Are you gearing up for an interview for a Deputy Treasurer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Deputy Treasurer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

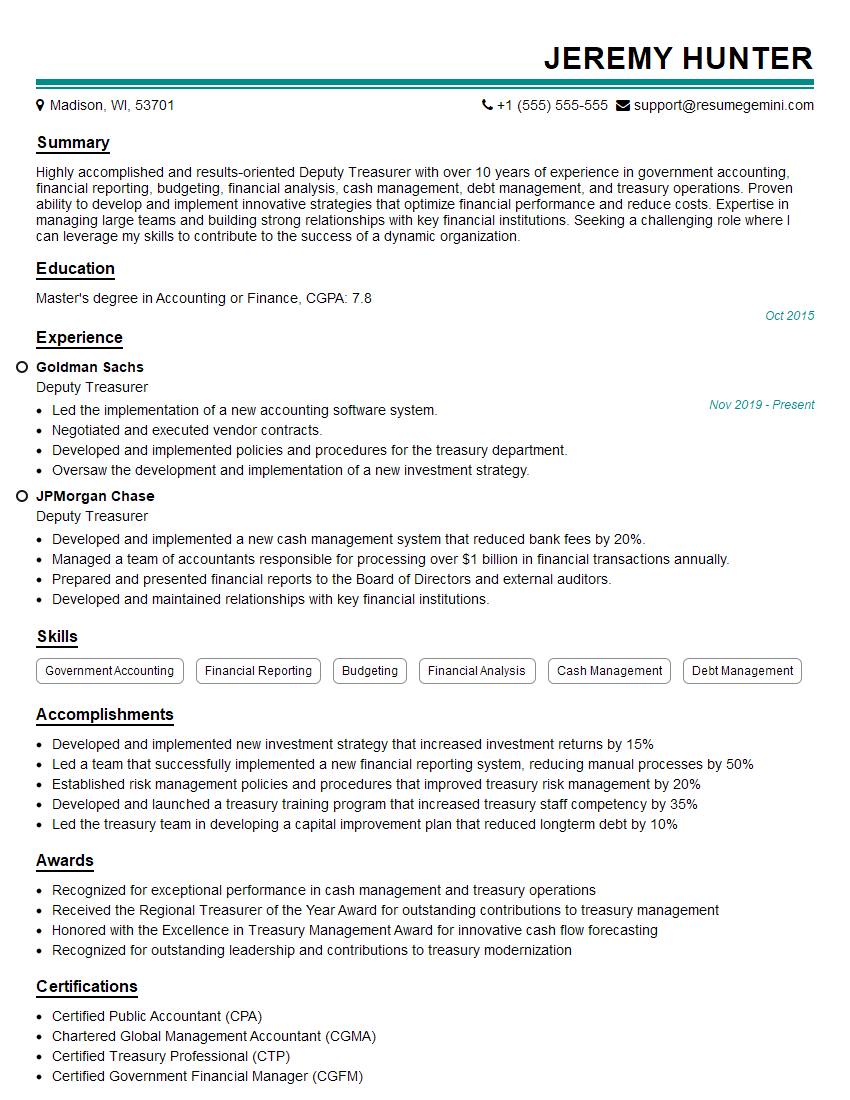

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Deputy Treasurer

1. What are the primary responsibilities of a Deputy Treasurer?

As a Deputy Treasurer, I would be responsible for the following key tasks:

- Assisting the Treasurer in managing the county’s financial affairs.

- Preparing and submitting the county’s financial reports.

- Investing county funds.

2. What are your strengths as they relate to this position?

Proven Experience in Treasury Operations

- 10 years of progressive experience in treasury management.

- Expertise in cash management, debt issuance, and investment strategies.

Financial Acumen and Analytical Skills

- Advanced understanding of financial accounting, auditing, and reporting principles.

- Strong analytical skills for evaluating financial data and making sound decisions.

Excellent Communication and Interpersonal Skills

- Ability to communicate complex financial information to stakeholders.

- Excellent interpersonal skills for building and maintaining relationships with investors, auditors, and other key parties.

3. What are the challenges facing the county in terms of its financial management?

The county is facing several challenges in terms of its financial management, including:

- Rising healthcare costs.

- Declining revenues due to the economic downturn.

- Infrastructure needs.

4. How do you plan to address these challenges?

I would address these challenges by:

- Working with the Treasurer to develop a comprehensive financial plan that outlines strategies for addressing the challenges.

- Exploring innovative financing options to supplement declining revenues.

- Prioritizing infrastructure projects based on their impact on the county.

5. What are your thoughts on the county’s current investment strategy?

The county’s current investment strategy is conservative and focuses on preserving capital. I believe that this is a prudent approach given the current economic climate. However, I would like to explore options for increasing the return on the county’s investments while still maintaining an acceptable level of risk.

6. What are your thoughts on the county’s current cash management practices?

The county’s current cash management practices are efficient and effective. I would like to explore opportunities to further optimize these practices, such as implementing a centralized cash management system.

7. What is your experience with financial reporting and compliance?

I have extensive experience with financial reporting and compliance. I am familiar with GAAP and GASB standards. I have also worked with auditors to ensure that the county’s financial statements are accurate and compliant.

8. What is your experience with debt issuance?

I have experience with all aspects of debt issuance, including planning, structuring, and marketing. I have worked on several successful debt issuances for municipalities and counties.

9. What is your experience with managing investments?

I have experience managing a portfolio of investments for a municipality. I am familiar with different investment strategies and asset classes. I have also worked with investment advisors to ensure that the portfolio is meeting its objectives.

10. What is your experience with budgeting and forecasting?

I have experience with budgeting and forecasting for both municipalities and counties. I am familiar with the different budgeting methods and techniques. I have also worked with elected officials and department heads to develop and implement budgets.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Deputy Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Deputy Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Deputy Treasurer

The Deputy Treasurer is a crucial role within an organization, assisting the Treasurer in managing the financial operations and ensuring compliance with regulatory requirements. Key responsibilities include:

1. Financial Operations Management

Oversee day-to-day financial operations, including cash flow management, accounts payable and receivable, and payroll processing.

- Develop and implement policies and procedures to streamline financial processes.

- Supervise accounting staff and ensure the accuracy and timeliness of financial reporting.

2. Treasury Management

Manage the organization’s cash position, investments, and debt portfolio.

- Forecast cash flow needs and develop strategies to optimize liquidity.

- Negotiate and secure financing arrangements, such as lines of credit and bonds.

- Monitor market conditions and make recommendations on investment opportunities.

3. Regulatory Compliance

Ensure compliance with all applicable financial regulations, including GAAP, IFRS, and SEC reporting requirements.

- Review financial statements for accuracy and completeness.

- Work closely with external auditors to facilitate the audit process.

- Respond to regulatory inquiries and ensure timely disclosure of material information.

4. Strategic Planning and Analysis

Assist in developing and implementing the organization’s financial strategy.

- Analyze financial data and trends to identify opportunities and risks.

- Prepare financial projections and models to support decision-making.

- Provide financial advice to the executive team and board of directors.

Interview Tips and Hacks

To ace an interview for the Deputy Treasurer position, candidates should prepare thoroughly and showcase their skills and experience that align with the job responsibilities. Here are some tips and hacks:

1. Research the Organization and Role

Before the interview, research the organization’s industry, financial performance, and recent news. Understand the specific responsibilities of the Deputy Treasurer role and how it fits into the organization’s overall financial strategy.

- Visit the company website and review financial statements, press releases, and annual reports.

- Identify the challenges and opportunities facing the organization and prepare to discuss how you can contribute to their success.

2. Highlight Relevant Skills and Experience

During the interview, emphasize your technical skills in financial management, accounting, and treasury operations. Showcase your experience in regulatory compliance, strategic planning, and risk management.

- Use specific examples to demonstrate how you have successfully managed financial operations, including cash flow, investments, and debt.

- Highlight your expertise in regulatory compliance and how you have ensured adherence to relevant regulations.

3. Show Your Communication and Leadership Abilities

The Deputy Treasurer position requires excellent communication and leadership skills. Be prepared to discuss your experiences in presenting financial information to stakeholders, collaborating with cross-functional teams, and managing a team of accounting professionals.

- Provide examples of how you have effectively communicated complex financial concepts to non-financial audiences.

- Explain how you have successfully led and motivated a team to achieve financial goals.

4. Be Prepared for Technical Questions

During the interview, you may be asked technical questions related to financial accounting, treasury management, and regulatory compliance. Prepare by reviewing key financial concepts, accounting standards, and recent regulatory updates.

- Focus on understanding the underlying principles and concepts rather than memorizing specific details.

- If you are unsure about a question, ask for clarification or provide a thoughtful response explaining your thought process.

Next Step:

Now that you’re armed with the knowledge of Deputy Treasurer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Deputy Treasurer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini