Are you gearing up for a career in Equities Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Equities Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

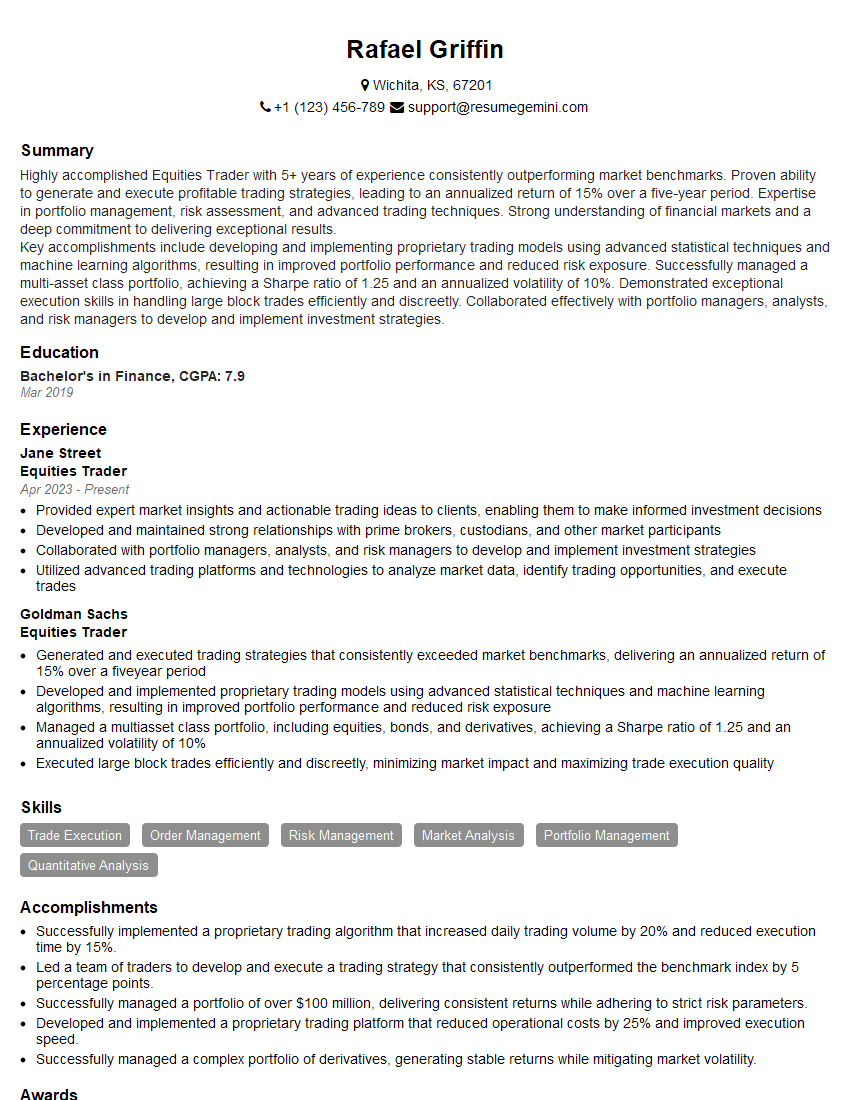

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Equities Trader

1. What are the different types of equity orders and how do you execute them?

- Market orders: Executed immediately at the current market price.

- Limit orders: Executed only when the price reaches a specified limit.

- Stop orders: Executed when the price moves past a specified stop price.

- Stop-limit orders: A combination of a stop order and a limit order.

2. What are the key factors that affect equity prices?

Fundamental factors

- Company earnings

- Economic conditions

- Interest rates

Technical factors

- Chart patterns

- Moving averages

- Technical indicators

3. How do you manage risk in equity trading?

- Diversification: Investing in a variety of stocks to reduce overall risk.

- Hedging: Using financial instruments to offset potential losses.

- Stop-loss orders: Automatically selling a stock when it falls below a certain price.

- Risk management models: Using quantitative models to assess and manage risk.

4. What are the different types of equity markets?

- Primary markets: Where new stocks are issued and sold to the public.

- Secondary markets: Where existing stocks are traded.

- Over-the-counter (OTC) markets: Where stocks are traded directly between buyers and sellers.

- Exchanges: Centralized marketplaces where stocks are traded.

5. What are the different types of equity derivatives?

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a stock at a specified price.

- Futures: Contracts that obligate the buyer to buy or the seller to sell a stock at a specified price on a specified date.

- Swaps: Contracts that exchange cash flows between two parties based on the performance of an underlying stock.

6. What are the key regulations that govern equity trading?

- Securities Exchange Act of 1934

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- Regulation NMS

- Market Abuse Regulation

7. What are the ethical considerations in equity trading?

- Insider trading: Trading on material non-public information.

- Front running: Trading ahead of a client’s order.

- Market manipulation: Artificially manipulating the price of a stock.

8. What are the latest trends in equity trading?

- Electronic trading

- Algorithmic trading

- High-frequency trading

- Social media trading

9. What are the key skills and qualifications for an equity trader?

- Strong understanding of financial markets

- Excellent analytical and problem-solving skills

- Expertise in trading platforms and software

- Ability to work under pressure and make quick decisions

10. Why are you interested in this role and why do you think you are the right person for the job?

- I have a strong passion for financial markets and a deep understanding of equity trading strategies.

- I am an analytical and detail-oriented individual with a proven track record of success in identifying and executing profitable trades.

- I am proficient in a variety of trading platforms and software, and I am adept at working under pressure and making quick decisions.

- I am confident that I have the skills and experience necessary to succeed in this role and make a significant contribution to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Equities Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Equities Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Equities traders play a crucial role in the financial markets and hold significant responsibilities within their organizations. Key job responsibilities include:intro paragraph

1. Execution of Trades

Executing buy and sell orders for clients quickly and efficiently, ensuring best possible prices and minimizing market impact

2. Market Analysis

Analyzing market trends, economic data, and news to make informed trading decisions, identifying potential opportunities and risks

3. Client Relationship Management

Building and maintaining strong relationships with clients, understanding their investment goals and risk appetite to provide tailored trading strategies

4. Risk Management

Monitoring and managing trading risks, implementing stop-loss orders and hedging strategies to minimize potential losses

Interview Tips

Preparing for an Equities Trader interview requires thorough research and an understanding of the industry, role, and your own qualifications.

1. Research the Company and Industry

Familiarize yourself with the company’s business model, financial performance, and industry trends. This will demonstrate your interest and understanding of the market

2. Practice Case Studies

Case studies are often used to assess your trading skills and decision-making abilities. Prepare for these by analyzing real-world market scenarios and presenting your trading recommendations

3. Showcase Your Skills

Highlight your technical analysis skills, knowledge of trading platforms, and ability to interpret financial data. Quantify your accomplishments with specific results whenever possible

4. Emphasize Your Communication Skills

Equities traders must be able to communicate effectively with clients, colleagues, and supervisors. Demonstrate your ability to convey complex trading concepts clearly and succinctly

5. Prepare Behavioral Questions

Behavioral questions focus on your past experiences and behaviors in the workplace. Be prepared to provide specific examples that highlight your teamwork, problem-solving, and decision-making skills

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Equities Trader interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.