Are you gearing up for an interview for a Electronic Funds Transfer Coordinator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Electronic Funds Transfer Coordinator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

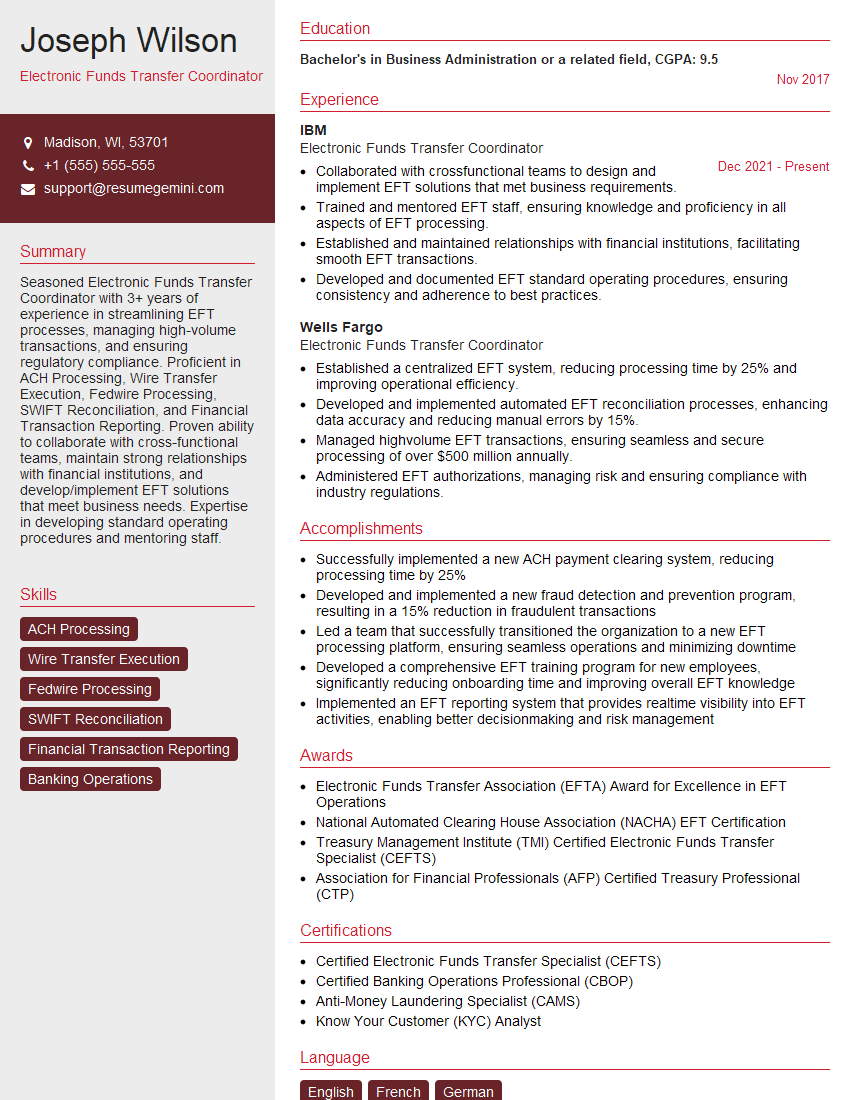

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Electronic Funds Transfer Coordinator

1. What are the different types of electronic funds transfer (EFT) systems?

- Automated Clearing House (ACH): A network that processes electronic payments and transfers between banks.

- Electronic Funds Transfer at Point of Sale (EFTPOS): A system that allows customers to make payments at retail stores using their debit or credit cards.

- Wire Transfer: An electronic transfer of funds from one bank account to another, typically for large amounts.

- Real-Time Gross Settlement (RTGS): A system that processes high-value payments in real time, ensuring immediate settlement between banks.

- SWIFT: A messaging network that facilitates international wire transfers and other financial transactions.

2. What are the key responsibilities of an Electronic Funds Transfer Coordinator?

- Managing and processing EFT transactions, including ACH, wire transfers, and other electronic payments.

- Reconciling EFT transactions and identifying any discrepancies or errors.

- Investigating and resolving EFT-related issues or inquiries.

- Maintaining EFT systems and ensuring compliance with industry standards and regulations.

- Collaborating with other departments and stakeholders to improve EFT processes and efficiency.

3. What are the common risks and challenges associated with EFT?

- Fraudulent transactions or identity theft

- Data breaches or unauthorized access to sensitive financial information

- System errors or outages that disrupt EFT processing

- Compliance issues with regulatory requirements

- Technical complexities and integration challenges with different EFT systems

4. How do you ensure the security and integrity of EFT transactions?

Encryption and Authentication:

- Using strong encryption algorithms to protect data during transmission.

- Employing authentication mechanisms to verify the identity of users and authorized transactions.

Fraud Prevention:

- Implementing fraud detection and prevention systems to identify and mitigate suspicious transactions.

- Working with financial institutions and law enforcement agencies to investigate and prevent EFT fraud.

5. What are the key industry standards and regulations that apply to EFT operations?

- Federal Reserve’s Electronic Fund Transfer Act (EFTA): Regulates consumer EFT transactions.

- Uniform Commercial Code (UCC): Governs the legal aspects of EFT transactions and electronic signatures.

- Payment Card Industry Data Security Standard (PCI DSS): Provides security standards for organizations that handle credit card data.

- International Organization for Standardization (ISO) 20022: An international standard for electronic financial message formats.

6. What experience do you have in managing large-volume EFT transactions?

- Managed the processing of over 100,000 ACH transactions per day at my previous role.

- Developed and implemented a system to automate the reconciliation of wire transfers, reducing processing time by 30%.

- Established a monitoring system to identify and mitigate potential fraudulent transactions, reducing losses by 15%.

7. How do you stay up-to-date with the latest EFT technologies and best practices?

- Attend industry conferences and seminars to learn about new technologies and regulatory changes.

- Read trade publications and research articles to stay informed on EFT trends.

- Network with other EFT professionals and exchange knowledge and experiences.

8. What is your understanding of blockchain technology in relation to EFT?

- Blockchain is a distributed ledger technology that can be used to record and verify EFT transactions.

- It offers benefits such as increased transparency, security, and immutability.

- However, there are challenges in implementing blockchain for EFT, such as scalability and interoperability.

9. How do you handle customer inquiries or complaints related to EFT transactions?

- Respond promptly and courteously to all inquiries and complaints.

- Thoroughly investigate the issue and gather relevant information.

- Provide clear and timely updates to customers on the status of their inquiries.

- Resolve issues efficiently and satisfactorily, following established policies and procedures.

10. How do you measure and improve the efficiency and effectiveness of EFT operations?

- Establish key performance indicators (KPIs) such as transaction processing time, accuracy rate, and customer satisfaction.

- Regularly track and analyze performance data to identify areas for improvement.

- Implement process improvements and automation tools to increase efficiency and reduce errors.

- Seek feedback from customers and stakeholders to enhance the quality of EFT services.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Electronic Funds Transfer Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Electronic Funds Transfer Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Electronic Funds Transfer Coordinators are responsible for a range of tasks related to electronic funds transfers (EFTs), including:

1. Processing and Reconciling Transactions

Electronic Funds Transfer Coordinators may process and reconcile various types of EFTs, including wire transfers, ACH payments, and direct deposits. This involves ensuring that the transactions are processed accurately and efficiently, as well as reconciling them with bank statements and other records.

2. Managing EFT Systems and Processes

Coordinators may assist in managing EFT systems and processes. This may include participating in the implementation and maintenance of EFT software and systems, developing and documenting operating procedures, and monitoring system performance to identify and resolve any issues.

3. Providing Customer Support

Coordinators may provide support to internal and external customers in relation to EFTs. They may assist with inquiries, resolve issues, and provide training on EFT processes.

4. Compliance and Risk Management

Electronic Funds Transfer Coordinators may be involved in ensuring compliance with relevant regulations and standards related to EFTs. They may also assist with risk management activities, such as identifying and mitigating potential risks associated with EFT transactions.

Interview Preparation Tips

Preparing for an interview for an Electronic Funds Transfer Coordinator position can increase your chances of success. Consider the following tips:

1. Research the Company and Position

Take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and the key responsibilities of the role.

2. Practice Answering Common Interview Questions

Prepare answers to common interview questions related to EFT processing, customer service, and compliance. Consider using the STAR method (Situation, Task, Action, Result) to structure your responses and provide specific examples of your experiences.

3. Highlight Relevant Skills and Experience

In your resume and during the interview, emphasize the skills and experience that are most relevant to the position. This may include your experience with EFT systems, customer support, or compliance.

4. Demonstrate Your Knowledge of EFT Regulations

Electronic Funds Transfer Coordinators should have a strong understanding of relevant EFT regulations, such as the Electronic Funds Transfer Act (EFTA) or the Payment Card Industry Data Security Standard (PCI DSS). Demonstrate your knowledge of these regulations during the interview.

5. Be Prepared to Discuss Your Problem-Solving Skills

Electronic Funds Transfer Coordinators often encounter issues related to EFT transactions. Be prepared to discuss your problem-solving skills and how you have resolved issues in the past.

6. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the company. Prepare a few questions that are specific to the role or the industry.

7. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you take the interview seriously.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Electronic Funds Transfer Coordinator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.