance reporting.

- Reviewing transactions for unusual patterns or outliers.

- Conducting surprise audits and spot checks.

6. How do you stay up-to-date with changes in sales accounting practices and regulations?

To stay current with industry best practices and regulatory changes, I would:

- Attend industry webinars and conferences.

- Read professional publications and stay informed about relevant regulations.

- Seek continuous professional development through certifications or online courses.

7. Describe your experience with data analysis and reporting tools.

I have experience with the following data analysis and reporting tools:

- Microsoft Excel for data organization, analysis, and visualization.

- SQL for querying and extracting data from databases.

- Tableau or Power BI for interactive data visualizations and reporting.

8. How do you handle working under pressure and meeting tight deadlines?

I am comfortable working under pressure and meeting tight deadlines. I prioritize my workload, stay organized, and effectively manage my time. I also seek support from colleagues or supervisors when necessary to ensure timely and accurate completion of tasks.

9. Can you explain the importance of internal controls in sales auditing?

Internal controls play a crucial role in sales auditing by:

- Preventing errors and fraud by establishing clear processes and responsibilities.

- Ensuring the accuracy and reliability of financial data.

- Protecting the organization’s assets and reputation.

10. What do you consider your strengths and weaknesses in relation to this role?

Strengths

- Strong analytical and problem-solving skills.

- Attention to detail and accuracy.

- Experience in sales accounting and data management.

Weaknesses

- Limited experience with specific industry-specific sales auditing software (willingness to learn).

- Working on a large-scale sales audit project involving multiple teams (eager to gain experience).

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Daily Sales Audit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Daily Sales Audit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Daily Sales Audit Clerk is responsible for ensuring the accuracy of daily sales transactions. They work closely with cashiers and other retail staff to ensure that all sales are recorded correctly and that the company’s financial records are accurate and up-to-date.

1. Verify and reconcile daily sales records

The Daily Sales Audit Clerk is responsible for verifying and reconciling daily sales records. This includes checking that all sales are recorded correctly, that the correct prices are charged, and that the correct taxes are applied. The Clerk also reconciles sales records with other financial records, such as cash register tapes and credit card receipts, to ensure that all sales are accounted for.

2. Investigate and resolve discrepancies

The Daily Sales Audit Clerk is responsible for investigating and resolving any discrepancies that are found in the sales records. This may involve contacting customers, cashiers, or other staff to gather information and determine the cause of the discrepancy. The Clerk then works to resolve the discrepancy and ensure that the sales records are accurate.

3. Prepare daily sales reports

The Daily Sales Audit Clerk is responsible for preparing daily sales reports. These reports summarize the sales activity for the day and are used by management to track sales trends and make business decisions. The Clerk also prepares other reports, such as weekly and monthly sales reports, as needed.

4. Maintain sales records

The Daily Sales Audit Clerk is responsible for maintaining sales records. This includes filing sales receipts, invoices, and other documents. The Clerk also maintains electronic sales records and ensures that they are backed up regularly.

Interview Tips

Preparing for an interview for a Daily Sales Audit Clerk position can be daunting, but with the right preparation, you can increase your chances of success.

1. Review the job description carefully

Before you start preparing for your interview, it is important to review the job description carefully. This will help you understand the key responsibilities of the position and the qualifications that the employer is looking for. Once you have a good understanding of the job description, you can tailor your resume and cover letter to highlight your relevant skills and experience.

2. Practice common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice answering these questions in a clear and concise manner. You should also prepare questions to ask the interviewer, which will show that you are interested in the position and the company.

3. Research the company

Before your interview, it is important to do some research on the company. This will help you understand the company’s culture, values, and goals. You should also be familiar with the company’s products or services. This will show the interviewer that you are interested in the company and that you have taken the time to learn about them.

4. Dress professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and pressed. If you are not sure what to wear, it is always better to err on the side of caution and dress more formally.

5. Be confident

Confidence is key when it comes to interviewing. Believe in yourself and your abilities, and let the interviewer know that you are confident that you have the skills and experience to be successful in the position. However, be sure to avoid being arrogant or overbearing. You want to come across as confident and capable, but not cocky or entitled.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Daily Sales Audit Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!