Feeling lost in a sea of interview questions? Landed that dream interview for Damage Appraiser but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Damage Appraiser interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

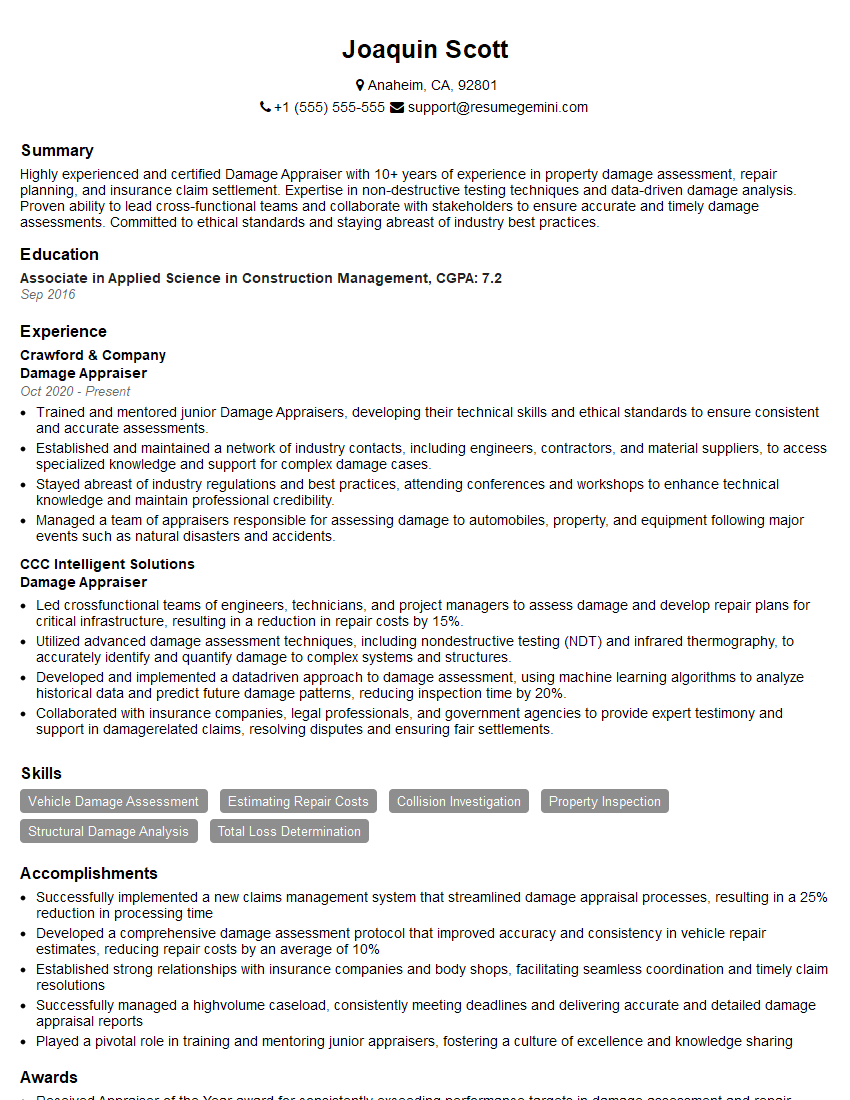

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Damage Appraiser

1. How do you determine the severity of damage to a vehicle?

To determine the severity of damage to a vehicle, I perform a comprehensive inspection that involves the following steps:

- Visual inspection: I examine the vehicle thoroughly for any visible damage, such as dents, scratches, broken lights, or leaks.

- Mechanical inspection: If necessary, I conduct a mechanical inspection to assess the extent of damage to the engine, transmission, suspension, and other mechanical components.

- Use of diagnostic tools: I utilize diagnostic tools, such as scan tools, to detect any fault codes or hidden issues with the vehicle’s electrical and mechanical systems.

- Review of repair history: I review the vehicle’s repair history to identify any previous repairs or accidents that may have affected its condition.

2. What software programs do you use for estimating repairs?

Estimating software:

- Mitchell Cloud Estimating

- CCC ONE Estimating

- Audatex

Additional tools:

- Collision Estimating Guide

- Vehicle Identification Number (VIN) decoder

- Labor time guides

3. How do you stay up-to-date on the latest repair techniques and industry standards?

To stay up-to-date on the latest repair techniques and industry standards, I engage in the following activities:

- Attend industry conferences and workshops: I participate in conferences and workshops to learn about new repair technologies, best practices, and industry regulations.

- Read trade publications and online resources: I subscribe to trade publications and follow industry blogs to stay informed about the latest advancements in vehicle repair.

- Network with other damage appraisers: I connect with other damage appraisers and exchange knowledge and experiences to stay abreast of emerging trends and best practices.

- Obtain certifications and continuing education: I pursue certifications and continuing education programs to enhance my skills and demonstrate my commitment to professional development.

4. What are the different factors that can affect the value of a damaged vehicle?

Several factors can affect the value of a damaged vehicle, including:

- Severity of damage: The extent of damage to the vehicle’s structure, mechanical components, and cosmetic appearance.

- Age and condition of the vehicle: The age, mileage, and overall condition of the vehicle prior to the damage.

- Market demand: The popularity and availability of similar vehicles in the current market.

- Insurance coverage: The type and amount of insurance coverage the vehicle owner has.

- Repair costs: The estimated cost of repairs to restore the vehicle to its pre-accident condition.

5. How do you handle disagreements with customers or insurance companies regarding damage estimates?

To handle disagreements with customers or insurance companies regarding damage estimates, I follow these steps:

- Communicate effectively: I engage in clear and respectful communication to explain my findings and the basis for my estimate.

- Provide supporting documentation: I present detailed repair estimates, photographs, and other supporting documentation to justify my assessment.

- Negotiate and compromise: I am willing to negotiate and compromise within reason to reach an agreement that is fair to all parties.

- Obtain external opinions: If necessary, I consult with independent experts or industry professionals to provide additional perspectives.

6. What are the ethical considerations involved in damage appraisal?

In damage appraisal, I adhere to the following ethical considerations:

- Impartiality: I conduct damage appraisals objectively and without bias or conflicts of interest.

- Accuracy and honesty: I provide accurate and honest assessments based on my professional judgment and industry standards.

- Confidentiality: I maintain the confidentiality of all information related to the appraisal process, including customer data and repair estimates.

- Transparency: I disclose all relevant factors and assumptions used in my damage assessments to ensure transparency and understanding.

- Professionalism: I conduct myself professionally and respectfully throughout the appraisal process.

7. How do you assess the extent of damage to unseen areas of a vehicle?

To assess the extent of damage to unseen areas of a vehicle, I employ the following techniques:

- Visual examination: I carefully inspect the surrounding areas for signs of damage, such as cracks, deformation, or fluid leaks.

- Diagnostic scanning: I use diagnostic tools to scan the vehicle’s computer systems for fault codes or other indicators of hidden damage.

- Removal of components: In some cases, I may remove certain components or panels to gain access to hidden areas and inspect for damage.

- Consulting with repair shops: I collaborate with experienced repair technicians to gather their insights and recommendations based on their knowledge of vehicle construction.

8. How do you handle salvage vehicles?

When handling salvage vehicles, I follow these procedures:

- Determine the extent of damage: I conduct a thorough inspection to assess the severity and nature of the damage.

- Research salvage values: I consult industry databases and market reports to determine the salvage value of the vehicle based on its make, model, year, and condition.

- Provide a salvage estimate: I prepare a detailed estimate that includes the salvage value, documentation of the damage, and any relevant recommendations.

- Comply with regulations: I adhere to all applicable laws and regulations regarding the handling and disposition of salvage vehicles.

9. Describe a complex damage appraisal case you handled and how you resolved it.

In a recent case, I encountered a complex damage appraisal involving a high-end sports car that had sustained significant damage in an accident.

- Assessment: I conducted a comprehensive inspection and determined the damage extended beyond the visible exterior and into the vehicle’s frame and mechanical components.

- Negotiation: The insurance company initially offered a settlement below my estimated repair costs. I provided detailed documentation and negotiated with the adjuster to justify my assessment.

- Expert consultation: To support my findings, I consulted with a specialized automotive engineer who provided an independent assessment of the hidden damage.

- Resolution: Based on the evidence presented, the insurance company agreed to a fair settlement that covered the necessary repairs to restore the vehicle to its pre-accident condition.

10. What are the emerging trends in the damage appraisal industry?

The damage appraisal industry is evolving, driven by technological advancements and changing consumer expectations:

- Virtual damage assessments: The use of virtual reality and augmented reality technology for remote vehicle inspections and damage assessments.

- Artificial intelligence (AI): AI algorithms are being developed to assist appraisers in damage assessment and repair cost estimation.

- Customer-centric services: A growing emphasis on providing transparent and convenient damage appraisal services to customers.

- Sustainability: Increased focus on eco-friendly repair practices and the use of recycled materials.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Damage Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Damage Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Damage Appraisers are responsible for assessing the extent and cost of damage to automobiles and other vehicles. They play a crucial role in the insurance industry, helping insurance companies determine the appropriate settlement amounts for claims.

1. Assessing Vehicle Damage

Damage Appraisers are responsible for inspecting damaged vehicles to determine the extent and severity of the damage. They use their knowledge of vehicle construction, repair methods, and materials to assess the damage and estimate the cost of repairs.

- Inspect vehicles for damage, taking photos and documenting the extent of the damage

- Identify the cause of the damage and determine if it is covered by insurance

- Estimate the cost of repairs, including parts, labor, and materials

2. Preparing Damage Reports

Damage Appraisers prepare detailed damage reports that outline the extent of the damage, the estimated cost of repairs, and the cause of the damage. These reports are used by insurance companies to determine the appropriate settlement amount for the claim.

- Write detailed reports that describe the damage to the vehicle

- Provide an estimate of the cost of repairs, including parts, labor, and materials

- Include photos and documentation to support their findings

3. Negotiating Settlements

Damage Appraisers may also be involved in negotiating settlements with claimants. They work with the claimant and the insurance company to reach a fair and reasonable settlement amount that covers the cost of repairs.

- Negotiate with claimants to reach a fair settlement amount

- Explain the damage appraisal process and answer any questions

- Provide updates on the status of the claim

4. Maintaining Professional Standards

Damage Appraisers must maintain high professional standards and ethical conduct. They must be knowledgeable about the insurance industry and the latest vehicle repair techniques. They must also be able to communicate effectively with claimants, insurance companies, and other professionals.

- Stay up-to-date on the latest vehicle repair techniques

- Adhere to the ethical guidelines of the insurance industry

- Maintain a professional demeanor and appearance

Interview Tips

Preparing for an interview for a Damage Appraiser position can help you make a positive impression on the hiring manager and increase your chances of getting the job. Here are some interview tips and preparation hacks:

1. Research the Company and the Position

Before the interview, take the time to research the company and the specific Damage Appraiser position you are applying for. This will help you better understand the company’s culture, values, and what they are looking for in a candidate. You can find information about the company on their website, social media pages, and industry publications.

- Visit the company’s website to learn about their history, mission, and values

- Read industry publications to learn about the latest trends and developments in the insurance industry

- Talk to people in your network who work in the insurance industry

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked in an interview for a Damage Appraiser position. It is helpful to practice answering these questions in advance so that you can deliver clear and concise answers. Some common interview questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with assessing vehicle damage?

- How do you negotiate settlements with claimants?

3. Bring Supporting Documents

It is helpful to bring supporting documents to your interview, such as a resume, portfolio, and references. This will help you demonstrate your qualifications and make a positive impression on the hiring manager.

- Bring a resume that highlights your experience and skills relevant to the Damage Appraiser position

- Create a portfolio of your work, such as damage reports and estimates

- Get letters of reference from previous employers or colleagues

4. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This will show the hiring manager that you are serious about the position and that you respect their time.

- Dress in business attire, such as a suit or dress

- Arrive on time for your interview

- Be polite and respectful to everyone you meet

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Damage Appraiser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!