Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Escrow Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

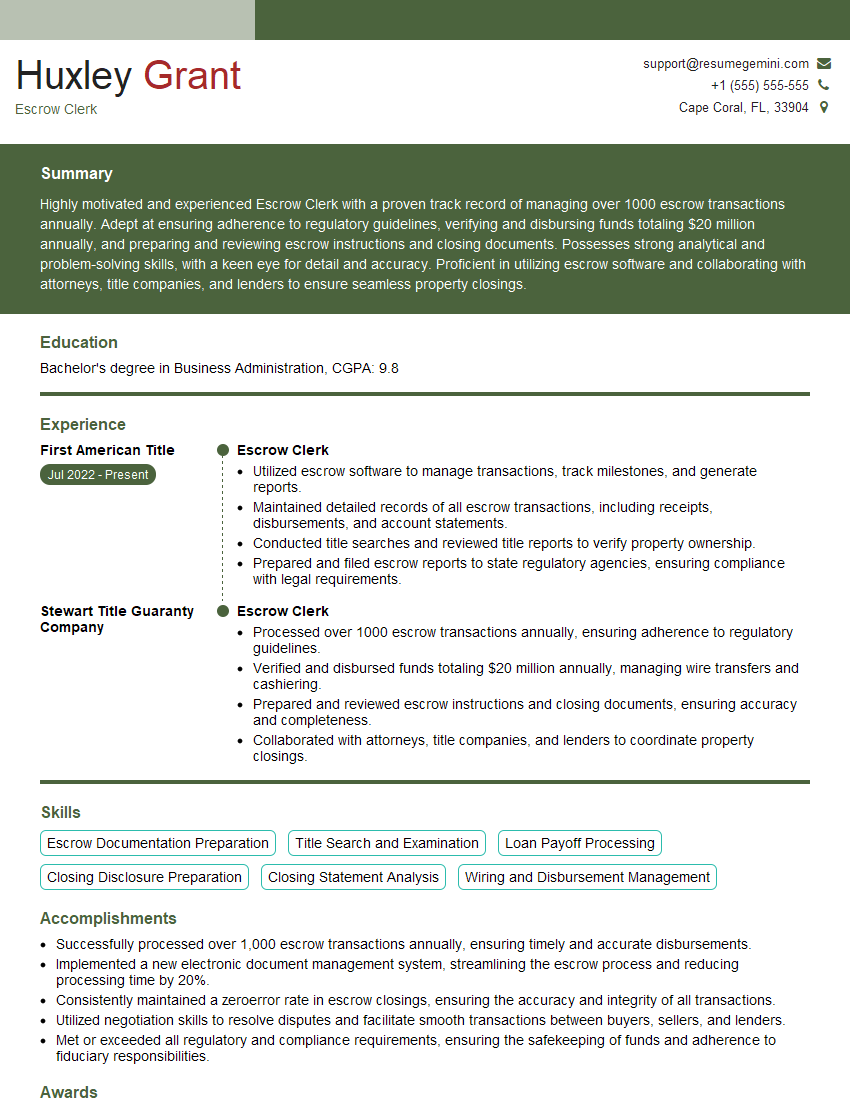

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Escrow Clerk

1. Describe the essential steps involved in handling an escrow transaction?

- Explain the process of receiving and reviewing purchase agreements and other required documents.

- Discuss the verification of buyer and seller information, including identity, financial eligibility, and property ownership.

- Outline the preparation and distribution of escrow instructions to all parties involved.

- Describe the process of collecting and holding funds, including earnest money deposits, closing costs, and loan proceeds.

- Explain the coordination of inspections, appraisals, and other contingencies required for closing.

2. How do you ensure the accuracy and completeness of closing documents?

Review of Legal Documents

- Thoroughly review all legal documents, including purchase agreements, loan documents, and deeds.

- Verify the accuracy of information such as names, dates, property descriptions, and financial figures.

- Ensure that all required signatures and notarizations are obtained.

Coordination with Attorneys and Lenders

- Communicate with attorneys and lenders to clarify any discrepancies or missing information.

- Obtain legal advice as needed to ensure compliance with laws and regulations.

3. What are the procedures you follow when there are disputes or disagreements among parties involved in an escrow transaction?

- Listen attentively to all parties involved to understand their perspectives.

- Review the escrow instructions and related documents to determine the legal obligations of each party.

- Attempt to facilitate communication and negotiation between the parties.

- If necessary, seek legal advice or engage a mediator to resolve the dispute amicably.

- Document all communication and actions taken during the dispute resolution process.

4. Explain your understanding of the role of an escrow holder in protecting the interests of both the buyer and seller in a real estate transaction.

- Impartiality and Confidentiality: Maintain a neutral position and treat all parties fairly.

- Safeguarding Funds: Hold funds and valuables securely, following escrow instructions and legal requirements.

- Facilitating Communication: Serve as a communication channel between the buyer and seller, ensuring a smooth and informed process.

- Enforcing Contractual Obligations: Ensure that all parties comply with the terms of the escrow agreement.

- Protecting Legal Rights: Advise parties of their legal rights and obligations, and seek legal advice when necessary.

5. Describe your experience with handling complex or high-value escrow transactions.

- Provide specific examples of complex transactions you have managed, highlighting the challenges and how you successfully navigated them.

- Discuss your ability to handle large sums of money and ensure the integrity of the funds throughout the escrow process.

- Explain how you coordinated with multiple parties, including attorneys, lenders, and title companies, to ensure a seamless closing.

6. How do you stay up-to-date on changes in real estate laws and regulations that impact escrow transactions?

- Attend industry events, seminars, and webinars.

- Subscribe to legal publications and online resources.

- Network with other escrow professionals and real estate attorneys.

- Review updates and announcements from regulatory agencies and professional organizations.

7. Can you describe your experience with handling wire transfers and other electronic fund transactions?

- Explain your understanding of wire transfer procedures and security protocols.

- Discuss your experience with verifying wire transfer information and ensuring funds are sent and received accurately.

- Describe your knowledge of electronic fund transfer systems and the steps you take to prevent fraud or errors.

8. What do you do to ensure the confidentiality and security of sensitive financial information handled during escrow transactions?

- Explain your understanding of confidentiality requirements and data protection regulations.

- Describe the security measures you implement, such as secure document storage, encryption, and access controls.

- Discuss your training and awareness of cybersecurity threats and how you protect against them.

9. How do you prioritize your workload and manage multiple escrow transactions simultaneously?

- Explain your time management techniques and how you prioritize tasks effectively.

- Describe your ability to stay organized and manage multiple deadlines without compromising accuracy.

- Discuss your experience with using technology and software tools to streamline your workflow.

10. Can you provide an example of a challenging situation you faced as an escrow clerk and how you resolved it?

- Describe a specific challenge or obstacle you encountered.

- Explain the steps you took to analyze the situation, identify solutions, and resolve the issue.

- Highlight your problem-solving skills, communication abilities, and professionalism.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Escrow Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Escrow Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Escrow Clerk plays a crucial role in the real estate industry, ensuring the smooth flow of funds and documents during property transactions. Their key responsibilities include:1. Managing Escrow Accounts

Maintaining accurate records of escrow accounts, including deposits, withdrawals, and disbursements.

Preparing and issuing escrow statements to clients, providing a detailed breakdown of transactions.

2. Processing Documents

Reviewing, verifying, and processing legal documents related to property transactions, such as purchase agreements, loan documents, and title reports.

Ensuring that all signatures, dates, and other details are accurate and complete.

3. Disbursing Funds

Distributing funds from escrow accounts to the appropriate parties, such as sellers, buyers, lenders, and title companies.

Preparing and releasing funds only upon receiving proper authorization and documentation.

4. Communicating with Clients

Providing clear and timely updates to clients on the status of escrow transactions.

Answering questions, addressing concerns, and ensuring that all parties are well-informed.

5. Maintaining Compliance

Adhering to industry regulations and best practices to ensure the integrity of escrow transactions.

Following established procedures and documentation requirements to mitigate risk and protect client funds.

Interview Tips

To ace an interview for an Escrow Clerk position, candidates should focus on demonstrating their technical skills, attention to detail, and ability to work effectively in a fast-paced environment. Here are some tips:1. Research the Industry and Company

Familiarize yourself with the real estate industry, escrow process, and specific practices of the company you are interviewing with.

This will enable you to speak intelligently about your understanding of the role and demonstrate your interest in the company.

2. Highlight Your Technical Skills

Emphasize your proficiency in escrow accounting, document processing, and knowledge of escrow software.

Provide specific examples of how you have used these skills to ensure accurate and efficient transaction management.

3. Showcase Your Accuracy and Detail-Oriented Nature

Stress your meticulous attention to detail and ability to handle complex financial transactions with precision.

Share anecdotes or provide evidence of your ability to identify and rectify errors in documentation or calculations.

4. Demonstrate Your Communication Skills

Emphasize your ability to communicate effectively with clients, colleagues, and other stakeholders.

Provide examples of how you have successfully resolved conflicts, provided clear explanations, or maintained positive relationships during challenging transactions.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest in the role and the company.

Consider questions about the company’s escrow procedures, quality control measures, or professional development opportunities.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Escrow Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.