Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Enrolled Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

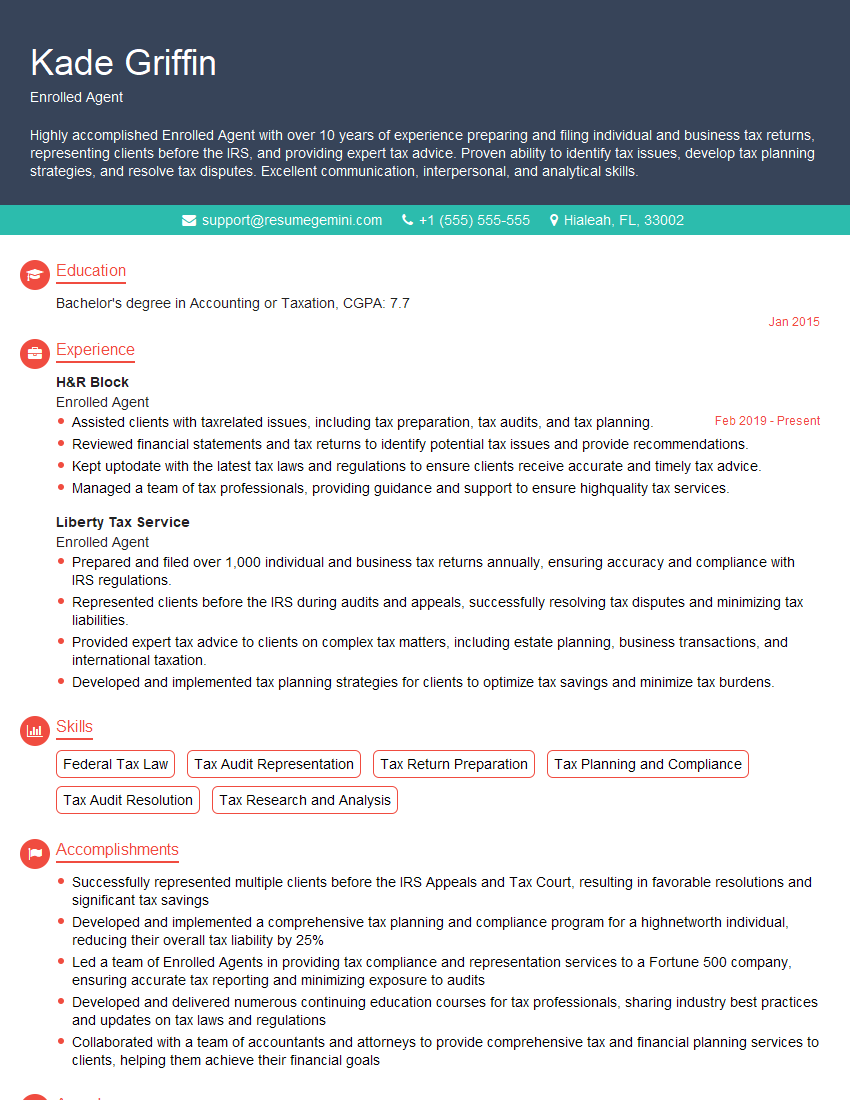

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Enrolled Agent

1. What are the key responsibilities of an Enrolled Agent?

- Representing taxpayers before the Internal Revenue Service (IRS)

- Preparing and filing tax returns

- Providing tax advice and guidance

- Auditing tax returns

- Resolving tax disputes

2. What are the qualifications to become an Enrolled Agent?

Education

- Bachelor’s degree in accounting, taxation, or a related field

- Or, five years of experience in the field of taxation

Examination

- Pass the Special Enrollment Examination (SEE)

Continuing Education

- Complete 72 hours of continuing education every three years

3. What are the benefits of becoming an Enrolled Agent?

- Increased credibility and professional recognition

- Ability to represent clients before the IRS

- Increased earning potential

- Access to exclusive resources and training

4. What are the different types of tax clients that Enrolled Agents typically work with?

- Individuals

- Businesses

- Non-profit organizations

- Trusts and estates

5. What are the most common tax issues that Enrolled Agents handle?

- Audits

- Tax liens

- Tax levies

- Tax disputes

- Tax planning

6. What are the ethical responsibilities of an Enrolled Agent?

- Maintain confidentiality

- Avoid conflicts of interest

- Provide competent and ethical service

- Comply with all applicable laws and regulations

7. What are the current trends in the field of taxation?

- The increasing use of technology

- The globalization of the economy

- The changing tax laws

8. What are the challenges facing Enrolled Agents in today’s market?

- The competition from other tax professionals

- The need to keep up with the changing tax laws

- The increasing complexity of the tax code

9. What are the opportunities for Enrolled Agents in the future?

- The growing demand for tax services

- The increasing use of technology

- The globalization of the economy

10. Why are you interested in becoming an Enrolled Agent?

- I have always been interested in helping others.

- I am passionate about the field of taxation.

- I believe that I have the skills and experience necessary to be successful as an Enrolled Agent.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Enrolled Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Enrolled Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of an Enrolled Agent

Enrolled Agents are federally licensed tax practitioners who specialize in providing comprehensive tax services to individuals and businesses. They possess a deep understanding of the complex tax laws and regulations and are authorized to represent taxpayers before the Internal Revenue Service (IRS) on any matter related to taxation.

1. Tax Preparation and Filing

Enrolled Agents are responsible for preparing and filing accurate and timely tax returns for individuals, businesses, trusts, and estates. They gather and analyze financial information, calculate tax liability, and ensure compliance with tax laws.

2. Tax Planning and Advisory

They help taxpayers minimize their tax liability by developing and implementing effective tax planning strategies. They advise on tax-saving opportunities, deductions, and credits, and provide guidance on complex tax issues.

3. Tax Representation

Enrolled Agents represent taxpayers before the IRS in case of audits, appeals, and other tax-related matters. They advocate for their clients’ interests, negotiate with the IRS, and ensure fair and equitable treatment.

4. Continuous Education

Enrolled Agents are required to complete 72 hours of continuing education every three years to maintain their license. This ensures that they stay up-to-date with the latest tax laws and regulations and provide their clients with the highest level of service.

Interview Tips for Enrolled Agent Candidates

To ace your Enrolled Agent interview, it’s crucial to prepare thoroughly and demonstrate your knowledge, skills, and professionalism. Here are some tips to help you succeed:

1. Research the Firm and the Role

Familiarize yourself with the firm’s website, industry reputation, and the specific role you’re applying for. This will help you understand the firm’s culture, values, and the expectations for the position.

2. Prepare for Common Interview Questions

Practice answering common interview questions, such as those related to your tax knowledge, experience with tax software, client management skills, and ethical considerations.

3. Showcase Your Technical Skills and Experience

Highlight your expertise in tax preparation, planning, and representation. Quantify your accomplishments whenever possible, using specific examples of how you helped clients resolve tax issues or save money.

4. Emphasize Your Communication and Interpersonal Skills

Enrolled Agents need to be able to effectively communicate with clients, the IRS, and other stakeholders. Explain how your excellent communication skills and ability to build rapport help you provide exceptional service.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the firm and the role. It also gives you an opportunity to clarify any questions you have and show your enthusiasm.

6. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive on time to show that you respect the interviewer’s schedule and the position.

7. Follow Up

After the interview, send a thank-you note to the interviewer, reiterating your interest in the position and summarizing why you’re a suitable candidate. This small gesture can make a positive impression.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Enrolled Agent, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Enrolled Agent positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.