Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Escrow Representative interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Escrow Representative so you can tailor your answers to impress potential employers.

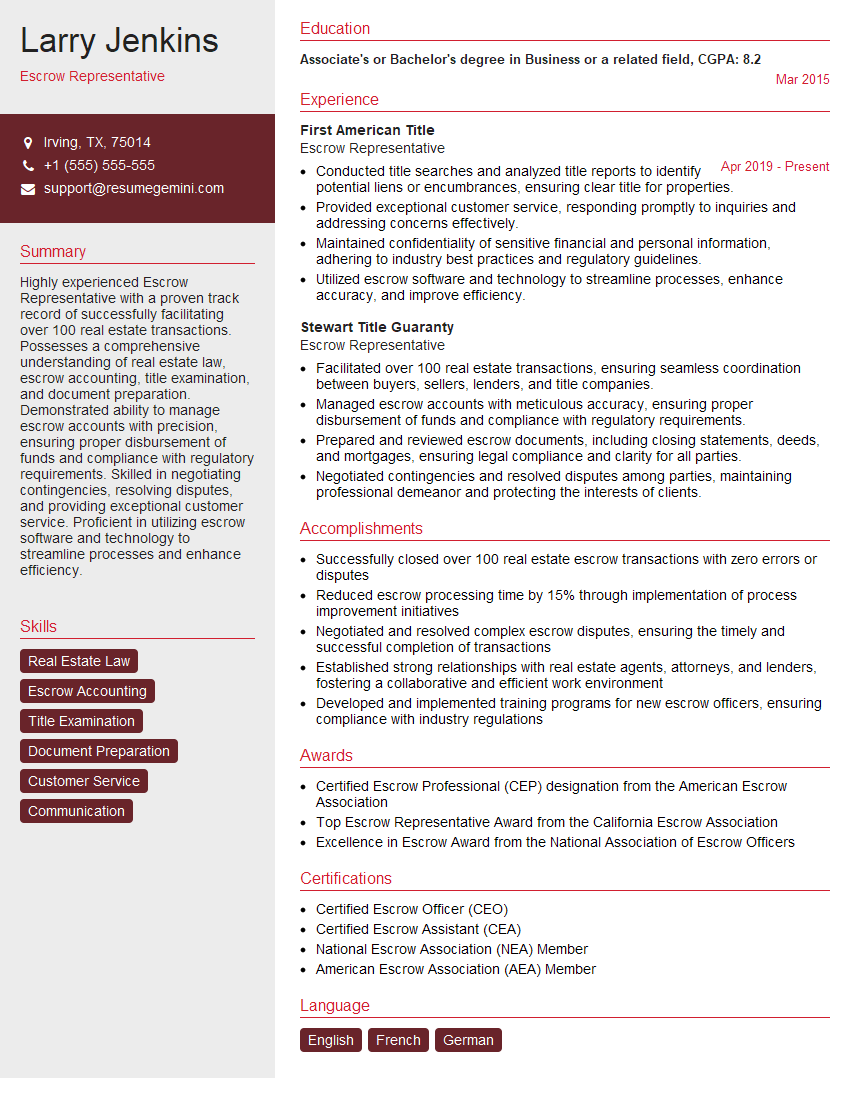

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Escrow Representative

1. What are the key responsibilities and duties of an Escrow Representative?

As an Escrow Representative, I would be responsible for:

- Acting as a neutral third party in real estate transactions

- Holding and disbursing funds and documents according to the escrow instructions

- Preparing and executing closing documents

- Communicating with buyers, sellers, lenders, and other parties involved in the transaction

- Ensuring that all legal and regulatory requirements are met

2. What are the qualities and skills that make a successful Escrow Representative?

Professional Qualities

- Strong attention to detail

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- High level of integrity and ethics

Technical Skills

- Knowledge of real estate law and escrow procedures

- Experience with closing software and transaction management systems

- Strong organizational and time management skills

- Ability to handle multiple transactions simultaneously

3. Describe your understanding of the escrow process.

The escrow process involves several key steps:

- The buyer and seller enter into a purchase agreement and open an escrow account.

- The buyer deposits earnest money into the escrow account.

- The escrow agent prepares and sends out closing documents to all parties.

- The buyer and seller sign the closing documents and the escrow agent disburses funds according to the instructions.

- The transaction is complete and the property is transferred to the buyer.

4. How do you handle disputes or conflicts that arise during an escrow transaction?

To handle disputes or conflicts, I would:

- Remain impartial and avoid taking sides.

- Communicate with all parties to understand their perspectives.

- Review the escrow instructions and applicable law.

- Attempt to negotiate a mutually acceptable solution.

- If necessary, seek legal advice or involve a mediator.

5. How do you stay up-to-date on changes in real estate law and escrow procedures?

To stay up-to-date, I would:

- Attend industry conferences and webinars.

- Subscribe to industry publications and email alerts.

- Network with other Escrow Representatives and professionals.

- Obtain continuing education and professional development.

6. What is your experience with handling complex or high-value escrow transactions?

In my previous role, I handled several complex and high-value escrow transactions, including:

- A $5 million commercial property purchase

- A luxury home transaction involving multiple contingencies

- A complex 1031 exchange transaction

7. How do you ensure the security and confidentiality of sensitive client information?

To ensure the security and confidentiality of sensitive client information, I would:

- Follow established security protocols and procedures

- Store and transmit data securely

- Limit access to information on a need-to-know basis

- Train staff on the importance of data security

8. How do you manage multiple escrow transactions simultaneously and meet deadlines?

To manage multiple escrow transactions simultaneously and meet deadlines, I would:

- Prioritize tasks and create a detailed schedule

- Delegate tasks to team members as needed

- Use technology to streamline processes and improve efficiency

- Communicate regularly with all parties to stay on track

9. What are some common challenges that Escrow Representatives face, and how do you overcome them?

Some common challenges that Escrow Representatives face include:

- Title issues and other unexpected delays

- Disputes between buyers and sellers

- Changes in financing or loan approvals

- I overcome these challenges by:

- Communicating clearly and frequently with all parties

- Remaining flexible and adapting to changing circumstances

- Seeking legal advice or involving a mediator when necessary

10. Why are you interested in joining our company as an Escrow Representative?

I am interested in joining your company as an Escrow Representative because:

- Your company has a strong reputation in the industry.

- I am impressed by your commitment to providing excellent customer service.

- I believe my skills and experience would be a valuable asset to your team.

- I am eager to learn and grow in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Escrow Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Escrow Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Escrow Representatives are the gatekeepers of financial transactions, ensuring the smooth transfer of funds and property between parties. Their responsibilities encompass a wide range of tasks, including:

1. Transaction Management

The core duty of an Escrow Representative is to oversee and manage escrow transactions, including:

- Preparing and reviewing escrow agreements

- Opening and maintaining escrow accounts

- Receiving and disbursing funds according to the agreement

- Ensuring all necessary documentation is collected and verified

- Closing the escrow transaction upon completion

2. Escrow Accounting

Escrow Representatives handle the financial aspects of escrow transactions, including:

- Maintaining accurate escrow account records

- Reconciling bank statements and escrow accounts

- Preparing and issuing escrow statements

- Communicating with parties about financial matters

3. Title and Property Verification

Escrow Representatives verify the legal aspects of real estate transactions, including:

- Reviewing title reports and title insurance policies

- Ensuring liens, encumbrances, and other issues are cleared

- Verifying property surveys and legal descriptions

4. Customer Service and Communication

Escrow Representatives serve as the primary contact for parties involved in escrow transactions, providing:

- Clear and timely communication throughout the process

- Updates on transaction status and any potential issues

- Assistance with paperwork and documentation

Interview Tips

Ace your Escrow Representative interview by following these expert tips:

1. Research the Industry

Show your knowledge and interest in the industry by researching:

- Current real estate trends and regulations

- Escrow laws and procedures in your jurisdiction

- Industry best practices and ethical guidelines

2. Highlight Your Accuracy and Attention to Detail

Emphasize your meticulous nature and ability to handle complex transactions flawlessly:

- Provide examples of your strong organizational and time management skills

- Discuss instances where you ensured accuracy in financial or legal documentation

3. Showcase Your Communication Skills

Demonstrate your ability to effectively communicate with clients and colleagues:

- Highlight your proficiency in written and verbal communication

- Provide examples of how you handled difficult conversations and resolved conflicts

4. Emphasize Your Customer Service Orientation

Convey your commitment to providing exceptional service:

- Share stories of how you went above and beyond to meet client needs

- Explain how you build and maintain strong relationships with clients and colleagues

5. Prepare Questions to Ask

Asking insightful questions shows your interest and preparation:

- Inquire about the company’s escrow process and best practices

- Ask about opportunities for professional development and career advancement

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Escrow Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.