Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Equity Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

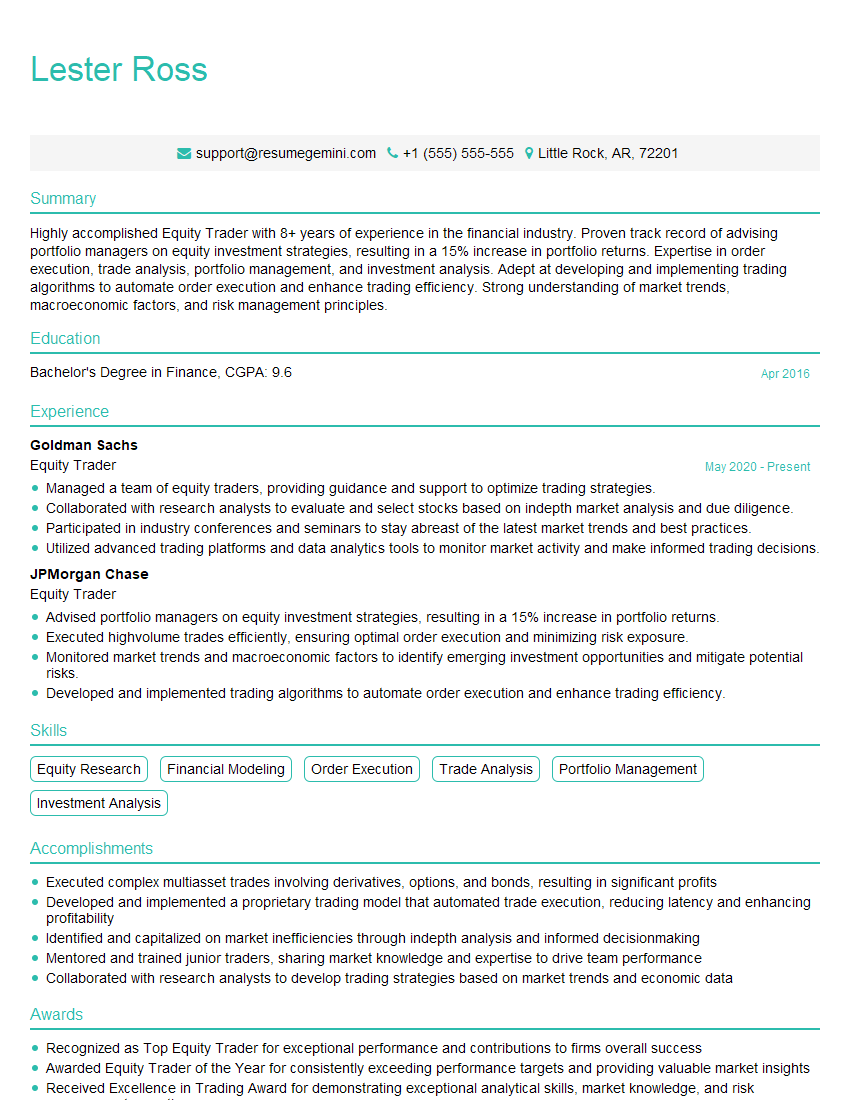

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Equity Trader

1. What are the key responsibilities of an Equity Trader?

- Understanding the equity markets and developing trading strategies

- Executing trades on behalf of clients and managing their portfolios

- Monitoring market trends and identifying trading opportunities

- Maintaining a deep understanding of financial regulations and compliance requirements

- Researching companies and analyzing their financial performance

2. What is your understanding of the different types of equity orders?

Market Orders

- Executed immediately at the current market price

Limit Orders

- Executed only when the stock price reaches a specified limit

Stop Orders

- Triggered when the stock price moves against the trader and helps to limit losses

3. Explain the concept of order routing and how you would determine the best execution for a client order?

- Order routing involves selecting the best exchange or trading platform to execute a client order

- Factors to consider include: speed of execution, cost, market depth, and reliability

- To determine the best execution, I would analyze market data, compare pricing and fees, and evaluate the track record of different venues

4. How do you manage risk in your trading strategies?

- I use stop-loss orders to limit potential losses on individual trades

- I diversify my portfolio across different sectors and asset classes

- I monitor market conditions and adjust my positions accordingly

- I stay updated on financial news and events that could impact the markets

5. How do you stay informed about market trends and identify trading opportunities?

- I read industry publications, attend conferences, and participate in online forums

- I use technical analysis tools to identify chart patterns and price trends

- I follow company news and earnings reports to stay informed about their financial performance

- I network with other traders and market professionals to exchange insights and ideas

6. What are the ethical and legal responsibilities of an Equity Trader?

- I am committed to adhering to all applicable laws and regulations

- I maintain confidentiality regarding client information and trading strategies

- I avoid conflicts of interest and disclose any potential conflicts to my clients

- I act with integrity and professionalism in all of my interactions

7. How do you keep up with the latest developments in the financial markets?

- I regularly attend industry conferences and webinars

- I read financial news and research reports

- I follow industry experts on social media

- I participate in online discussion forums

8. What are the key performance indicators (KPIs) that you track to measure your trading performance?

- Return on investment (ROI)

- Annualized return

- Sharpe ratio

- Win rate

- Average trade duration

9. How do you handle stressful situations in the trading environment?

- I remain calm and composed under pressure

- I focus on the task at hand and avoid making impulsive decisions

- I take breaks when necessary to clear my head

- I rely on my team and colleagues for support

10. What are your career goals and how do you see this role contributing to your professional development?

- My career goal is to become a portfolio manager

- This role will provide me with the opportunity to develop my trading skills, manage client portfolios, and gain exposure to the investment decision-making process

- I believe that the experience and knowledge I gain in this role will be invaluable to my future career

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Equity Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Equity Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Equity Traders buy and sell stocks, bonds, and other financial instruments for clients. They work in a fast-paced environment and must be able to make quick decisions. Their main responsibilities include:

1. Buy and sell equities

Equity traders execute trades for clients, either on the client’s behalf or as part of a larger trading strategy. They must have a deep understanding of the equity markets and be able to identify when a stock is undervalued or overvalued.

2. Monitor the market

Equity traders must constantly monitor the market for potential trading opportunities. They use a variety of tools to help them make decisions, including charting software, news feeds, and financial analysis.

3. Manage risk

Equity traders must manage the risk involved in their trades. They use a variety of techniques to do this, including stop-loss orders, limit orders, and hedging.

4. Build relationships with clients

Equity traders build relationships with clients to understand their needs and objectives. They must be able to communicate effectively with clients and keep them informed of the status of their trades.

Interview Tips

To ace an interview for an equity trader position, it is important to be prepared. Here are a few tips:

1. Research the firm and the industry

Before your interview, be sure to research the firm you are interviewing with and the equity trading industry. This will help you understand the firm’s culture and the challenges and opportunities facing the industry.

2. Practice your answers to common interview questions

There are a number of common interview questions that you can expect to be asked in an equity trader interview. It is important to practice your answers to these questions so that you can deliver them confidently and concisely. Some common interview questions include:

- Tell me about yourself.

- Why are you interested in equity trading?

- What are your strengths and weaknesses?

- How do you manage risk?

- What are your career goals?

3. Be prepared to talk about your experience

If you have any experience in equity trading, be sure to highlight this in your interview. Discuss your responsibilities, your accomplishments, and any challenges you faced. If you do not have any direct experience in equity trading, you can talk about your other experiences that are relevant to the job, such as your work in finance or your coursework in a related field.

4. Ask questions

At the end of your interview, be sure to ask the interviewer questions about the firm and the position. This shows that you are interested in the opportunity and that you are taking the interview seriously.

5. Follow up

After your interview, be sure to send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to remind them of your interest in the position.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Equity Trader, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Equity Trader positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.