Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Escrow Closer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

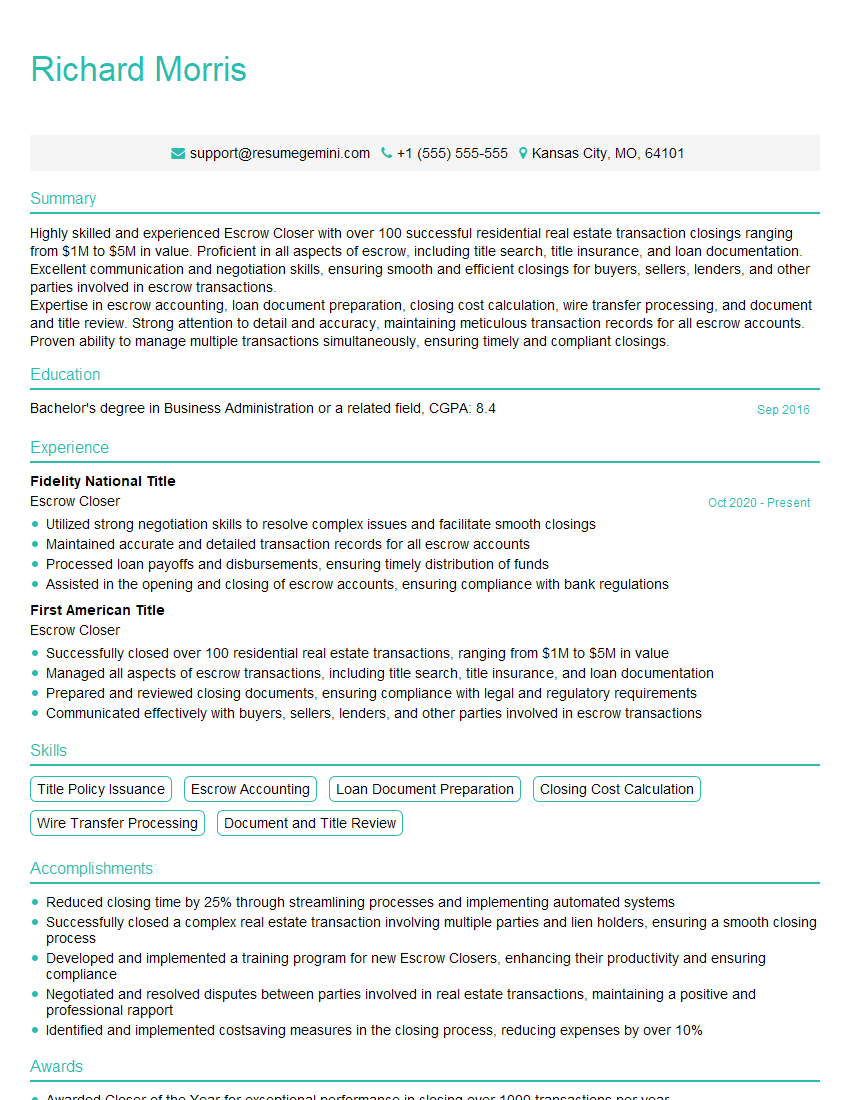

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Escrow Closer

1. What are the key responsibilities of an Escrow Closer?

As an Escrow Closer, I am responsible for a wide range of tasks that contribute to the smooth and efficient closing of real estate transactions. These responsibilities include:

- Preparing and reviewing loan documents, deeds, and other closing documents.

- Ensuring that all parties involved in the transaction have a thorough understanding of the documents and their responsibilities.

- Calculating and collecting closing costs, including title insurance, lender fees, and other expenses.

- Disbursing funds to the appropriate parties, such as the lender, seller, and buyer.

- Maintaining accurate records of all transactions and providing updates to clients.

2. What is the difference between an Escrow Officer and an Escrow Closer?

Role of Escrow Officer

- Manages the escrow account.

- Receives and holds funds from buyers and sellers.

- Disburses funds according to the instructions of the parties involved.

Role of Escrow Closer

- Reviews and prepares closing documents.

- Conducts the closing meeting.

- Ensures that all parties understand and sign the closing documents.

- Distributes the funds and records the transaction.

Key Difference

While both roles are involved in the escrow process, the Escrow Closer has a more direct involvement in the closing of the transaction.

3. What are some of the challenges you have faced as an Escrow Closer?

- Dealing with complex transactions, such as those involving multiple properties or parties.

- Resolving title issues or other legal problems that may arise during the escrow period.

- Managing the expectations of clients who may have different timelines or priorities.

- Staying up-to-date with changes in laws and regulations that affect real estate transactions.

4. How do you stay organized and manage multiple transactions simultaneously?

I use a combination of tools and techniques to stay organized and manage multiple transactions simultaneously, including:

- Creating a detailed closing timeline for each transaction.

- Using checklists to track the progress of each task.

- Prioritizing tasks based on their urgency and importance.

- Delegating tasks to other team members when necessary.

- Communicating regularly with clients to keep them updated on the status of their transactions.

5. What is your experience with handling short sales or foreclosures?

I have experience handling both short sales and foreclosures. In a short sale, I work with the lender to negotiate a settlement that allows the borrower to sell the property for less than the amount owed on the mortgage. In a foreclosure, I work with the lender to finalize the legal process of repossessing the property.

- In both cases, my goal is to protect the interests of all parties involved and to ensure a smooth and efficient closing.

6. How do you handle disputes or conflicts that may arise during the escrow process?

- I approach disputes or conflicts with a focus on communication and problem-solving.

- I listen to the concerns of all parties involved and try to understand their perspectives.

- I work to identify the root cause of the dispute and explore options for resolution that are fair to all parties.

- If necessary, I consult with legal counsel or other experts to ensure that the resolution is compliant with applicable laws.

7. What is your understanding of the Real Estate Settlement Procedures Act (RESPA)?

The Real Estate Settlement Procedures Act (RESPA) is a federal law that governs the disclosure of closing costs and other settlement charges in real estate transactions. RESPA is designed to protect consumers from unfair or deceptive practices.

- As an Escrow Closer, I am responsible for complying with RESPA’s requirements.

- This includes providing buyers and sellers with a detailed closing disclosure that outlines all of the costs associated with the transaction.

8. How do you stay updated on changes in laws and regulations that affect real estate transactions?

I stay updated on changes in laws and regulations that affect real estate transactions by attending industry conferences, reading industry publications, and taking continuing education courses.

- I am also a member of professional organizations, such as the American Escrow Association (AEA), which provides resources and updates on regulatory changes.

9. What software or tools do you use in your role as an Escrow Closer?

In my role as an Escrow Closer, I use a variety of software and tools to manage transactions and stay organized. These include:

- Escrow management software

- Document preparation software

- Electronic signature software

- Communication and collaboration tools

- Project management tools

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing excellent customer service and your reputation for ethical and professional conduct.

- I am also drawn to your company’s focus on technology and innovation.

- I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the continued success of your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Escrow Closer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Escrow Closer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Escrow Closer is a crucial professional who facilitates real estate transactions by ensuring the smooth transfer of funds and ownership between buyers, sellers, and lenders. Their primary responsibilities include:

1. Review and Prepare Closing Documents

Escrow Closers meticulously review and prepare a comprehensive set of closing documents, including deeds, mortgages, and title policies. They ensure that all documents are accurate, complete, and compliant with legal requirements.

2. Conduct Escrow Closing Meetings

Escrow Closers conduct closing meetings with all parties involved in the transaction. They explain the closing process, review the documents, and facilitate the signing of all necessary paperwork. They ensure that all parties understand the terms of the transaction and have their questions answered.

3. Disburse Funds and Record Documents

Once the closing documents are signed, Escrow Closers coordinate the disbursement of funds to the appropriate parties, including buyers, sellers, lenders, and title companies. They also file the necessary documents with government agencies to transfer ownership and record the transaction.

4. Provide Customer Service

Escrow Closers provide exceptional customer service throughout the transaction. They respond promptly to inquiries, address concerns, and keep all parties informed of the progress of the closing process.

Interview Tips

To ace an interview for an Escrow Closer position, it’s essential to prepare thoroughly and showcase your skills and qualifications. Here are some effective tips:

1. Research the Company and Role

Before the interview, research the company and the specific Escrow Closer position you’re applying for. Understand their business model, values, and any specific requirements for the role. This will demonstrate your interest and knowledge of the industry.

2. Quantify Your Accomplishments

When discussing your experience, use specific numbers and metrics to quantify your accomplishments. For example, instead of saying “I closed a large number of transactions,” say “I closed over 150 transactions exceeding $75 million in value in the past year.”

3. Highlight Your Attention to Detail

Escrow Closers must have exceptional attention to detail. Highlight your ability to meticulously review and handle complex documents. Provide examples of times you identified errors or discrepancies and took prompt action to resolve them.

4. Demonstrate Your Communication Skills

As an Escrow Closer, you will interact with various stakeholders. Emphasize your strong communication skills, both verbal and written. Share examples of how you effectively convey complex information to clients and colleagues.

5. Practice Answering Common Interview Questions

Prepare answers to common Escrow Closer interview questions, such as:

- Tell us about your experience in reviewing and preparing closing documents.

- Describe a challenging escrow transaction you handled successfully.

- How do you stay up-to-date with industry regulations and best practices?

Next Step:

Now that you’re armed with the knowledge of Escrow Closer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Escrow Closer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini