Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Debt Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

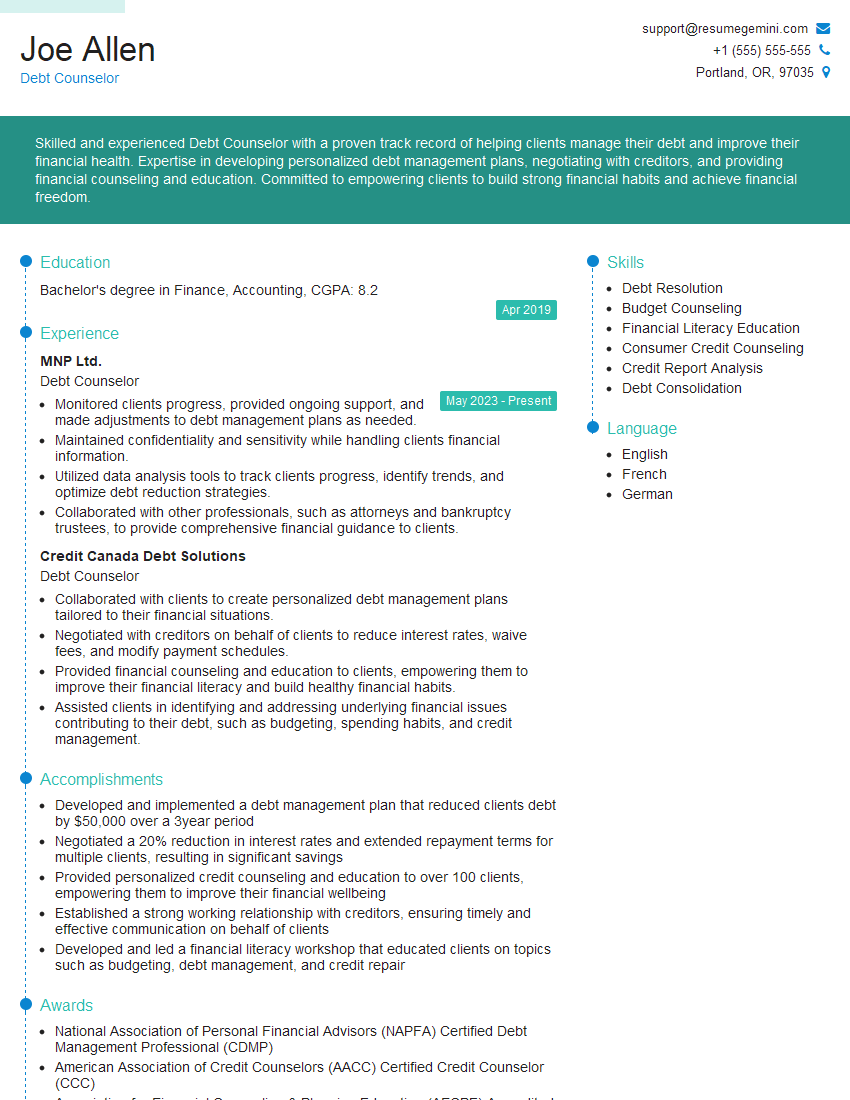

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Debt Counselor

1. Walk me through the steps involved in creating a debt management plan for a client?

- Review the client’s financial situation and gather necessary information, including income, expenses, assets, and debts.

- Analyze the client’s financial situation and identify potential areas for improvement.

- Develop a personalized debt management plan that outlines a strategy for repaying debts, managing expenses, and improving financial health.

- Discuss the plan with the client and ensure that they understand its terms and conditions.

- Implement the plan and monitor the client’s progress, making adjustments as needed.

2. What are the key factors to consider when evaluating a client’s eligibility for a debt management plan?

Factors to consider

- The client’s income and expenses

- The client’s debt-to-income ratio

- The client’s credit history

- The client’s willingness to commit to the terms of the plan

Additional considerations

- The client’s ability to make regular payments

- The client’s financial goals

- The client’s overall financial situation

3. How do you handle clients who are resistant to change or who have difficulty following through with their debt management plan?

- Build a strong rapport with the client and establish trust.

- Identify the client’s concerns and barriers to change.

- Provide the client with education and support to help them understand their financial situation and the benefits of following the plan.

- Break down the plan into smaller, more manageable steps.

- Celebrate the client’s successes and provide encouragement along the way.

- If necessary, refer the client to other professionals, such as a therapist or financial planner, for additional support.

4. What are some common challenges that clients face when trying to manage their debt?

- Lack of financial knowledge and skills

- Overspending and poor budgeting habits

- Unexpected financial emergencies

- High interest rates and fees on debt

- Emotional and psychological barriers to managing debt

5. How do you stay up-to-date on the latest changes in consumer credit laws and regulations?

- Attend industry conferences and webinars

- Read trade publications and online resources

- Network with other debt counselors and financial professionals

- Take continuing education courses

- Stay informed about changes to federal and state laws

6. What are the ethical considerations that debt counselors must be aware of when working with clients?

- Confidentiality

- Conflicts of interest

- Fair and impartial treatment of clients

- Respect for client autonomy

- Transparency and disclosure

7. What are some of the most rewarding aspects of working as a debt counselor?

- Helping clients improve their financial well-being

- Empowering clients to take control of their finances

- Making a positive impact on clients’ lives

- Working with a diverse group of clients

- Learning from clients and their unique experiences

8. What are some of the challenges of working as a debt counselor?

- Dealing with clients who are in financial distress

- Working with clients who are resistant to change

- Managing a large caseload

- Staying up-to-date on the latest changes in consumer credit laws and regulations

- Dealing with the emotional toll of working with clients who are struggling financially

9. How do you prioritize your work and manage your time effectively?

- Use a to-do list or task management system to keep track of your tasks

- Set priorities and focus on the most important tasks first

- Delegate tasks to others when possible

- Take breaks throughout the day to avoid burnout

- Use technology to your advantage, such as scheduling tools and email filters

10. What are your career goals and aspirations?

- I would like to continue to develop my skills and knowledge as a debt counselor.

- I am interested in taking on a leadership role in the field of financial counseling.

- I am passionate about helping people improve their financial well-being, and I would like to continue to make a positive impact on the lives of others.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Debt Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Debt Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Debt Counselors play a pivotal role in helping individuals overcome financial challenges and achieve financial stability. Their responsibilities encompass a wide range of tasks, including:

1. Client Assessment

Conducting thorough financial assessments to understand clients’ debt obligations, income, expenses, and financial goals.

2. Budgeting and Debt Management

Developing personalized debt management plans to assist clients in reducing debt, improving cash flow, and budgeting effectively.

3. Credit Counseling

Providing guidance and education on credit management, credit repair, and responsible borrowing practices.

4. Negotiation and Advocacy

Negotiating with creditors on behalf of clients to reduce interest rates, waive fees, and establish manageable payment plans.

5. Emotional Support

Offering emotional support and guidance to clients who may face stress, anxiety, or depression due to financial difficulties.

6. Education and Empowerment

Educating clients on financial literacy, money management, and strategies to prevent future debt problems.

Interview Tips

To ace the interview for a Debt Counselor position, it’s crucial to prepare thoroughly. Here are some essential tips:

1. Research the Company and Position

Take the time to learn about the organization’s mission, values, and areas of expertise. Understand the specific responsibilities of the Debt Counselor role and how it aligns with your skills and experience.

2. Highlight Your Empathy and Compassion

Debt Counselors play a sensitive role that requires a deep understanding of human behavior. Emphasize your ability to connect with clients, understand their financial and emotional challenges, and provide support and guidance.

3. Showcase Your Analytical and Problem-Solving Skills

Debt management involves analyzing financial data, identifying underlying issues, and developing effective solutions. Highlight your ability to assess complex financial situations and create customized plans to address clients’ specific needs.

4. Demonstrate Your Negotiation and Communication Skills

Negotiating with creditors and advocating for clients’ interests is an essential aspect of the role. Showcase your ability to communicate effectively, build relationships, and negotiate favorable outcomes.

5. Practice Answering Common Interview Questions

Prepare thoughtful answers to commonly asked interview questions, such as “Why are you interested in becoming a Debt Counselor?” or “How would you handle a client who is facing significant financial distress?”

6. Bring Relevant Examples

To support your answers, provide specific examples of how you have applied your skills and knowledge to help clients overcome financial challenges. This could include developing successful debt management plans, negotiating with creditors, or providing emotional support.

7. Dress Professionally and Maintain a Positive Attitude

First impressions matter. Dress appropriately and maintain a positive and enthusiastic demeanor throughout the interview. Show the interviewer that you are confident in your abilities and passionate about helping others.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Debt Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!