Feeling lost in a sea of interview questions? Landed that dream interview for Energy Trader but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Energy Trader interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

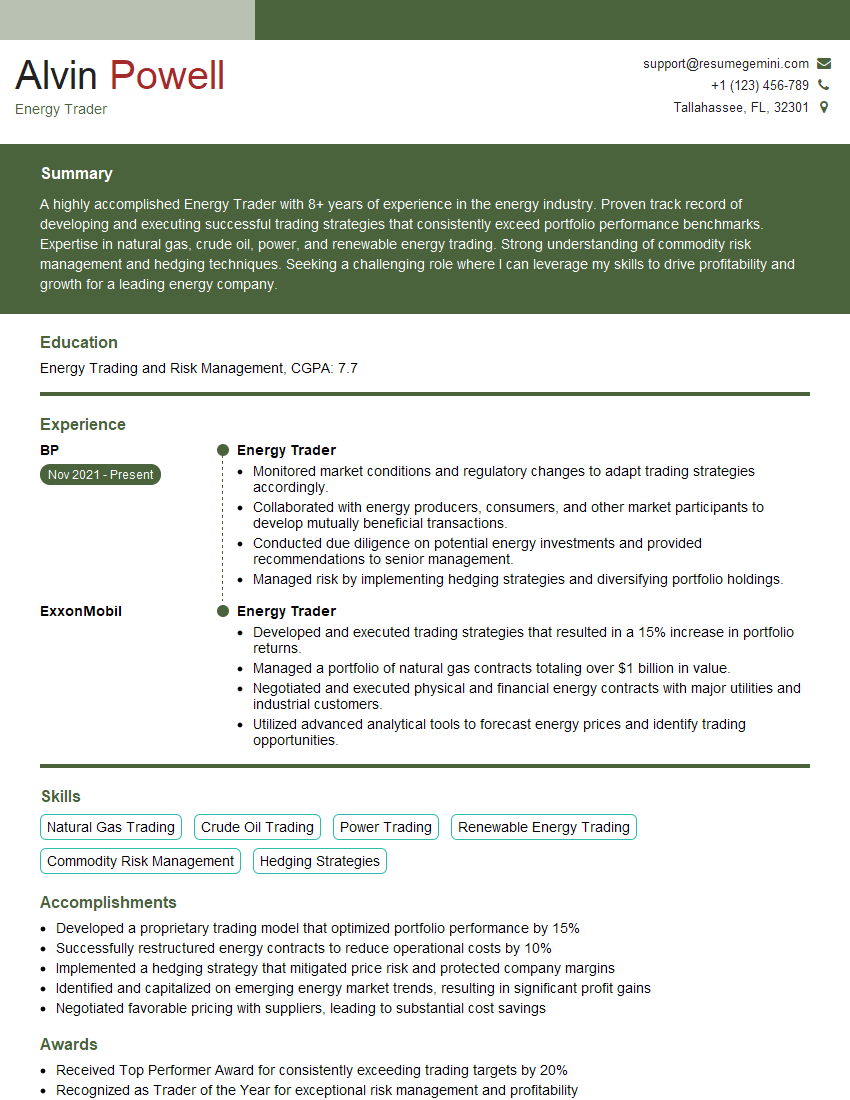

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Energy Trader

1. Explain the concept of spark spread and how it is used in energy trading?

A spark spread is the difference between the price of electricity and the price of the fuel used to generate that electricity. It is a measure of the profitability of electricity generation. A positive spark spread indicates that it is profitable to generate electricity, while a negative spark spread indicates that it is not.

Spark spreads are used in energy trading to make decisions about when to buy and sell electricity. For example, a trader might buy electricity when the spark spread is positive and sell it when the spark spread is negative.

2. Describe the different types of energy contracts and their key terms?

Physical contracts

- Physical contracts require the delivery of a physical commodity, such as electricity, natural gas, or oil.

- The key terms of a physical contract include the quantity of the commodity to be delivered, the delivery date, the delivery location, and the price.

Financial contracts

- Financial contracts are based on the underlying price of an energy commodity, but they do not require the delivery of a physical commodity.

- The most common type of financial contract is a futures contract.

- A futures contract is an agreement to buy or sell a specific quantity of an energy commodity at a specified price on a specified date in the future.

3. Explain the concept of basis risk and how it can impact energy trading?

Basis risk is the risk that the price of a physical commodity will be different from the price of a futures contract for that commodity. This can occur when there are disruptions in the supply chain or changes in the demand for the commodity.

Basis risk can have a significant impact on energy trading. For example, if a trader buys a futures contract for electricity and the price of electricity falls before the contract expires, the trader will lose money.

To mitigate basis risk, traders can use hedging strategies. Hedging involves taking an opposite position in a different market to offset the risk of price changes in the original market.

4. Discuss the role of weather forecasts in energy trading?

Weather forecasts play a critical role in energy trading. The weather can have a significant impact on the demand for electricity and natural gas.

For example, a cold winter can lead to an increase in the demand for natural gas for heating, which can drive up prices. Similarly, a hot summer can lead to an increase in the demand for electricity for air conditioning, which can also drive up prices.

Energy traders use weather forecasts to make decisions about when to buy and sell energy commodities. For example, a trader might buy natural gas in the fall if they expect a cold winter.

5. What are the different types of energy markets and how do they operate?

Spot markets

- Spot markets are markets where commodities are bought and sold for immediate delivery.

- The price of a commodity in a spot market is determined by the forces of supply and demand.

Forward markets

- Forward markets are markets where commodities are bought and sold for future delivery.

- The price of a commodity in a forward market is determined by the spot price and the cost of carry.

Futures markets

- Futures markets are markets where standardized contracts for the future delivery of commodities are bought and sold.

- The price of a futures contract is determined by the forces of supply and demand.

6. Explain the concept of volatility and how it can impact energy trading?

Volatility is a measure of the risk of price changes in a market. A volatile market is a market where prices are likely to change quickly and significantly.

Volatility can have a significant impact on energy trading. For example, a trader who buys a futures contract for electricity in a volatile market is taking on more risk than a trader who buys a futures contract for electricity in a less volatile market.

Traders can use volatility to their advantage by using hedging strategies. Hedging involves taking an opposite position in a different market to offset the risk of price changes in the original market.

7. Discuss the impact of government regulations on energy trading?

Government regulations can have a significant impact on energy trading. Regulations can affect the price of energy commodities, the availability of energy commodities, and the way that energy commodities are traded.

For example, government regulations can impose taxes on energy commodities, which can increase the price of those commodities. Regulations can also impose limits on the amount of energy that can be produced or consumed, which can affect the availability of energy commodities.

Energy traders need to be aware of the government regulations that affect their markets. They need to understand how these regulations can impact the price of energy commodities, the availability of energy commodities, and the way that energy commodities are traded.

8. What are the ethical considerations that energy traders need to be aware of?

- Energy traders need to be aware of the ethical considerations that apply to their work.

- These considerations include the need to avoid conflicts of interest, the need to disclose material information to clients, and the need to avoid insider trading.

- Energy traders also need to be aware of the environmental and social impacts of their work.

- They need to make decisions that are in the best interests of their clients and the public.

9. What are the challenges and opportunities in the energy trading industry?

Challenges

- The energy trading industry is a challenging one.

- Traders need to have a deep understanding of the energy markets, the ability to make quick decisions, and the ability to manage risk.

Opportunities

- The energy trading industry is also a rewarding one.

- Traders who are successful can earn high salaries and bonuses.

- They also have the opportunity to work with a variety of people and to make a real impact on the world.

10. What are your career goals and how do you see this role helping you achieve them?

My career goal is to become a successful energy trader. I believe that this role will help me achieve my goal by providing me with the opportunity to learn from experienced traders and to gain the skills and knowledge that I need to be successful in the industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Energy Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Energy Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Energy Traders play a crucial role in the energy industry, managing the buying and selling of energy commodities to meet the needs of their clients. Their key responsibilities encompass diverse areas of expertise, including:

1. Market Analysis and Forecasting

Thoroughly analyze energy markets, including supply and demand dynamics, geopolitical events, and economic trends. Utilize this knowledge to forecast price fluctuations and volatility, enabling informed trading decisions.

- Monitor and interpret market data, news, and industry reports.

- Develop forecasting models to predict future energy prices and trends.

2. Trading Execution

Execute trades in various energy markets, such as physical, futures, and options. Manage risk by implementing hedging strategies and optimizing trading positions.

- Negotiate and execute energy contracts with suppliers, producers, and consumers.

- Monitor market conditions and adjust trading strategies to maximize profit and minimize risk.

3. Client Relationship Management

Build and maintain strong relationships with clients to understand their energy needs and provide tailored solutions. Act as a trusted advisor, offering guidance and insights on market trends and trading strategies.

- Understand client risk tolerance, investment objectives, and regulatory requirements.

- Develop customized trading strategies that align with client goals.

4. Risk Management

Identify, assess, and manage risks associated with energy trading. Implement measures to mitigate financial, operational, and legal risks. Monitor market volatility and adjust trading strategies accordingly.

- Conduct thorough due diligence on counterparties and transactions.

- Develop and implement risk management policies and procedures.

Interview Preparation Tips

To excel in an energy trader interview, thorough preparation is essential. Consider the following tips to enhance your chances of success:

1. Research the Company and Industry

Familiarize yourself with the company’s business model, target markets, and recent financial performance. Research the energy industry, including current trends, key players, and regulatory frameworks.

- Review the company’s website, annual reports, and news articles.

- Stay up-to-date with industry publications and market analysis.

2. Practice Your Technical Skills

Energy trading requires strong analytical and quantitative skills. Practice solving case studies, interpreting market data, and evaluating financial models.

- Review fundamental trading concepts and strategies.

- Work through practice problems and simulations.

3. Prepare for Behavioral Questions

Interviewers often assess candidates’ soft skills, such as teamwork, communication, and problem-solving abilities. Prepare for common behavioral questions and develop STAR (Situation, Task, Action, Result) stories to demonstrate your strengths.

- Identify your key skills and experiences relevant to the role.

- Craft specific examples that highlight your accomplishments and transferable skills.

4. Leverage Your Network

Reach out to your professional network, including former colleagues, industry contacts, or alumni, to gain insights into the company and the role. Seek advice on potential interview questions and gather tips on how to showcase your qualifications.

- Attend industry events and conferences to connect with professionals.

- Utilize LinkedIn and other professional networking platforms to expand your reach.

5. Dress Professionally and Arrive Punctually

First impressions matter. Dress professionally and arrive for the interview on time to demonstrate your respect and punctuality. Maintain a positive and confident demeanor throughout the interview.

- Choose attire that is appropriate for the company culture and industry norms.

- Allow ample time for travel and unexpected delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Energy Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!