Are you gearing up for an interview for a Escrow Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Escrow Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

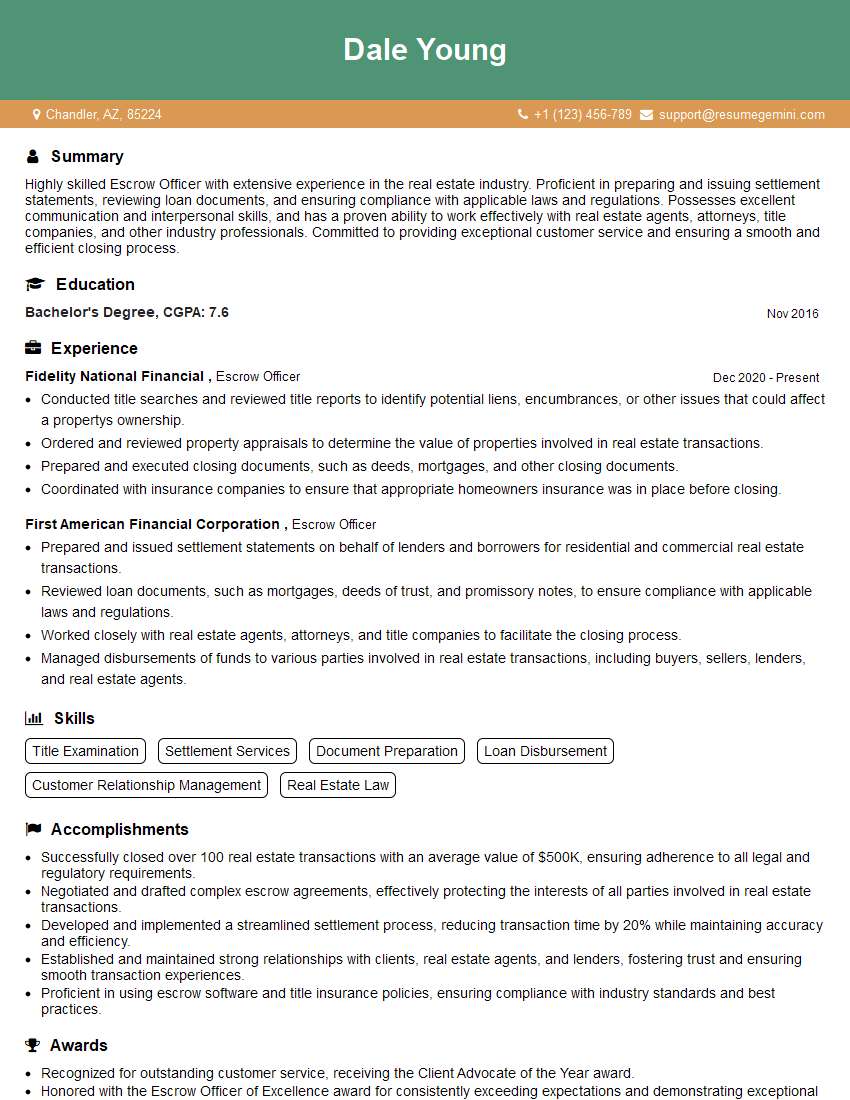

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Escrow Officer

1. Describe the role of an escrow officer in a real estate transaction.

The escrow officer acts as a neutral third party who holds and disburses funds, documents and instructions between the buyer, seller, lender and other parties involved in a real estate transaction.

2. What are the key responsibilities of an escrow officer?

Compliance

- Ensure compliance with all applicable laws, regulations and ethical standards.

- Maintain accurate and complete records.

Communication

- Communicate effectively with all parties involved in the transaction.

- Keep clients informed of the status of their transaction.

Transaction Management

- Coordinate all aspects of the transaction, including document preparation, fund disbursement and property inspections.

- Review and approve all documents before closing.

3. What are the qualities and skills required to be successful as an escrow officer?

Excellent communication and interpersonal skills, strong attention to detail, ability to manage multiple tasks and projects, knowledge of real estate law and procedures, ability to work independently and as part of a team.

4. What is the difference between an escrow officer and a title officer?

- Escrow officers handle the financial aspects of a real estate transaction, while title officers handle the legal aspects.

- Escrow officers hold and disburse funds, while title officers research and issue title insurance.

5. What are the common challenges faced by escrow officers?

- Dealing with difficult clients

- Managing complex transactions

- Meeting deadlines

- Staying up-to-date on changes in the real estate industry

6. What is the role of technology in the escrow process?

- Technology has streamlined many aspects of the escrow process, making it more efficient and convenient.

- Escrow officers now use software to track transactions, manage documents, and communicate with clients.

7. How do you ensure the security of funds and documents in an escrow transaction?

- Escrow officers use a variety of security measures to protect funds and documents, including secure storage facilities, encryption, and background checks on employees.

- They also follow strict procedures to prevent fraud and theft.

8. What is your experience with handling complex real estate transactions?

Provide specific examples of complex transactions you have handled, such as transactions involving multiple properties, foreign buyers, or estate sales.

9. What is your understanding of the legal and ethical responsibilities of an escrow officer?

Escrow officers have a fiduciary duty to act in the best interests of their clients and to comply with all applicable laws and regulations.

10. How do you stay up-to-date on changes in the real estate industry?

- Attend industry conferences and webinars

- Read trade publications and online resources

- Network with other professionals in the field

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Escrow Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Escrow Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Escrow Officer is a licensed professional who acts as a neutral third party in real estate transactions, ensuring that the terms of the purchase agreement are met and that all funds and documents are handled securely.

1. Manage Escrow Accounts

Open and maintain escrow accounts, track incoming and outgoing funds, and reconcile account balances.

- Ensure that all funds are deposited into the escrow account as per the purchase agreement.

- Disburse funds to the appropriate parties at the closing of the transaction.

2. Prepare and Review Documents

Prepare and review closing documents, such as deeds, mortgages, and title insurance policies.

- Verify the accuracy and completeness of all documents to ensure that they comply with legal requirements.

- Obtain necessary signatures from all parties involved in the transaction.

3. Coordinate with Lenders and Real Estate Agents

Communicate with lenders, real estate agents, buyers, and sellers to coordinate the closing process.

- Provide status updates and answer questions from all parties involved.

- Facilitate the exchange of documents and funds between the parties.

4. Comply with Regulations

Adhere to all applicable laws, regulations, and industry standards governing escrow transactions.

- Maintain accurate records of all transactions and comply with reporting requirements.

- Stay up-to-date on changes in legal and regulatory requirements.

Interview Tips

To ace an interview for an Escrow Officer position, candidates should focus on highlighting their knowledge of escrow processes, attention to detail, and communication skills.

1. Research the Company and Position

Thoroughly research the company and the specific Escrow Officer role you are applying for.

- Understand the company culture, values, and areas of specialization.

- Review the job description and identify the key responsibilities and qualifications.

2. Highlight Relevant Experience

Emphasize your experience in escrow closings, document handling, and customer service.

- Provide specific examples of successful escrow transactions you have managed.

- Showcase your ability to handle multiple tasks and meet deadlines.

3. Demonstrate Attention to Detail

Escrow Officers must be meticulous and accurate.

- Highlight your attention to detail and ability to detect and correct errors.

- Mention any processes or systems you have implemented to improve accuracy.

4. Emphasize Communication Skills

Escrow Officers often interact with clients, lenders, and real estate agents.

- Showcase your strong verbal and written communication skills.

- Provide examples of how you have effectively communicated complex information to different audiences.

5. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers.

- Research typical questions asked in Escrow Officer interviews.

- Develop clear and concise answers that highlight your skills and experience.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Escrow Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Escrow Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.