Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Estate Tax Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

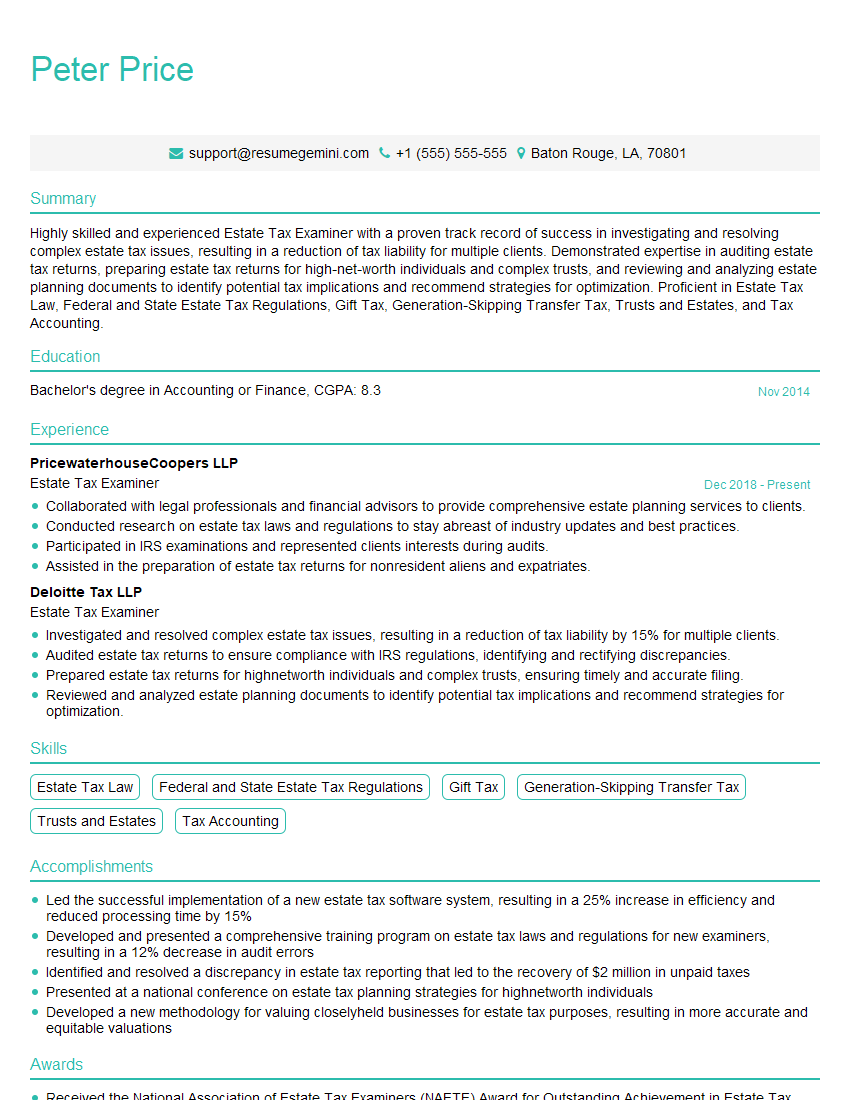

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Estate Tax Examiner

1. How do you determine the value of an estate?

To determine the value of an estate, I consider various factors, including:

- Real estate and personal property:

- Assess market value

- Consider comparable sales and appraisals

- Financial assets:

- Stocks, bonds, mutual funds

- Review account statements and market data

- Business interests:

- Estimate business value using industry benchmarks

- Consider financial statements and cash flow

- Other assets and liabilities:

- Vehicles, jewelry, collectibles

- Outstanding debts, mortgages

2. What are the different types of estate taxes?

Federal Estate Tax

- Applies to estates over a certain threshold

- Progressive tax rates

State Estate Taxes

- Imposed by some states

- Can vary significantly in rates and exemptions

Generation-Skipping Transfer Tax (GST)

- Applies to transfers that skip a generation

- Intends to prevent estate tax avoidance

3. How do you handle complex estate valuations, such as illiquid assets or intangible property?

For illiquid assets, I:

- Consider appraisals by qualified professionals

- Use industry-specific valuation methods (e.g., discounted cash flow for businesses)

For intangible property, I:

- Analyze intellectual property rights

- Consider market data and comparable licensing agreements

4. What are the common tax avoidance strategies used by estate owners?

- Inter vivos gifts

- Marital deductions

- Charitable contributions

- Family limited partnerships

- Trusts

5. How do you identify and address potential tax liabilities in an estate?

- Review financial records and assets

- Estimate estate value and potential tax due

- Identify tax credits and deductions

- Consider tax planning strategies to minimize liability

6. What software and tools do you use for estate tax calculations and audits?

- Estate tax software (e.g., CCH Axcess Tax, Lacerte)

- Spreadsheets for calculations and modeling

- Internal Revenue Service (IRS) online tools

7. How do you stay up-to-date on the latest tax laws and regulations related to estate taxation?

- Attend conferences and seminars

- Read professional journals and publications

- Monitor IRS updates and guidance

8. What ethical considerations do you take into account when conducting estate tax examinations?

- Confidentiality and privacy

- Accuracy and fairness

- Timeliness and efficiency

- Professionalism and respect

9. Describe a challenging or complex estate tax case you have handled. How did you approach it?

I handled a case involving a significant business interest. I:

- Reviewed financial statements and industry data

- Consulted with an independent business appraiser

- Estimated the business’s cash flow and potential future earnings

- Negotiated a fair valuation with the taxpayer’s representatives

10. Why are you interested in working as an Estate Tax Examiner?

- Passion for tax law and estate planning

- Desire to contribute to the fair and equitable administration of the tax system

- Strong analytical and problem-solving skills

- Ability to collaborate effectively with clients and other professionals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Estate Tax Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Estate Tax Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Estate Tax Examiners are responsible for ensuring that individuals and companies pay their fair share of estate taxes. They conduct audits to verify the accuracy of estate tax returns, determine the value of assets, and calculate the amount of tax owed. Estate Tax Examiners must be able to interpret complex tax laws, understand accounting principles, and apply statistical techniques to their work. Some of their key responsibilities include:

1. Conduct audits of estate tax returns

Estate Tax Examiners review estate tax returns to ensure that they are accurate and complete. They may request additional documentation from taxpayers to support the information on their returns. Estate Tax Examiners also conduct field audits to verify the value of assets and to interview executors and beneficiaries.

- Analysing financial records to ensure that all assets and liabilities are disclosed

- Interviewing beneficiaries and executors to gather information about the estate

- Calculating the amount of tax owed and issuing assessments

2. Determine the value of assets

Estate Tax Examiners must have a strong understanding of accounting principles and valuation techniques. They must be able to determine the value of a wide range of assets, including real estate, stocks, bonds, and closely held businesses.

- Using comparable sales data to value real estate

- Analysing financial statements to value businesses

- Consulting with experts to value specialised assets

3. Calculate the amount of tax owed

Estate Tax Examiners use their knowledge of tax laws and regulations to calculate the amount of estate tax owed. They must be able to apply complex calculations and to make sound judgements.

- Applying the estate tax rates to the value of the estate

- Determining the allowable deductions and credits

- Issuing tax bills and collecting payments

4. Represent the IRS in court

In some cases, Estate Tax Examiners may be required to represent the IRS in court. They must be able to present evidence and to argue the government’s case.

- Preparing for and attending trial

- Examining witnesses and presenting evidence

- Negotiating settlements

Interview Tips

Ace the Interview for Estate Tax Examiner

1. Research the company and the position

Before the interview, candidates should take the time to research the IRS and the specific position they are applying for. This will help them to understand the company’s culture and the specific duties of the role. Candidates should also be prepared to discuss their own qualifications and how they align with the position requirements.

- Visit the IRS website to learn about its mission and goals.

- Read articles and news stories about the IRS and its recent activities.

- Network with people who work for the IRS or who have experience in the field of estate tax.

2. Practice answering common interview questions

There are a number of common interview questions that candidates can expect to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” Candidates should practice answering these questions in advance so that they can deliver clear and concise responses during the interview.

- Use the STAR method to answer behavioural questions.

- Be prepared to discuss your knowledge of estate tax law and accounting principles.

- Highlight your experience in conducting audits and valuing assets.

3. Dress professionally and arrive on time

First impressions matter, so it is important for candidates to dress professionally and arrive on time for their interview. Candidates should also be prepared to shake hands with the interviewer and make eye contact.

- Wear a suit or business casual attire.

- Arrive at the interview location 15 minutes early.

- Bring a portfolio with copies of your resume and other relevant documents.

4. Be enthusiastic and positive

Interviewers are looking for candidates who are enthusiastic about the position and who are passionate about working for the IRS. Candidates should be positive and upbeat during the interview, and they should be able to articulate why they are the best fit for the role.

- Demonstrate your passion for the field of estate tax.

- Be excited about the opportunity to work for the IRS.

- Express your commitment to providing excellent customer service.

5. Follow up after the interview

After the interview, candidates should send a thank-you note to the interviewer. This note should thank the interviewer for their time and reiterate the candidate’s interest in the position. Candidates should also follow up with the interviewer if they have any questions or if they have not heard back within a reasonable amount of time.

- Send a thank-you note within 24 hours of the interview.

- Reiterate your interest in the position.

- Inquire about the next steps in the hiring process.

Next Step:

Now that you’re armed with the knowledge of Estate Tax Examiner interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Estate Tax Examiner positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini