Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Employment Benefits or Pensions Retirement Plan Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

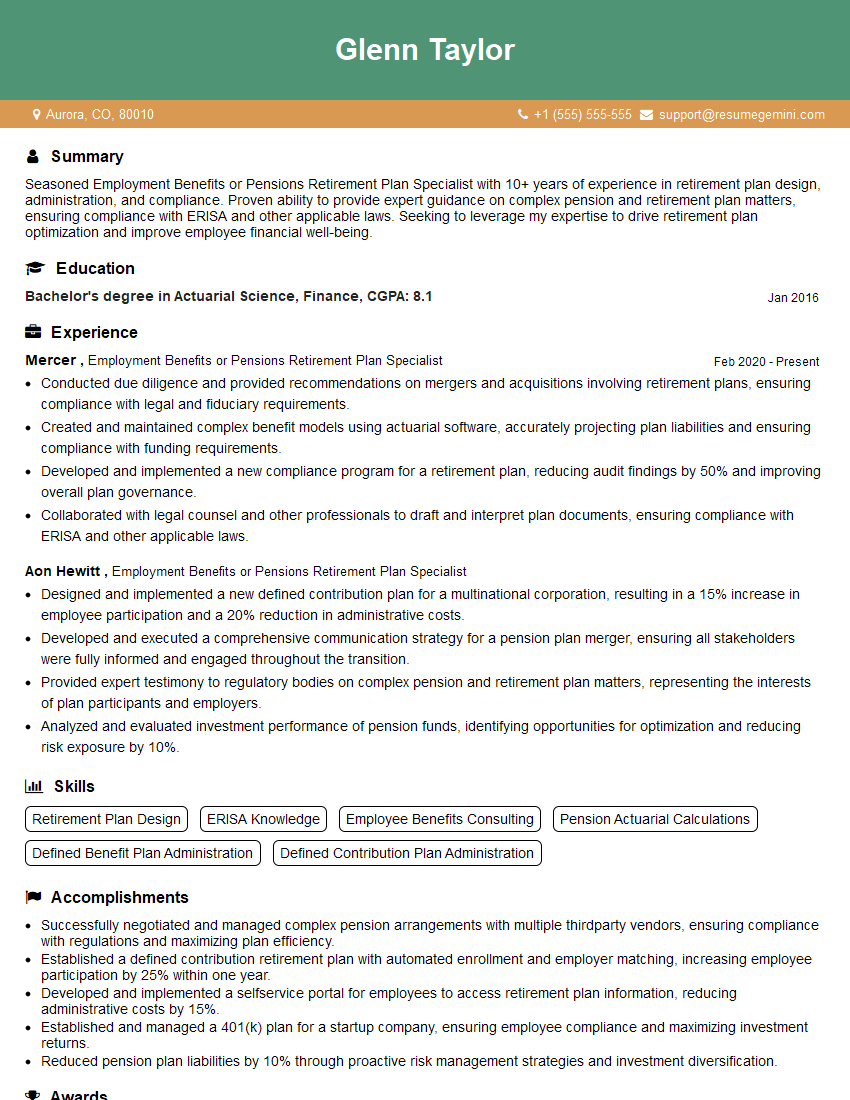

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Employment Benefits or Pensions Retirement Plan Specialist

1. Explain the key differences between a defined benefit plan and a defined contribution plan.

- Defined Benefit Plan: Fixed amount of retirement income based on years of service and salary, employer bears the investment risk.

- Defined Contribution Plan: Individual accounts with contributions from employee and/or employer, investment risk shared by employee.

2. What are the different types of health insurance plans?

Managed Care Plans

- Health Maintenance Organization (HMO): Limited provider network, low out-of-pocket costs, referrals required.

- Preferred Provider Organization (PPO): Broader provider network, higher out-of-pocket costs, referrals not always required.

Indemnity Plans

- Traditional Indemnity: Covers approved medical expenses, higher flexibility, higher out-of-pocket costs.

- Fee-for-Service (FFS): Providers bill directly for services, higher flexibility, higher out-of-pocket costs.

3. What are the implications of the Affordable Care Act (ACA) for employee benefits plans?

- Mandate for Health Insurance: Most Americans now required to have health insurance or face penalties.

- Essential Health Benefits: All health insurance plans must cover a minimum set of essential health benefits.

- Insurance Exchanges: Online marketplaces where individuals can purchase health insurance plans.

4. How do you stay up-to-date on changes to employee benefits laws and regulations?

- Attend industry conferences and workshops

- Read industry publications and online resources

- Network with other benefits professionals

- Seek continuing education and certifications

5. What are some of the most common challenges faced by employee benefits managers?

- Rising healthcare costs

- Increasing employee expectations

- Regulatory compliance

- Employee communication and education

6. How do you handle employee complaints about their benefits plans?

- Listen attentively to the complaint.

- Research the issue thoroughly.

- Explain the plan provisions clearly.

- Provide options or alternatives if available.

- Follow up with the employee to ensure their satisfaction.

7. What is your experience with developing and implementing employee benefits programs?

In previous roles, I played a key role in designing, implementing, and administering various employee benefits programs, including:

- Health insurance plans

- Retirement plans

- Flexible spending accounts

- Wellness programs

8. How do you work with vendors to ensure that employee benefits plans are meeting the needs of the organization and its employees?

- Establish clear communication channels

- Conduct regular performance reviews

- Seek feedback from employees and stakeholders

- Negotiate contracts that benefit both parties

9. What are your thoughts on the future of employee benefits?

- Consumer-Directed Health Plans: Employees have more control over their healthcare spending.

- Wellness and Prevention: Employers focus on promoting employee health and well-being.

- Technology: Digital tools and platforms simplify benefits administration and communication.

10. What is your proudest accomplishment in your career as an employee benefits professional?

I am particularly proud of the work I did in redesigning the company’s health insurance plan. By implementing a consumer-directed plan, we were able to reduce costs while providing employees with more choice and flexibility.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Employment Benefits or Pensions Retirement Plan Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Employment Benefits or Pensions Retirement Plan Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Employment Benefits or Pensions Retirement Plan Specialists are responsible for administering and managing employee benefit plans, such as health insurance, retirement plans, and paid time off. They also provide guidance to employees on these plans and ensure that the plans are in compliance with all applicable laws and regulations.

1. Plan Administration

This involves tasks such as enrolling employees in plans, processing claims, and making sure that contributions are made on time. Specialists must also stay up-to-date on changes to plan regulations and make sure that the plans are in compliance.

- Enroll employees in plans

- Process claims

- Make sure that contributions are made on time

- Stay up-to-date on changes to plan regulations

- Make sure that the plans are in compliance

2. Employee Education

Retirement plan and benefits specialists must be able to clearly explain the plans to employees and answer their questions. They may also provide educational materials and workshops to help employees understand their benefits.

- Clearly explain the plans to employees

- Answer employee questions

- Provide educational materials and workshops

3. Compliance

Retirement plan and benefits specialists must make sure that the plans are in compliance with all applicable laws and regulations. This includes filing required reports and making sure that the plans are not discriminatory.

- File required reports

- Make sure that the plans are not discriminatory

4. Communication

Retirement plan and benefits specialists must be able to communicate effectively with employees, other staff members, and regulatory agencies. They must be able to clearly explain complex information and answer questions in a way that is easy to understand.

- Communicate effectively with employees

- Communicate effectively with other staff members

- Communicate effectively with regulatory agencies

- Clearly explain complex information

- Answer questions in a way that is easy to understand

Interview Tips

Interviewing for an Employment Benefits or Pensions Retirement Plan Specialist position can be challenging, but there are certain preparation tips and hacks you can use to ace the interview.

1. Research the Company and the Position

Before the interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture and the specific requirements of the job. You can find information about the company on their website, social media pages, and Glassdoor.

- Visit the company website

- Review the company’s social media pages

- Read reviews on Glassdoor

- Identify the specific requirements of the job

2. Practice Answering Common Interview Questions

There are certain common interview questions that you are likely to be asked in an interview for an Employment Benefits or Pensions Retirement Plan Specialist position. It is helpful to practice answering these questions in advance so that you can deliver well-prepared and thoughtful responses during the interview.

- Tell me about your experience in administering employee benefit plans.

- What are your strengths and weaknesses as an Employment Benefits or Pensions Retirement Plan Specialist?

- Why are you interested in working for our company?

- What are your salary expectations?

3. Prepare Questions to Ask the Interviewer

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the company and the position. It is important to prepare a few thoughtful questions to ask the interviewer.

- What are the biggest challenges facing the company right now?

- What is the company’s culture like?

- What are the opportunities for advancement within the company?

4. Dress Professionally and Arrive on Time

It is important to make a good first impression on the interviewer. Dress professionally and arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you are serious about the position.

- Dress professionally

- Arrive on time

- Be respectful of the interviewer’s time

- Show that you are serious about the position

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Employment Benefits or Pensions Retirement Plan Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Employment Benefits or Pensions Retirement Plan Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.