Are you gearing up for an interview for a Director of Securities and Real Estate position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Director of Securities and Real Estate and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

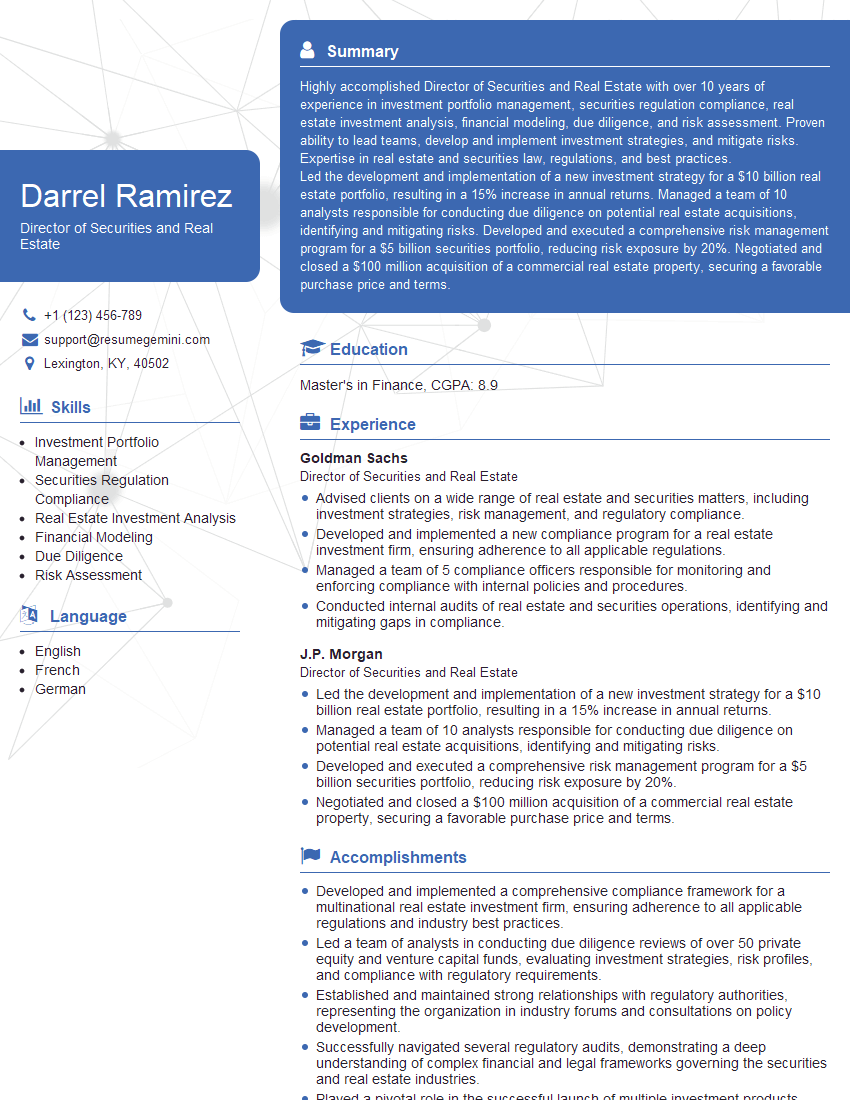

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Director of Securities and Real Estate

1. What are the key responsibilities of a Director of Securities and Real Estate?

As the Director of Securities and Real Estate, my key responsibilities include:

- Overseeing the firm’s investment portfolio, including securities and real estate investments

- Developing and implementing investment strategies in alignment with the firm’s goals and risk appetite

- Managing relationships with external investment managers and brokers

- Providing strategic advice to the firm’s management team on investment matters

- Ensuring compliance with all applicable securities and real estate regulations

2. What are the current trends in the securities and real estate markets?

Investment Landscape

- Increased volatility and uncertainty due to geopolitical events and economic factors

- Shift towards sustainable and ESG-focused investments

Real Estate Market Trends

- Strong demand for multifamily and industrial properties

- Rising interest rates and their impact on property valuations

3. How do you stay up-to-date on the latest developments in these markets?

To stay abreast of industry trends, I regularly engage in the following activities:

- Attend industry conferences and webinars

- Read financial publications and research reports

- Network with professionals in the securities and real estate sectors

- Monitor economic and political news that may impact the markets

4. What is your investment philosophy and how does it guide your investment decisions?

My investment philosophy is centered around the following principles:

- Long-term perspective: Investing for the long haul to capture market growth

- Diversification: Spreading investments across different asset classes and sectors to mitigate risk

- Value investing: Identifying undervalued assets with potential for appreciation

- Risk management: Implementing strategies to control and minimize investment risks

5. Can you describe a successful investment that you have made in the past?

One notable investment that stands out is my involvement in the acquisition of an industrial property in a growing logistics hub.

- Conducted thorough due diligence and market analysis to identify the property’s potential

- Negotiated a favorable purchase price and lease terms with the tenants

- The property has generated stable rental income and experienced significant appreciation in value

6. How do you evaluate the performance of your investments?

To evaluate investment performance, I employ a comprehensive approach that includes:

- Regularly tracking key financial metrics (e.g., returns, risk measures, cash flow)

- Comparing performance against industry benchmarks and peer groups

- Conducting scenario analysis to assess potential risks and identify areas for improvement

7. How do you manage risk in your investment portfolio?

Risk management is an integral part of my investment strategy:

- Diversification across different asset classes and sectors

- Stress testing and scenario analysis to assess portfolio resilience

- Hedging strategies to reduce exposure to specific risks

- Regular monitoring and rebalancing to maintain desired risk levels

8. What are the ethical considerations that you take into account when making investment decisions?

Ethics play a crucial role in my decision-making process:

- Adhering to fiduciary responsibilities and acting in the best interest of investors

- Considering the environmental, social, and governance (ESG) impact of investments

- Avoiding conflicts of interest and maintaining transparency in dealings

- Complying with all applicable laws and regulations

9. How do you stay informed about changes in securities and real estate regulations?

To stay updated on regulatory changes, I:

- Monitor regulatory websites and publications

- Attend industry events and conferences to hear from experts

- Consult with legal counsel to ensure compliance with all applicable laws

- Engage with professional organizations to stay informed about best practices

10. How do you handle challenging situations or conflicts of interest?

When faced with challenges or conflicts of interest, I adopt the following approach:

- Remain calm and objective, assessing the situation thoroughly

- Consult with legal and compliance professionals for guidance

- Prioritize the interests of the firm and investors

- Communicate openly and transparently with all parties involved

- Document decisions and actions to ensure accountability

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Director of Securities and Real Estate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Director of Securities and Real Estate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Director of Securities and Real Estate is a highly specialized and experienced professional who oversees the investment and management of an organization’s securities and real estate portfolio.

1. Strategic Planning and Management

Develops and implements investment strategies to optimize returns and minimize risks for the organization’s securities and real estate portfolio.

- Conducts thorough market research and analysis to identify potential investment opportunities.

- Builds and maintains relationships with investment managers, brokers, and other industry professionals.

2. Securities Management

Oversees the investment and management of the organization’s securities portfolio, including stocks, bonds, and other financial instruments.

- Develops and implements investment strategies for specific asset classes and risk-return objectives.

- Monitors portfolio performance, makes adjustments as necessary, and reports to senior management.

3. Real Estate Management

Oversees the investment and management of the organization’s real estate portfolio, including properties acquired for investment or operational purposes.

- Conducts due diligence and acquisition analysis to identify and purchase suitable properties.

- Manages property renovations, leases, and sales to maximize returns and minimize expenses.

4. Financial Analysis and Reporting

Provides comprehensive performance analysis and reporting on the organization’s securities and real estate portfolio to senior management and stakeholders.

- Develops and maintains financial models for portfolio valuation, risk assessment, and performance measurement.

- Prepares regular reports on portfolio performance and provides recommendations for adjustments or improvements.

Interview Tips

To ace the interview for the Director of Securities and Real Estate role, it is essential to prepare thoroughly and showcase your expertise and skills.

1. Research the Organization and Role

Thoroughly research the organization’s investment philosophy, portfolio structure, and financial objectives. Understand the specific responsibilities of the Director of Securities and Real Estate.

- Visit the organization’s website, read annual reports, and review industry publications.

- Identify the organization’s key stakeholders and their expectations.

2. Quantify Your Accomplishments

Use specific metrics and data to demonstrate the impact of your previous experiences and achievements. Quantify your contributions to portfolio management, real estate acquisitions, and financial reporting.

- For example, highlight the percentage return you generated on a specific investment or the cost savings achieved through a successful real estate transaction.

- Be prepared to provide detailed examples of your analytical skills, financial modeling capabilities, and strategic decision-making.

3. Emphasize Your Industry Knowledge

Demonstrate your deep understanding of the securities and real estate markets, investment strategies, and regulatory frameworks. Reference industry best practices and case studies to support your insights.

- Stay up-to-date on the latest market trends, industry developments, and regulatory changes.

- Showcase your familiarity with specialized investment tools, such as portfolio optimization software and financial modeling techniques.

4. Prepare for Technical Questions

Expect technical questions related to portfolio construction, risk management, real estate investment analysis, and financial reporting standards.

- Review fundamental concepts in finance, accounting, and real estate. Be prepared to discuss different investment strategies and their risks and returns.

- Practice answering questions about portfolio optimization, due diligence, and financial modeling.

5. Showcase Your Communication and Interpersonal Skills

As a Director of Securities and Real Estate, you must effectively communicate with senior management, stakeholders, and external partners. Highlight your strong communication, presentation, and negotiation skills.

- Prepare to articulate your investment strategies and recommendations clearly and persuasively.

- Demonstrate your ability to build and maintain relationships with key stakeholders.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Director of Securities and Real Estate role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.