Are you gearing up for a career in Debt and Budget Counselor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Debt and Budget Counselor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

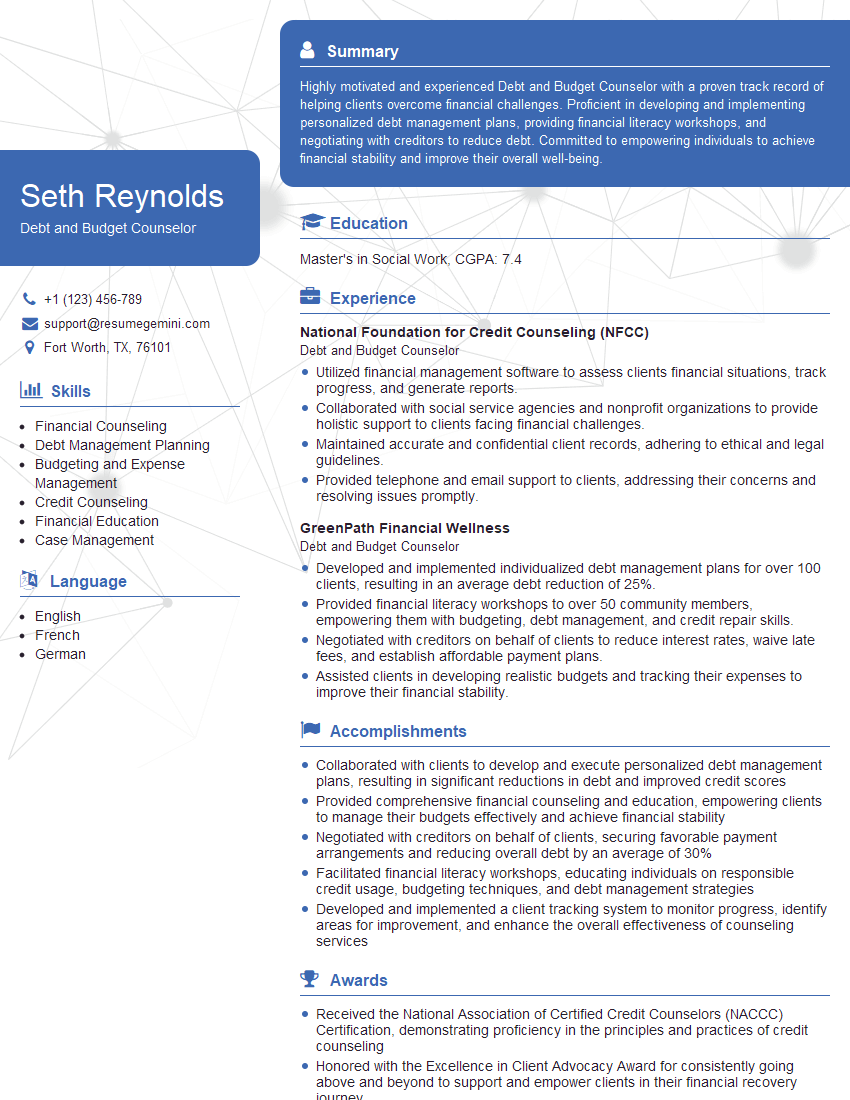

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Debt and Budget Counselor

1. What strategies do you employ to help clients prioritize their debts and develop effective repayment plans?

As a Debt and Budget Counselor, I understand the importance of prioritizing debts to help clients manage their finances effectively. Here are the strategies I employ:

- I use the debt avalanche method to prioritize debts by focusing on paying off the debt with the highest interest rate first, regardless of the balance.

- I also consider the client’s individual circumstances, such as their income, expenses, and debt obligations, when creating a repayment plan.

- I help clients create a realistic budget that allocates funds towards essential expenses, debt repayment, and savings.

- I provide ongoing support and guidance to ensure that clients stay on track with their repayment plans and achieve their financial goals.

2. How do you approach clients who are struggling with financial anxiety or stress?

Understanding the Client’s Perspective

- I start by acknowledging and validating the client’s feelings of financial anxiety and stress.

- I listen attentively to their concerns and demonstrate empathy and understanding.

- I help them identify the root causes of their financial challenges and provide support and reassurance.

Providing Practical Assistance

- I provide clear and concise financial education, explaining complex concepts in a way that is easy to understand.

- I work with clients to develop tailored debt repayment plans and budgets that are realistic and achievable.

- I connect clients with resources and support groups if needed, such as credit counseling agencies or mental health professionals.

3. Describe your experience in negotiating with creditors on behalf of clients.

I possess strong negotiation skills and have a proven track record of successfully negotiating with creditors on behalf of clients. Here are some key strategies I employ:

- I thoroughly research the client’s financial situation and gather all relevant documentation.

- I develop a clear and compelling case for debt reduction or modification, highlighting the client’s hardship and willingness to repay.

- I approach creditors professionally and respectfully, establishing a rapport and building trust.

- I leverage my knowledge of consumer protection laws and industry regulations to advocate for the client’s best interests.

- I remain persistent and determined throughout the negotiation process, working tirelessly to secure favorable outcomes for my clients.

4. How do you stay up-to-date on changes in consumer credit laws and regulations?

Staying up-to-date on changes in consumer credit laws and regulations is crucial in my role as a Debt and Budget Counselor. Here are the methods I use to ensure that my knowledge is current:

- I regularly attend industry conferences, workshops, and webinars to gain insights from experts and stay informed about the latest legal updates.

- I subscribe to professional journals and newsletters that provide in-depth analysis of consumer credit laws and regulations.

- I actively participate in online forums and discussion groups to connect with other professionals and exchange knowledge.

- I consult with legal professionals and reputable sources to clarify complex legal matters and ensure that I am providing accurate and up-to-date information to my clients.

5. Describe your approach to educating clients about financial literacy and responsible money management.

Financial literacy and responsible money management are essential for clients to achieve long-term financial stability. My approach to educating clients includes the following:

- I simplify complex financial concepts and explain them in a clear and relatable manner.

- I use real-life examples and case studies to make financial literacy more engaging and applicable.

- I encourage clients to ask questions and actively participate in discussions to ensure understanding.

- I provide handouts, resources, and online tools to reinforce the concepts covered in our sessions.

- I emphasize the importance of setting financial goals, creating budgets, and managing debt effectively.

6. How do you handle situations where clients are resistant to change or unwilling to make necessary financial sacrifices?

Resistance to change and unwillingness to make financial sacrifices are common challenges in my role as a Debt and Budget Counselor. I approach these situations with the following strategies:

- I acknowledge the client’s concerns and empathize with their reluctance.

- I provide clear and logical explanations of the benefits of making changes and sacrifices.

- I work with clients to identify their values and goals and show how financial changes can align with those goals.

- I offer alternative solutions or compromises that can help clients overcome their resistance.

- I encourage clients to take small, manageable steps and celebrate their progress along the way.

7. How do you ensure that clients adhere to the agreed-upon financial plans and make timely payments?

Ensuring that clients adhere to financial plans and make timely payments is crucial for their success. I employ the following strategies:

- I establish clear expectations and accountability with clients from the outset.

- I develop realistic and achievable plans that clients are more likely to follow.

- I provide ongoing support and encouragement to clients, addressing any challenges they face.

- I use technology, such as budgeting apps and payment reminders, to help clients stay organized and on track.

- I celebrate clients’ successes and provide constructive feedback to help them maintain their progress.

8. How do you measure the effectiveness of your counseling services and track client outcomes?

Measuring the effectiveness of my counseling services and tracking client outcomes is essential for continuous improvement. I use the following methods:

- I collect client feedback through surveys, testimonials, and follow-up calls.

- I track key metrics such as debt reduction, improved credit scores, and increased financial literacy.

- I compare client outcomes to industry benchmarks and best practices.

- I use the data gathered to identify areas where I can enhance my services and better meet the needs of my clients.

9. Describe a challenging case you handled and how you helped the client overcome their financial difficulties.

One of the most challenging cases I handled involved a client who was struggling with overwhelming debt and had lost hope of ever regaining control of their finances. I employed the following strategies to help them:

- I provided emotional support and encouragement, helping them to believe in themselves and their ability to improve their situation.

- I worked with them to create a realistic and achievable debt repayment plan.

- I negotiated with creditors on their behalf, securing reduced interest rates and extended repayment terms.

- I provided financial literacy education, helping them to understand the root causes of their debt and develop healthy money management habits.

- I connected them with community resources and support groups for additional assistance.

10. What sets you apart from other Debt and Budget Counselors in the industry?

I believe that what sets me apart from other Debt and Budget Counselors in the industry is my:

- Deep understanding of consumer credit laws and regulations, which enables me to provide sound legal advice to my clients.

- Strong negotiation skills, which I use to secure favorable outcomes for clients when dealing with creditors.

- Ability to connect with clients on a personal level and build trusting relationships, which is essential for effective counseling.

- Commitment to ongoing professional development, ensuring that my knowledge and skills are always up-to-date.

- Passion for helping individuals overcome financial challenges and achieve their financial goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Debt and Budget Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Debt and Budget Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Debt and Budget Counselors play a vital role in assisting individuals and families in managing their finances and overcoming financial hardships. Their primary responsibilities include:

1. Financial Assessment and Counseling

Conduct comprehensive financial assessments to understand clients’ income, expenses, assets, and liabilities.

Develop personalized debt management plans and budgets tailored to clients’ specific financial situations.

2. Debt Management

Negotiate with creditors on behalf of clients to reduce interest rates, fees, and monthly payments.

Explore and recommend debt consolidation options, such as debt consolidation loans or debt settlement programs.

3. Budget Planning and Education

Guide clients in creating realistic and sustainable budgets that prioritize essential expenses and reduce unnecessary spending.

Provide financial education and counseling on topics such as credit management, saving strategies, and investing.

4. Case Management and Support

Monitor clients’ progress and provide ongoing support throughout the debt management process.

Refer clients to other financial assistance programs or resources as needed, such as credit counseling agencies or housing assistance.

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace your interview for a Debt and Budget Counselor position:

1. Research the Company and Position

Familiarize yourself with the company’s mission, values, and services. Understand the specific requirements of the Debt and Budget Counselor role.

Example: Research the company’s website, LinkedIn page, and industry news to gain insights into their approach to financial counseling.

2. Highlight Relevant Skills and Experience

Emphasize your core competencies in financial assessment, debt management, budgeting, and financial education.

Example: Quantify your achievements, using specific examples of successful debt management plans you have developed and implemented.

3. Demonstrate Passion and Empathy

Convey your genuine interest in helping individuals overcome financial challenges.

Example: Share personal experiences or anecdotes that illustrate your understanding of the struggles faced by clients in financial distress.

4. Be Prepared to Discuss Ethical Considerations

Debt and Budget Counseling involves handling sensitive financial information. Expect questions about your understanding of ethical guidelines and confidentiality.

Example: Explain how you maintain client confidentiality and protect personal data in your work.

5. Practice Your Interview Skills

Conduct mock interviews with a friend, colleague, or family member to refine your answers and build confidence.

Example: Practice answering specific behavioral interview questions, such as “Describe a time when you had to negotiate a difficult financial situation.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Debt and Budget Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.