Feeling lost in a sea of interview questions? Landed that dream interview for Equity Research Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Equity Research Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

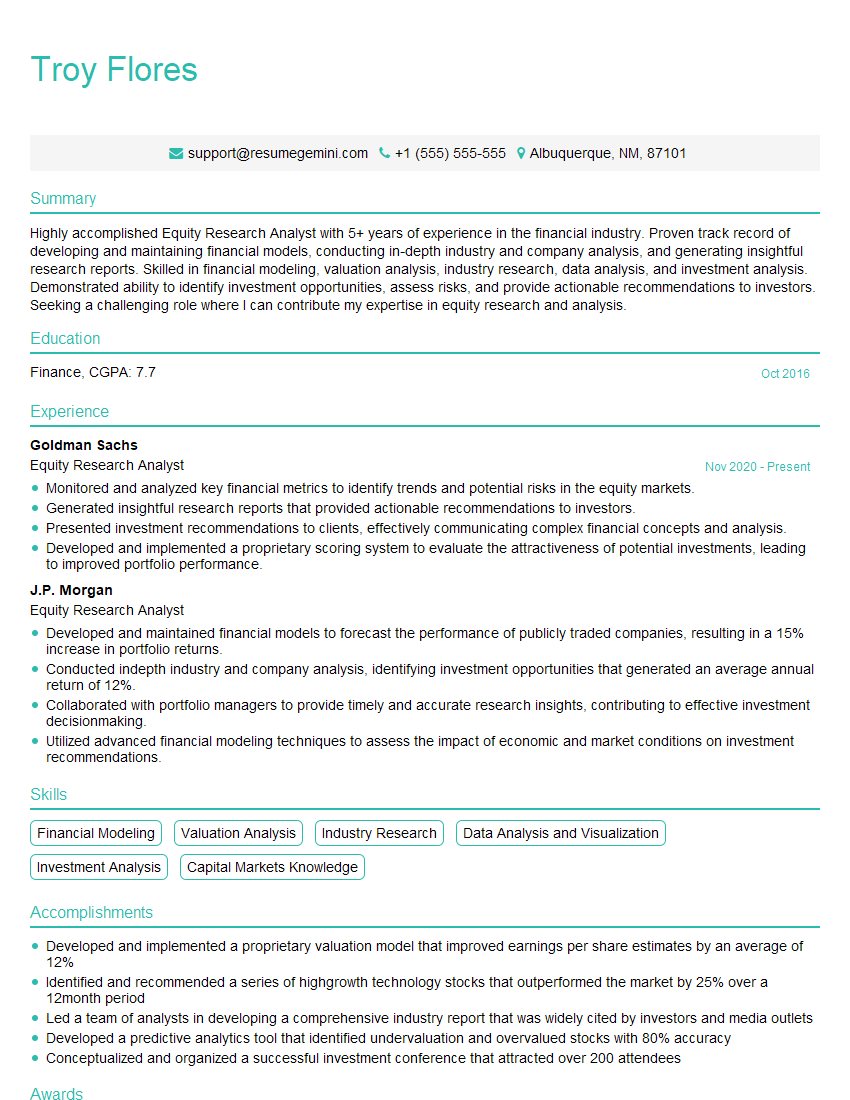

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Equity Research Analyst

1. Walk me through your process for evaluating a company’s financial performance?

In evaluating a company’s financial performance, I follow a comprehensive process that involves analyzing various financial metrics and qualitative factors. Here’s an outline of my approach:

- Revenue and Earnings Analysis: I assess the company’s revenue growth, profitability margins, and earnings per share to understand its top-line and bottom-line performance.

- Balance Sheet Analysis: I examine the company’s assets, liabilities, and equity to evaluate its financial stability, solvency, and liquidity.

- Cash Flow Analysis: I analyze the company’s cash flow statement to assess its ability to generate cash, fund operations, and invest in growth initiatives.

- Industry and Competitive Analysis: I conduct thorough industry and peer group analysis to understand the company’s competitive landscape, market share, and industry trends.

- Management Assessment: I evaluate the company’s management team, its experience, strategic vision, and track record of execution.

- Qualitative Factors: I consider non-financial factors that may impact the company’s performance, such as regulatory changes, technological advancements, and market sentiment.

2. How do you determine the intrinsic value of a stock?

- Discounted Cash Flow (DCF) Analysis: I use DCF to forecast future cash flows and discount them back to the present to estimate the intrinsic value of a stock.

- Comparable Company Analysis: I compare the company’s financial metrics to those of comparable companies in the industry to derive a valuation multiple.

- Asset-Based Valuation: I analyze the company’s assets, such as its property, plant, and equipment, to determine a liquidation value as a floor for the valuation.

- Market Sentiment and Technical Analysis: I consider market sentiment and technical indicators to identify potential overvaluation or undervaluation in the stock price.

3. How do you identify potential investment opportunities?

- Company Fundamentals: I focus on companies with strong financial performance, solid management teams, and compelling industry outlooks.

- Technical Analysis: I use technical indicators to identify trends, support and resistance levels, and potential trading opportunities.

- Industry Research: I track industry news, trends, and developments to identify sectors and companies with high growth potential.

- IPO Market: I monitor the IPO market for potential investment opportunities in newly listed companies.

- Emerging Markets: I explore investment opportunities in emerging markets with high growth rates and favorable market conditions.

4. Describe your experience in using financial modeling tools and techniques.

- Excel: I am proficient in using Excel for financial modeling, data analysis, and scenario planning.

- Bloomberg: I leverage Bloomberg’s capabilities for real-time data access, market analysis, and financial modeling.

- Python and R: I have experience in using Python and R for data manipulation, statistical analysis, and machine learning applications.

- Other Tools: I am familiar with industry-specific financial modeling software and data providers.

5. How do you stay up-to-date with market trends and industry developments?

- Industry News and Publications: I regularly read industry publications, research reports, and financial news to stay informed about market trends.

- Conferences and Webinars: I attend industry conferences and webinars to gain insights from experts and network with peers.

- Online Learning: I take online courses and participate in certifications to enhance my knowledge and skills.

- Social Media: I follow industry influencers and thought leaders on social media to stay updated on the latest developments.

6. How do you handle multiple assignments and meet deadlines in a fast-paced environment?

- Prioritization and Planning: I prioritize tasks based on importance and urgency to ensure timely completion.

- Time Management: I use time management techniques, such as the Pomodoro Technique, to efficiently allocate my time.

- Delegation: I delegate tasks to team members when appropriate to manage workload and meet deadlines.

- Communication: I communicate regularly with stakeholders to keep them updated on my progress and identify potential bottlenecks.

7. Describe a time when you had to manage a complex financial analysis project.

Background

- I was tasked with evaluating the potential acquisition of a target company by my firm.

Challenges

- Limited financial data and information about the target company.

- Tight deadline to complete the analysis and present recommendations.

Actions

- Conducted extensive industry and competitor analysis to gather insights.

- Developed financial models to forecast the target company’s performance and assess the potential synergies.

- Presented clear and concise recommendations to management, outlining the risks and opportunities of the acquisition.

Results

- My analysis played a crucial role in the firm’s decision-making process.

- The acquisition was ultimately completed, resulting in significant value creation for the firm.

8. How do you handle mistakes or errors in your analysis?

- Acknowledge and Identify: I acknowledge errors promptly and identify the root cause to prevent recurrence.

- Transparency and Communication: I am transparent with stakeholders about errors and take ownership of my mistakes.

- Learning and Improvement: I use errors as learning opportunities to improve my analytical skills and processes.

- Focus on Solutions: I focus on finding solutions and corrective actions rather than dwelling on the mistake itself.

9. How do you collaborate with other team members, such as portfolio managers or traders?

- Regular Communication: I maintain open and regular communication with team members to exchange insights and coordinate efforts.

- Clear and Timely Updates: I provide timely updates on my research and analysis to keep team members informed.

- Constructive Feedback: I welcome constructive feedback from others and actively seek opportunities to collaborate and learn from their expertise.

- Alignment: I align my research and analysis with the overall investment strategy of the team.

10. Why are you interested in this role at our firm specifically?

- Firm Reputation and Expertise: I am drawn to your firm’s reputation as a leading provider of equity research and asset management services.

- Team and Culture: I am impressed by the caliber of your team and the collaborative and intellectually stimulating environment you foster.

- Growth Opportunities: I believe that this role will provide me with the opportunity to develop my skills, expand my knowledge, and contribute to the success of your firm.

- Alignment with Career Goals: This position aligns perfectly with my career goals of becoming a top-performing equity research analyst.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Equity Research Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Equity Research Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Equity Research Analysts play a vital role in the financial industry by providing valuable insights and recommendations to investors in making informed investment decisions. Their key responsibilities include:1. Company and Industry Analysis

Conduct in-depth research on individual companies and their respective industries to evaluate their financial performance, competitive landscape, and growth potential.

- Analyze financial statements, market data, and industry reports.

- Identify industry trends and macroeconomic factors that may impact company performance.

2. Valuation and Financial Modeling

Develop financial models to estimate the intrinsic value of companies and assess their investment potential.

- Use various valuation methods, such as discounted cash flow and comparable analysis.

- Create financial models to forecast future business performance and generate investment recommendations.

3. Investment Recommendations

Provide buy, sell, or hold recommendations to clients based on their investment analysis and industry knowledge.

- Write research reports that articulate their findings and support their investment recommendations.

- Communicate their insights to clients through meetings, presentations, and written reports.

4. Market Monitoring and Reporting

Track market developments, economic indicators, and company news to stay abreast of potential investment opportunities and risks.

- Monitor industry news and company announcements.

- Identify and report on potential market trends and emerging risks.

Interview Tips

To ace an interview for an Equity Research Analyst position, it is essential to demonstrate a combination of technical skills, analytical abilities, and communication proficiency. Effective interview preparation can significantly increase your chances of success. Here are some tips and hacks to help you prepare:1. Research the Company and Industry

Thoroughly research the company where you are applying, including its business model, financial performance, and industry standings. This will show the interviewer that you are genuinely interested in their organization and have taken the time to understand their operations.

- Review the company’s website, financial reports, and industry analysis.

- Identify recent company news, press releases, and announcements.

2. Practice Valuation and Modeling Techniques

Ensure you are well-versed in different valuation methods and financial modeling techniques. Interviewers will likely test your understanding of these concepts through case studies or simulations.

- Refer to industry publications, textbooks, or online resources to refresh your knowledge.

- Practice building financial models and performing valuations on hypothetical companies.

3. Bring Examples and Relevant Experience

During the interview, prepare to discuss specific examples of your past work and how they demonstrate your abilities in equity research. Quantify your accomplishments whenever possible.

- Share examples of successful investment recommendations you have made in the past.

- Highlight your experience in financial modeling or industry analysis.

4. Be Prepared to Discuss Your Investment Philosophy

Interviewers may ask you to elaborate on your investment philosophy and approach to equity research. Be ready to articulate your views on topics such as market valuation, risk management, and investment strategy.

- Reflect on your approach to research and investing.

- Explain your preferences for specific sectors, industries, or types of investments.

5. Practice Your Communication Skills

Exceptional communication skills are essential for Equity Research Analysts. Practice your ability to clearly articulate complex concepts, present your findings, and answer questions confidently.

- Engage in mock interviews with friends or colleagues.

- Record yourself presenting your research to assess your effectiveness.

Next Step:

Now that you’re armed with the knowledge of Equity Research Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Equity Research Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini