Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Estate Planner interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Estate Planner so you can tailor your answers to impress potential employers.

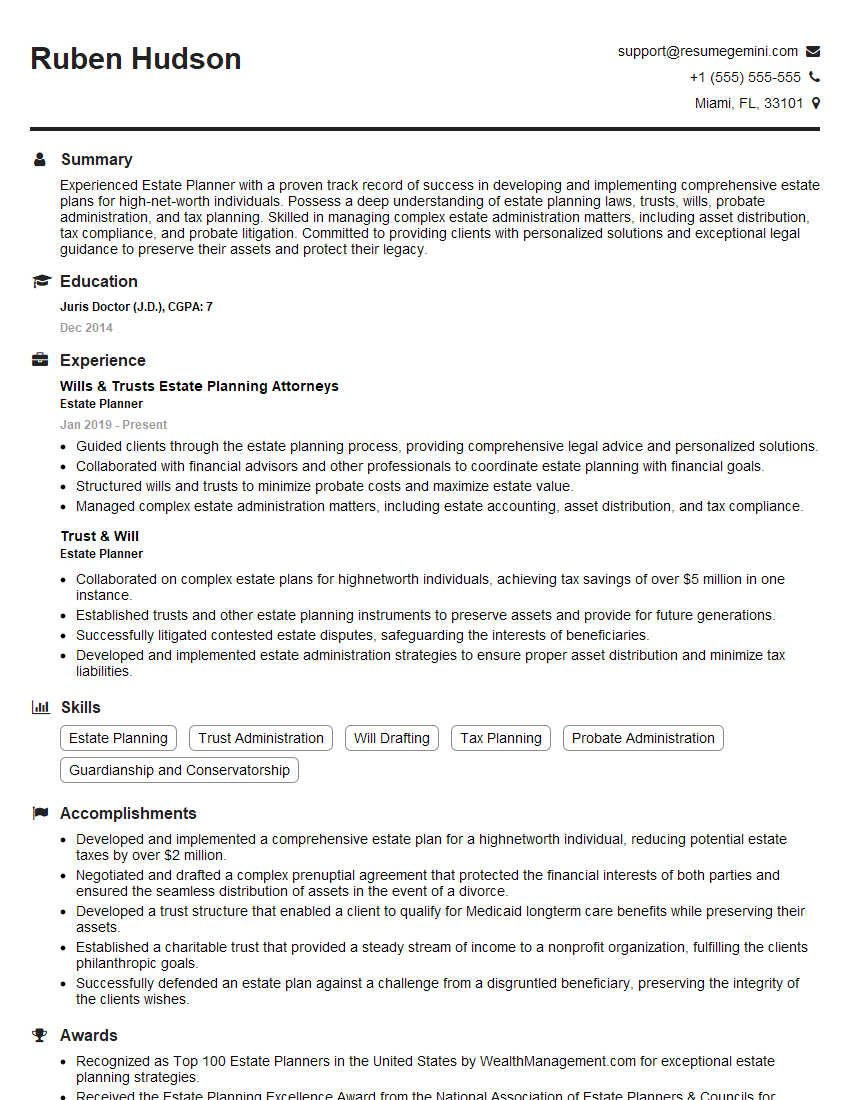

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Estate Planner

1. Explain the key steps involved in preparing an estate plan?

The key steps involved in preparing an estate plan include:

- Gathering information about the client’s assets, liabilities, and family situation

- Identifying the client’s estate planning goals

- Developing a plan to achieve the client’s goals

- Drafting the necessary estate planning documents, such as a will, trust, and power of attorney

- Reviewing the estate plan with the client and making any necessary changes

- Implementing the estate plan

2. What are the different types of trusts and when would you recommend each type?

Revocable Living Trusts

- Provides flexibility and control over assets during the grantor’s lifetime

- Avoids probate and allows for privacy

- Recommended for individuals seeking asset protection and estate tax minimization

Irrevocable Life Insurance Trusts (ILITs)

- Removes life insurance proceeds from the grantor’s taxable estate

- Provides estate tax savings and asset protection

- Recommended for high-net-worth individuals with significant life insurance policies

Charitable Remainder Trusts (CRTs)

- Provides a stream of income to the grantor or beneficiaries for a set period

- After the term expires, the remaining assets are distributed to a designated charity

- Recommended for individuals seeking both tax savings and charitable giving

3. Describe the role of a personal representative in estate administration.

The role of a personal representative, also known as an executor or administrator, in estate administration includes:

- Probate the will or administer the estate if there is no will

- Identify and gather the decedent’s assets

- Pay the decedent’s debts and taxes

- Distribute the remaining assets to the beneficiaries

- File all necessary paperwork and legal documents

4. What are the key tax considerations when drafting an estate plan?

Key tax considerations when drafting an estate plan include:

- Federal estate tax

- Federal generation-skipping transfer tax

- State inheritance tax

- Gift tax

- Capital gains tax

5. Explain the concept of “testamentary capacity” and how it is determined.

Testamentary capacity is the legal ability to make a valid will or trust. To have testamentary capacity, an individual must:

- Be of sound mind and body

- Understand the nature and extent of their property

- Understand the nature and consequences of making a will or trust

- Not be under the influence of undue influence or coercion

Determining testamentary capacity is a legal question that is typically decided by a court or jury.

6. What are the ethical considerations for estate planners?

Ethical considerations for estate planners include:

- Confidentiality

- Conflicts of interest

- Duty of loyalty

- Duty of competence

Estate planners must adhere to these ethical standards to ensure that their clients’ interests are protected.

7. Describe the process of administering a trust.

The process of administering a trust typically involves:

- Identifying and gathering the trust assets

- Investing the trust assets

- Distributing income and principal to the beneficiaries

- Filing all necessary paperwork and legal documents

- Terminating the trust when the trust term expires or the trust purpose has been fulfilled

8. What are the advantages and disadvantages of using a will versus a trust?

Wills

Advantages:

- Simple and straightforward to create

- Relatively inexpensive to create

Disadvantages:

- Subject to probate, which can be time-consuming and expensive

- Less privacy than a trust

- Less control over the distribution of assets

Trusts

Advantages:

- Avoids probate

- Provides more privacy

- More control over the distribution of assets

Disadvantages:

- More complex and expensive to create than a will

- Requires ongoing administration

9. Discuss the use of life insurance in estate planning.

Life insurance can be used in estate planning in a number of ways, including:

- To provide liquidity to pay estate taxes

- To replace income lost due to the death of a breadwinner

- To fund a trust or other estate planning vehicle

- To provide a death benefit to a charity or other organization

10. Describe the role of technology in modern estate planning.

Technology is playing an increasingly important role in modern estate planning. Some of the ways that technology is being used in estate planning include:

- Document management and storage

- Estate planning software

- Online trusts

- Digital assets

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Estate Planner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Estate Planner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Estate Planner has the crucial role of advising clients on strategies related to estate planning. The goal is to ensure that the client’s assets are distributed according to their wishes upon their passing. Below are some key responsibilities of an Estate Planner:1. Estate Planning Consultation and Analysis

An Estate Planner gathers relevant client information and assesses their estate planning needs through in-depth consultations. Understanding the client’s goals, wealth, and family dynamics is integral to developing tailor-made solutions.

2. Estate Plan Design and Implementation

Based on the client’s objectives, the Estate Planner devises and implements a comprehensive estate plan. This might involve drafting wills, trusts, powers of attorney, and other legal documents essential for managing assets and ensuring the seamless transfer of wealth during transition.

3. Tax and Accounting Considerations

Estate Planners possess a deep understanding of tax laws and accounting principles. They leverage this knowledge to design strategies that minimize tax liabilities and optimize asset distribution, ensuring the maximization of the client’s wealth.

4. Asset Protection and Risk Management

Estate Planners safeguard clients’ assets from legal disputes, creditors, and other potential threats through trusts and other legal mechanisms. They also collaborate with other professionals, such as financial advisors, to manage and preserve wealth.

Interview Tips

To excel in an Estate Planner interview, specific preparation is critical. Below are some valuable tips:1. Research the Firm and Industry

Thoroughly research the law firm you’re applying to and the estate planning industry. Understand their expertise, clientele, and approach to estate planning. This knowledge demonstrates your genuine interest and preparedness.

2. Highlight Skills and Experience

Emphasize your technical skills in estate planning, including drafting legal documents, tax planning, and asset management. Share specific examples that showcase your ability to provide holistic advice and manage complex estate matters.

3. Interpersonal and Communication Skills

Estate Planners interact with clients, other professionals, and the court system regularly. Showcase your exceptional communication, interpersonal, and negotiation skills. Explain how you build rapport, resolve conflicts, and present complex legal concepts clearly.

4. Ethical and Professional Conduct

Estate Planners handle sensitive financial and personal matters. Emphasize your integrity, confidentiality, and adherence to ethical guidelines. Highlight instances where you maintained client confidentiality, acted with integrity, and prioritized their best interests.

5. Continuing Education and Knowledge

Estate planning laws and regulations constantly evolve. Demonstrate your commitment to continuous learning by discussing professional development activities, certifications, and publications you’ve pursued.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Estate Planner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.