Feeling lost in a sea of interview questions? Landed that dream interview for Energy Trading Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Energy Trading Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

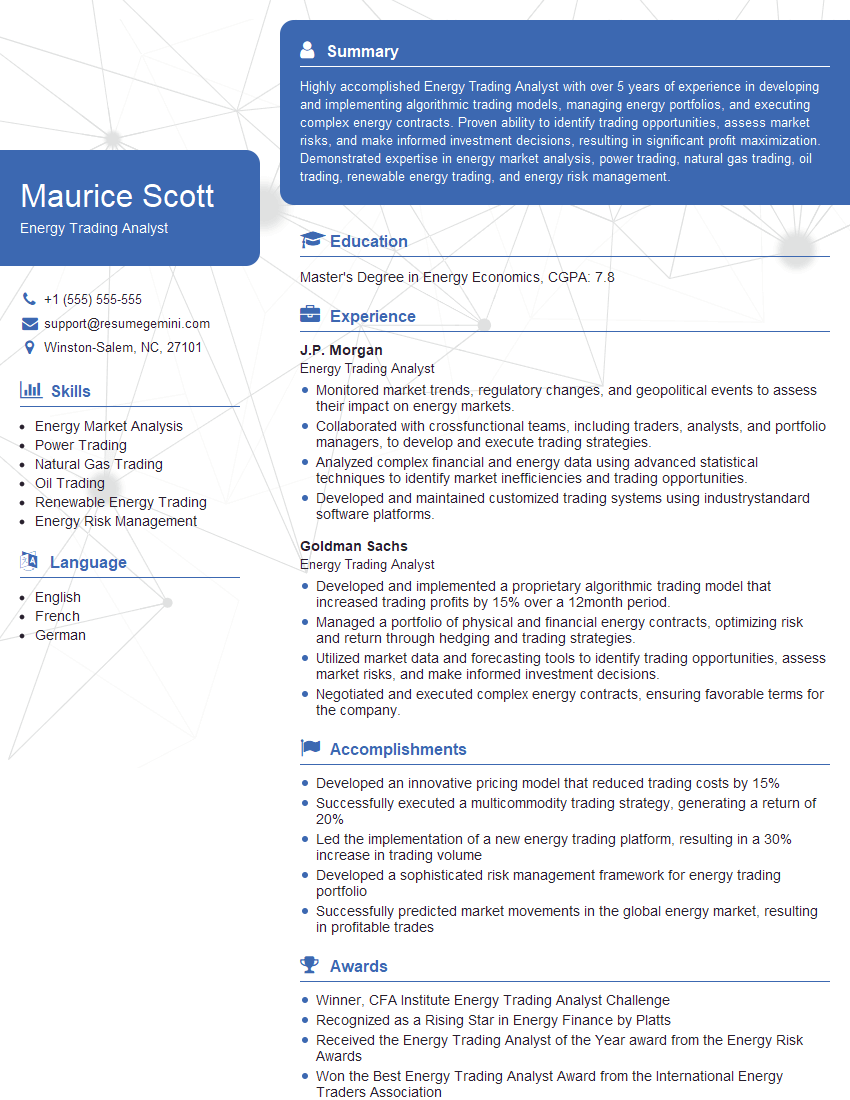

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Energy Trading Analyst

1. How do you determine the fair market value of an energy commodity?

To determine the fair market value of an energy commodity, I consider various factors such as:

- Supply and demand: Analyze market dynamics to assess the balance between supply and demand, which significantly influences prices.

- Production costs: Estimate the costs associated with extracting or producing the commodity, including labor, equipment, and transportation.

- Transportation and storage costs: Evaluate the expenses related to transporting and storing the commodity, as these can impact its final value.

- Quality and specifications: Assess the physical attributes and specifications of the commodity, as these can affect its desirability and market value.

- Market sentiment and volatility: Monitor market sentiment and volatility to understand how market expectations and fluctuations can impact prices.

2. Explain the difference between a forward contract and a futures contract for energy commodities.

Forward Contract

- Customized agreement between two parties to exchange an energy commodity at a specified price and date in the future.

- Traded over-the-counter (OTC) and not standardized.

- Offers more flexibility in terms of contract terms and specifications.

Futures Contract

- Standardized contract traded on an exchange.

- Obligates the buyer to purchase and the seller to deliver a specific quantity and quality of an energy commodity at a predetermined price and date.

- Provides greater transparency and liquidity, but less flexibility compared to forward contracts.

3. How do you use technical analysis to identify trading opportunities in the energy market?

To identify trading opportunities in the energy market using technical analysis, I employ various techniques such as:

- Trend analysis: Examine price movements over time to identify overall trends and potential reversals.

- Support and resistance levels: Identify areas where prices tend to bounce off or encounter resistance, indicating potential reversal points.

- Moving averages: Calculate the average price of a commodity over a specified period to smooth out price fluctuations and identify potential trading signals.

- Chart patterns: Recognize and interpret recurring chart patterns, such as head and shoulders or double tops, to predict future price movements.

- Indicators: Utilize technical indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to confirm trends and identify overbought or oversold conditions.

4. How do you manage risk in energy trading?

I employ various risk management strategies in energy trading, including:

- Hedging: Use financial instruments, such as futures or options, to offset potential losses from price fluctuations.

- Scenario analysis: Analyze different market scenarios and their potential impact on trading positions to prepare for unexpected events.

- Diversification: Spread investments across different energy commodities and markets to reduce overall risk exposure.

- Position sizing: Determine the appropriate size of trading positions based on risk tolerance and available capital.

- Stop-loss orders: Set predetermined price levels at which positions are automatically closed to limit potential losses.

5. How do you stay up-to-date with the latest developments in the energy market?

To stay informed about the latest developments in the energy market, I:

- Monitor news and industry publications: Regularly read industry news sources, research reports, and analyst commentary to keep abreast of market trends and events.

- Attend conferences and webinars: Participate in industry events to network with professionals and learn about emerging technologies and market insights.

- Utilize data and analytics tools: Leverage market data platforms and analytics tools to analyze market data, identify patterns, and make informed trading decisions.

- Engage with industry experts: Connect with energy professionals on LinkedIn and other platforms to exchange knowledge and stay informed about industry developments.

- Conduct ongoing research: Continuously study market trends, geopolitical events, and economic factors that influence the energy market.

6. How do you assess the performance of your energy trading strategies?

I evaluate the performance of my energy trading strategies through various metrics, including:

- Return on investment (ROI): Calculate the percentage return generated on invested capital.

- Sharpe ratio: Determine the risk-adjusted return of the strategy by dividing excess return by standard deviation.

- Maximum drawdown: Measure the largest peak-to-trough decline in the value of the portfolio.

- Win rate: Calculate the percentage of trades that resulted in a profit.

- Correlation to benchmarks: Assess the correlation of the strategy’s performance to industry benchmarks or indices.

7. How do you handle periods of market volatility?

During periods of market volatility, I:

- Increase monitoring: Closely monitor market movements and news to identify potential trading opportunities and risks.

- Adjust risk parameters: Re-evaluate risk tolerance and adjust position sizes and stop-loss orders accordingly.

- Explore hedging strategies: Consider using hedging instruments, such as options or futures, to mitigate potential losses.

- Maintain discipline: Adhere to trading strategies and avoid making impulsive decisions driven by emotions.

- Seek professional guidance: Consult with industry experts or financial advisors to gain insights and adjust trading strategies as needed.

8. What are some of the challenges you have faced as an Energy Trading Analyst?

Some of the challenges I have encountered as an Energy Trading Analyst include:

- Market volatility: Navigating rapid and unpredictable price fluctuations in the energy market.

- Data availability and quality: Ensuring access to timely and reliable market data to make informed trading decisions.

- Regulatory changes: Keeping up with evolving regulatory frameworks and their impact on energy trading activities.

- Competition: Operating in a competitive market with numerous other traders and market participants.

- Managing risk: Balancing the pursuit of profit with the need to manage and mitigate potential financial losses.

9. What are your thoughts on the future of energy trading?

I believe the future of energy trading will be shaped by:

- Renewable energy integration: The increasing adoption of renewable energy sources and their impact on traditional energy trading models.

- Technological advancements: The role of artificial intelligence, machine learning, and data analytics in enhancing trading strategies.

- Climate change: The influence of climate change on energy demand and supply, creating new opportunities and challenges for traders.

- Geopolitical factors: The impact of geopolitical events and trade policies on energy markets.

- Decentralized energy systems: The emergence of decentralized energy systems and their implications for energy trading.

10. Why should we hire you as an Energy Trading Analyst?

I am confident that I possess the skills and experience to excel as an Energy Trading Analyst in your esteemed organization. My strong technical foundation in energy markets, combined with my analytical and problem-solving abilities, enables me to make informed trading decisions. I am also adept at managing risk, staying up-to-date with industry trends, and adapting to changing market conditions. Furthermore, my passion for the energy sector and my unwavering commitment to delivering results make me an ideal candidate for this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Energy Trading Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Energy Trading Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Energy Trading Analyst is a highly specialized professional who plays a vital role in the energy industry. Their responsibilities encompass a wide range of analytical and advisory tasks that contribute to the efficient and profitable trading of energy commodities.

1. Market Analysis and Forecasting

Energy Trading Analysts are responsible for conducting in-depth market research and analysis to understand the factors that influence energy prices. They analyze historical data, current events, and industry trends to identify opportunities and risks in the market. Using quantitative and qualitative techniques, they develop forecasts and projections for future energy prices and market conditions.

2. Trading Strategy Development

Based on their market analysis, Energy Trading Analysts develop and recommend trading strategies to optimize returns and manage risk. They identify potential trading opportunities, such as arbitrage, hedging, and speculative trades. They also evaluate the potential risks and rewards associated with each strategy and recommend appropriate risk management measures.

3. Trade Execution and Monitoring

Once trading strategies are approved, Energy Trading Analysts execute trades in the energy markets. They work closely with traders to implement trading orders and ensure that trades are executed efficiently and in compliance with company policies and regulations. They also monitor trades in real-time to identify any deviations from expectations and make necessary adjustments.

4. Performance Analysis and Reporting

Energy Trading Analysts evaluate the performance of trading strategies and provide regular reports to management. They analyze trade outcomes, identify areas for improvement, and make recommendations to enhance future performance. They also prepare reports on market conditions, trading activity, and risk management practices for internal and external stakeholders.

Interview Tips

To ace an interview for an Energy Trading Analyst position, candidates should be well-prepared and demonstrate their skills and knowledge in the following areas:

1. Technical Skills

Candidates should possess strong analytical skills and a deep understanding of energy markets, trading strategies, and risk management techniques. They should be proficient in using quantitative analysis tools and models for market forecasting and trade evaluation.

- Example: Prepare for questions that assess your understanding of statistical analysis, time series analysis, and econometric modeling.

2. Market Knowledge

In-depth knowledge of the energy industry is crucial. Candidates should demonstrate a thorough understanding of the different types of energy commodities, their pricing mechanisms, and the factors that influence their supply and demand. They should also be aware of the regulatory and policy environment governing the energy markets.

- Example: Be prepared to discuss the factors that affect the volatility of oil prices, the impact of renewable energy on the electricity market, or the implications of carbon pricing on the energy industry.

3. Communication and Presentation Skills

Energy Trading Analysts need to be able to communicate complex technical information clearly and effectively. They should be able to present their analysis and recommendations to management and other stakeholders in a persuasive and engaging manner.

- Example: Practice presenting your analysis in a concise and structured way. Prepare for hypothetical case studies where you need to explain your trading strategy and justify your recommendations.

4. Teamwork and Collaboration

Collaboration is essential in the energy trading industry. Candidates should demonstrate their ability to work effectively in a team environment and contribute to the success of the trading desk. They should also be able to build strong relationships with traders, brokers, and other stakeholders.

- Example: Highlight your experience working on cross-functional projects or your ability to build rapport and establish trust with colleagues and clients.

5. Continuous Learning and Adaptation

The energy industry is constantly evolving. Candidates should demonstrate their commitment to continuous learning and staying up-to-date with the latest market developments and trading techniques. They should also be able to adapt to changing market conditions and adjust their strategies accordingly.

- Example: Discuss your interest in industry conferences, webinars, or online courses to enhance your knowledge and stay abreast of the latest trends.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Energy Trading Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!