Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Escrow Assistant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

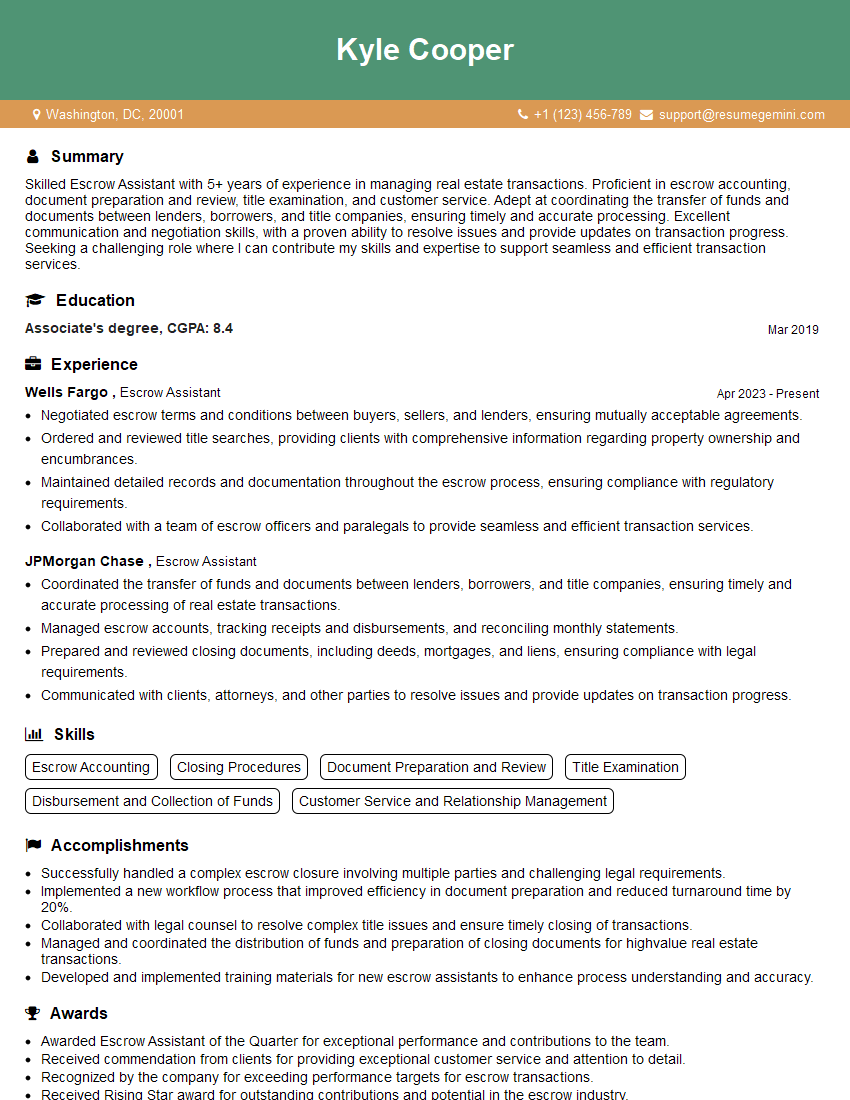

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Escrow Assistant

1. Describe the role of an Escrow Assistant.

An Escrow Assistant is responsible for assisting in the administration of escrow accounts and ensuring the smooth flow of transactions. Key responsibilities include:

- Coordinating with buyers, sellers, lenders, and other parties involved in real estate transactions

- Preparing and reviewing escrow documents, including deeds, mortgages, and closing statements

- Disbursing funds and ensuring that all financial obligations are met

- Tracking the status of transactions and maintaining accurate records

- Providing customer service and addressing any queries or concerns

2. Explain the different types of escrow accounts.

Types of Escrow Accounts

- Standard Escrow Account: Used in real estate transactions to hold funds from the buyer until the closing

- Construction Escrow Account: Holds funds used for the construction or repairs of a property

- Tax Escrow Account: Collects funds from homeowners to pay property taxes

- Insurance Escrow Account: Holds funds for the payment of insurance premiums

3. Describe the process of opening an escrow account.

The process of opening an escrow account typically involves the following steps:

- The buyer and seller (or their representatives) sign an escrow agreement

- The buyer deposits the required funds into the escrow account

- The escrow agent reviews the agreement and ensures that all necessary documents are in place

- The escrow account is opened and the funds are held until the closing

4. What are the common challenges faced by Escrow Assistants?

Some common challenges faced by Escrow Assistants include:

- Managing multiple transactions simultaneously: Coordinating the flow of documents and funds across several deals

- Meeting deadlines: Ensuring that all tasks are completed on time, even amidst unexpected delays

- Handling complex transactions: Understanding and resolving legal and financial issues that arise

- Communicating effectively: Relaying information clearly and promptly to all parties involved

- Staying organized: Maintaining accurate records and tracking the status of each transaction

5. How do you stay updated on changes in real estate laws and regulations?

To stay updated on changes in real estate laws and regulations, I regularly engage in the following practices:

- Attending industry conferences and workshops: Participating in events organized by professional associations

- Reading industry publications: Subscribing to newsletters, magazines, and online resources

- Consulting with legal and financial professionals: Seeking advice from experts in the field

- Taking continuing education courses: Enrolling in courses offered by institutions and organizations

- Monitoring government websites: Checking official sources for announcements and updates

6. What software programs are you proficient in using for escrow management?

I am proficient in using the following software programs for escrow management:

- Escrow Management Software: Specialized platforms designed specifically for escrow operations (e.g., Escrow Vision, Escrow Systems, TRU Digital)

- Document Management Systems: Software used for organizing and storing escrow documents (e.g., Dropbox, Google Drive, Microsoft SharePoint)

- Financial Accounting Software: Programs used for managing financial transactions and generating reports (e.g., QuickBooks, NetSuite, SAP)

- Communication Tools: Platforms used for communication and collaboration (e.g., Slack, Microsoft Teams, Zoom)

7. Describe your experience in handling wire transfers.

In my previous role as an Escrow Assistant, I was responsible for processing and managing wire transfers throughout the escrow process. My experience includes:

- Initiating wire transfers: Preparing and sending instructions to financial institutions for the transfer of funds

- Receiving wire transfers: Monitoring incoming wire transfers and ensuring that they are credited to the appropriate accounts

- Reconciling wire transfers: Matching wire transfer records with transaction details to ensure accuracy

- Troubleshooting wire transfer issues: Identifying and resolving any problems or delays encountered during wire transfers

8. Explain the importance of confidentiality in escrow.

Confidentiality is of utmost importance in escrow as it involves handling sensitive financial and personal information. I understand and adhere to the following principles to maintain confidentiality:

- Secure storage of documents: Storing escrow documents in a safe and secure manner, both physically and electronically

- Limited access to information: Restricting access to escrow-related information to authorized personnel only

- Encryption of data: Encrypting sensitive data to prevent unauthorized access

- Compliance with privacy regulations: Adhering to all applicable privacy laws and regulations, such as HIPAA and GDPR

9. How do you handle discrepancies in closing statements?

When discrepancies arise in closing statements, I follow a systematic process to resolve them efficiently:

- Identify the discrepancy: Carefully reviewing the closing statement and identifying the specific items that do not match

- Communicate with parties involved: Informing the buyer, seller, lender, and other relevant parties about the discrepancy

- Verify the source of the discrepancy: Investigating the origin of the error, whether it’s a calculation mistake, data entry error, or miscommunication

- Propose a solution: Suggesting a solution to correct the discrepancy while ensuring compliance with escrow instructions and legal requirements

- Update the closing statement: Once the discrepancy is resolved, updating the closing statement to reflect the corrected information

10. Describe your communication style and how you manage relationships with clients.

My communication style is professional, clear, and effective. I prioritize the following aspects in managing relationships with clients:

- Responsiveness: Promptly responding to inquiries and providing timely updates

- Transparency: Offering clear and concise explanations, ensuring that clients understand the escrow process and their obligations

- Active listening: Paying attention to clients’ concerns and needs, and addressing them promptly

- Building rapport: Establishing positive relationships based on trust and mutual respect

- Conflict resolution: Handling disagreements or misunderstandings in a professional and empathetic manner, aiming for mutually acceptable solutions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Escrow Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Escrow Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Escrow Assistant is a crucial role in the real estate transaction process, providing administrative and operational support to the Escrow Officer. They are responsible for ensuring the smooth flow of documents, communication, and coordination between parties involved in the transaction.

1. Document Management

Escrow Assistants are responsible for handling and managing a wide range of documents throughout the transaction, including contracts, deeds, loan applications, and closing statements. They ensure that all documents are accurate, complete, and properly filed and maintained.

- Prepare and review legal documents, such as deeds, mortgages, and closing statements.

- Maintain and organize escrow files, including all relevant documents and correspondence.

2. Communication and Coordination

Escrow Assistants act as a liaison between multiple parties involved in the transaction, including buyers, sellers, lenders, and attorneys. They facilitate communication, keep all parties informed, and coordinate schedules for signings and closings.

- Communicate with buyers, sellers, lenders, and other parties involved in the transaction.

- Schedule and coordinate closing appointments, ensuring that all necessary parties are present.

3. Transaction Processing

Escrow Assistants assist in the processing and tracking of funds involved in the transaction. They reconcile accounts, prepare disbursement statements, and ensure that all financial aspects of the transaction are handled accurately and efficiently.

- Receive and deposit earnest money deposits and other funds related to the transaction.

- Prepare and distribute disbursement statements, ensuring that all funds are distributed correctly.

4. Customer Service

Escrow Assistants often interact directly with buyers and sellers, providing them with information, support, and guidance throughout the transaction process. They strive to ensure a positive and seamless experience for all parties involved.

- Provide excellent customer service to buyers, sellers, and other parties involved in the transaction.

- Answer questions, address concerns, and provide updates on the status of the transaction.

- Maintain a high level of professionalism and confidentiality.

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace your interview for an Escrow Assistant position:

1. Research the company and the role

Before the interview, take the time to research the company you are applying to and the specific role you are interviewing for. This will help you understand their business, culture, and the key responsibilities of the position. You can visit the company’s website, read industry news, and check out their social media pages.

- Example: “I was particularly impressed by your company’s commitment to customer service, as evidenced by your recent award from the Better Business Bureau.”

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to encounter, such as “Tell me about yourself” or “Why are you interested in this role?” Prepare thoughtful and concise answers to these questions, highlighting your relevant skills and experience.

- Example: For the question “Why are you interested in this role?” you could respond with, “I am drawn to the opportunity to utilize my strong organizational and communication skills in a role that supports the smooth flow of real estate transactions.”

3. Prepare questions to ask the interviewer

Asking thoughtful questions during the interview shows that you are engaged and interested in the position. Prepare a few questions that you can ask the interviewer about the role, the company, or the industry.

- Example: “I am curious to learn more about the company’s plans for growth in the coming years. Can you share any insights on that?”

4. Dress professionally and arrive on time

First impressions matter, so make sure to dress professionally for your interview. Arrive on time, or even a few minutes early, to show that you are punctual and respectful of the interviewer’s time.

- Example: Arrive at the interview location 10-15 minutes early to allow yourself time to relax and prepare.

5. Be confident and enthusiastic

Confidence is key in an interview. Believe in your abilities and present yourself in a positive and enthusiastic manner. Your interviewer will be more likely to be impressed by someone who is confident and passionate about the role.

- Example: Maintain eye contact with the interviewer, speak clearly and confidently, and use positive body language.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Escrow Assistant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.