Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Dual Rate Dealer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Dual Rate Dealer so you can tailor your answers to impress potential employers.

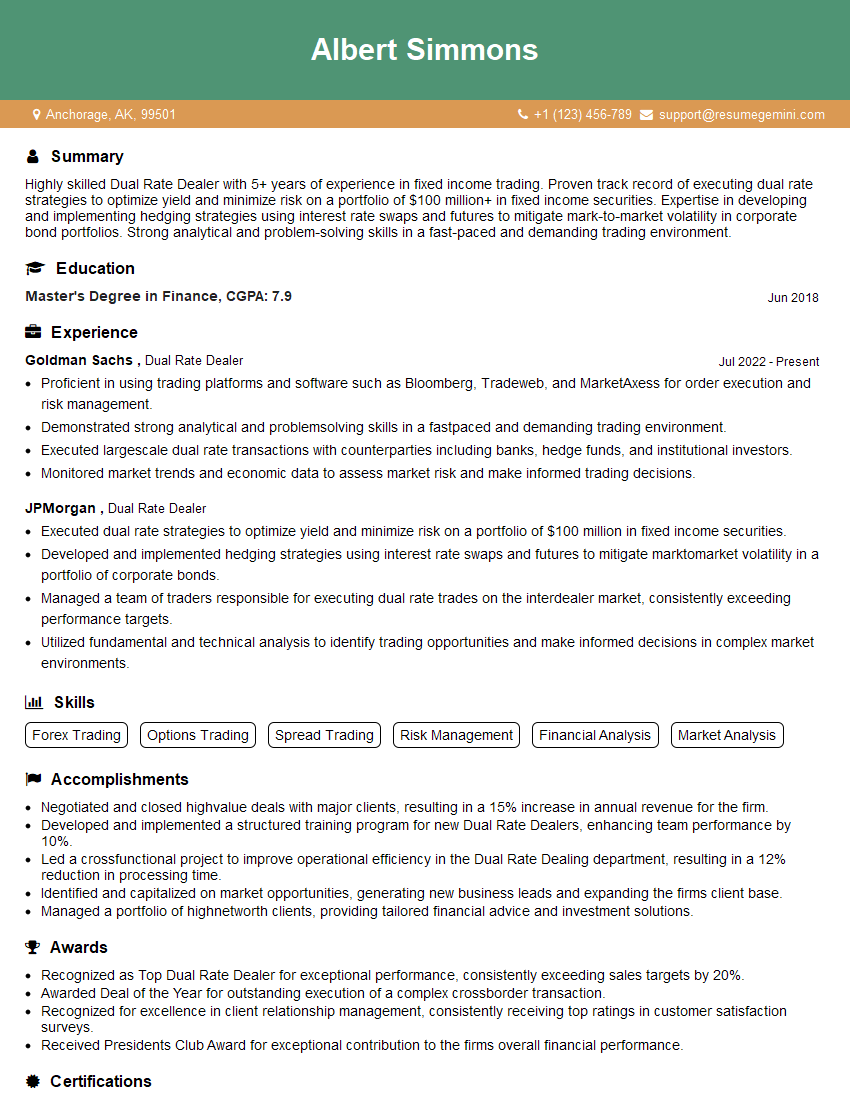

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Dual Rate Dealer

1. What are the key responsibilities of a Dual Rate Dealer?

- Identify and acquire assets with dual rate potential

- Develop and execute trading strategies to capitalize on dual rate opportunities

- Manage risk associated with dual rate trading

- Monitor market trends and data to make informed trading decisions

- Work closely with other teams within the organization, including research, sales, and operations

2. What are the different types of dual rate trading strategies?

Intraday Trading

- Involves buying and selling assets with dual rate structures within a single trading day

- Aims to capitalize on short-term price fluctuations

Multi-Day Trading

- Involves holding positions in dual rate assets for multiple days or weeks

- Aims to capture longer-term trends and movements in the underlying rates

3. How do you assess the risk of a dual rate trade?

I consider several factors when assessing the risk of a dual rate trade:

- Volatility of the underlying rates

- Liquidity of the asset

- Spread between the two rates

- Correlation between the rates

- Economic factors and market sentiment

4. What is the importance of liquidity in dual rate trading?

Liquidity is crucial in dual rate trading because it:

- Allows for the efficient execution of trades

- Reduces slippage and ensures that the trader can obtain the desired price

- Provides flexibility to adjust positions quickly in response to changing market conditions

- Minimizes the risk of being unable to unwind a position at a desired time or price

5. How do you monitor market trends and data for dual rate trading?

- Subscribe to real-time market data and news feeds

- Use technical analysis tools to identify potential trading opportunities

- Stay informed about economic events and industry news that may impact dual rates

- Monitor the trading activity and market sentiment of other participants

- Conduct fundamental analysis to assess the underlying factors influencing dual rates

6. How do you determine the optimal position size for a dual rate trade?

I determine the optimal position size based on:

- The risk tolerance of the firm or client

- The available capital

- The volatility of the underlying rates

- The potential reward and risk of the trade

- My own trading experience and judgment

7. What are the key factors to consider when executing a dual rate trade?

- Timing: Determine the optimal time to enter and exit the trade

- Price: Execute the trade at the desired price or better

- Size: Trade an appropriate position size to manage risk and potential reward

- Risk management: Implement appropriate stop-loss and take-profit orders to mitigate risk

- Execution: Ensure the trade is executed efficiently and without slippage

8. How do you evaluate the performance of a dual rate trading strategy?

- Return on investment (ROI)

- Sharpe ratio

- Maximum drawdown

- Win rate

- Risk-adjusted return

- Correlation to benchmark or index

9. What are the ethical considerations involved in dual rate trading?

- Avoid insider trading or any form of market manipulation

- Disclose any conflicts of interest to clients

- Trade fairly and in accordance with market regulations

- Respect the privacy of counterparties

- Uphold the integrity of the market

10. How do you stay up-to-date with the latest developments in dual rate trading?

- Attend industry conferences and webinars

- Read financial publications and research reports

- Network with other professionals in the field

- Conduct ongoing research and analysis

- Take relevant training courses or certifications

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Dual Rate Dealer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Dual Rate Dealer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Trade Execution

Executing trades on behalf of clients, ensuring timely and accurate execution.

- Analyzing market conditions and making trading decisions promptly.

2. Client Management

Developing and maintaining strong relationships with clients, understanding their investment goals and risk tolerance.

- Providing personalized service and addressing client needs effectively.

- Offering tailored investment solutions that align with client objectives.

3. Market Analysis

Monitoring and analyzing financial markets to identify trading opportunities and manage risk.

- Interpreting economic data and market trends to make informed trading decisions.

- Developing and implementing trading strategies based on market analysis.

4. Risk Management

Managing risk exposure by adhering to established guidelines and implementing appropriate risk control measures.

- Monitoring market volatility and evaluating potential risks.

- Setting stop-loss levels to limit potential losses.

Interview Tips

Before the interview:

1. Research the Company and Role

Familiarize yourself with the company’s background, industry, and specific requirements of the Dual Rate Dealer role.

- Review the company’s website and social media pages.

- Research relevant industry trends and best practices.

2. Practice Answering Common Interview Questions

Prepare responses to common interview questions related to your skills, experience, and motivations.

- Use the STAR method to structure your answers:

- Situation: Describe the situation or task.

- Task: Explain your role and responsibilities.

- Action: Describe the specific actions you took.

- Result: Highlight the positive outcomes of your actions.

3. Highlight Your Relevant Skills and Experience

Identify and emphasize the skills and experience that are most relevant to the Dual Rate Dealer role.

- Quantify your accomplishments whenever possible using specific metrics.

- Provide examples that demonstrate your expertise in trading, risk management, and client service.

4. Prepare Questions to Ask the Interviewer

Asking thoughtful questions at the end of the interview shows your interest and engagement.

- Inquire about the company’s current market position and future goals.

- Ask about the specific responsibilities and expectations for the Dual Rate Dealer role within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Dual Rate Dealer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.