Feeling lost in a sea of interview questions? Landed that dream interview for Disbursing Agent but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Disbursing Agent interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

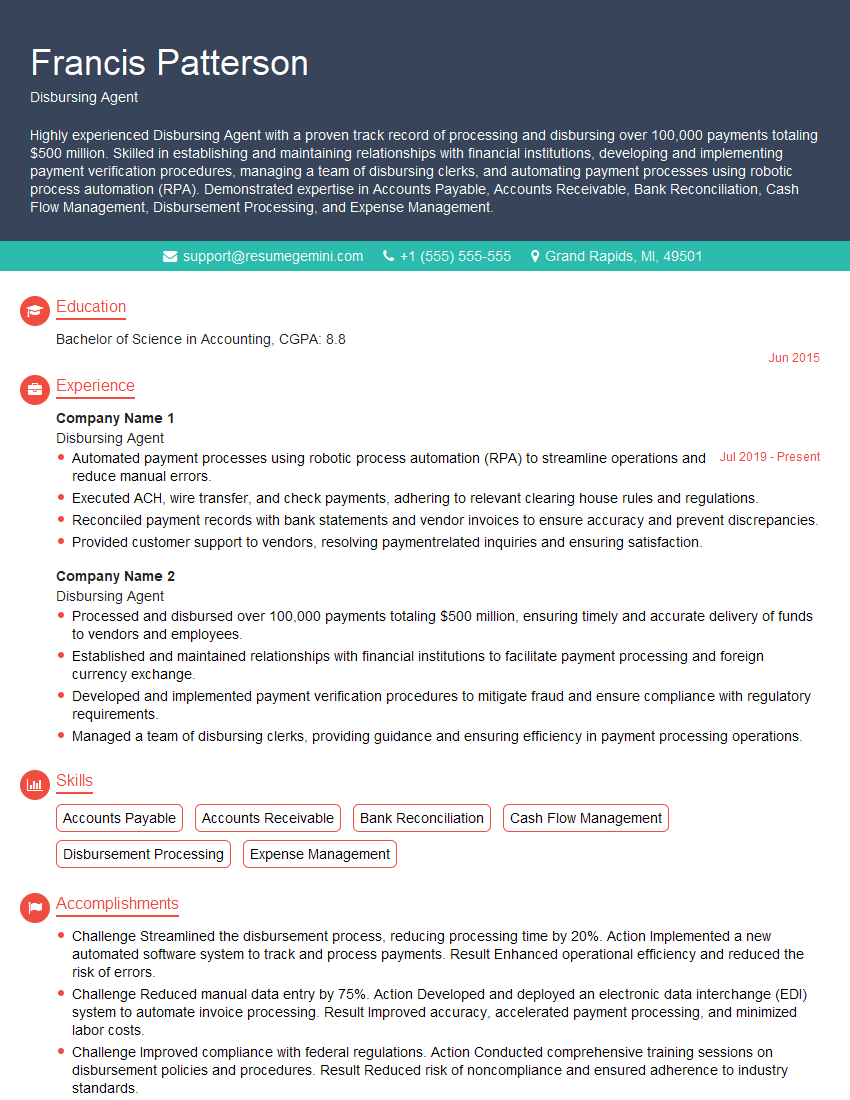

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Disbursing Agent

1. Describe the key responsibilities of a Disbursing Agent?

As a Disbursing Agent, I would be responsible for the following key tasks:

- Disbursing funds according to the approved budget and financial plans

- Maintaining accurate and up-to-date financial records

- Reconciling bank statements and preparing financial reports

- Ensuring compliance with all applicable laws and regulations

- Working closely with other departments to ensure smooth financial operations

2. What are the essential skills and qualifications required for a Disbursing Agent?

- Strong understanding of accounting principles and financial management

- Excellent cash management and budgeting skills

- Proficient in using accounting software and financial systems

- Attention to detail and accuracy

- Strong communication and interpersonal skills

3. How do you ensure the accuracy of financial transactions?

I follow a rigorous process to ensure the accuracy of financial transactions, including:

- Verifying all supporting documentation before approving payments

- Reconciling bank statements regularly

- Conducting internal audits to identify any discrepancies

- Implementing strong internal controls to prevent errors

4. How do you handle discrepancies in financial records?

- When I identify a discrepancy, I immediately investigate the cause

- I work with the relevant departments to resolve the issue promptly

- I document all discrepancies and corrective actions taken

- I report any material discrepancies to management

5. What are some of the challenges you have faced as a Disbursing Agent, and how did you overcome them?

- Challenge: Implementing a new financial system

- Solution: I worked closely with the IT department to ensure a smooth implementation, provided training to staff, and developed clear documentation

- Challenge: Managing a large volume of transactions

- Solution: I automated processes, streamlined workflows, and outsourced non-critical tasks to increase efficiency

6. How do you stay up-to-date on changes in accounting regulations and best practices?

- I regularly attend industry conferences and workshops

- I subscribe to professional journals and publications

- I seek guidance from professional organizations and regulatory bodies

- I engage in ongoing training and development

7. What is your experience with managing petty cash and issuing payments?

- In my previous role, I was responsible for managing a petty cash fund of $5,000

- I established clear procedures for issuing payments, including obtaining proper approvals and documentation

- I reconciled the petty cash fund monthly and reported any discrepancies promptly

8. How do you prioritize and manage multiple projects and deadlines?

- I use a task management system to track my projects and deadlines

- I prioritize tasks based on urgency and importance

- I delegate Aufgaben to others when necessary

- I communicate regularly with stakeholders to keep them updated on progress

9. How do you handle working under pressure and meeting tight deadlines?

- I remain calm and focused under pressure

- I prioritize tasks and allocate my time effectively

- I seek support from colleagues and supervisors when needed

- I take breaks to avoid burnout

10. Why are you interested in this Disbursing Agent position?

- I am passionate about financial management and ensuring the accuracy of financial transactions

- I am eager to contribute my skills and experience to your organization

- I am confident that I can make a significant contribution to your team

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Disbursing Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Disbursing Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Disbursing Agents play a crucial role in financial transactions. Let’s delve into their key responsibilities:

1. Processing Payments

Disbursing Agents are responsible for ensuring that payments are processed accurately and on time.

- Process payments to vendors, employees, and other parties.

- Verify the accuracy and completeness of payment requests.

2. Managing Cash Flow

They are involved in managing and forecasting cash flow to ensure the organization’s financial stability.

- Monitor cash inflows and outflows.

- Prepare cash flow statements and reports.

3. Reconciling Bank Accounts

Disbursing Agents maintain accurate records of financial transactions.

- Reconcile bank accounts to ensure that all transactions are recorded correctly.

- Investigate and resolve discrepancies.

4. Complying with Regulations

They must comply with relevant financial regulations and policies.

- Adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- Maintain a high level of confidentiality.

Interview Tips

To ace your interview for a Disbursing Agent position, follow these tips:

1. Research the Organization and Role

Before the interview, thoroughly research the organization and the specific role you are applying for.

- Visit the company website to understand their mission, values, and industry.

- Review the job description to identify the key responsibilities and qualifications required.

2. Prepare for Technical Questions

Be prepared to answer questions related to your technical skills and knowledge of financial regulations.

- Practice explaining your experience in processing payments, reconciling accounts, and managing cash flow.

- Study up on AML and KYC regulations.

3. Emphasize Your Soft Skills

In addition to technical skills, highlight your soft skills that are essential for this role.

- Demonstrate strong attention to detail and accuracy.

- Emphasize your ability to work independently and as part of a team.

4. Prepare Questions for the Interviewer

Asking well-thought-out questions shows your interest and engagement in the position.

- Inquire about the organization’s financial goals and strategies.

- Ask about the team you will be working with and the company culture.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Disbursing Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.