Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Deposit Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

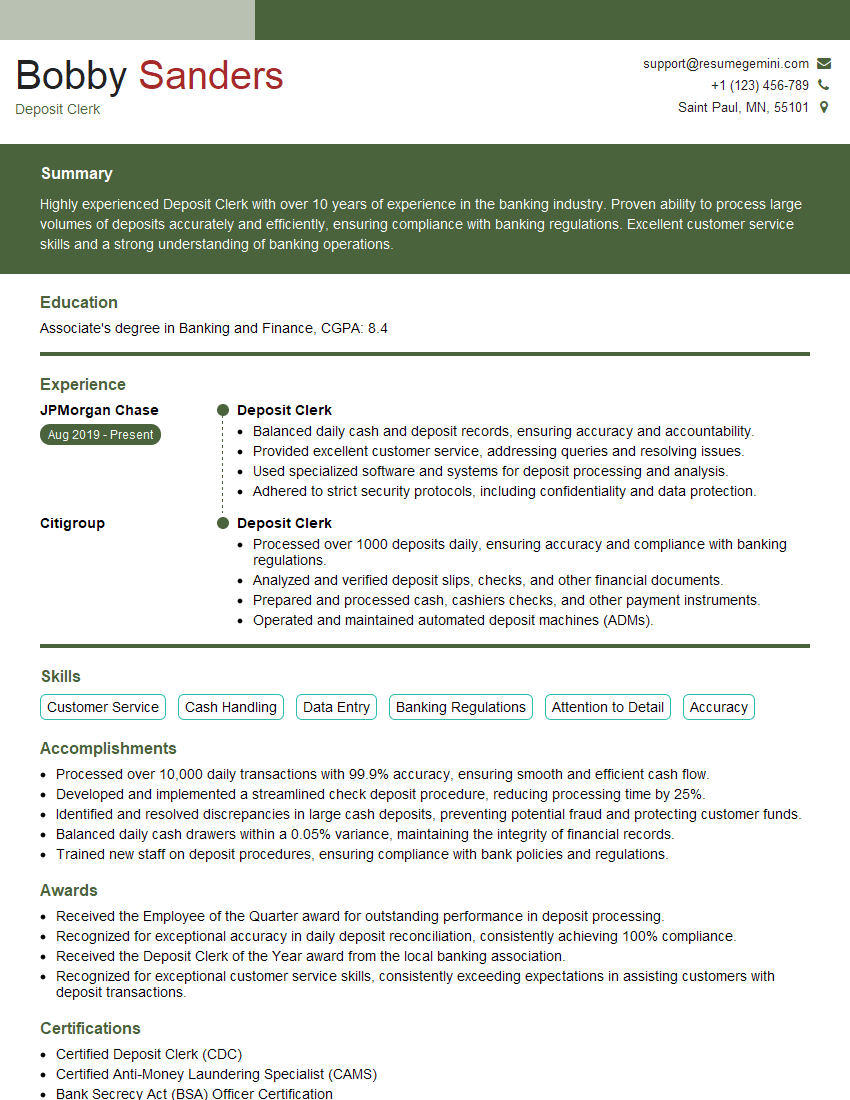

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Deposit Clerk

1. Explain the process of verifying and authenticating cash and checks at the deposit window?

Answer:

- Visually inspect cash for counterfeits, tears, or alterations.

- Verify check authenticity by checking magnetic ink character recognition (MICR) line, signature, and watermark.

- Compare check amount with deposit slip and payee information.

- Use counterfeit detection pen or UV light to detect suspicious bills.

- Check for endorsements or alterations on checks to ensure they are valid.

2. Describe the procedures for counting, batching, and preparing deposits for processing?

Answer:

- Count cash deposits accurately using a cash counter or by hand.

- Batch checks into groups based on denomination and account type.

- Prepare deposit tickets with accurate details of currency, checks, and total value.

- Wrap and seal deposits securely with proper documentation and tracking information.

- Balance cash deposits against deposit tickets to ensure accuracy.

3. What security measures do you employ when handling cash and valuables at the deposit window?

Answer:

- Maintain a secure workspace and cash handling area.

- Use anti-theft devices such as cash boxes and drop safes.

- Count and verify cash deposits in a secure location.

- Follow established procedures for cash handling, including dual custody.

- Adhere to all bank regulations and policies regarding cash management.

4. How would you handle a situation where a customer presents a large cash deposit but lacks proper identification?

Answer:

- Request additional forms of identification or alternate verification methods.

- Document the customer’s information and the reason for not accepting the deposit.

- Contact a supervisor or manager for assistance and guidance.

- Follow bank policies and procedures regarding suspicious or large cash deposits.

- Maintain a professional and courteous demeanor throughout the process.

5. Describe your experience using cash handling equipment, such as cash counters and note sorters?

Answer:

- Expertise in operating cash counters, note sorters, and currency discriminators.

- Proficient in troubleshooting and maintaining cash handling equipment.

- Knowledge of cash handling best practices and bank regulations.

- Experience in calibrating and testing cash equipment for accuracy.

- Ability to maintain a clean and organized cash handling environment.

6. How do you prioritize and manage multiple tasks while working at a deposit window?

Answer:

- Maintain a calm and organized approach under pressure.

- Establish clear priorities based on urgency and importance.

- Delegate tasks to other team members when necessary.

- Use technology and resources to streamline processes.

- Communicate effectively with customers and colleagues to ensure a smooth workflow.

7. What is your understanding of Bank Secrecy Act (BSA) regulations and how do you comply with them?

Answer:

- Knowledge of BSA requirements, including KYC (Know Your Customer) and reporting suspicious activities.

- Compliance with anti-money laundering (AML) and combating financing of terrorism (CFT) regulations.

- Proper identification of customers and documentation of transactions.

- Monitoring of large or unusual transactions.

- Filing timely and accurate Currency Transaction Reports (CTRs) and Suspicious Activity Reports (SARs).

8. How do you ensure the accuracy of your work and maintain a high level of attention to detail in a fast-paced environment?

Answer:

- Double-checks and verifies all transactions before finalizing.

- Balances deposits against deposit tickets to ensure accuracy.

- Remains focused and alert, even during peak hours.

- Uses checklists and procedures to minimize errors.

- Continuously monitors own performance and seeks feedback for improvement.

9. Describe a situation where you resolved a customer issue or complaint effectively at the deposit window?

Answer:

- Listens attentively to the customer’s concerns.

- Empathizes with the customer’s perspective.

- Investigates the issue thoroughly and identifies the root cause.

- Provides clear and concise explanations to the customer.

- Resolves the issue promptly and to the customer’s satisfaction.

10. How do you stay up-to-date with changes in banking regulations and industry best practices?

Answer:

- Attends industry conferences and workshops.

- Reads trade publications and regulatory updates.

- Participates in online forums and discussions.

- Networks with other banking professionals.

- Completes continuing education courses and certifications.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Deposit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Deposit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Deposit Clerks are responsible for handling and processing financial transactions, ensuring the accuracy and security of funds. They work in various settings such as banks, credit unions, and other financial institutions.

1. Accepting and Verifying Deposits

Deposit Clerks receive cash, checks, and other forms of payment from customers, verifying the authenticity and amount of each deposit.

- Counting and reconciling cash deposits

- Examining checks for validity and endorsement

- Processing electronic deposits

2. Maintaining Deposit Records

Deposit Clerks maintain accurate records of all deposits, including the date, amount, and source of the funds.

- Recording deposits in a register or database

- Balancing deposit totals to ensure accuracy

- Preparing daily or weekly deposit reports

3. Providing Customer Service

Deposit Clerks interact with customers, answering questions, providing information, and resolving any issues related to deposits.

- Greeting customers and answering inquiries

- explaining deposit procedures and requirements

- Resolving customer complaints

4. Safeguarding Funds

Deposit Clerks are responsible for safeguarding the funds they handle, ensuring the security and integrity of financial transactions.

- Following established security protocols

- Identifying and reporting suspicious activities

- Maintaining a clean and organized work environment

Interview Tips

Preparing for a deposit clerk interview requires a combination of research, practice, and self-confidence. Here are some tips and hacks to help you ace the interview:

1. Research the Company and Position

Before the interview, thoroughly research the company and the specific position you are applying for. Familiarize yourself with the company’s products, services, and industry standing. You can also read news articles, visit the company’s website, and check out their social media presence.

- Prepare questions about the company’s culture, values, and growth opportunities

- Research common interview questions for deposit clerks

2. Practice Answering Common Interview Questions

Practice answering common interview questions to build your confidence and prepare for various scenarios. You can use the STAR method (Situation, Task, Action, Result) to structure your answers, providing specific examples of your skills and experience.

- Describe a time when you handled a large volume of deposits with accuracy and efficiency.

- Tell me about a situation where you provided excellent customer service to a difficult customer.

3. Emphasize Your Attention to Detail and Accuracy

Deposit clerks must have a high level of attention to detail and accuracy. Highlight your strong numerical skills, ability to follow instructions precisely, and commitment to error-free work.

- Provide examples of your experience in handling financial transactions, balancing accounts, and maintaining records.

- Explain how you ensure data accuracy and minimize errors in your work.

4. Highlight Your Customer Service Skills

Deposit clerks often interact with customers, so it’s essential to demonstrate your customer service skills. Share examples of how you have provided excellent customer service, resolved complaints, and built positive relationships with clients.

- Describe a time when you went above and beyond to assist a customer with a complex deposit.

- Explain how you handle difficult customers and maintain a professional demeanor.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Deposit Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.